Introduction

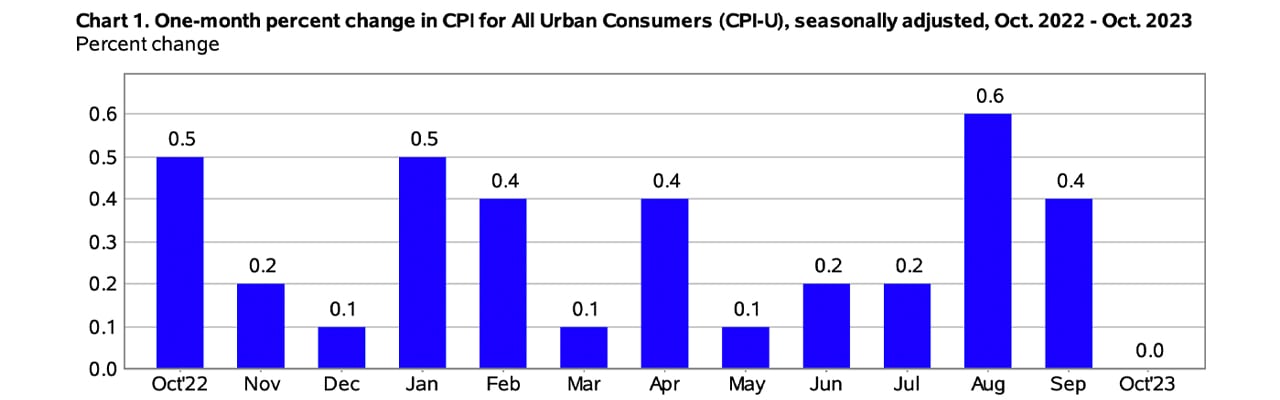

The U.S. Bureau of Labor Statistics recently released the October Consumer Price Index for All Urban Consumers (CPI-U), which revealed that there was no change in the index compared to the previous month. This comes after a 0.4% increase in September. However, over the past year, consumer prices have risen by 3.2% before seasonal adjustment, indicating a significant upward trend.

Shelter Prices Rise, Gasoline Prices Drop

The October CPI report highlighted a notable increase in the shelter index, which helped offset a significant 5% drop in the gasoline index. As a result, the seasonally adjusted index remained unchanged for the month. Additionally, the broader energy index decreased by 2.5%, contributing to the overall stabilization of consumer prices.

Food Prices Show Modest Increase

The U.S. Labor Department reported that the food index experienced a modest increase of 0.3% in October, continuing its upward trend from a 0.2% rise in September. The cost of food at home mirrored this increase, while expenses for food consumed away from home rose slightly higher at 0.4%.

Comparison to Previous Year

Looking at the 12-month period ending in October, the all-items index saw a 3.2% rise, which is a deceleration from the 3.7% increase observed in the previous year. During the same period, the energy index decreased by 4.5%, while the food index increased by 3.3%. Following the release of the report, the U.S. stock market reacted with mixed sentiments, with the Dow Jones Industrial Average and the Russell 2000 Index experiencing varying movements.

Mixed Reactions in the Cryptocurrency Market

In the cryptocurrency market, reactions were also mixed after the release of the report. The overall crypto market value decreased by 0.84% in the last 24 hours. Bitcoin (BTC) saw a decline of 0.69%, while ethereum (ETH) experienced a decrease of 0.6%. In contrast, the precious metals market saw growth, with gold prices increasing by 0.6% and silver surging by over 2%.

Uncertainty in the Market

Currently, the yield on the 10-year U.S. Treasury note stands at a reduced rate of 4.457%. Investors remain uncertain following the announcement of an unremarkable Consumer Price Index (CPI) report, which indicates some slowing down. This uncertainty arises from speculation about the U.S. Federal Reserve's next steps.

"Despite the deceleration, the Fed will likely continue to speak hawkishly and will keep warning investors not to be complacent about the Fed's resolve to get inflation down to the long-run 2% target," stated Jeffrey Roach, Chief Economist at LPL Financial.

What are your thoughts on Tuesday's CPI release? Share your opinions in the comments section below.

Frequently Asked Questions

How is gold taxed in Roth IRA?

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

You don't pay tax if you have the money in a traditional IRA/401k. Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

The rules that govern these accounts differ from one state to the next. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. Massachusetts allows you to delay withdrawals until April 1. New York has a maximum age limit of 70 1/2. To avoid penalties, plan ahead so you can take distributions at the right time.

What are the benefits of having a gold IRA?

You can save money on retirement by putting your money into an Individual Retirement Account. It's not subject to tax until you withdraw it. You have total control over how much each year you take out. There are many types and types of IRAs. Some are better suited for college students. Others are designed for investors looking for higher returns. For example, Roth IRAs allow individuals to contribute after age 59 1/2 and pay taxes on any earnings at retirement. However, once they begin withdrawing funds, these earnings are not taxed again. This type of account might be a good choice if your goal is to retire early.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA where you pay taxes on gains, a gold IRA doesn't require you to worry about taxation while you wait to get them. For people who would rather invest than spend their money, gold IRA accounts are a good option.

An additional benefit to owning gold through an IRA, is the ease of automatic withdrawals. It means that you don’t have to remember to make deposits every month. You could also set up direct debits to never miss a payment.

Finally, the gold investment is among the most reliable. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even during economic turmoil, gold prices tend to stay relatively stable. As a result, it's often considered a good choice when protecting your savings from inflation.

Should You Invest Gold in Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. Consider investing in both.

Not only is it a safe investment but gold can also provide potential returns. Retirement investors will find gold a worthy investment.

While most investments offer fixed rates of return, gold tends to fluctuate. Its value fluctuates over time.

This does not mean you shouldn’t invest in gold. You should just factor the fluctuations into any overall portfolio.

Another benefit of gold is that it's a tangible asset. Gold is more convenient than bonds or stocks because it can be stored easily. It can also be transported.

As long as you keep your gold in a secure location, you can always access it. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold tends to rise when the stock markets fall.

Investing in gold has another advantage: you can sell it anytime you want. You can easily liquidate your investment, just as with stocks. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't purchase too much at once. Start small, buying only a few ounces. You can add more as you need.

Remember, the goal here isn't to get rich quickly. Instead, the goal here is to build enough wealth to not need to rely upon Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

Can I buy or sell gold from my self-directed IRA

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contracts are financial instruments that are based on gold's price. These financial instruments allow you to speculate about future prices without actually owning the metal. However, physical bullion is real gold or silver bars you can hold in your hands.

What proportion of your portfolio should you have in precious metals

This question can only be answered if we first know what precious metals are. Precious metals refer to elements with a very high value relative other commodities. This makes them valuable in investment and trading. Today, gold is the most commonly traded precious metal.

There are many other precious metals, such as silver and platinum. The price for gold is subject to fluctuations, but stays relatively stable in times of economic turmoil. It is also relatively unaffected both by inflation and deflation.

In general, all precious metals have a tendency to go up with the market. They do not always move in the same direction. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors choose safe assets such Treasury Bonds over precious metals. Because they are rare, they become more pricey and lose value.

It is important to diversify your portfolio across precious metals in order to maximize your profit from precious metals investments. Furthermore, because the price of precious Metals fluctuates, it is best not to focus on just one type of precious Metals.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

cftc.gov

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options Types, Spreads, Example and Risk Metrics

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement account

How To

How to Buy Physical Gold in An IRA

The most obvious way to invest in gold is by buying shares from companies producing gold. But this investment method has many risks as there is no guarantee of survival. Even if they survive, there's always the risk that they will lose money due fluctuations in gold prices.

You can also buy gold directly. You can either open an account with a bank, online bullion dealer, or buy gold directly from a seller you trust. This option has many advantages, including the ease of access (you don’t have to deal with stock markets) and the ability of making purchases at low prices. It is also easier to check how much gold you have stored. So you can see exactly what you have paid and if you missed any taxes, you will get a receipt. You are also less likely to be robbed than investing in stocks.

However, there can be some downsides. There are some disadvantages, such as the inability to take advantage of investment funds and interest rates from banks. It won't allow you to diversify any of your holdings. Instead, you'll be stuck with what's been bought. Finally, tax man may want to ask where you put your gold.

If you'd like to learn more about buying gold in an IRA, visit the website of BullionVault.com today!

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: October’s Inflation Report: Shelter Prices Up, Gasoline Plummets — Mixed Market Reactions Follow

Sourced From: news.bitcoin.com/octobers-inflation-report-shelter-prices-up-gasoline-plummets-mixed-market-reactions-follow/

Published Date: Tue, 14 Nov 2023 16:30:17 +0000

Did you miss our previous article…

https://altcoinirareview.com/is-fiat-money-safe-robert-kiyosaki-warns-against-central-bankers/