According to Tether's latest announcement, Friday, the company announced that the Polkadot Blockchain system now supports it. The stablecoin received new support after the token was added to the Near Protocol 11-days ago. This news comes after Tether was ordered by a New York judge last Tuesday to produce financial documents.

Polkadot Blockchain Ecosystem adds Tether

Tether Operations Limited recently announced that it had been added to the Near Protocol on Sept 12th and 11 days later, it revealed that it is now located on the Polkadot Blockchain.

Polkadot is an open-source distributed ledger project. It connects decentralized finance (defi) and blockchains. Tether is the world's largest stablecoin asset, with a market value of $68.24 Billion on September 23.

USDT is the dominant crypto currency today at 7.078%, out of the $963.16 trillion market. Tether announced Friday that the Polkadot ecosystem's addition of USDT was "another milestone" in its stablecoin-issuer.

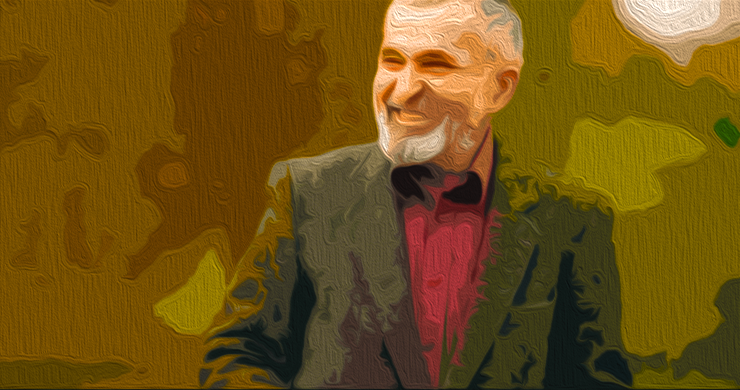

USDT now hosts on 15 different blockchain networks after being added to the Near Protocol, Polkadot Polkadot and Polkadot Polkadot ecosystems. Tether's CTO Paolo Ardoino wrote to Bitcoin.com News that the company was "delighted" to launch Tether on the Polkadot Blockchain network.

Ardoino stated that "Polkadot has been on a path of growth and evolution this past year, and we believe Tether will be crucial in helping it continue its success." Statistics show that tether's stock cap increased by 0.8% in the past 30 days. On Friday, USDT commanded $45.51 billion of $81.84 billion global crypto trade volume.

Tether's volume equals 55.60% of $81.84 billion worth of swaps. 62% of all BTC trades are paired with Tether. A New York judge ordered Polkadot Blockchain Support to be provided by Tether Operations Limited.

The order of the judge stems from a three-year-old class action lawsuit brought by five plaintiffs. Roche Freedman LLP is also involved in the case. Tether's lawyer recently stated that the law firm should be dropped due to the controversy surrounding Roche Freedman co-founder Kyle Roche.

What are your thoughts on tether being included in the Polkadot Blockchain ecosystem? Please comment below to let us know your thoughts on this topic.

Frequently Asked Questions

Should You Buy Gold?

Gold was once considered an investment safe haven during times of economic crisis. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

Some experts believe that this could change very soon. They say that gold prices could rise dramatically with another global financial crisis.

They also point out that gold is becoming popular because of its perceived value and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- The first thing to do is assess whether you actually need the money you're putting aside for retirement. It is possible to save for retirement while still investing your gold savings. However, you can still save for retirement without putting your savings into gold.

- Second, be sure to understand your obligations before you purchase gold. Each type offers varying levels and levels of security.

- Last but not least, gold doesn't provide the same level security as a savings account. It is possible to lose your gold coins.

If you are thinking of buying gold, do your research. If you already have gold, make sure you protect it.

Can I keep physical gold in an IRA?

Gold is money. Not just paper currency. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Today, many Americans invest in precious metals such as gold and silver rather than stocks and bonds. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

Gold has historically performed better during financial panics than other assets. The S&P 500 dropped 21 percent in the same time period, while gold prices rose by nearly 100 percent between August 2011-early 2013. During turbulent market conditions gold was one of few assets that outperformed stock prices.

The best thing about gold investing is the fact that there's virtually no counterparty risk. Even if your stock portfolio is down, your shares are still yours. You can still own your gold even if the company where you invested fails to pay its debt.

Finally, the liquidity that gold provides is unmatched. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows for you to benefit from the short-term fluctuations of the gold market.

What does gold do as an investment?

The supply and demand for gold affect the price of gold. It is also affected by interest rates.

Due to their limited supply, gold prices fluctuate. You must also store physical gold somewhere to avoid the risk of it becoming stale.

Can I have a gold ETF in a Roth IRA

You may not have this option with a 401(k), however, you might want to consider other options, like an Individual retirement account (IRA).

A traditional IRA allows contributions from both employee and employer. An Employee Stock Ownership Plan (ESOP) is another way to invest in publicly traded companies.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money you invest in the ESOP will be taxed at a lower rate than if it were directly held by the employee.

A Individual Retirement Annuity (IRA), is also available. An IRA allows you to make regular payments throughout your life and earn income in retirement. Contributions to IRAs do not have to be taxable

Should you Invest In Gold For Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. Consider investing in both.

Not only is it a safe investment but gold can also provide potential returns. It is a good choice for retirees.

Although most investments promise a fixed rate of return, gold is more volatile than others. Its value fluctuates over time.

But this doesn't mean you shouldn't invest in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another benefit to gold? It's a tangible asset. Unlike stocks and bonds, gold is easier to store. It is also easily portable.

You can always access your gold if it is stored in a secure place. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. It's a great way to hedge against rising prices, as gold prices tend to increase along with other commodities.

Also, you'll reap the benefits of having some savings invested in something with a stable value. Gold rises in the face of a falling stock market.

Gold investment has another advantage: You can sell it anytime. You can easily liquidate your investment, just as with stocks. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't buy too many at once. Start small, buying only a few ounces. You can add more as you need.

It's not about getting rich fast. It is to create enough wealth that you no longer have to depend on Social Security.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

cftc.gov

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options? Types, Spreads, Example, and Risk Metrics

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Investing in gold vs. investing in stocks

These days, it might seem quite risky to invest your money in gold. This is because most people believe that it is no longer economically profitable to invest gold. This belief comes from the fact most people see gold prices falling due to the global economy. People believe that investing in gold would result in them losing money. In reality, though, gold investment can offer significant benefits. Below are some of them.

The oldest form of currency known to mankind is gold. Its use can be traced back to thousands of years ago. It was used by many people around the globe as a currency store. It is still used as a payment method by South Africa and other countries.

You must first decide how much you are willing and able to pay per gram to decide whether or not gold should be your investment. You must determine how much gold bullion you can afford per gram before you consider buying it. If you don’t know what the current market price is, you can always call a local jewelry store and ask them their opinion.

Noting that gold prices have fallen in recent years, it is worth noting that the cost to produce gold has gone up. The price of gold may have fallen, but the production costs haven’t.

When deciding whether to buy gold, another thing to consider is how much gold you intend on buying. It is sensible to avoid buying gold if you are only looking to cover the wedding rings. However, if you are planning on doing so for long-term investments, then it is worth considering. Selling your gold at a higher value than what you bought can help you make money.

We hope you have gained a better understanding about gold as an investment tool. We strongly recommend that you research all available options before making any decisions. Only after doing so can you make an informed decision.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: Tether Reveals USDT Stablecoin Is Now Supported by Polkadot

Sourced From: news.bitcoin.com/tether-reveals-usdt-stablecoin-is-now-supported-by-polkadot/

Published Date: Fri, 23 Sep 2022 20:30:57 +0000