Merchant loyalty programs have long been a key strategy for businesses to attract and retain customers. Traditionally, these programs have been built on the fiat standard, with card-linked offers driving customer engagement and spend. However, the rise of Bitcoin presents a new opportunity to reimagine merchant loyalty in a way that can deliver unprecedented value and efficiency.

The Evolution of Loyalty Business

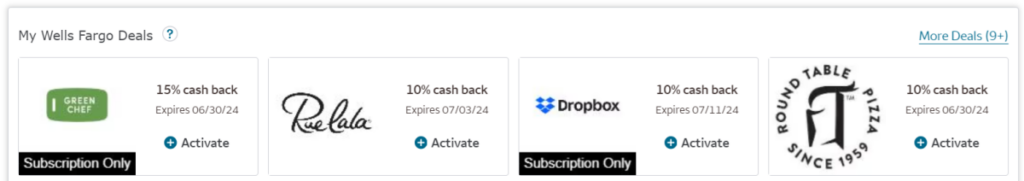

Working in the industry for a decade, I've witnessed firsthand how card-linked offer solutions have been instrumental in driving merchant loyalty. These programs incentivize cardholders with discounts and deals from participating merchants, driving customer acquisition, increased spend frequency, and larger basket sizes. While effective, these programs come with significant costs and complexities associated with the fiat payment system.

Enter Bitcoin: A Game-Changer for Merchant Loyalty

Bitcoin, often viewed as a store of value rather than a medium of exchange, has the potential to revolutionize the way merchant loyalty programs operate. By leveraging Bitcoin rails instead of fiat rails, businesses can streamline operations, reduce costs, and enhance the customer experience like never before.

Cost Efficiency and Streamlined Processes

Traditional fiat-based loyalty programs involve a multitude of steps, from merchant credentialization to reward redemption, all driven through costly credit card payment channels. In contrast, Bitcoin offers a more efficient model, where merchants can self-service their participation, fund marketing budgets in real-time with Bitcoin, and conduct transactions on the low-cost Lightning Network. By eliminating intermediaries and leveraging blockchain technology, businesses can significantly reduce costs and streamline operations.

Real-Time Engagement and Flexibility

One of the key advantages of Bitcoin-based loyalty programs is the ability to provide real-time notifications and discounts to customers at the point of sale. With technologies like LN Bits and Bolt 12, merchants can offer split payments and adjust offer values dynamically, providing a seamless and immediate experience for both customers and businesses. This level of flexibility and engagement is unparalleled in traditional fiat programs.

Overcoming Challenges and Expanding Reach

While the Bitcoin audience is still relatively niche, businesses can capitalize on the value of attracting early adopters and loyal Bitcoin users. Despite challenges such as limited transaction history for targeting, the potential for higher margins and unique customer experiences make Bitcoin-native loyalty programs a compelling proposition for merchants.

Driving Hyperbitcoinization through Innovation

As industry experts and enthusiasts continue to explore the possibilities of Bitcoin in various domains, including loyalty programs, there is a clear opportunity to drive hyperbitcoinization and unlock new use cases. By reimagining traditional practices through the lens of Bitcoin, businesses can achieve cost savings, operational efficiencies, and customer satisfaction that set them apart from competitors.

As Michael Saylor advocates, embracing Bitcoin and proactively innovating in this space can lead to transformative outcomes for businesses and consumers alike. The potential for Bitcoin-native merchant offers to deliver superior value and experiences is a testament to the disruptive power of cryptocurrency in the loyalty landscape.

John McCabe's insights shed light on the transformative potential of Bitcoin in reshaping merchant loyalty programs. By embracing this innovative approach, businesses can stay ahead of the curve and unlock new opportunities in the ever-evolving digital economy.

Frequently Asked Questions

Who owns the gold in a Gold IRA?

The IRS considers gold owned by an individual to be “a type of money” and is subject taxation.

You must have at least $10,000 in gold and keep it for at most five years to qualify for this tax-free status.

While gold may be a great investment to help prevent inflation and volatility in the market, it's not wise to keep it if you won't use it.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

Consult a financial advisor or accountant to determine your options.

Is gold a good investment IRA option?

Any person looking to save money is well-served by gold. It's also a great way to diversify your portfolio. There's more to gold that meets the eye.

It's been used as a form of payment throughout history. It's sometimes called “the world's oldest money”.

Gold, unlike other paper currencies created by governments is mined directly from the earth. This makes it highly valuable as it is hard and rare to produce.

Gold prices fluctuate based on demand and supply. The economy that is strong tends to be more affluent, which means there are less gold miners. Gold's value rises as a result.

On the other hand, people will save cash when the economy slows and not spend it. This means that more gold is produced, which reduces its value.

It is this reason that gold investing makes sense for businesses and individuals. You will benefit from economic growth if you invest in gold.

Additionally, you'll earn interest on your investments which will help you grow your wealth. If gold's value falls, you don't have to lose any of your investments.

What precious metals can you invest in for retirement?

Gold and silver are the best precious metal investments. They are both easy to trade and have been around for years. If you want to diversify your portfolio, you should consider adding them to your list.

Gold: The oldest form of currency known to man is gold. It's also very safe and stable. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: Silver is a popular investment choice. This is a great choice for people who want to avoid volatility. Silver tends to move up, not down, unlike gold.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. It's durable and resists corrosion, just like gold and silver. It is, however, more expensive than its competitors.

Rhodium: Rhodium can be used in catalytic convertors. It is also used as a jewelry material. It's also relatively inexpensive compared to other precious metals.

Palladium: Palladium, which is a form of platinum, is less common than platinum. It's also less expensive. For these reasons, it's become a favorite among investors looking to add precious metals to their portfolios.

What is a gold IRA account?

The Gold Ira Accounts are tax-free investment options for those who want to make investments in precious metals.

You can purchase physical bullion gold coins at any point in time. To start investing in gold, it doesn't matter if you are retired.

An IRA allows you to keep your gold forever. You won't have to pay taxes on your gold investments when you die.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

First, an individual retirement account will be set up to allow you to open a golden IRA. After you do this, you will be granted an IRA custodian. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual returns.

Once you've set up your gold IRA, it's possible to buy gold bullion. Minimum deposit required is $1,000 However, you'll receive a higher interest rate if you put in more.

You'll have to pay taxes if you take your gold out of your IRA. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

However, if you only take out a small percentage, you may not have to pay taxes. There are exceptions. If you take out 30% of your total IRA assets or more, you will owe federal income taxes and a 20 percent penalty.

It's best not to take out more 50% of your total IRA investments each year. If you do, you could face severe financial consequences.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement account

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

finance.yahoo.com

How To

The best way to buy gold (or silver) online

Before you can buy gold, it is important to understand its workings. It is a precious metal that is very similar to platinum. Because of its resistance to corrosion and durability, it is very rare. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

There are two types today of gold coins. One is legal tender while the other is bullion. The legal tender coins are issued for circulation in a country. They usually have denominations such as $1, $5, $10, and so on.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They cannot be used in currency exchanges. If a person purchases $100 worth of gold, 100 grams of the gold will be given to him/her. The $100 value is $100. Every dollar spent on gold purchases, the buyer receives one gram of gold.

The next thing you should know when looking to buy gold is where to do it from. There are several options available if your goal is to purchase gold from a dealer. First, you can visit your local coin store. Another option is to go through a reputable site like eBay. Finally, you can look into purchasing gold through private sellers online.

Individuals who sell gold at wholesale and retail prices are called private sellers. Private sellers will charge you a 10% to 15% commission for every transaction. You would receive less money from a private buyer than you would from a coin store or eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

The other option is to purchase physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

When buying gold on your own, you can visit a bank or a pawnshop. A bank will provide you with a loan that allows you to purchase the amount of gold you desire. Customers can borrow money from pawnshops to purchase items. Banks often charge higher interest rates then pawnshops.

Another way to purchase gold is to ask another person to do it. Selling gold is also easy. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————–

By: John McCabe

Title: Making Merchant Loyalty a Competitive Advantage with Bitcoin

Sourced From: bitcoinmagazine.com/business/merchant-loyalty-competitive-advantage-reimagined-through-bitcoin

Published Date: Thu, 11 Jul 2024 18:05:08 GMT