For seniors, particularly those nearing retirement age, the concept of investing in or owning bitcoin can provoke a range of responses from doubt to disbelief. However, delving beyond the common narratives reveals a more nuanced story. Here are six compelling reasons why including bitcoin in your retirement portfolio is worth considering.

1. Diversifies Your Asset Allocation

Asset allocation is a traditional investment strategy that aims to distribute and protect funds from market risks over time. By diversifying across various asset classes like bonds, stocks, real estate, cash, and commodities, investors can mitigate risk. With the emergence of bitcoin as a new asset class, adding it to your portfolio can enhance diversification and improve risk management.

2. Acts as a Hedge Against Inflation

As retirees, safeguarding against inflation is crucial for preserving purchasing power. Bitcoin's fixed supply and decentralized nature make it an effective hedge against currency devaluation caused by excessive money printing. Unlike fiat currencies, bitcoin's scarcity ensures its value remains intact over time, making it a reliable store of value.

3. Provides Potential for High Returns

Bitcoin's limited supply and increasing adoption as a store of value position it to deliver asymmetric returns. Holding bitcoin for the long term can offer significant upside potential, especially in a retirement scenario where extended time horizons allow for capital appreciation. Despite short-term volatility, bitcoin's long-term growth prospects make it a compelling investment option.

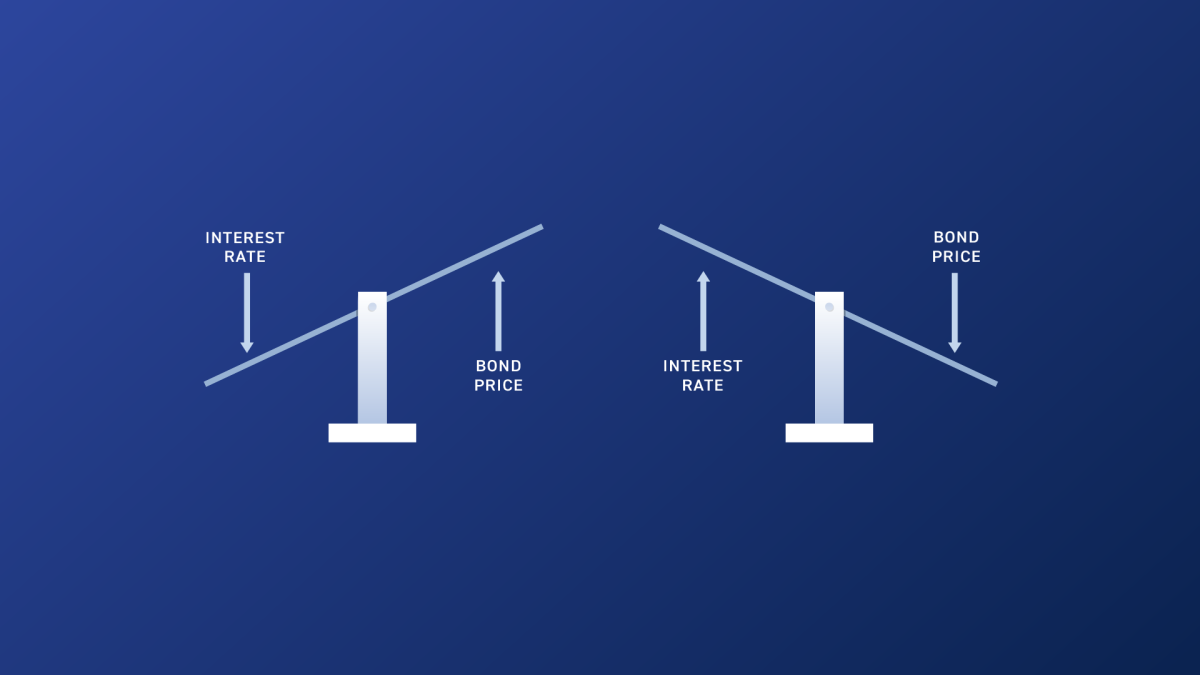

4. Mitigates Risks Associated with Bonds

With bond yields at historic lows and the potential for rising interest rates, traditional bond investments may pose significant risks for retirees. Bitcoin, as a separate asset class, offers a distinct value proposition that can offset risks associated with bond market fluctuations. Including bitcoin in your portfolio can provide a buffer against bond-related risks.

5. Addresses Long-Term Healthcare Costs

Rising healthcare expenses, particularly long-term care costs, present a significant financial challenge for retirees. Bitcoin's inflation-hedging properties and long-term appreciation potential make it a viable option for hedging against escalating healthcare expenses. Allocating a portion of your portfolio to bitcoin can serve as a strategic hedge against healthcare-related financial risks.

6. Enhances Individual Sovereignty

Bitcoin empowers individuals with unparalleled ownership and control over their wealth. Its borderless and censorship-resistant nature ensures that your funds remain secure and accessible, free from external interference. By holding bitcoin in a self-custody IRA or multisig wallet, retirees can maintain financial sovereignty and protect their assets from external threats.

By incorporating bitcoin into their retirement strategy, seniors can leverage its unique properties to enhance diversification, hedge against inflation, and secure long-term financial stability. With careful research and consideration, owning bitcoin can align with sound financial principles and provide a valuable addition to a well-rounded retirement portfolio.

Frequently Asked Questions

What are the pros & con's of a golden IRA?

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. An IRA is a good choice for those who want a way to save some money but don’t want the tax. However, there are disadvantages to this type investment.

You may lose all your accumulated savings if you take too much out of your IRA. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

Another disadvantage is that you must pay fees to manage your IRA. Most banks charge 0.5% to 2.0% per annum. Other providers charge monthly management fees ranging from $10 to $50.

If you prefer your money to be kept out of a bank, then you will need insurance. A majority of insurance companies require that you possess a minimum amount gold to be eligible for a claim. It is possible that you will be required to purchase insurance that covers losses of up to $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. Some providers limit the amount of gold that you are allowed to own. Some providers allow you to choose your weight.

It's also important to decide whether or not to buy gold futures contracts. Gold futures contracts are more expensive than physical gold. Futures contracts, however, allow for greater flexibility in buying gold. You can set up futures contracts with a fixed expiration date.

You also need to decide the type and level of insurance coverage you want. The standard policy doesn't include theft protection or loss due to fire, flood, or earthquake. It does provide coverage for damage from natural disasters, however. You may consider adding additional coverage if you live in an area at high risk.

Apart from insurance, you should consider the costs of storing your precious metals. Storage costs are not covered by insurance. Banks charge between $25 and $40 per month for safekeeping.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians don't have the right to sell assets. Instead, they must retain them for as long and as you require.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). It is also important to specify how much money you will invest each month.

After filling in the forms, please send them to the provider. The company will review your application and send you a confirmation letter.

If you are thinking of opening a gold IRA for retirement, a financial professional is a great idea. Financial planners are experts in investing and will help you decide which type of IRA works best for your situation. You can also reduce your insurance costs by working with them to find lower-cost alternatives.

How much gold do you need in your portfolio?

The amount of capital required will affect the amount you make. Start small with $5k-10k. As your business grows, you might consider renting out office space or desks. So you don't have all the hassle of paying rent. Rent is only paid per month.

Also, you need to think about the type of business that you are going to run. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. So if you do this kind of thing, you need to consider how much income you expect from each client.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. So you might only get paid once every 6 months or so.

You need to determine what kind or income you want before you decide how much of it you will need.

I recommend starting with $1k to $2k of gold, and then growing from there.

How much do gold IRA fees cost?

$6 per month is the Individual Retirement Account Fee (IRA). This includes account maintenance fees and investment costs for your chosen investments.

Diversifying your portfolio may require you to pay additional fees. These fees vary depending on what type of IRA you choose. Some companies offer free checking, but charge monthly fees for IRAs.

Many providers also charge annual management fees. These fees can range from 0% up to 1%. The average rate per year is.25%. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

How much money should my Roth IRA be funded?

Roth IRAs can be used to save taxes on your retirement funds. You can't withdraw money from these accounts before you reach the age of 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, you cannot touch your principal (the original amount deposited). This means that no matter how much you contribute, you can never take out more than what was initially contributed to this account. If you decide to withdraw more money than what you contributed initially, you will need to pay taxes.

The second rule is that your earnings cannot be withheld without income tax. When you withdraw, you will have to pay income tax. Let's assume that you contribute $5,000 each year to your Roth IRA. Let's further assume you earn $10,000 annually after contributing. You would owe $3,500 in federal income taxes on the earnings. The remaining $6,500 is yours. Because you can only withdraw what you have initially contributed, this is all you can take out.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. You'd also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). So even though you received $7,000 in Roth IRA contributions, you only received $4,000.

Two types of Roth IRAs are available: Roth and traditional. Traditional IRAs allow for pre-tax deductions from your taxable earnings. Your traditional IRA can be used to withdraw your balance and interest when you are retired. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs do not allow you to deduct your contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. There is no minimum withdrawal limit, unlike traditional IRAs. You don't have to wait until you turn 70 1/2 years old before withdrawing your contribution.

What are the benefits of having a gold IRA?

The best way to save money for retirement is to place it in an Individual Retirement Account. You can withdraw it at any time, but it is tax-deferred. You have complete control over how much you take out each year. There are many types of IRAs. Some are better suited for college students. Others are made for investors seeking higher returns. Roth IRAs are a way for individuals to make contributions after the age of 59 1/2, and then pay taxes on any earnings upon retirement. Once they start withdrawing money, however, the earnings aren’t subject to tax again. This account may be worth considering if you are looking to retire earlier.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA where you pay taxes on gains, a gold IRA doesn't require you to worry about taxation while you wait to get them. People who want to invest their money rather than spend it make gold IRA accounts a great option.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. This eliminates the need to constantly make deposits. To ensure that you never miss a payment, you could set up direct debits.

Finally, gold is one the most secure investment options available. Because it isn't tied to any particular country its value tends be steady. Even in times of economic turmoil, gold prices tend not to fluctuate. It is therefore a great choice for protecting your savings against inflation.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

investopedia.com

finance.yahoo.com

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Legal – WSJ

bbb.org

How To

Tips for Investing Gold

Investing in Gold is one of the most popular investment strategies worldwide. This is because there are many benefits if you choose to invest in gold. There are many ways you can invest in gold. Some people purchase physical gold coins. Others prefer to invest their money in gold ETFs.

You should consider some things before you decide to purchase any type of gold.

- First, you must check whether your country allows you to own gold. If it is, you can move on. You can also look at buying gold abroad.

- You should also know the type of gold coin that you desire. You can go for yellow gold, white gold, rose gold, etc.

- Third, consider the cost of gold. Start small and build up. It is important to diversify your portfolio whenever you purchase gold. Diversifying assets should include stocks, bonds real estate mutual funds and commodities.

- Don't forget to keep in mind that gold prices often change. You need to keep up with current trends.

—————————————————————————————————————————————————————————————–

By: Unchained

Title: Reasons Why Seniors Should Consider Owning Bitcoin During Retirement

Sourced From: bitcoinmagazine.com/markets/6-reasons-to-own-bitcoin-in-retirement

Published Date: Fri, 03 May 2024 21:31:09 GMT