Introduction to Roth IRAs and Bitcoin

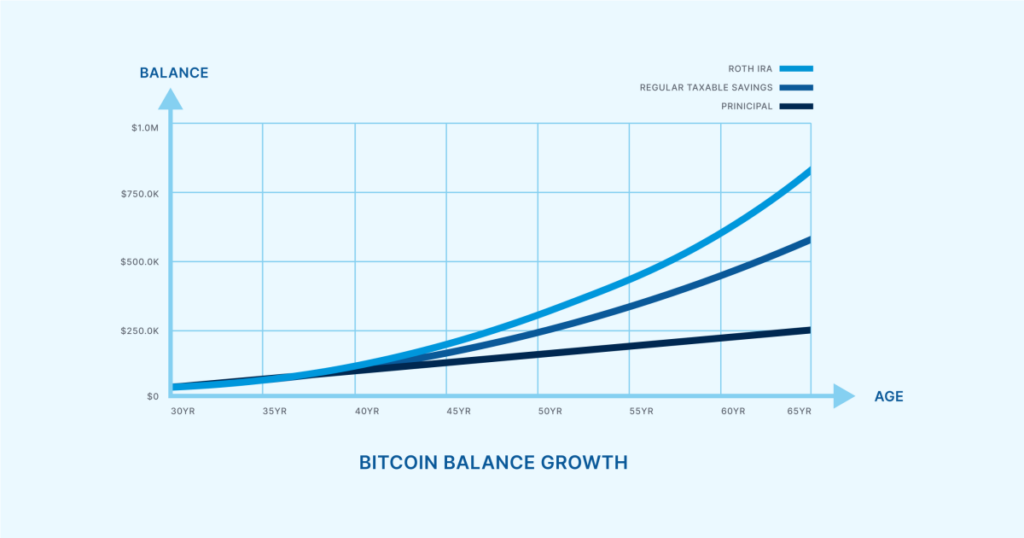

Roth IRAs can play a crucial role in achieving your financial goals, whether you are young, mid-career, or nearing retirement. By integrating bitcoin into Roth IRAs, you can secure your retirement savings, optimize your tax strategy, and pass on your bitcoin to future generations. Let's explore four case studies to understand the benefits of holding bitcoin in a Roth IRA.

Case Study 1: Sally the Super Stacker

Sally, in her early 30s, believes in bitcoin's potential as a superior savings technology. By investing in bitcoin post-tax, Sally avoids double taxation on her earnings. However, by utilizing a Roth IRA, Sally can benefit from tax-free growth on her bitcoin investments. This tax advantage can lead to significant savings over time and enhance her purchasing power in retirement.

Case Study 2: Rod is Retirement Ready

Rod, approaching retirement, recognizes the importance of diversifying his tax strategies. By incorporating a Roth IRA, Rod can leverage different tax buckets to manage his income in retirement efficiently. With tax-free growth in a Roth IRA, Rod decides to allocate a portion of his portfolio to bitcoin, aiming to maximize its potential without incurring additional taxes.

Case Study 3: Larry Wants to Leave a Legacy

Larry, focused on inheritance planning, aims to pass on his wealth to the next generation. Setting up a Roth IRA allows Larry to grow his assets tax-free and designate beneficiaries to receive the funds without incurring income tax. By converting existing retirement funds to a Roth IRA, Larry can ensure a tax-efficient transfer of his bitcoin holdings to his loved ones.

Case Study 4: "Why Would I?" Wayne

Wayne, in his peak earning years, prefers a simple lifestyle and plans to leave his assets to charity. Considering his high income tax bracket, Wayne evaluates the suitability of a Roth IRA for his financial strategy. While a Roth IRA may not be ideal for Wayne's situation due to his charitable intentions and tax considerations, he explores alternative options for tax-efficient wealth transfer.

In conclusion, the versatility of Roth IRAs combined with the potential of bitcoin as a savings technology offers individuals a powerful tool to secure their financial future. Whether you are saving for retirement, transitioning into retirement, or planning your inheritance, exploring the benefits of holding bitcoin in a Roth IRA can provide long-term financial stability and tax advantages.

Frequently Asked Questions

How does gold perform as an investment?

The supply and the demand for gold determine how much gold is worth. Interest rates can also affect the gold price.

Due to their limited supply, gold prices fluctuate. Additionally, physical gold can be volatile because it must be stored somewhere.

What Should Your IRA Include in Precious Metals?

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. It doesn't matter how rich you are to invest in precious metals. There are many ways to make money on silver and gold investments without spending too much.

You might think about buying physical coins such a bullion bar or round. You could also buy shares in companies that produce precious metals. You may also be interested in an IRA transfer program offered by your retirement provider.

You can still get benefits from precious metals regardless of what choice you make. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

And, unlike traditional investments, their prices tend to rise over time. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

Is buying gold a good way to save money for retirement?

Although buying gold as an investment might not sound appealing at first, when you look at the average annual gold consumption worldwide, it is worth looking into.

The most popular form of investing in gold is through physical bullion bars. You can also invest in gold in other ways. It is best to research all options and make informed decisions based on your goals.

If you're not looking to secure your wealth, it may be worth considering purchasing shares in mining equipment or companies that extract gold. If you need cash flow from an investment, purchasing gold stocks is a good choice.

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs often include stocks of gold miners, precious metals refiners, and commodity trading companies.

How much should precious metals be included in your portfolio?

Before we can answer this question, it is important to understand what precious metals actually are. Precious metals have elements with an extremely high worth relative to other commodity. This makes them valuable in investment and trading. Gold is today the most popular precious metal.

There are many other precious metals, such as silver and platinum. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It is also unaffected significantly by inflation and Deflation.

In general, prices for precious metals tend increase with the overall marketplace. That said, they do not always move in lockstep with each other. The price of gold tends to rise when the economy is not doing well, but the prices of the other precious metals tends downwards. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors choose safe assets such Treasury Bonds over precious metals. They are more rare, so they become more expensive and less valuable.

To maximize your profits when investing in precious metals, diversify across different precious metals. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

What are the benefits of having a gold IRA?

You can save money on retirement by putting your money into an Individual Retirement Account. It is tax-deferred until it's withdrawn. You have total control over how much each year you take out. There are many types to choose from when it comes to IRAs. Some are better for those who want to save money for college. Some are better suited for investors who want higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. These earnings don't get taxed if they withdraw funds. This account may be worth considering if you are looking to retire earlier.

An IRA with a gold status is like any other IRA because you can put money into different asset classes. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. This eliminates the need to constantly make deposits. To ensure that you never miss a payment, you could set up direct debits.

Finally, gold remains one of the best investment options today. Its value is stable because it's not tied with any one country. Even in times of economic turmoil gold prices tend to remain stable. Therefore, gold is often considered a good investment to protect your savings against inflation.

Can the government steal your gold?

The government cannot take your gold because you own it. You worked hard to earn it. It belongs entirely to you. However, there may be some exceptions to this rule. You could lose your gold if convicted of fraud against a federal government agency. If you owe taxes, your precious metals could be taken away. You can keep your gold even if your taxes are not paid.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

investopedia.com

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement plans

finance.yahoo.com

How To

A rising trend in gold IRAs

As investors seek to diversify their portfolios while protecting themselves from inflation, the trend towards gold IRAs is on the rise.

Owners can invest in gold bars and bullion with the gold IRA. It is a tax-free investment that can be used to grow wealth and offers an alternative investment option to those who are concerned about stocks or bonds.

A gold IRA allows investors the freedom to manage their wealth without worrying about volatility in the markets. The gold IRA can be used to protect against inflation or other potential problems.

Investors also enjoy the benefits of owning physical gold, which includes its unique properties such as durability, portability, and divisibility.

The gold IRA also offers many other benefits, such as the ability to quickly transfer the ownership of the gold to heirs, and the fact the IRS doesn't consider gold a currency.

Investors who seek financial stability and a safe haven are finding the gold IRA increasingly attractive.

—————————————————————————————————————————————————————————————–

By: Unchained

Title: Should You Hold Bitcoin In A Roth IRA? A Comprehensive Guide

Sourced From: bitcoinmagazine.com/guides/four-case-studies-should-you-hold-bitcoin-in-a-roth-ira

Published Date: Sun, 17 Mar 2024 14:00:00 GMT