Bitcoin's recent price surge has been captivating, but delving deeper into on-chain data reveals valuable insights. By examining metrics that measure network activity, investor sentiment, and market cycles, a clearer picture of Bitcoin's current status and potential trajectory emerges.

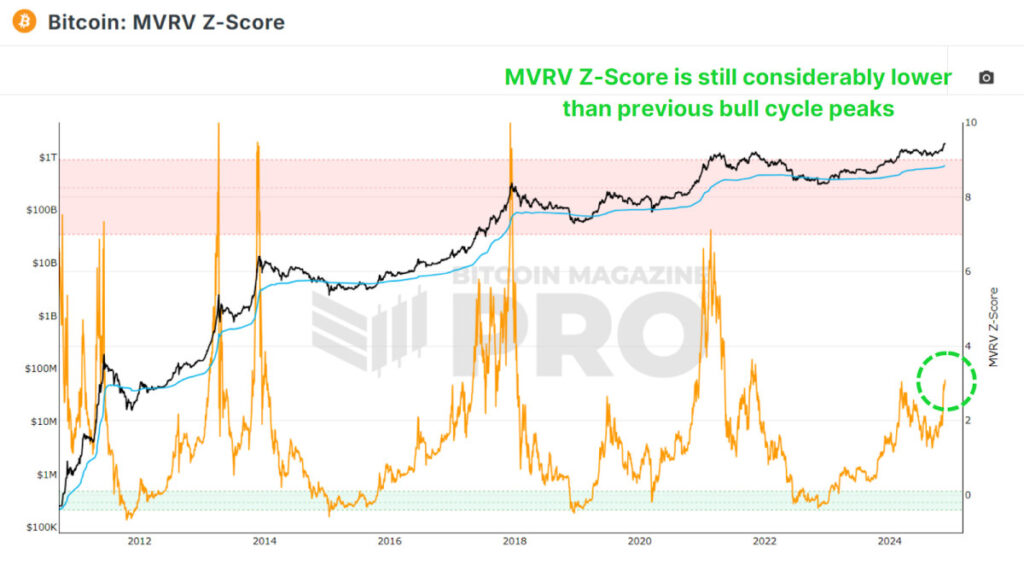

Remaining Upside Potential

The MVRV Z-Score contrasts Bitcoin's market cap with its realized cap to identify market conditions. A red zone suggests overheating, while the green zone indicates undervaluation. Despite Bitcoin hitting new highs, the Z-score remains neutral, signaling room for further growth based on historical trends.

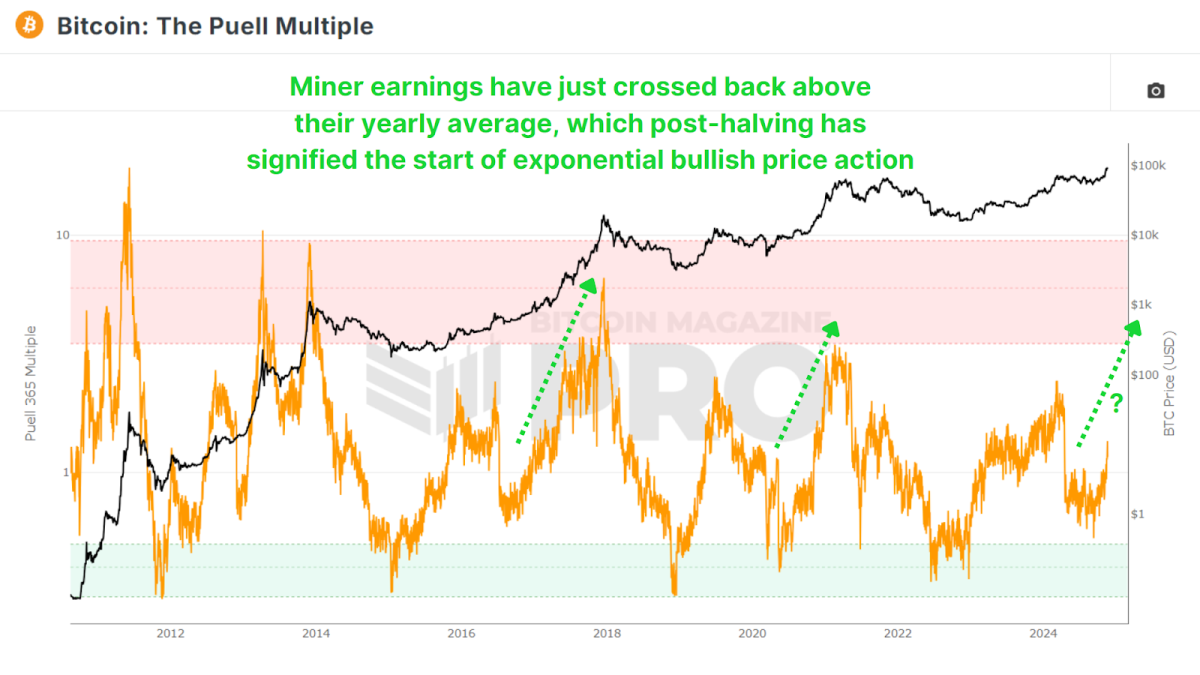

Miner Profitability Assessment

The Puell Multiple assesses miner profitability by comparing daily revenue to the previous one-year average. Despite Bitcoin's price surge, miner profitability has only increased by 30% compared to historical averages, indicating early-to-mid bull market stages with potential for significant growth.

Market Sentiment Analysis

The Net Unrealized Profit and Loss (NUPL) metric gauges overall profitability and sentiment levels. Bitcoin is currently in the 'Belief' zone, suggesting room for price appreciation before reaching 'Euphoria' or 'Greed', aligning with other data indicating bullish potential.

Long-Term Holder Trends

The percentage of Bitcoin held for over a year remains high at around 64%, signaling a nascent phase in the current bull run with potential for further transfers to new market participants.

Tracking 'Smart Money'

The Coin Days Destroyed metric evaluates whale activity based on coin holding duration, providing insights into profit realization. Current levels indicate that significant profit-taking by large holders has not yet begun.

Despite the ongoing rally, on-chain metrics suggest that Bitcoin is not overheated. Long-term holders are holding steady, and key indicators point towards growth potential. However, profit-taking and new market entrants indicate a shift towards the mid to late-cycle phase, likely to continue through 2025.

For investors, data-driven decisions are crucial. Avoid emotional reactions driven by FOMO and instead rely on on-chain data and metrics discussed above for informed investment strategies.

For a detailed analysis of this topic, watch the recent YouTube video: What's Happening On-chain: Bitcoin Update

Frequently Asked Questions

What is the tax on gold in an IRA

The fair market price of gold when it is sold determines the tax due on its sale. Gold is not subject to tax when it's purchased. It's not considered income. If you sell it later you will have a taxable profit if the price goes down.

For loans, gold can be used to collateral. Lenders will seek the highest return on your assets when you borrow against them. In the case of gold, this usually means selling it. The lender might not do this. They might just hold onto it. Or they might decide to resell it themselves. In either case, you risk losing potential profits.

To avoid losing money, only lend against gold if you intend to use it for collateral. If you don't plan to use it as collateral, it is better to let it be.

Are gold investments a good idea for an IRA?

Any person looking to save money is well-served by gold. It is also an excellent way to diversify you portfolio. There is much more to gold than meets your eye.

It's been used as a form of payment throughout history. It is often called “the most ancient currency in the universe.”

Gold is not created by governments, but it is extracted from the earth. It's hard to find and very rare, making it extremely valuable.

The price of gold fluctuates based on supply and demand. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. Gold's value rises as a result.

On the flip side, people save cash for emergencies and don't spend it. This causes more gold to be produced, which lowers its value.

This is why both individuals as well as businesses can benefit from investing in gold. You'll reap the benefits of investing in gold when the economy grows.

Also, your investments will earn you interest which can help increase your wealth. Additionally, you won't lose cash if the gold price falls.

Do you need to open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. If you lose money in your investment, nothing can be done to recover it. This includes any loss of investments from theft, fire, flood or other circumstances.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These coins have been around for thousands and represent a real asset that can never be lost. They are likely to fetch more today than the price you paid for them in their original form.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. It's also wise to consider using a third-party custodian who will keep your assets safe while giving you access to them anytime.

Do not open an account unless you're ready to retire. Keep your eyes open for the future.

How much should I contribute to my Roth IRA account?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. You cannot withdraw funds from these accounts until you reach 59 1/2. However, if your goal is to withdraw funds before that time, there are certain rules you must observe. You cannot touch your principal (the amount you originally deposited). This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. If you decide to withdraw more money than what you contributed initially, you will need to pay taxes.

You cannot withhold your earnings from income taxes. Withdrawing your earnings will result in you paying taxes. For example, let's say that you contribute $5,000 to your Roth IRA every year. Let's further assume you earn $10,000 annually after contributing. Federal income taxes would apply to the earnings. You would be responsible for $3500 You would have $6,500 less. Since you're limited to taking out only what you initially contributed, that's all you could take out.

If you took $4,000 from your earnings, you would still owe taxes for the $1,500 remaining. You'd also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types if Roth IRAs: Roth and Traditional. Traditional IRAs allow you to deduct pretax contributions from your taxable income. Your traditional IRA can be used to withdraw your balance and interest when you are retired. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs are not allowed to allow you deductions for contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. There is no minimum withdrawal requirement, unlike traditional IRAs. You don't need to wait until your 70 1/2 year old age before you can withdraw your contribution.

How is gold taxed in Roth IRA?

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. You pay taxes only on earnings from dividends and capital gains — which apply only to investments held longer than one year.

These accounts are subject to different rules depending on where you live. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you up to April 1st. New York allows you to wait until age 70 1/2. To avoid penalties, plan ahead so you can take distributions at the right time.

Can I buy gold using my self-directed IRA

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts are financial instruments based on the price of gold. They allow you to speculate on future prices without owning the metal itself. But physical bullion refers to real gold and silver bars you can carry in your hand.

Is buying gold a good retirement plan?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

The best form of investing is physical bullion, which is the most widely used. There are many ways to invest your gold. You should research all options thoroughly before making a decision on which option you prefer.

For example, purchasing shares of companies that extract gold or mining equipment might be a better option if you aren't looking for a safe place to store your wealth. If you need cash flow from an investment, purchasing gold stocks is a good choice.

You can also invest your money in exchange-traded fund (ETFs), which give you exposure to the gold price by holding securities related to gold. These ETFs usually include stocks of precious metals refiners or gold miners.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

cftc.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Legal – WSJ

How To

3 Ways to Invest in Gold for Retirement

It's essential to understand how gold fits into your retirement plan. There are many ways to invest in gold if you have a 401k account at work. You might also be interested to invest in gold outside the workplace. If you have an IRA (Individual Retirement Account), a custodial account could be opened at Fidelity Investments. You may also want to purchase precious metals from a reputable dealer if you don’t already have them.

These are three simple rules to help you make an investment in gold.

- Buy Gold With Your Cash – Do not use credit cards to purchase gold. Instead, put cash into your accounts. This will help protect you against inflation and keep your purchasing power high.

- Own Physical Gold Coins – You should buy physical gold coins rather than just owning a paper certificate. The reason is that it's much easier to sell physical gold coins than certificates. You don't have to store physical gold coins.

- Diversify Your Portfolio – Never put all of your eggs in one basket. This is how you spread your wealth. You can invest in different assets. This will reduce your risk and give you more flexibility in times of market volatility.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Insights from On-Chain Data: Bitcoin Price Bull Run Analysis

Sourced From: bitcoinmagazine.com/markets/on-chain-data-shows-the-bitcoin-price-bull-run-is-far-from-over

Published Date: Fri, 22 Nov 2024 14:29:00 GMT