Le portefeuille d'Ego Death Capital révèle des métriques d'adoption, dont 1,5 milliard de dollars de volume d'échanges alimentés par Lightning, tandis que Block choque l'industrie avec leur rendement de 9,7 % sur le réseau Lightning.

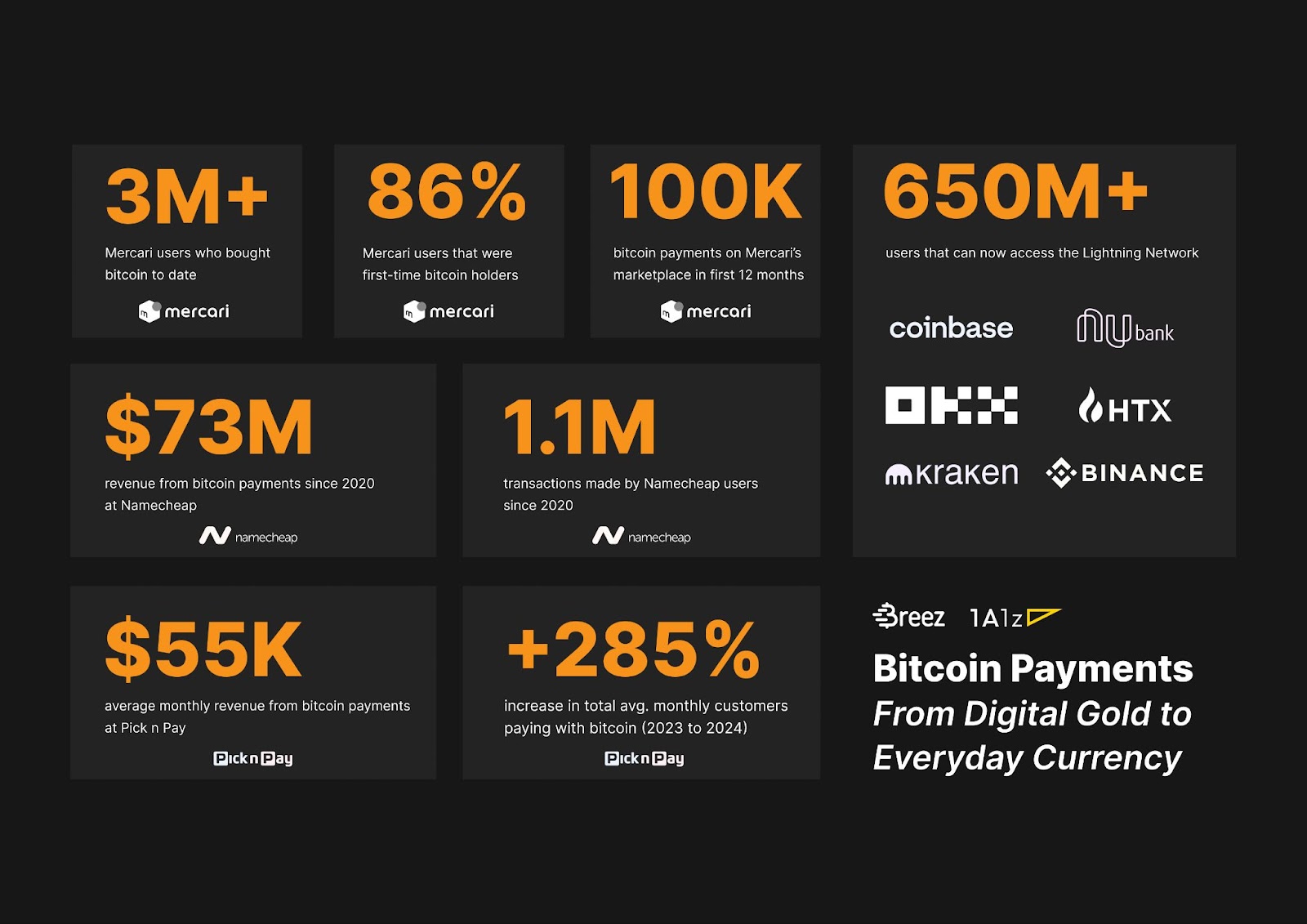

Alors que les entreprises de trésorerie bitcoin, les débats sur les projets de structure de marché et la défense stratégique des réserves de bitcoin dominent les gros titres en 2025, une tendance est en train de se développer discrètement en arrière-plan : le succès des entreprises technologiques Bitcoin.

Un Aperçu des Entreprises Révolutionnant l'Adoption de Bitcoin

Block: Générer des Revenus Importants avec Lightning et les Paiements Bitcoin

Le contraste entre la thèse de l'or numérique et ceux qui croient en Bitcoin en tant que technologie de paiement a été récemment observé à Bitcoin Vegas 2025, où Block, la société mère de Cash App, a révélé qu'ils génèrent un rendement de 9,7 % sur leur nœud Lightning Bitcoin.

Ego Death Capital

Ego Death Capital investit dans des start-ups d'infrastructure Bitcoin depuis 2022. Booth a rappelé : "Bitcoin était un protocole. Il se développait en couches et c'était le début. Et si vous aviez réalisé cela et aidé ces entreprises qui se développaient dans les couches, aidant à créer l'infrastructure, alors vous auriez accéléré cela. Vous auriez accéléré ce que nous voyions de Bitcoin : une monnaie, une réserve de valeur, un tout nouveau réseau."

Breez : Alimenter un Réseau Global de Paiements Lightning

Breez, fondée en 2018, est un fournisseur de Lightning en tant que service auto-custodial qui permet aux développeurs d'intégrer des paiements Bitcoin dans les applications à l'aide de son SDK Breez open source. En simplifiant les complexités de Lightning, Breez a stimulé l'adoption à travers diverses industries.

LN Markets : L'Essor du Trading Alimenté par Lightning

LN Markets, lancé en 2020, est une plateforme de trading de dérivés Bitcoin-native, exploitant le Lightning Network pour des règlements instantanés et un risque de contrepartie réduit au minimum.

Relai : La Néobanque Bitcoin de l'Europe

Relai, une application mobile basée en Suisse fondée en 2020, simplifie l'adoption de Bitcoin pour les Européens avec un portefeuille et un service de courtage conviviaux et non-custodiaux. En ciblant les nouveaux venus, elle met l'accent sur le coût moyen en dollars et l'auto-garde, rendant les économies Bitcoin accessibles.

Madeira : Une Économie Bitcoin en Action

Le projet Bitcoin de Madeira, lancé sur l'île pittoresque, vise à établir une économie prospère native de Bitcoin, s'inspirant de Bitcoin Beach au Salvador.

Ce billet La Croissance Technologique de Bitcoin : Les Données sur Lightning Défient le Récit de l'Or Numérique est apparu pour la première fois sur Bitcoin Magazine et est écrit par Juan Galt.

Frequently Asked Questions

How Do You Make a Withdrawal from a Precious Metal IRA?

First, decide if it is possible to withdraw funds from an IRA. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

You should open a taxable brokerage account if you're willing to pay a penalty if you withdraw early. If you decide to go with this option, you will need to take into account the taxes due on the amount you withdraw.

Next, you need to determine how much money is going to be taken out from your IRA. This calculation is dependent on several factors like your age when you take the money out, how long you have had the account, and whether or not your plan to continue contributing.

Once you have an idea of the amount of your total savings you wish to convert into cash you will need to decide what type of IRA you want. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Once these calculations have been completed you will need to open an account with a brokerage. A majority of brokers offer free signup bonuses, as well as other promotions, to get people to open accounts. To avoid unnecessary fees, however, try opening an account using a debit card rather than a credit card.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. Before choosing one, consider the pros and disadvantages of each.

Bullion bars, for example, require less space as you're not dealing with individual coins. However, you'll need to count every coin individually. You can track their value by keeping individual coins.

Some prefer to keep their money in a vault. Some prefer to keep them in a vault. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

What is the best way to hold physical gold?

Gold is money. Not just paper currency. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Investors use gold today as part of their diversified portfolio, because it tends to perform better in times of financial turmoil.

Many Americans now invest in precious metals. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

Another reason is that gold has historically outperformed other assets in financial panic periods. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

Another benefit to investing in gold? It has virtually zero counterparty exposure. Your shares will still be yours even if your stock portfolio drops. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Finally, gold offers liquidity. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. Gold is liquid and therefore it makes sense to purchase small amounts. This allows you take advantage of the short-term fluctuations that occur in the gold markets.

What are some of the advantages and disadvantages to a gold IRA

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. An IRA is a great option for those who want to save money, but don't want tax on any interest earned. This type of investment has its downsides.

You could lose all of your accumulated money if you take out too much from your IRA. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

You will also need to pay fees for managing your IRA. Many banks charge between 0.5%-2.0% per year. Others charge management fees that range from $10 to $50 per month.

Insurance is necessary if you wish to keep your money safe from the banks. Insurance companies will usually require that you have at least $500,000. It is possible that you will be required to purchase insurance that covers losses of up to $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. Some providers limit the amount of gold that you are allowed to own. Others allow you to pick your weight.

You will also have to decide whether to purchase futures or physical gold. Physical gold is more costly than gold futures. Futures contracts allow you to buy gold with more flexibility. They let you set up a contract that has a specific expiration.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy does NOT include theft protection and loss due to fire or flood. However, it does cover damage caused by natural disasters. If you live in a high-risk area, you may want to add additional coverage.

Additional to your insurance, you will need to consider how much it costs to store your gold. Storage costs are not covered by insurance. Safekeeping costs can be as high as $25-40 per month at most banks.

Before you can open a gold IRA you need to contact a qualified Custodian. Custodians keep track of your investments and ensure compliance with federal regulations. Custodians are not allowed to sell your assets. Instead, they must keep your assets for as long you request.

After you have decided on the type of IRA that best suits you, you will need to complete paperwork detailing your goals. You should also include information about your desired investments, such as stocks or bonds, mutual funds, real estate, and mutual funds. You should also specify how much you want to invest each month.

After filling out the forms, you'll need to send them to your chosen provider along with a check for a small deposit. The company will then review your application and mail you a letter of confirmation.

You should consult a financial planner before opening a Gold IRA. Financial planners are experts in investing and will help you decide which type of IRA works best for your situation. They can help reduce your expenses by helping you find cheaper alternatives to buying insurance.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

cftc.gov

irs.gov

bbb.org

investopedia.com

How To

Three Ways to Invest In Gold For Retirement

It's important to understand how gold fits in with your retirement plan. There are several options to invest in precious metals if your employer has a 401k. You may also be interested in investing in gold beyond your workplace. One example is opening a custodial accounts at Fidelity Investments if an IRA (Individual Retirement Account), if you already own one. You may also want to purchase precious metals from a reputable dealer if you don’t already have them.

These are the rules for gold investing:

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, invest in cash. This will help you to protect yourself against inflation while also preserving your purchasing power.

- Physical Gold Coins to Own – Physical gold coin ownership is better than having a paper certificate. Physical gold coins can be sold much faster than paper certificates. You don't have to store physical gold coins.

- Diversify Your Portfolio – Never put all of your eggs in one basket. This means that you should diversify your wealth by investing in different assets. This helps to reduce risk and provides more flexibility when markets are volatile.

—————————————————————————————————————————————————————————————–

By: Juan Galt

Title: La Croissance Technologique de Bitcoin : Les Données sur Lightning Défient le Récit de l'Or Numérique

Sourced From: bitcoinmagazine.com/business/bitcoin-tech-booms-lightning-data-defies-digital-gold-narrative

Published Date: Wed, 18 Jun 2025 16:00:47 +0000