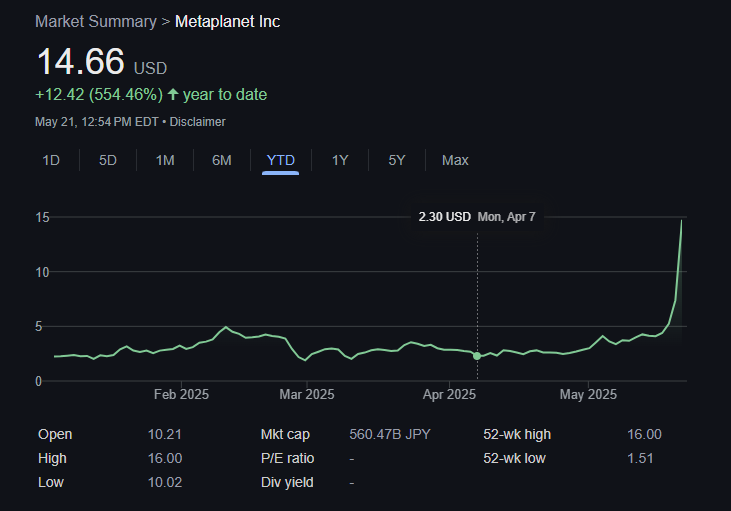

Have you heard the buzz? Metaplanet, Japan's top Bitcoin treasury company, is making waves by reaching a new all-time high in market capitalization. This exciting milestone comes hot on the heels of Bitcoin smashing its own record price. Let's dive into the details of this remarkable journey.

The Meteoric Rise of Metaplanet

Strategic Bitcoin Acquisition

Imagine this: in just a little over a year, Metaplanet has skyrocketed its Bitcoin holdings from 98 BTC to a whopping 7,800 BTC as of May 19, 2025. That's like transforming a tiny garden into a flourishing forest! This strategic move has propelled the company's value to a staggering ¥470.3 billion, marking a phenomenal 554.5% surge this year.

Innovative Financing Strategies

Picture this: Metaplanet's innovative "21 Million Plan" has been a game-changer. By completing multiple series of stock acquisition rights, the company raised a jaw-dropping ¥93.3 billion in a mere 60 trading days. These funds fueled additional Bitcoin purchases, ensuring growth without compromising shareholder value. It's like planting seeds today to harvest a bountiful crop tomorrow!

The OTCQX Market Triumph

Global Expansion

Metaplanet's journey to success didn't stop there. By listing on the OTCQX Market, the company opened its doors to U.S. investors, expanding its reach and influence. This move reflects Metaplanet's dedication to driving Bitcoin adoption worldwide while enhancing value for its shareholders. It's like spreading the Bitcoin gospel far and wide!

Financial Fortitude and Growth

Strategic Alignment

Metaplanet's growth isn't just luck; it's a result of meticulous planning and a keen eye on Bitcoin's trajectory. By focusing on Bitcoin in 2024, the company reaped impressive quarterly BTC yields, propelling its net asset value and market capitalization to new heights in sync with Bitcoin's meteoric rise. It's like riding a wave of success alongside Bitcoin's soaring journey!

Record-Breaking Performance

In Q1 FY2025, Metaplanet reported stellar financial results, showcasing robust revenue growth, increased operating profit, and a surge in net income. The company's strategic Bitcoin investments yielded substantial unrealized gains, solidifying its financial position. It's like hitting the jackpot with every Bitcoin milestone!

Investor Magnetism

Resilience and Rebound

Despite brief valuation fluctuations tied to Bitcoin's performance, Metaplanet quickly recovered, showcasing its resilience and strong correlation with Bitcoin's market movements. This reliability has attracted investors seeking exposure to Bitcoin through the Tokyo Stock Exchange. It's like having a steadfast partner in the ever-evolving world of cryptocurrency!

Ready to ride the Bitcoin wave with Metaplanet? Learn more about this groundbreaking journey in the full article here.

Frequently Asked Questions

Can I have physical gold in my IRA

Gold is money, not just paper currency or coinage. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Investors use gold today as part of their diversified portfolio, because it tends to perform better in times of financial turmoil.

Many Americans today prefer to invest in precious metals, such as silver and gold, over stocks and bonds. It's not guaranteed that you'll make any money investing gold, but there are several reasons it might be worthwhile to add gold to retirement funds.

One reason is that gold historically performs better than other assets during financial panics. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. Gold was one asset that outperformed stocks in turbulent market conditions.

One of the best things about investing in gold is its virtually zero counterparty risk. Your shares will still be yours even if your stock portfolio drops. Gold can be worth more than its investment in a company that defaults on its obligations.

Finally, gold offers liquidity. This means you can easily sell your gold any time, unlike other investments. Gold is liquid and therefore it makes sense to purchase small amounts. This allows you to take advantage of short-term fluctuations in the gold market.

How can you withdraw from an IRA of Precious Metals?

First, you must decide if you wish to withdraw money from your IRA account. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

If you are willing to pay a penalty for early withdrawal, you should consider opening a taxable brokerage account instead of an IRA. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, figure out how much money will be taken out of your IRA. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you have an idea of the amount of your total savings you wish to convert into cash you will need to decide what type of IRA you want. Traditional IRAs allow for you to withdraw funds without tax when you turn 59 1/2. Roth IRAs, on the other hand, charge income taxes upfront but you can access your earnings later and pay no additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. It is better to open an account with a debit than a creditcard in order to avoid any unnecessary fees.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. Some storage facilities will take bullion bars while others require you only to purchase individual coins. You'll have to weigh the pros of each option before you make a decision.

Bullion bars are easier to store than individual coins. But you will have to count each coin separately. On the flip side, storing individual coins allows you to easily track their value.

Some people like to keep their coins in vaults. Some people prefer to store their coins safely in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

How Much of Your IRA Should Include Precious Metals?

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. You don’t need to have a lot of money to invest. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You might consider purchasing physical coins, such as bullion bars and rounds. Also, you could buy shares in companies producing precious metals. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

You will still reap the benefits of owning precious metals, regardless of which option you choose. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

Their prices are more volatile than traditional investments. If you decide to sell your investment, you will likely make more than with traditional investments.

How much is gold taxed under a Roth IRA

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

These rules vary from one state to another. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you to wait until April 1. And in New York, you have until age 70 1/2 . To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

cftc.gov

irs.gov

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

Tips for Investing In Gold

Investing in Gold is one of the most popular investment strategies worldwide. This is due to the many benefits of investing in gold. There are several options to invest in the gold. Some people prefer to buy gold coins in physical form, while others prefer to invest in gold ETFs.

Before buying any kind of gold, you need to consider these things.

- First, find out if your country allows gold ownership. If the answer is yes, you can go ahead. Or, you might consider buying gold overseas.

- You should also know the type of gold coin that you desire. There are many options for gold coins: yellow, white, and rose.

- You should also consider the price of gold. Start small and move up. Diversifying your portfolio is a key thing to remember when purchasing gold. Diversifying assets should include stocks, bonds real estate mutual funds and commodities.

- Remember that gold prices are subject to change regularly. Be aware of the current trends.

—————————————————————————————————————————————————————————————–

By: Oscar Zarraga Perez

Title: Metaplanet: Soaring High Alongside Bitcoin's Record Price Surge

Sourced From: bitcoinmagazine.com/news/metaplanet-hits-new-all-time-high-as-bitcoin-hits-record-price

Published Date: Wed, 21 May 2025 17:33:11 +0000