A Game-Changer in Sports and Finance

Amsterdam, Netherlands – StocksFC, the innovative football (soccer) stock market platform that runs on Ethereum, is proud to announce its astounding success since its inception six months ago. In this short span, StocksFC has redefined the sports investment landscape, presenting fans with an unprecedented opportunity to monetize their football acumen.

Unrivalled Profits and Portfolio Power

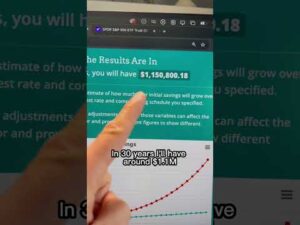

With its launch in May 2023, StocksFC offered fans the chance to buy, sell, and trade football player stocks with the potential to earn crypto rewards when players shine on the pitch. Fast forward six months, and the market cap has increased by 1350%, with over half a million stocks in circulation. This seismic shift in sports engagement mirrors the bullish trends of the most dynamic financial markets.

The platform's robust growth is underpinned by the soaring value of player stocks – premier players like Maddison surging over 400% since being listed. These are not anomalies but rather the norm on StocksFC, where every week offers the thrill of potential profits. Football fans have the freedom to craft their portfolios to capitalize on the weekly, monthly, and end-of-season cash rewards, with strategies ranging from investing in undervalued players to identifying future superstars.

Alex Thomas, founder of StocksFC said, "The surge in growth we've experienced in the past 6 months has been remarkable. We remain firmly committed to establishing ourselves as a leading force in the rapidly growing field of alternative financial assets."

Three-tier model to retain rapid growth

The three-tier model to retain rapid growth at StocksFC includes an unparalleled commitment to transparency, sustainability, and community.

Transparency is not just a buzzword at StocksFC; it's the backbone. The platform guarantees an immutable ledger of transactions, fostering unmatched trust among its users. Following this, sustainability is equally vital, with StocksFC's design ensuring long-term value growth. Each stock is an ERC20 token and with a limit of 100k stocks per player and a systematic burn of stocks on trades, scarcity is artfully crafted to boost potential rewards.

Additionally, at the heart of StocksFC's ethos is a community-first approach. User polls will guide significant platform decisions, ensuring that those who invest their time and passion into StocksFC have a voice that resonates at the very core of its operations.

The Future is Bright

The groundbreaking platform has not only attracted fans but has also garnered the confidence of financial and technological titans. Early investment from venture capital firm Antler has supercharged StocksFC’s ascent, while partnerships with Bitgo, Ramp, Coinbase Commerce, and Opta have provided a solid infrastructure for seamless, secure trading experiences.

With its exceptional growth, StocksFC continues to blaze a trail in the sports investment domain. The future promises an exciting expansion of its offerings, with plans to release hundreds of additional players in the coming months and to expand into Europe's top 5 leagues, as well as other sports.

StocksFC extends an open invitation to football fans and sports traders worldwide to join them and be a part of this winning streak that melds passion with profits.

For more information and to become part of this investment revolution, visit StocksFC’s platform, engage with the community on Telegram, Discord and X (Twitter).

Score Big with StocksFC – Where Every Fan is an Investor.

StocksFC – Buy. Sell. Earn

Frequently Asked Questions

Can the government seize your gold?

The government cannot take your gold because you own it. You worked hard to earn it. It is yours. This rule may not apply to all cases. You could lose your gold if convicted of fraud against a federal government agency. Also, if you owe taxes to the IRS, you can lose your precious metals. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

What are the pros & con's of a golden IRA?

An Individual Retirement Account is a more beneficial option than regular savings accounts. You don't pay taxes on any interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. There are some disadvantages to this investment.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. Also, the IRS may not allow you to make withdrawals from your IRA until you're 59 1/2 years old. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

The downside is that managing your IRA requires fees. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

Insurance is necessary if you wish to keep your money safe from the banks. In order to make a claim, most insurers will require that you have a minimum amount in gold. You may be required by some insurers to purchase insurance that covers losses as high as $500,000.

You will need to decide how much gold you wish to use if you opt for a gold IRA. You may be limited in the amount of gold you can have by some providers. Others let you choose your weight.

It's also important to decide whether or not to buy gold futures contracts. The price of physical gold is higher than that of gold futures. However, futures contracts give you flexibility when buying gold. You can set up futures contracts with a fixed expiration date.

You also need to decide the type and level of insurance coverage you want. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does provide coverage for damage from natural disasters, however. If you live near a high-risk region, you might want to consider additional coverage.

Additional to your insurance, you will need to consider how much it costs to store your gold. Insurance doesn't cover storage costs. Banks charge between $25 and $40 per month for safekeeping.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian is responsible for keeping track of your investments. They also ensure that you adhere to federal regulations. Custodians aren't allowed to sell your assets. Instead, they must retain them for as long and as you require.

Once you have chosen the right type of IRA to suit your needs, it is time to fill out paperwork defining your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). You should also specify how much you want to invest each month.

Once you have completed the forms, you will need to mail them to your provider with a check and a small deposit. After reviewing your application, the company will send you a confirmation mail.

You should consult a financial planner before opening a Gold IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can also help reduce your costs by suggesting cheaper options for purchasing insurance.

Which precious metal is best to invest in?

This depends on what risk you are willing take and what kind of return you desire. Although gold has been considered a safe investment, it is not always the most lucrative. For example, if you need a quick profit, gold may not be for you. Silver is a better investment if you have patience and the time to do it.

If you're not looking to make quick money, gold is probably your best choice. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

Can I purchase gold with my self directed IRA?

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. You can also transfer funds from an existing retirement fund.

The IRS allows individuals contributing up to $5.500 each ($6,500 if married, filing jointly) into a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. These contracts allow you to speculate on future gold prices without actually owning it. But physical bullion refers to real gold and silver bars you can carry in your hand.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Lawful – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement account

irs.gov

cftc.gov

How To

Tips for Investing in Gold

Investing in Gold remains one of the most preferred investment strategies. This is due to the many benefits of investing in gold. There are many ways to invest gold. Some people choose to purchase gold coins physically, while some prefer to invest with gold ETFs.

Before buying any kind of gold, you need to consider these things.

- First, find out if your country allows gold ownership. If the answer is yes, you can go ahead. Or, you might consider buying gold overseas.

- Secondly, you should know what kind of gold coin you want. You have options: you can choose from yellow gold, white or rose gold.

- Thirdly, you should take into consideration the price of gold. Start small and move up. It is important to diversify your portfolio whenever you purchase gold. Diversify your investments in stocks, bonds or real estate.

- You should also remember that gold prices can change often. It is important to stay up-to-date with the latest trends.

—————————————————————————————————————————————————————————————–

By: Media

Title: Meet StocksFC: The Football Stock Market Where Goals Earn You Crypto

Sourced From: news.bitcoin.com/meet-stocksfc-the-football-stock-market-where-goals-earn-you-crypto/

Published Date: Fri, 17 Nov 2023 06:00:42 +0000

Did you miss our previous article…

https://altcoinirareview.com/critics-express-concern-as-two-major-bitcoin-mining-pools-dominate-over-50-of-hashrate/