Hey there, fellow finance enthusiasts! Today, I'm thrilled to dive into the exciting realm of Metaplanet's groundbreaking move that has set the financial world abuzz. Let's explore how Metaplanet has tripled its assets in Q2 by introducing Bitcoin-backed preferred shares tailored for Japan's thirst for yield.

Unlocking Japan's Yield Potential with Metaplanet Prefs

Japan, home to a staggering $14.9 trillion in household financial assets, has long grappled with lackluster returns in its fixed income market. With the 10-year Japanese Government Bond yields barely scraping ~1% and corporate bonds struggling to breach 2%, traditional investors have been craving alternative avenues.

Metaplanet's Game-Changing Strategy

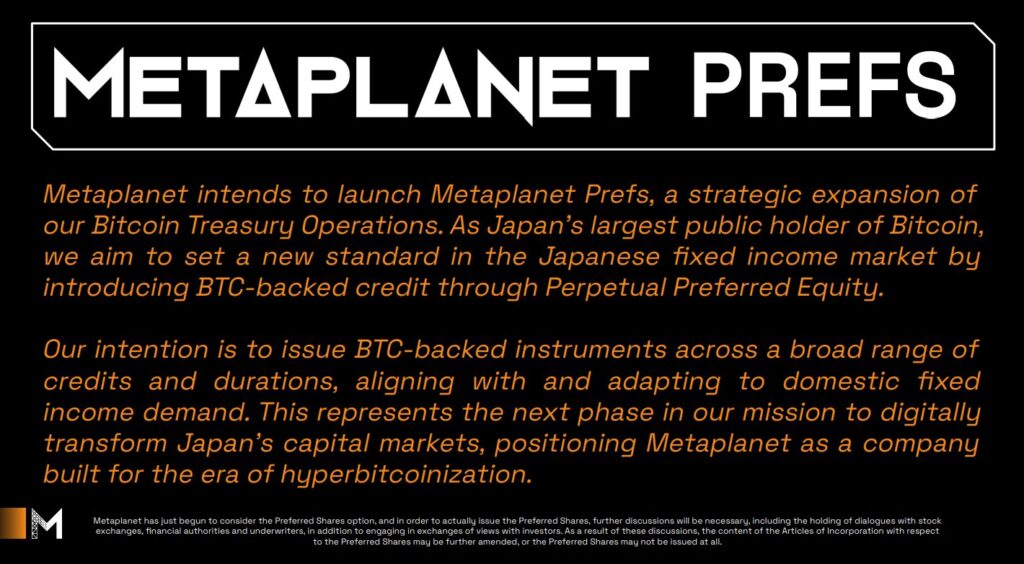

Metaplanet's recent move involves the introduction of "Metaplanet Prefs," a groundbreaking program offering Bitcoin-Backed Preferred Shares aiming to revolutionize the landscape of Japan's fixed income market. Imagine a scenario where even a "high yield" offering stands at low single digits—Metaplanet's innovative approach offering 7–12% has the potential to turn heads and attract substantial capital.

Record Q2 Growth Fuels Metaplanet's Vision

The Q2 earnings report by Metaplanet not only heralded a new funding model but also showcased one of its most robust quarters to date. With soaring revenue, profitability, assets, and net assets, Metaplanet's exponential growth sets the stage for the widespread adoption of Bitcoin-Backed Preferred Shares.

Metaplanet's Financial Leap in Q2:

- Revenue: ¥1.239B ($8.4M) +41% QoQ

- Gross Profit: ¥816M ($5.5M) +38% QoQ

- Net Income: ¥11.1B ($75.1M) vs. -¥5.0B

- Assets: ¥238.2B ($1.61B) +333% QoQ

Metaplanet's stellar performance bolsters investor confidence and positions the company to spearhead the Bitcoin-Backed Preferred Shares initiative, capturing a segment of Japan's lucrative, yet yield-starved market.

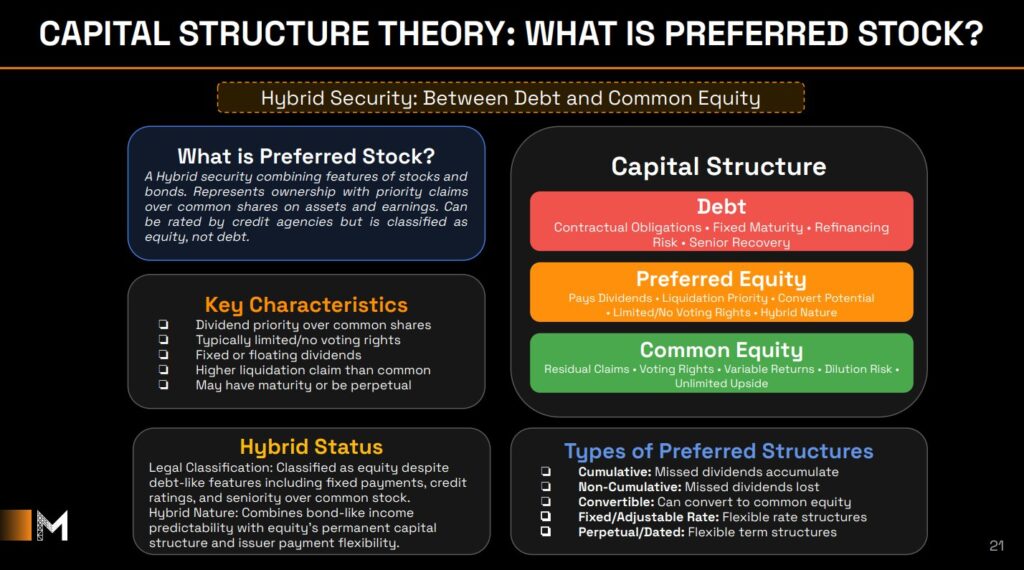

Demystifying BTC-Backed Preferred Equity: The Metaplanet Prefs Unveiled

Preferred equity, nestled between debt and common stock, offers dividend priority, enhanced liquidation claims, and predictable payouts minus the voting dilution. Metaplanet's Bitcoin-Backed Preferred Shares aim to deliver:

- Higher yields compared to JGBs

- Refinancing risk mitigation

- Diversified funding avenues for BTC accumulation

Following Strategy's Footsteps with Multi-Class Stack

Building on Strategy's success, Metaplanet is adopting a multi-class strategy for Bitcoin-backed preferred equity issuance. By tailoring offerings to diverse investor profiles and market demands, Metaplanet seeks to replicate Strategy's triumph in growing its Bitcoin reserves.

Seizing the $14.9 Trillion Opportunity in Japan's Capital Market

Japan's fixed income realm, plagued by meager yields, presents a golden opportunity for innovative instruments like Bitcoin-Backed Preferred Shares. With trillions tied up in low-return assets, the prospect of an 8% yielding share could entice both institutional and retail investors, bridging the yield gap effectively.

Engineering a Bitcoin-Backed Yield Curve for Japan

Metaplanet's strategy involves issuing a range of Bitcoin-Backed Preferred Shares tailored for different investor segments, constructing an investable BTC-backed yield curve. This strategic move aligns with Japan's quest for higher yields in a market hungry for income-generating solutions.

Driving Corporate Bitcoin Strategies Forward

Metaplanet's approach offers valuable insights for corporate strategists worldwide:

- Embracing capital efficiency with Bitcoin-Backed Preferred Shares

- Adapting market fit strategies to match local investor behaviors

- Normalizing Bitcoin as collateral in regulated, yield-seeking portfolios

The Future Ahead: Bitcoin's Fixed Income Revolution

Metaplanet's pioneering move sets the stage for a potential Bitcoin integration into national capital markets. By leveraging Bitcoin as a legitimate collateral base in a yield-constrained economy, Metaplanet paves the way for a new era in fixed income markets, redefining corporate Bitcoin strategies globally.

Exciting times lie ahead as we witness the evolution of corporate finance intertwined with the transformative power of Bitcoin. Let's stay tuned for more groundbreaking developments in this enthralling journey!

Frequently Asked Questions

What proportion of your portfolio should you have in precious metals

Before we can answer this question, it is important to understand what precious metals actually are. Precious metals are those elements that have an extremely high value relative to other commodities. This makes them extremely valuable for trading and investing. The most traded precious metal is gold.

There are many other precious metals, such as silver and platinum. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It is not affected by inflation or deflation.

As a general rule, the prices for all precious metals tend to increase with the overall market. That said, they do not always move in lockstep with each other. When the economy is in trouble, for example, gold prices tend to rise while other precious metals fall. Investors expect lower interest rates which makes bonds less appealing investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. Since these are scarce, they become more expensive and decrease in value.

It is important to diversify your portfolio across precious metals in order to maximize your profit from precious metals investments. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

Do you need to open a Precious Metal IRA

Before opening an IRA, it is important to understand that precious metals aren't covered by insurance. You cannot recover any money you have invested. This includes investments that have been damaged by fire, flooding, theft, and so on.

Protect yourself against this type of loss by investing in physical gold or silver coins. These coins have been around for thousands and represent a real asset that can never be lost. You would probably get more if you sold them today than you paid when they were first created.

When opening an IRA account, make sure you choose a reputable company offering competitive rates and high-quality products. It is also a smart idea to use a third-party trustee who will help you have access to your assets at all times.

Do not open an account unless you're ready to retire. Don't forget the future!

Should You Invest in gold for Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. You can invest in both options if you aren't sure which option is best for you.

Gold is a safe investment and can also offer potential returns. It is a good choice for retirees.

While many investments promise fixed returns, gold is subject to fluctuations. This causes its value to fluctuate over time.

This does not mean you shouldn’t invest in gold. You should just factor the fluctuations into any overall portfolio.

Another advantage of gold is its tangible nature. Gold is much easier to store than bonds and stocks. It can be easily transported.

Your gold will always be accessible as long you keep it in a safe place. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

A portion of your savings can be invested in something that doesn't go down in value. Gold usually rises when the stock market falls.

Another advantage to investing in gold is the ability to sell it whenever you wish. Just like stocks, you can liquidate your position whenever you need cash. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Do not buy too much at one time. Begin by buying a few grams. Next, add more as required.

It's not about getting rich fast. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

How much should you have of gold in your portfolio

The amount of capital that you require will determine how much money you can make. A small investment of $5k-10k would be a great option if you are looking to start small. Then as you grow, you could move into an office space and rent out desks, etc. Renting out desks and other equipment is a great way to save money on rent. Rent is only paid per month.

You also need to consider what type of business you will run. In my case, we charge clients between $1000-2000/month, depending on what they order. So if you do this kind of thing, you need to consider how much income you expect from each client.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. So you might only get paid once every 6 months or so.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I recommend starting with $1k-$2k of gold and growing from there.

What is the Performance of Gold as an Investment?

Gold's price fluctuates depending on the supply and demand. It is also affected by interest rates.

Due to the limited supply of gold, prices for gold are highly volatile. Additionally, physical gold can be volatile because it must be stored somewhere.

What precious metal is best for investing?

This question depends on how risky you are willing to take, and what return you want. Although gold has been considered a safe investment, it is not always the most lucrative. For example, if your goal is to make quick money, gold may not suit you. If you have time and patience, you should consider investing in silver instead.

If you're not looking to make quick money, gold is probably your best choice. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

What is a Precious Metal IRA (IRA)?

You can diversify your retirement savings by investing in precious metal IRAs. This allows you to invest in gold, silver and platinum as well as iridium, osmium and other rare metals. These are “precious metals” because they are hard to find, and therefore very valuable. These are excellent investments that will protect your wealth from inflation and economic instability.

Bullion is often used to refer to precious metals. Bullion refers only to the actual metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

A precious metal IRA lets you invest in bullion direct, instead of purchasing stock. This ensures that you will receive dividends each and every year.

Precious Metal IRAs don’t require paperwork nor have annual fees. You pay only a small percentage of your gains tax. You can also access your funds whenever it suits you.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

bbb.org

cftc.gov

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- You want to keep gold in your IRA at home? It's not exactly legal – WSJ

finance.yahoo.com

How To

Investing In Gold vs. Investing In Stocks

This might make it seem very risky to invest gold as an investment tool. This is because many people believe gold is no longer financially profitable. This belief stems from the fact that most people see gold prices being driven down by the global economy. They feel that gold investment would cause them to lose money. However, investing in gold can still provide significant benefits. We'll be looking at some of these benefits below.

One of the oldest forms known of currency is gold. It has been used for thousands of years. It has been used as a store for value by people all over the globe. As a means of payment, South Africa and many other countries still rely on it.

Consider the price per gram when you decide whether you should invest in or not. It is important to determine the price per gram you are willing and able to pay for gold bullion. If you don’t know what the current market price is, you can always call a local jewelry store and ask them their opinion.

It's also important to note that, although gold prices are down in recent months, the costs of producing it have risen. Although the price of gold has dropped, production costs have not.

It is important to keep in mind the amount you plan to purchase of gold when you're weighing whether or not it is worth your time. It is sensible to avoid buying gold if you are only looking to cover the wedding rings. However, if you are planning on doing so for long-term investments, then it is worth considering. If you sell your gold for more than you paid, you can make a profit.

We hope this article has given you an improved understanding of gold investment tools. We recommend that you investigate all options before making any major decisions. Only then can you make informed decisions.

—————————————————————————————————————————————————————————————–

By: Nick Ward

Title: Metaplanet Triples Assets in Q2 With Bitcoin-Backed Preferred Shares for Japan’s Yield-Starved Market

Sourced From: bitcoinmagazine.com/bitcoin-for-corporations/metaplanet-bitcoin-backed-preferred-shares

Published Date: Wed, 13 Aug 2025 12:02:19 +0000

Did you miss our previous article…

https://altcoinirareview.com/the-intriguing-tale-of-money-unraveling-the-secrets-of-value-and-price/