Introduction

PropyKeys, a new gamified application, is introducing a home addresses market onchain as part of the Propy ecosystem. This decentralized application (dApp) game is powered by the PRO token and launched on Base, a layer-2 network operating on top of Ethereum and part of the Coinbase ecosystem. Participants can mint their own or someone else's home addresses onchain and stake or sell them later.

Simplifying Real Estate with Blockchain

Real estate has faced barriers to entry such as exorbitant title fees and inefficiencies that blockchain can simplify. Propy and its ecosystem companies aim to make homeownership seizure-resistant, more affordable, and user-friendly. The $280 trillion market has remained entrenched in a "no trading zone," but PropyKeys seeks to rewrite this narrative by being a fun entry point to the Propy ecosystem and onchain title ownership. Now, anyone can start their onchain journey by minting home addresses via PropyKeys, verifying ownership via Propy, and even creating instant property sales or micro mortgages within the onchain Propy ecosystem.

Unlocking Property Ownership

PropyKeys addresses critical pain points in property ownership:

Democratized Minting and Trading

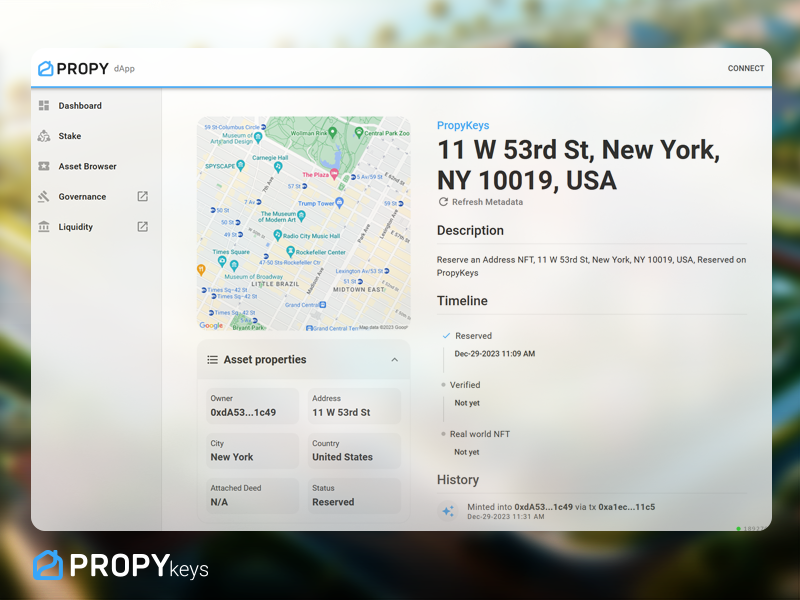

PropyKeys allows crypto natives to mint addresses, stake them, and seamlessly facilitate trades with property owners. Address NFTs can be minted for a PRO token fee. Home address holders and real owners of acquired addresses have advantages for the 3 tiers of NFTs. The fee for minting onchain addresses and property titles is collected in $PRO, which sustains ecosystem development and incentivizes community participation. All collected fees from addresses are redirected to incentivize and reward the network of address owners, ensuring active engagement and network growth. Staking and governance participation also offer avenues for token holders to contribute and influence the ecosystem while earning rewards in $PRO tokens.

Onchain Titles & RWA NFTs

Property owners can elevate their addresses to onchain titles, enabling them to stake these titles or convert them into Real World Asset (RWA) NFTs. These NFTs facilitate easy sales or micro mortgages, opening new avenues for property transactions.

Trust & Security

PropyKeys champions an onchain, open-source, and community-governed title registry, leveraging user trust. By replacing paper deeds with algorithm-based systems, the platform guarantees a trustworthy and secure environment for all users.

Get your real-world address minted today

Visit PropyKeys.com today to mint your real-world address onchain. Join the movement empowering accessible property transactions and ownership like never before.

PropyKeys' innovation embodies philosophical tenets—trust and transparency. The transition from conventional property registries to blockchain-based onchain titles instills trust in algorithms rather than centralized intermediaries. This philosophical shift reverberates beyond the real estate sphere, transcending into a broader societal paradigm that has started its rapid revolution with programmable decentralized money.

About Propy

Propy is a pioneering platform that leverages blockchain technology to facilitate seamless transactions of real-world assets (RWA), with a specific focus on revolutionizing global real estate markets. As an industry leader, Propy specializes in providing secure and efficient solutions, ensuring an enhanced experience for buying and selling properties worldwide.

X (Twitter): https://twitter.com/PropyInc

Facebook: https://www.facebook.com/propyinc

Website: https://propy.com/

Media contact: andrew@propykeys.com

Disclaimer: This press release contains forward-looking statements and should not be construed as investment advice. The actual results may differ materially from those projected in the forward-looking statements.

Frequently Asked Questions

Do you need to open a Precious Metal IRA

The most important thing you should know before opening an IRA account is that precious metals are not covered by insurance. It is impossible to get back money if you lose your investment. This includes any loss of investments from theft, fire, flood or other circumstances.

You can protect yourself against such losses by purchasing physical gold and silver coins. These items are timeless and have a lifetime value. They are likely to fetch more today than the price you paid for them in their original form.

When opening an IRA account, make sure you choose a reputable company offering competitive rates and high-quality products. It is also a smart idea to use a third-party trustee who will help you have access to your assets at all times.

If you decide to open an account, remember that you won't see any returns until after you retire. Do not forget about the future!

What should I pay into my Roth IRA

Roth IRAs let you save tax on retirement by allowing you to deposit your own money. You can't withdraw money from these accounts before you reach the age of 59 1/2. If you decide to withdraw some of your contributions, you will need to follow certain rules. First, your principal (the original deposit amount) cannot be touched. This means that you can't take out more money than you originally contributed. If you decide to withdraw more money than what you contributed initially, you will need to pay taxes.

You cannot withhold your earnings from income taxes. You will pay income taxes when you withdraw your earnings. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's say you earn $10,000 each year after contributing. This would mean that you would have to pay $3,500 in federal income tax. This leaves you with $6,500 remaining. You can only take out what you originally contributed.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. You'd also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types of Roth IRAs: Traditional and Roth. A traditional IRA allows for you to deduct pretax contributions of your taxable income. Your traditional IRA allows you to withdraw your entire contribution plus any interest. You can withdraw as much as you want from a traditional IRA.

Roth IRAs don't allow you deduct contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. There is no minimum withdrawal required, unlike a traditional IRA. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

How much is gold taxed under a Roth IRA

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. If you invest $1,000 in mutual funds or stocks and then later sell them, all gains are subjected to taxes.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

These accounts are subject to different rules depending on where you live. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York offers a waiting period of up to 70 1/2 years. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Should you Invest In Gold For Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. Consider investing in both.

Not only is it a safe investment but gold can also provide potential returns. Retirement investors will find gold a worthy investment.

While many investments promise fixed returns, gold is subject to fluctuations. Therefore, its value is subject to change over time.

However, it doesn't necessarily mean that you shouldn't invest your money in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another advantage of gold is its tangible nature. Gold is much easier to store than bonds and stocks. It is also easily portable.

You can always access your gold as long as it is kept safe. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold usually rises when the stock market falls.

Gold investment has another advantage: You can sell it anytime. Just like stocks, you can liquidate your position whenever you need cash. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

You shouldn't buy too little at once. Begin by buying a few grams. Next, add more as required.

Keep in mind that the goal is not to quickly become wealthy. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

How much tax is gold subject to in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. When you purchase gold, you don't have to pay any taxes. It isn't considered income. If you decide to sell it later, there will be a taxable gain if its price rises.

You can use gold as collateral to secure loans. Lenders will seek the highest return on your assets when you borrow against them. In the case of gold, this usually means selling it. It's not guaranteed that the lender will do it. They may hold on to it. They may decide to resell it. The bottom line is that you could lose potential profit in any case.

So to avoid losing money, you should only lend against your gold if you plan to use it as collateral. It's better to keep it alone.

Can I keep physical gold in an IRA?

Gold is money. Not just paper currency. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Many Americans are now more inclined to invest in precious metals like gold and silver than stocks or bonds. Although owning gold does not guarantee that you will make money investing in it, there are many reasons to consider adding gold into your retirement portfolio.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. The S&P 500 dropped 21 percent in the same time period, while gold prices rose by nearly 100 percent between August 2011-early 2013. Gold was one asset that outperformed stocks in turbulent market conditions.

Another benefit to investing in gold? It has virtually zero counterparty exposure. You still have your shares even if your stock portfolio falls. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Finally, gold offers liquidity. This means you can easily sell your gold any time, unlike other investments. You can buy gold in small amounts because it is so liquid. This allows you to take advantage of short-term fluctuations in the gold market.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement funds

irs.gov

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

How To

Tips to Invest in Gold

Investing in Gold is one of the most popular investment strategies worldwide. There are many benefits to investing in gold. There are several ways to invest in gold. Some people buy physical gold coins, while others prefer investing in gold ETFs (Exchange Traded Funds).

Before you purchase any type or gold, here are some things to think about.

- First, check to see if your country permits you to possess gold. If you have permission to possess gold in your country, you can then proceed. You might also consider buying gold in foreign countries.

- Secondly, you should know what kind of gold coin you want. You can go for yellow gold, white gold, rose gold, etc.

- Thirdly, you should take into consideration the price of gold. It is best to begin small and work your ways up. One thing that you should never forget when purchasing gold is to diversify your portfolio. Diversifying your portfolio includes stocks, bonds, mutual funds, real estate, commodities, and mutual funds.

- You should also remember that gold prices can change often. Keep an eye on current trends.

—————————————————————————————————————————————————————————————–

By: Media

Title: Mint and Trade Real-World Addresses Onchain With PropyKeys dApp, Part of Propy Ecosystem

Sourced From: news.bitcoin.com/mint-and-trade-real-world-addresses-onchain-with-propykeys-dapp-part-of-propy-ecosystem/

Published Date: Fri, 05 Jan 2024 08:15:37 +0000

Did you miss our previous article…

https://altcoinirareview.com/bain-and-company-recognizes-400-billion-revenue-opportunity-with-tokenization-of-alternative-investments/

Related posts:

Arkham Reveals Onchain Addresses Linked to 4 Major Bitcoin ETFs, Boosting Market Transparency

Arkham Reveals Onchain Addresses Linked to 4 Major Bitcoin ETFs, Boosting Market Transparency

OFAC Sanctions 7 New Bitcoin Addresses Allegedly Associated With Iran-Related Ransomware Activities

OFAC Sanctions 7 New Bitcoin Addresses Allegedly Associated With Iran-Related Ransomware Activities

Escalation of Ethereum Inflation Amid Onchain Activity Slowdown; $35.31M Accretion in 17 Days

Escalation of Ethereum Inflation Amid Onchain Activity Slowdown; $35.31M Accretion in 17 Days

Tokenized Real-World Assets (RWA): A Superior Alternative to Traditional ETFs

Tokenized Real-World Assets (RWA): A Superior Alternative to Traditional ETFs