Introduction

According to the latest statistics, several countries are grappling with inflation rates that have surpassed 40% as of October 2023. In fact, four nations are currently enduring inflation rates exceeding 100%. This alarming trend, as revealed by data from the International Monetary Fund's World Economic Outlook, paints a bleak picture for these struggling economies. Let's delve into the details and explore the impact of soaring inflation on both consumers and businesses.

The Global Inflation Crisis

Throughout 2023, numerous fiat currencies have faced significant challenges, resulting in their depreciation when compared to other currencies. This inflationary pressure translates to a diminished purchasing power, making it increasingly difficult for individuals to afford goods and services with the same amount of money. As a result, consumers bear the brunt of this financial burden, and businesses face disruption, often leading to their collapse. It's worth noting that hyperinflation is typically characterized by monthly inflation rates surpassing 50%.

Inflation Leaders: Venezuela and Zimbabwe

As of October 2023, data from the International Monetary Fund (IMF) highlights Venezuela as the country with the highest inflation rate in the world, standing at a staggering 360%. Situated in South America, Venezuela has consistently topped the global inflation charts, with the Venezuelan bolivar continuously losing its purchasing power. Zimbabwe follows closely behind, with its inflation rate reaching 314.5%, as per the IMF's data.

Inflation Woes Across the Globe

Other countries are also grappling with their own economic challenges due to soaring inflation. Sudan, located in Northeast Africa, is enduring an inflation rate of approximately 256.2% for an extended period. The Sudanese pound has been on a downward spiral, experiencing significant devaluations and fluctuations in recent times. Meanwhile, Argentina, situated in South America, is facing its own economic turmoil with an inflation rate soaring to 121.7%. The swift increase in money supply has been a major driver behind Argentina's inflation saga, resulting in a significant decline in the purchasing power of the Argentine peso.

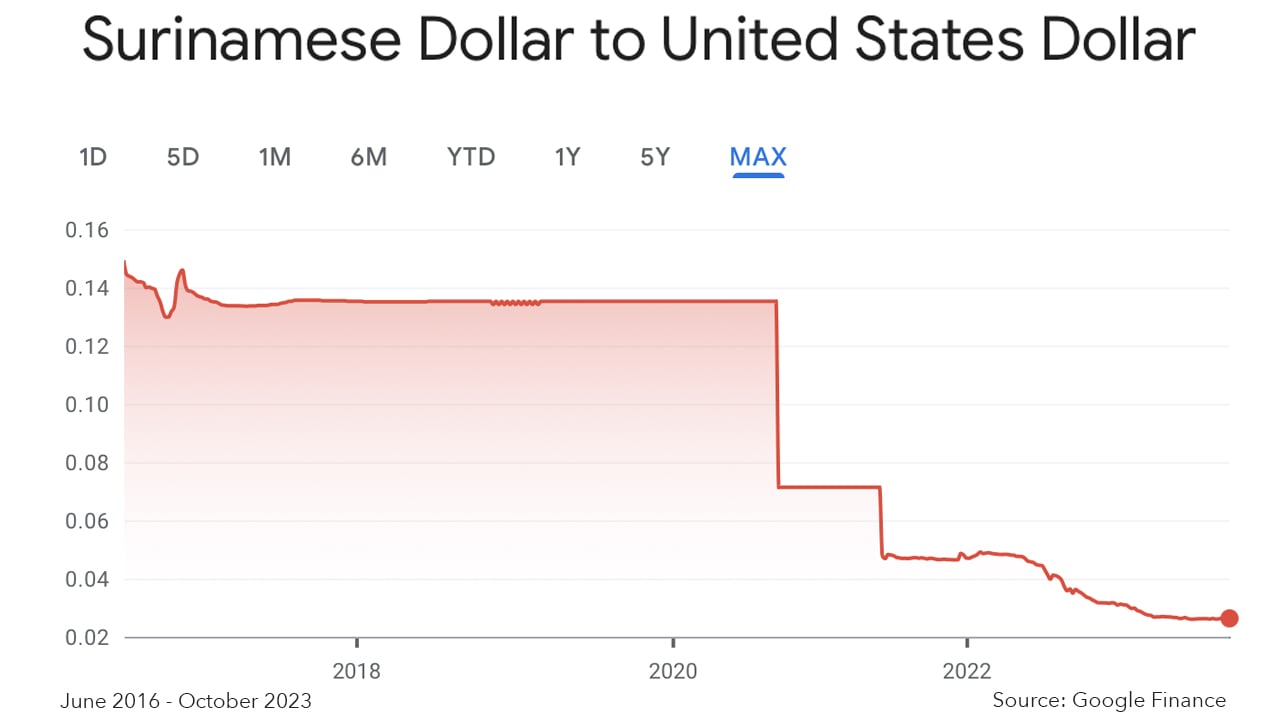

Suriname, the smallest sovereign nation in South America, is experiencing an inflation rate of 53.3% as of October 2023. The inflationary pressures in Suriname stem from various factors, including rampant money creation, fiscal imbalances, and external disruptions. Notably, the Surinamese dollar (SRD) underwent a 228% devaluation from August 2020 to October 2021. Turkey, straddling Southeast Europe and West Asia, is contending with an inflation rate of 51.2%. This economic challenge is fueled by Turkish President Recep Tayyip Erdogan's unconventional stance favoring low interest rates. These six countries, namely Venezuela, Zimbabwe, Sudan, Argentina, Suriname, and Turkey, currently top the global charts with the highest inflation rates.

Finding Solutions: Barter Systems and Digital Currencies

As these nations grapple with soaring inflation, their residents are adopting various strategies to mitigate its effects. Barter systems have gained popularity, with individuals trading goods and services directly instead of relying on their weakening national currencies. Moreover, digital currencies like bitcoin (BTC) and stablecoins are increasingly being used as alternative forms of payment. Reports indicate that cryptocurrency usage is prevalent in regions most affected by inflation. For example, in Venezuela, USDT has become a popular means of settlement.

Residents in Zimbabwe and Argentina are also turning to crypto assets and stablecoins as economic uncertainty looms. Sudan has witnessed a noticeable shift toward digital currencies, and the Turkish lira is gaining traction as one of USDT's leading trading pairs globally, alongside the US dollar. These borderless financial assets offer individuals a viable alternative, empowering them to preserve their wealth against the inflationary pressures imposed by their respective fiat currencies.

Conclusion

The ten nations grappling with inflation rates above 40% face significant economic challenges. Soaring inflation not only diminishes the purchasing power of individuals but also disrupts businesses, leading to potential collapses. As these countries explore various strategies to combat inflation, the adoption of barter systems and digital currencies offers hope for individuals seeking stability and financial security. The global community observes with anticipation as these struggling nations navigate the turbulent waters of economic turmoil.

What are your thoughts on the ten countries experiencing inflation rates above 40%? Share your opinions and insights in the comments section below.

Frequently Asked Questions

Should you Invest In Gold For Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. You can invest in both options if you aren't sure which option is best for you.

Gold offers potential returns and is therefore a safe investment. Retirees will find it an attractive investment.

While most investments offer fixed rates of return, gold tends to fluctuate. This causes its value to fluctuate over time.

But this doesn't mean you shouldn't invest in gold. It is important to consider the fluctuations when planning your portfolio.

Another benefit of gold is that it's a tangible asset. Gold is much easier to store than bonds and stocks. It's also portable.

Your gold will always be accessible as long you keep it in a safe place. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold usually rises when the stock market falls.

Another benefit to investing in gold? You can always sell it. Like stocks, you can sell your position anytime you need cash. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

Also, don't buy too much at once. Start small, buying only a few ounces. Continue adding more as necessary.

The goal is not to become rich quick. It is to create enough wealth that you no longer have to depend on Social Security.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

What are the benefits of having a gold IRA?

It is best to put your retirement money in an Individual Retirement Account (IRA). It will be tax-deferred up until the time you withdraw it. You have total control over how much each year you take out. There are many types available. Some are better suited for people who want to save for college expenses. Others are intended for investors seeking higher returns. Roth IRAs, for example, allow people to contribute after they turn 59 1/2. They also pay taxes on any earnings when they retire. These earnings don't get taxed if they withdraw funds. This type of account might be a good choice if your goal is to retire early.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA you don't need to worry about taxes while you wait for your gains to be available. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. This means that you don't need to worry about making monthly deposits. Direct debits could be set up to ensure you don't miss a single payment.

Finally, gold is one the most secure investment options available. It is not tied to any country so its value tends stay steady. Even in economic turmoil, gold prices tends to remain relatively stable. Therefore, gold is often considered a good investment to protect your savings against inflation.

Can I keep physical gold in an IRA?

Gold is money and not just paper currency. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Today, investors invest in gold as part a diversified portfolio. This is because gold tends do better in financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

Gold has historically performed better during financial panics than other assets. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Even if your stock portfolio is down, your shares are still yours. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Finally, gold offers liquidity. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. Gold is liquid and therefore it makes sense to purchase small amounts. This allows you take advantage of the short-term fluctuations that occur in the gold markets.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

cftc.gov

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options? Types, Spreads. Example. And Risk Metrics

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's not exactly legal – WSJ

finance.yahoo.com

How To

Investing In Gold vs. Investing In Stocks

This might make it seem very risky to invest gold as an investment tool. This is because many people believe that gold investment is no longer profitable. This belief arises because most people believe that the global economy is driving down gold prices. They think that they would lose money if they invested in gold. In reality, though, gold investment can offer significant benefits. Here are some examples.

One of the oldest forms known of currency is gold. It has been used for thousands of years. It was used all around the world as a reserve of value. It is still used as a payment method by South Africa and other countries.

Consider the price per gram when you decide whether you should invest in or not. You must determine how much gold bullion you can afford per gram before you consider buying it. If you don’t know the current market rate for gold bullion, you can always consult a local jeweler to get their opinion.

It is important to remember that even though gold prices have dropped in recent times, the cost of making gold has risen. So while the price of gold has declined, production costs haven't changed.

You should also consider the amount of your intended purchase when considering whether you should buy or not. It is sensible to avoid buying gold if you are only looking to cover the wedding rings. However, if you are planning on doing so for long-term investments, then it is worth considering. You can profit if you sell your gold at a higher price than you bought it.

We hope that this article has helped you gain a better understanding and appreciation for gold as an investment option. We recommend you do your research before making any final decisions. Only then can you make informed decisions.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: Soaring Inflation Rates: 10 Nations Struggle to Combat Economic Turmoil

Sourced From: news.bitcoin.com/from-venezuelas-360-to-ghanas-42-10-countries-worldwide-feel-the-sting-of-inflation/

Published Date: Sun, 29 Oct 2023 18:30:28 +0000

Did you miss our previous article…

https://altcoinirareview.com/the-altcoins-that-outperformed-bitcoin-with-over-700-surge-in-2023/