Hey there, fellow crypto enthusiasts! Today, I'm thrilled to dive into Michael Saylor's recent groundbreaking announcement regarding Strategy (MSTR) aggressively buying Bitcoin. Exciting stuff, right?

The Buzz Around Saylor's Bitcoin Buying Spree

Clarifying the Rumors

Amidst the chaos in the crypto realm, whispers emerged about Strategy potentially offloading its Bitcoin stash. But wait, here comes Michael Saylor to the rescue! He promptly shut down these speculations, affirming, "We are buying bitcoin." Phew, crisis averted!

Staying Strong Amidst Volatility

Despite the turbulence, Saylor urges investors to keep their eyes on the prize. He reminds us to zoom out and reflect on Bitcoin's journey from $55,000-$65,000 to the current $95,000 range. In Saylor's eyes, the future still looks pretty darn bright!

Bitcoin: The Ultimate Investment

Saylor's Bullish Vision

Saylor's unwavering confidence in Bitcoin shines through as he labels it a top-tier investment. Comparing its growth to traditional assets, he highlights Bitcoin's impressive 50% annual surge over the past five years, outshining gold and the S&P. Now, that's what we call a stellar performance!

Onwards and Upwards

Despite market uncertainties, Strategy remains steadfast in its commitment. Saylor's resounding message? "We're always buying." Brace yourselves for more Bitcoin moves ahead!

Saylor's Trillion-Dollar Bitcoin Dream

Revolutionizing Finance

In a recent chat with Bitcoin Magazine, Saylor unveiled his grand plan to amass a trillion-dollar Bitcoin balance sheet. Imagine the possibilities! By leveraging Bitcoin's long-term growth, he aims to reshape the financial landscape, offering innovative credit solutions and paving the way for new financial products denominated in Bitcoin.

Continuing the Trend

Strategy's recent purchase of 487 BTC reaffirms its unwavering dedication to the Bitcoin cause. With the average price per BTC at $102,557, Strategy's Bitcoin holdings soar to 641,692 BTC, showcasing their steadfast Bitcoin treasury strategy.

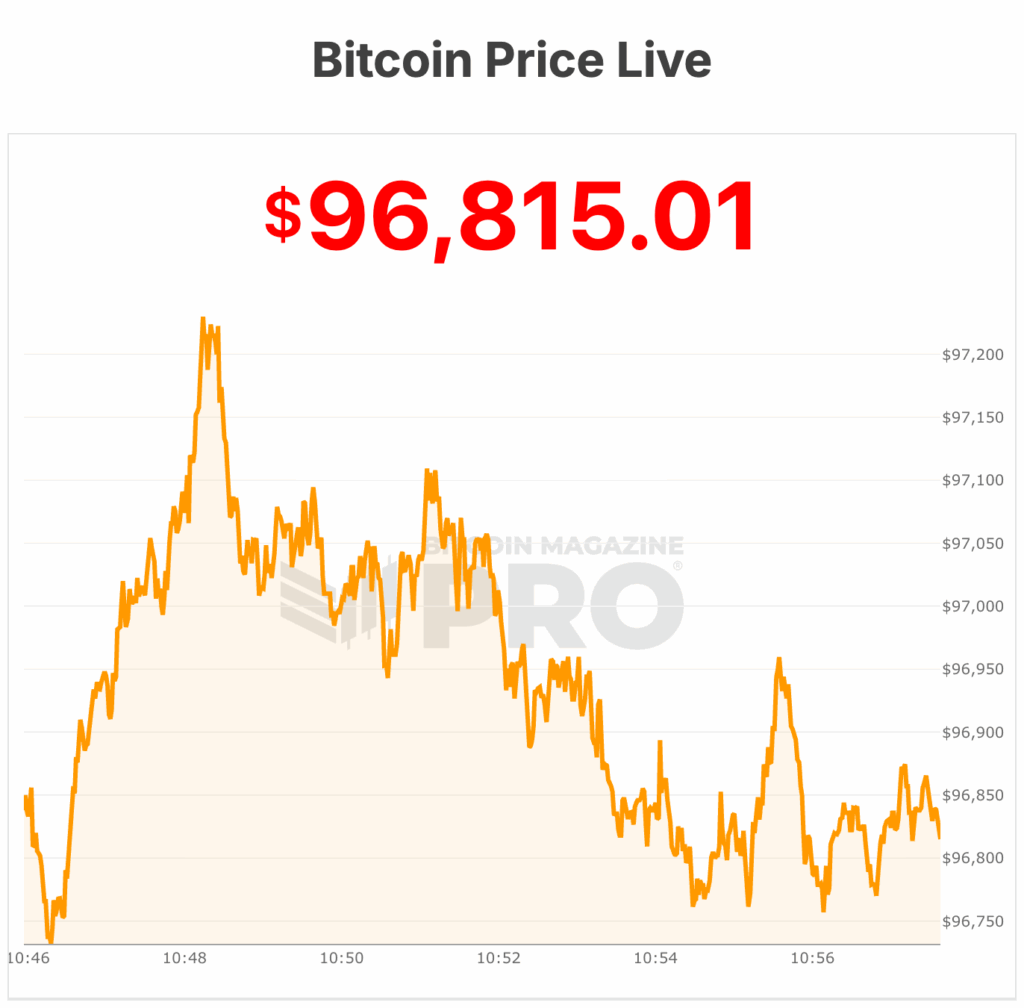

As of now, Bitcoin is trading at $96,815, with recent lows near $94,000. Exciting times ahead in the crypto universe!

Are you ready to ride the Bitcoin wave with Strategy and Michael Saylor? Let's embrace the future of finance, one Bitcoin at a time!

Frequently Asked Questions

Should You Buy Gold?

Gold was a safe investment option for those who were in financial turmoil. Many people today are moving away from stocks and bonds to look at precious metals, such as gold, as a way to diversify their investments.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

Some experts think that this could change in the near future. Experts believe that gold prices could skyrocket in the face of another global financial crisis.

They also noted that gold is growing in popularity because of its perceived value as well as potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- Consider whether you will actually need the money that you are saving for retirement. You can save money for retirement even if you don't invest in gold. Gold does offer an extra layer of protection for those who reach retirement age.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each offers varying levels of flexibility and security.

- Don't forget that gold does not offer the same safety level as a bank accounts. Losing your gold coins could result in you never being able to retrieve them.

Don't buy gold unless you have done your research. You should also ensure that you do everything you can to protect your gold.

Can I purchase gold with my self directed IRA?

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. Transfer funds from an existing retirement account are also possible.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contract are financial instruments that depend on the gold price. You can speculate on future prices, but not own the metal. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

What are the pros & cons of a Gold IRA?

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. An IRA is a great way to save money and not have to pay taxes on the interest you earn. However, there are also disadvantages to this type of investment.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. Also, the IRS may not allow you to make withdrawals from your IRA until you're 59 1/2 years old. If you do decide to withdraw funds from your IRA, you'll likely need to pay a penalty fee.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management costs ranging from $10-50.

Insurance will be required if you would like to keep your cash out of banks. In order to make a claim, most insurers will require that you have a minimum amount in gold. Some insurers may require you to have insurance that covers losses up $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. You may be limited in the amount of gold you can have by some providers. Others let you choose your weight.

You will also have to decide whether to purchase futures or physical gold. Futures contracts for gold are less expensive than physical gold. Futures contracts provide flexibility for purchasing gold. Futures contracts allow you to create a contract with a specified expiration date.

You also need to decide the type and level of insurance coverage you want. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does provide coverage for damage from natural disasters, however. Additional coverage may be necessary if you reside in high-risk areas.

You should also consider the cost of storage for your gold. Storage costs will not be covered by insurance. Banks charge between $25 and $40 per month for safekeeping.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian maintains track of all your investments and ensures you are in compliance with federal regulations. Custodians aren't allowed to sell your assets. They must instead keep them for as long as you ask.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. Your monthly investment goal should be stated.

After filling out the forms, you'll need to send them to your chosen provider along with a check for a small deposit. After reviewing your application, the company will send you a confirmation mail.

When opening a gold IRA, you should consider using a financial planner. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement account

investopedia.com

finance.yahoo.com

How To

Gold Roth IRA guidelines

Starting early is the best way to save for retirement. You should start as soon as you are eligible (usually at age 50) and continue saving throughout your career. To ensure sufficient growth, it is vital that you contribute enough each year.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles enable you to make contributions while not paying any taxes on the earnings, until they are withdrawn. These savings vehicles can be a great option for individuals who don't qualify for employer matching funds.

It's important to save regularly and over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————–

By: Micah Zimmerman

Title: Michael Saylor's Bold Move: ‘We Are Buying' Bitcoin Like Never Before

Sourced From: bitcoinmagazine.com/business/strategy-mstr-is-buying-bitcoin

Published Date: Fri, 14 Nov 2025 16:01:46 +0000

Related posts:

Michael Saylor: Bitcoin’s Journey to $1 Million and Beyond

Michael Saylor: Bitcoin’s Journey to $1 Million and Beyond

Michael Saylor’s Bitcoin Strategy Boosts $2.8B Q3 Net Income, Surging Bitcoin Profits

Michael Saylor’s Bitcoin Strategy Boosts $2.8B Q3 Net Income, Surging Bitcoin Profits

Michael Saylor Expects Bitcoin Demand to Double After Halving and Spot Bitcoin ETF Approvals

Michael Saylor Expects Bitcoin Demand to Double After Halving and Spot Bitcoin ETF Approvals

Michael Saylor Publishes Open Letter Discussing the ‘Sheer Volume of Misinformation’ Tied to Bitcoin

Michael Saylor Publishes Open Letter Discussing the ‘Sheer Volume of Misinformation’ Tied to Bitcoin