Bitcoin mining has experienced exponential growth since the initial shipment of ASIC miners in 2013, significantly enhancing hardware efficiency from 1,200 J/TH to just 15 J/TH. While these advancements primarily stemmed from improved chip technology, the industry is now approaching the limits of silicon-based semiconductors. As further gains in efficiency level off, the focal point must transition towards optimizing other facets of mining operations, with a particular emphasis on the power setup.

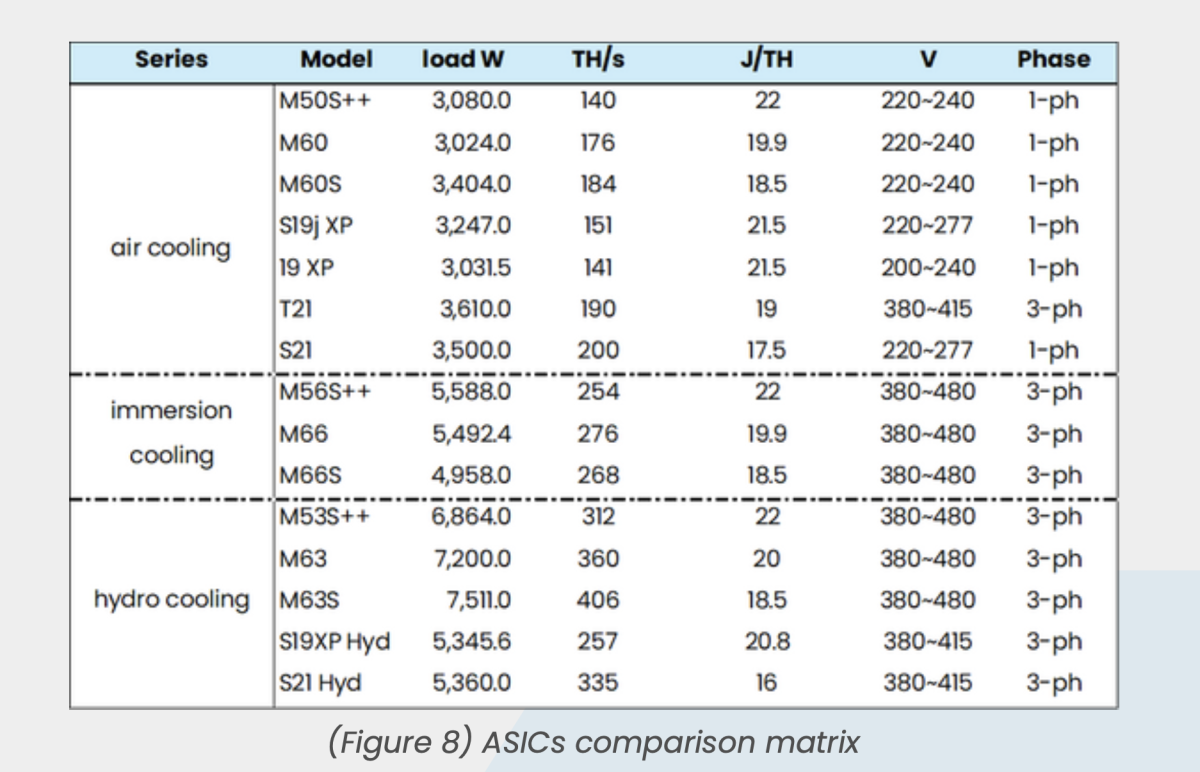

Three-phase power has emerged as a superior alternative to single-phase power in the realm of bitcoin mining. With an increasing number of ASICs being tailored for three-phase voltage input, future mining infrastructure should contemplate embracing a standardized 480v three-phase system, especially in light of its abundance and scalability across North America.

Understanding Single-Phase and Three-Phase Power

To grasp the significance of three-phase power in the context of bitcoin mining, it is imperative to first comprehend the fundamentals of single-phase and three-phase power systems.

Single-phase power represents the most prevalent type of power supply utilized in residential settings. It comprises two wires: one live wire and one neutral wire. The voltage in a single-phase system oscillates sinusoidally, delivering power that peaks and then drops to zero twice during each cycle.

For instance, envision pushing an individual on a swing. With each push, the swing moves forward, reaches a peak height, descends to the lowest point, and the cycle repeats. Analogous to the swing scenario, a single-phase power system experiences intervals of maximum and zero power delivery, potentially resulting in inefficiencies, especially in scenarios necessitating consistent power, a significant consideration in high-demand, industrial-scale operations like bitcoin mining.

In contrast, three-phase power is predominantly employed in industrial and commercial settings. It comprises three live wires, offering a more consistent and reliable power flow.

Extending the swing analogy, consider having three individuals pushing the swing at different intervals. Each person pushes the swing at specific points during its motion cycle, resulting in a smoother and more consistent movement due to continuous pushes from various angles, thereby maintaining a constant motion.

Similarly, a three-phase power system ensures a consistent and balanced power flow, ultimately leading to heightened efficiency and reliability, particularly advantageous for high-demand applications such as bitcoin mining.

The Evolution of Bitcoin Mining Power Requirements

The landscape of bitcoin mining has undergone substantial transformations concerning power requirements over the years.

Prior to 2013, miners relied on CPUs and GPUs for bitcoin mining. The advent of ASIC (Application-Specific Integrated Circuit) miners marked a pivotal shift as the bitcoin network expanded and competition intensified. These specialized devices were engineered exclusively for mining bitcoins, offering unparalleled efficiency and performance. However, the increased power demands of these machines necessitated advancements in power supply systems.

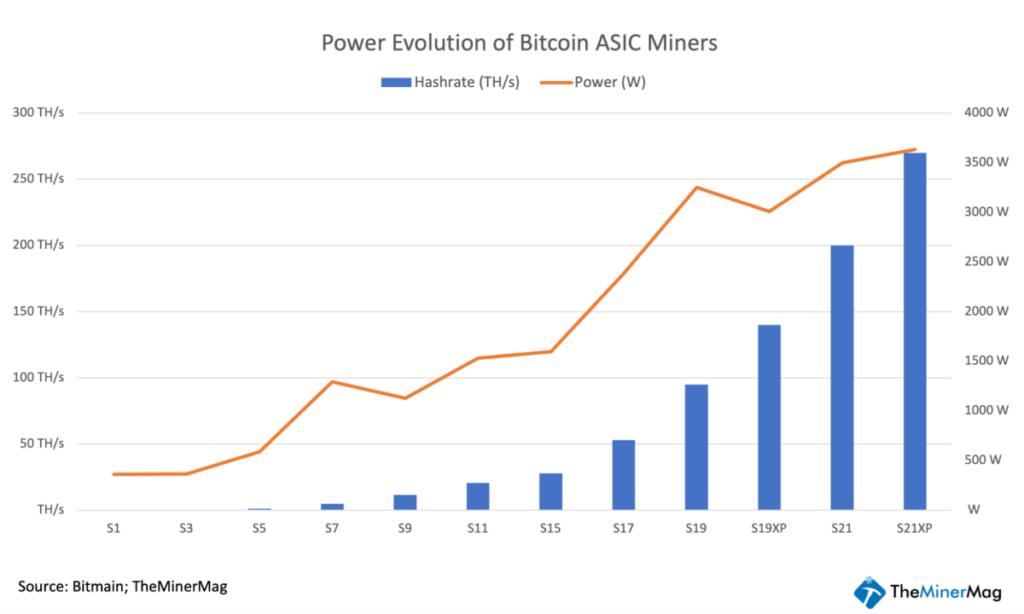

By 2016, a cutting-edge miner could compute 13 TH/s with a power consumption of roughly 1,300 watts (W). Though deemed highly inefficient by today's standards, mining with such a setup remained profitable due to the relatively low network competition at the time. However, to generate substantial profits in today's fiercely competitive landscape, institutional miners now operate rigs requiring approximately 3,510 W.

The constraints of single-phase power systems have become increasingly apparent as ASIC power requirements and the efficiency demands of high-performance mining operations escalate. The transition to three-phase power represents a logical progression to support the industry's burgeoning energy needs.

480v Three-Phase in Bitcoin Mining

480v three-phase power has long served as the standard in industrial settings across North America, South America, and other regions due to its myriad benefits in terms of efficiency, cost savings, and scalability. The consistency and reliability inherent in 480v three-phase power render it ideal for operations necessitating enhanced operational uptime and fleet efficiency, particularly in a post-halving era.

One of the primary advantages of three-phase power lies in its capacity to deliver higher power density, thereby reducing energy losses and ensuring optimal performance levels of mining equipment.

Moreover, the implementation of a three-phase power system can yield significant savings in electrical infrastructure costs. Reduced requirements for transformers, smaller wiring, and diminished need for voltage stabilization equipment contribute to lower installation and maintenance expenditures.

For instance, a load demanding 17.3 kilowatts of power at 208v three-phase would necessitate a current of 48 amps. However, if the same load is supplied by a 480v source, the current requirement diminishes to just 24 amps. This halving of the current not only diminishes power loss but also reduces the necessity for thicker, more costly wiring.

Implementing Three-Phase Power in Bitcoin Mining Operations

The transition to a three-phase power system mandates meticulous planning and execution. Below are the key steps entailed in implementing three-phase power in bitcoin mining operations.

Assessing Power Requirements

The initial phase in adopting a three-phase power system involves evaluating the power needs of the mining operation. This encompasses computing the total power consumption of all mining equipment and determining the requisite capacity for the power system.

Upgrading Electrical Infrastructure

Enhancing the electrical infrastructure to accommodate a three-phase power system might entail the installation of new transformers, wiring, and circuit breakers. Collaborating with qualified electrical engineers is crucial to ensure the installation adheres to safety and regulatory standards.

Configuring ASIC Miners for Three-Phase Power

Many contemporary ASIC miners are engineered to function on three-phase power. Nonetheless, older models may necessitate modifications or the utilization of power conversion equipment. Configuring the miners to operate on three-phase power is a pivotal step in maximizing efficiency.

Implementing Redundancy and Backup Systems

To safeguard against interruptions in mining operations, implementing redundancy and backup systems is imperative. This encompasses installing backup generators, uninterruptible power supplies, and redundant power circuits to mitigate the impact of power outages and equipment malfunctions.

Monitoring and Maintenance

Following the operationalization of the three-phase power system, ongoing monitoring and maintenance are critical to ensure optimal performance. Regular inspections, load balancing, and proactive maintenance can aid in identifying and rectifying potential issues before they disrupt operations.

Conclusion

The future of bitcoin mining hinges on the efficient utilization of power resources. As advancements in chip processing technologies approach their limits, the emphasis on the power setup becomes increasingly paramount. Three-phase power, particularly a 480v system, offers numerous advantages capable of revolutionizing bitcoin mining operations.

By delivering higher power density, enhanced efficiency, reduced infrastructure costs, and scalability, three-phase power systems can accommodate the escalating demands of the mining industry. While implementing such a system demands meticulous planning and execution, the benefits far surpass the associated challenges.

As the bitcoin mining sector continues to evolve, embracing three-phase power can pave the way for more sustainable and profitable operations. With the appropriate infrastructure in place, miners can harness the full potential of their equipment and maintain a competitive edge in the dynamic realm of bitcoin mining.

This guest post is authored by Christian Lucas, Strategy at Bitdeer. The opinions expressed are entirely those of the author and do not necessarily align with BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

Should You Purchase Gold?

Gold was a safe investment option for those who were in financial turmoil. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

Although gold prices have shown an upward trend in recent years, they are still relatively low when compared to other commodities like oil and silver.

Experts believe this could change soon. Experts predict that gold prices will rise sharply in the wake of another global financial collapse.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- The first thing to do is assess whether you actually need the money you're putting aside for retirement. It is possible to save enough money to retire without investing in gold. However, when you retire at age 65, gold can provide additional protection.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each one offers different levels security and flexibility.

- Don't forget that gold does not offer the same safety level as a bank accounts. Your gold coins may be lost and you might never get them back.

If you are thinking of buying gold, do your research. And if you already own gold, ensure you're doing everything possible to protect it.

How much should you have of gold in your portfolio

The amount of capital required will affect the amount you make. Start small with $5k-10k. As you grow, it is possible to rent desks or office space. So you don't have all the hassle of paying rent. Only one month's rent is required.

Consider what type of business your company will be running. My website design company charges clients $1000-2000 per month depending on the order. You should also consider the expected income from each client when you do this type of thing.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. Therefore, you might only get paid one time every six months.

Decide what kind of income do you want before you calculate how much gold is needed.

I recommend starting with $1k-$2k in gold and working my way up.

What is the tax on gold in Roth IRAs?

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

You don't pay tax if you have the money in a traditional IRA/401k. Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

Each state has its own rules regarding these accounts. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. Massachusetts allows you up to April 1st. New York allows you to wait until age 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

investopedia.com

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- How do you keep your IRA Gold at Home? It's not legal – WSJ

forbes.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

How To

How to Hold Physical Gold in an IRA

An easy way to invest gold is to buy shares from gold-producing companies. This method is not without risks. There's no guarantee these companies will survive. There is always the chance of them losing their money due to fluctuations of the gold price.

The alternative is to buy physical gold. You'll need to open a bank account, buy gold online from a trusted seller, or open an online bullion trading account. This option offers the advantages of being able to purchase gold at low prices and easy access (you don’t need to deal directly with stock exchanges). It is also easier to check how much gold you have stored. You will receive a receipt detailing exactly what you paid. There's also less chance of theft than investing in stocks.

However, there are disadvantages. Bank interest rates and investment funds won't help you. You can't diversify your holdings, and you are stuck with the items you have bought. Finally, the taxman might want to know where your gold has been placed!

BullionVault.com is the best website to learn about gold purchases in an IRA.

—————————————————————————————————————————————————————————————–

By: Christian Lucas

Title: Revolutionizing Bitcoin Mining: The Power of Three-Phase Systems

Sourced From: bitcoinmagazine.com/technical/revolutionizing-bitcoin-mining-the-power-of-three-phase-systems

Published Date: Thu, 12 Sep 2024 13:00:00 GMT