South Korean Traders Favor High-Risk Altcoins

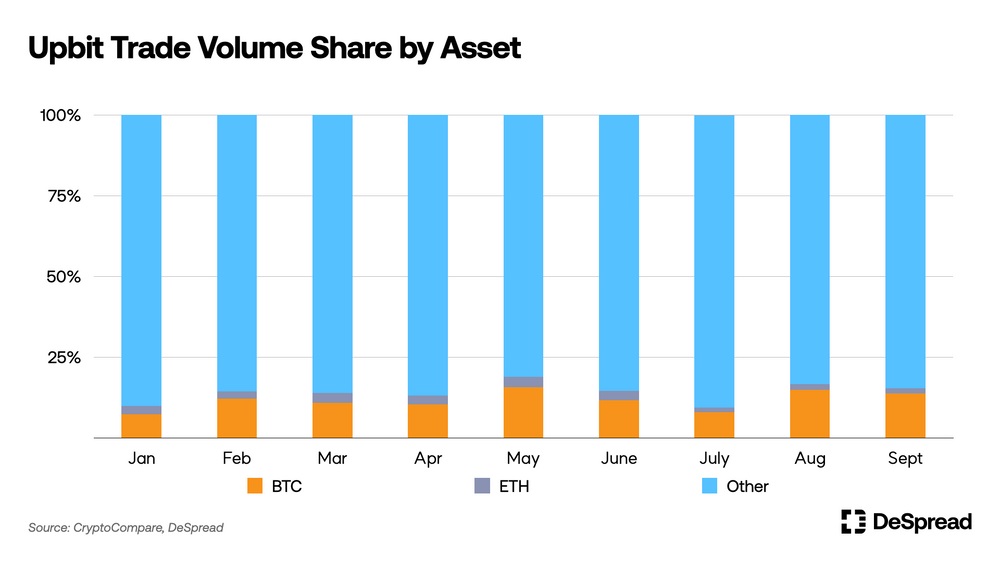

A recent report suggests that South Korean cryptocurrency traders are more interested in investing in high-risk altcoins compared to their American counterparts. The study indicates that the trading volumes of major cryptocurrencies like bitcoin and ethereum on the largest Korean exchange are significantly smaller than those on the leading U.S. exchange.

High-Profit Potential of Altcoins Attracts South Korean Investors

According to a study conducted by Web3 market strategy consulting firm Despread, many South Korean investors prefer a high-risk approach to crypto investments that can potentially yield high rewards. The majority of individual investors on Upbit, South Korea's largest crypto trading platform, show a strong interest in altcoins with high-profit potential, despite the associated risks.

The authors of the study stated in a blog post, "This is considered one of the reasons for the high proportion of altcoin trading in the Korean market."

Differences Between South Korean and American Crypto Trading

Upbit, which accounts for 70-80% of the domestic exchange market in South Korea, has a trading volume largely driven by individual investors. On the other hand, trading on Coinbase, the leading cryptocurrency exchange in the United States, is influenced to a greater extent by institutional players.

According to Coinbase's Q2 shareholder letter, institutional investors account for about 85% of the exchange's total trading volume. These investors prioritize portfolio stability and therefore have a larger share in trading bitcoin (BTC) and ethereum (ETH), the cryptocurrencies with the largest market caps.

Top Altcoins Traded in South Korea

Among the most actively traded altcoins in South Korea, loom network (LOOM) claimed the top spot last week, with the highest trading volume ratio of 62%, as revealed by Despread. It was followed by ecash (XEC) with 55% and flow (FLOW) with 43%. Stacks (STX) and bitcoin SV (BSV) also made it to the rankings with ratios of 37% and 34% respectively.

The researchers highlighted that cryptocurrencies like stacks and ecash continue to receive consistent attention on Korean exchanges, irrespective of temporary events. These cases are noteworthy as they are consistently traded in the Korean market regardless of global trends.

Conclusion

The research indicates that South Korean investors are more inclined to invest in altcoins due to their high-profit potential, even though they come with higher risks. This preference for altcoins is reflected in the trading volumes on major Korean exchanges. Understanding the differences in trading behavior between countries can provide valuable insights into the global crypto market.

What do you think about South Koreans' interest in altcoins? Share your thoughts in the comments section below.

Frequently Asked Questions

What are the benefits of a Gold IRA?

It is best to put your retirement money in an Individual Retirement Account (IRA). It will be tax-deferred up until the time you withdraw it. You have complete control over how much you take out each year. There are many types of IRAs. Some are better suited to college savings. Some are for investors who seek higher returns. For example, Roth IRAs allow individuals to contribute after age 59 1/2 and pay taxes on any earnings at retirement. These earnings don't get taxed if they withdraw funds. This account is a good option if you plan to retire early.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another benefit of owning gold through an IRA is that you get to enjoy the convenience of automatic withdrawals. That means you won't have to think about making deposits every month. To avoid missing a payment, direct debits can be set up.

Finally, gold remains one of the best investment options today. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even in times of economic turmoil gold prices tend to remain stable. As a result, it's often considered a good choice when protecting your savings from inflation.

How much do gold IRA fees cost?

A monthly fee of $6 for an Individual Retirement Account is charged. This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

If you want to diversify, you may be required to pay extra fees. These fees will vary depending upon the type of IRA chosen. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

A majority of providers also charge annual administration fees. These fees range from 0% to 1%. The average rate per year is.25%. These rates can be waived if the broker is TD Ameritrade.

Is gold a good investment IRA option?

Any person looking to save money is well-served by gold. It's also a great way to diversify your portfolio. There's more to gold that meets the eye.

It has been used as a currency throughout history and is still a popular method of payment. It's often referred to as “the world's oldest currency.”

Gold is not created by governments, but it is extracted from the earth. That makes it very valuable because it's rare and hard to create.

Gold prices fluctuate based on demand and supply. The economy that is strong tends to be more affluent, which means there are less gold miners. As a result, the value of gold goes up.

On the other hand, people will save cash when the economy slows and not spend it. This causes more gold to be produced, which lowers its value.

This is why both individuals as well as businesses can benefit from investing in gold. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

You'll also earn interest on your investments, which helps you grow your wealth. You won't lose your money if gold prices drop.

What are the pros and cons of a gold IRA?

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. An IRA is a good choice for those who want a way to save some money but don’t want the tax. However, there are disadvantages to this type investment.

You could lose all of your accumulated money if you take out too much from your IRA. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

A disadvantage to managing your IRA is the fact that fees must be paid. Most banks charge 0.5% to 2.0% per annum. Other providers charge monthly management fees ranging from $10 to $50.

Insurance will be required if you would like to keep your cash out of banks. In order to make a claim, most insurers will require that you have a minimum amount in gold. You may be required by some insurers to purchase insurance that covers losses as high as $500,000.

If you are considering a Gold IRA, you need to first decide how much of it you would like to use. Some providers limit the number of ounces of gold that you can own. Some providers allow you to choose your weight.

It is also up to you to decide whether you want to purchase physical gold or futures. The price of physical gold is higher than that of gold futures. Futures contracts offer flexibility for buying gold. They let you set up a contract that has a specific expiration.

It is also important to choose the type of insurance coverage that you need. The standard policy does NOT include theft protection and loss due to fire or flood. It does provide coverage for damage from natural disasters, however. If you live near a high-risk region, you might want to consider additional coverage.

Insurance is not enough. You also need to think about the cost of gold storage. Storage costs will not be covered by insurance. In addition, most banks charge around $25-$40 per month for safekeeping.

If you decide to open a gold IRA, you must first contact a qualified custodian. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians can't sell assets. Instead, they must retain them for as long and as you require.

Once you've decided which type of IRA best suits your needs, you'll need to fill out paperwork specifying your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. You should also specify how much you want to invest each month.

After completing the forms, send them along with a check or a small deposit to your chosen provider. After reviewing your application, the company will send you a confirmation mail.

When opening a gold IRA, you should consider using a financial planner. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can help you find cheaper insurance options to lower your costs.

How to open a Precious Metal IRA

First, decide if an Individual Retirement Account is right for you. If you do, you must open the account by completing Form 8606. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form should be completed within 60 days after opening the account. You can then start investing once you have this completed. You might also be able to contribute directly from the paycheck through payroll deduction.

For a Roth IRA you will need to complete Form 8903. Otherwise, the process will look identical to an existing IRA.

You'll need to meet specific requirements to qualify for a precious metals IRA. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. And, you have to make contributions regularly. These rules apply regardless of whether you are contributing directly to your paychecks or through your employer.

A precious metals IRA can be used to invest in palladium or platinum, gold, silver, palladium or rhodium. But, you'll only be able to purchase physical bullion. You won't have the ability to trade stocks or bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. Some IRA providers offer this option.

However, investing in precious metals via an IRA has two serious drawbacks. First, they don't have the same liquidity as stocks or bonds. It's also more difficult to sell them when they are needed. Second, they don’t produce dividends like stocks or bonds. Therefore, you will lose more money than you gain over time.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

finance.yahoo.com

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

cftc.gov

bbb.org

How To

Guidelines for Gold Roth IRA

The best way to invest for retirement is by starting early. You should start as soon as you are eligible (usually at age 50) and continue saving throughout your career. It is important to invest enough money each and every year to ensure you get adequate growth.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles permit you to make contributions, but not pay any tax until your earnings are withdrawn. They are a great option for those who do not have access to employer matching money.

The key is to save regularly and consistently over time. You may not be eligible for any tax benefits if your contribution is less than the maximum allowed.

—————————————————————————————————————————————————————————————–

By: Lubomir Tassev

Title: South Koreans Show Strong Interest in Altcoins, Research Reveals

Sourced From: news.bitcoin.com/south-koreans-fascinated-with-altcoins-more-than-americans-research-shows/

Published Date: Sat, 28 Oct 2023 10:30:32 +0000