Trump's Strategic Bitcoin Move: A Game Changer

Donald J. Trump's recent announcement about a "Strategic Bitcoin Stockpile" marked a significant turning point for Bitcoin. This move signifies a point of no return, driven by game theory principles. The US acquiring a significant portion of Bitcoin for free has set a new standard, challenging other nations to follow suit or risk falling behind.

Institutions Embracing Bitcoin

With nation-states entering the Bitcoin space, institutions are also recognizing the need to accumulate Bitcoin. The shift towards Bitcoin as a treasury asset ensures long-term price appreciation, putting pressure on corporations to diversify their treasuries into BTC to stay competitive.

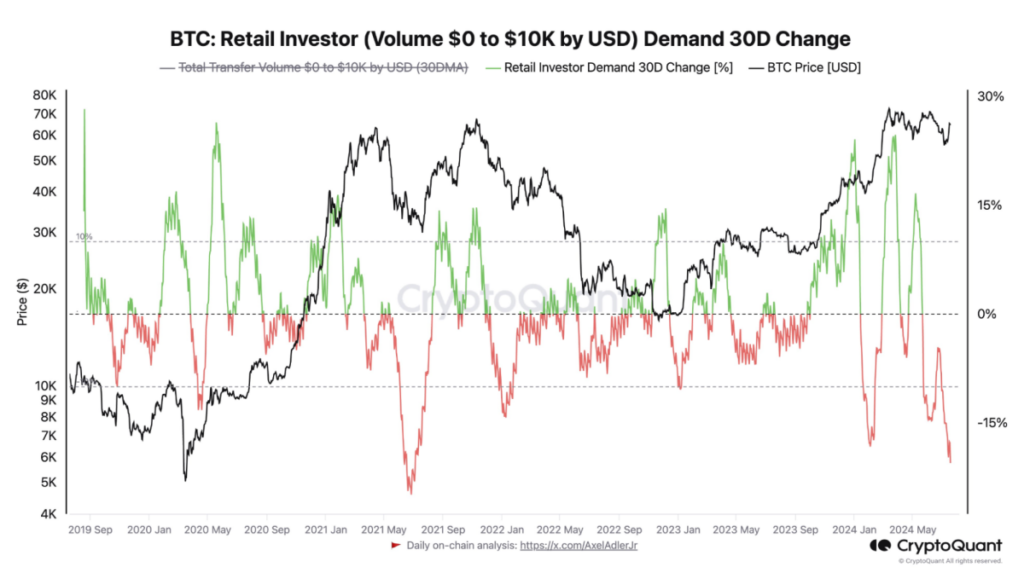

Challenges in Retail Adoption

Despite Bitcoin's proximity to its all-time high, retail involvement remains low. The recent conference highlighted a sense of reluctance among retail buyers, possibly awaiting a significant catalyst to re-engage in the market.

UTXO Alpha Day: Venture Capitalists' Perspective

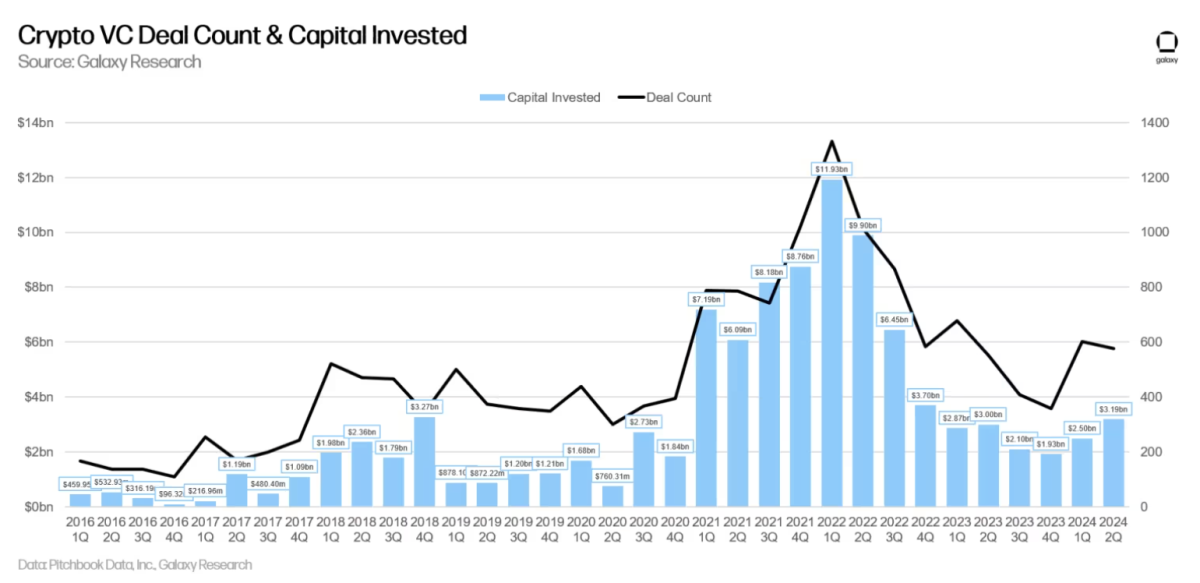

UTXO Alpha Day showcased the growing interest in yield-bearing assets within the Bitcoin ecosystem. Venture capitalists are recognizing the potential of Bitcoin-based startups, signaling a shift towards more investment in Bitcoin-related ventures.

The Rise of Bitcoin Infrastructure

As discussions around Bitcoin investments grow, there is a notable gap in venture capital funding for Bitcoin projects. However, the tide is expected to turn as the unique opportunities presented by Bitcoin DeFi and infrastructure become more apparent.

Exploring Bitcoin Fi (BTCfi) Ecosystem

The BTCfi landscape is evolving, offering various avenues for investors to participate, including sidechains, Layer-2 solutions, and Bitcoin metaprotocols. The emergence of Bitcoin-native assets and infrastructure is reshaping the investment landscape.

Lightning Network's Resilience

Despite the current focus on sidechains, Lightning Network remains a fundamental part of the Bitcoin ecosystem. Recent advancements in Lightning technology, such as Taproot Assets, highlight its potential for enabling trustless and efficient transactions on Bitcoin.

The Evolution of Bitcoin Mining

Mining operations are undergoing a transformation, with a shift towards AI and high-performance computing. The commoditization of blockspace and the exploration of new revenue streams are reshaping the mining industry's landscape.

Bitcoin Governance and User Consensus

Matt Corallo's insights shed light on the governance dynamics within the Bitcoin community. User consensus remains a key driver of change within the protocol, emphasizing the importance of community engagement in shaping Bitcoin's future.

Key Takeaways from Nashville Bitcoin Event

The Nashville Bitcoin event highlighted the need for educational content and improved user experience in the Bitcoin space. Emphasizing self-custody and infrastructure investment can drive broader adoption and engagement with Bitcoin and its evolving ecosystem.

If you are interested in exploring opportunities in the Bitcoin space or learning more about UTXO's initiatives, feel free to reach out to us. Remember, the future of Bitcoin holds immense potential, and staying informed is key to maximizing opportunities in this dynamic landscape.

Frequently Asked Questions

Is gold buying a good retirement option?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

The most popular form of investing in gold is through physical bullion bars. You can also invest in gold in other ways. Research all options carefully and make an informed decision about what you desire from your investments.

If you don’t have the funds to invest in safe places, such as a safe deposit box or mining equipment companies, buying shares of these companies might be a better investment. If you are looking for cash flow from your investment, buying gold stocks will work well.

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs may include stocks that are owned by gold miners or precious metals refining companies as well as commodity trading firms.

What precious metal should I invest in?

This question is dependent on the amount of risk you are willing and able to accept as well as the type of return you desire. Although gold has been considered a safe investment, it is not always the most lucrative. For example, if you need a quick profit, gold may not be for you. If you have time and patience, you should consider investing in silver instead.

If you don't care about getting rich quickly, gold is probably the way to go. Silver might be a better investment option if steady returns are desired over a long period of time.

Can I buy or sell gold from my self-directed IRA

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. Transfer funds from an existing retirement account are also possible.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contracts are financial instruments that are based on gold's price. They allow you to speculate on future prices without owning the metal itself. But physical bullion refers to real gold and silver bars you can carry in your hand.

What is a Precious Metal IRA?

A precious metal IRA allows you to diversify your retirement savings into gold, silver, platinum, palladium, rhodium, iridium, osmium, and other rare metals. These are called “precious” metals because they're very hard to find and very valuable. They make excellent investments for your money and help you protect your future from inflation and economic instability.

Precious metals are often referred to as “bullion.” Bullion is the physical metal.

You can buy bullion through various channels, including online retailers, large coin dealers, and some grocery stores.

With a precious metal IRA, you invest in bullion directly rather than purchasing shares of stock. This ensures that you will receive dividends each and every year.

Precious metal IRAs are not like regular IRAs. They don't need paperwork and don't have to be renewed annually. You pay only a small percentage of your gains tax. Additionally, you have access to your funds at no cost whenever you need them.

How does gold perform as an investment?

The supply and demand for gold affect the price of gold. Interest rates can also affect the gold price.

Due to their limited supply, gold prices fluctuate. Additionally, physical gold can be volatile because it must be stored somewhere.

Can I keep physical gold in an IRA?

Gold is money. Not just paper currency. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Today, many Americans invest in precious metals such as gold and silver rather than stocks and bonds. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

Gold has historically performed better during financial panics than other assets. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. During turbulent market conditions gold was one of few assets that outperformed stock prices.

Another benefit to investing in gold? It has virtually zero counterparty exposure. Your stock portfolio can fall, but you will still own your shares. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, gold offers liquidity. This allows you to sell your gold whenever you want, unlike many other investments. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows one to take advantage short-term fluctuations within the gold price.

How can I withdraw from a Precious metal IRA?

First, determine if you would like to withdraw money directly from an IRA. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

You should open a taxable brokerage account if you're willing to pay a penalty if you withdraw early. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, you need to determine how much money is going to be taken out from your IRA. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. Traditional IRAs allow you to withdraw funds tax-free when you turn 59 1/2 while Roth IRAs charge income taxes upfront but let you access those earnings later without paying additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. Brokers often offer promotional offers and signup bonuses to encourage people into opening accounts. It is better to open an account with a debit than a creditcard in order to avoid any unnecessary fees.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. Some storage facilities will accept bullion bars, others require you to buy individual coins. Before choosing one, consider the pros and disadvantages of each.

Bullion bars require less space, as they don't contain individual coins. But, each coin must be counted separately. On the flip side, storing individual coins allows you to easily track their value.

Some people prefer to keep their coins in a vault. Others prefer to store their coins in a vault. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Legal – WSJ

cftc.gov

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options? Types, Spreads. Example. And Risk Metrics

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

3 Ways to Invest in Gold for Retirement

It's important to understand how gold fits in with your retirement plan. There are many ways to invest in gold if you have a 401k account at work. You may also want to consider investing in gold outside of your workplace. A custodial account can be opened by a brokerage firm like Fidelity Investments if you already have an IRA. Or, if you don't already own any precious metals, you may want to consider buying them directly from a reputable dealer.

These are three easy rules to remember if you invest in gold.

- Buy Gold with Cash – Avoid using credit cards or borrowing money to fund investments. Instead, cash in your accounts. This will protect you from inflation and help keep your purchasing power high.

- Physical Gold Coins You Should Buy – Physical gold coins should be purchased over a paper certificate. Physical gold coins are easier to sell than certificates. Also, there are no storage fees associated with physical gold coins.

- Diversify Your Portfolio. Never place all your eggs in the same basket. In other words, spread your wealth around by investing in different assets. This can reduce market volatility and help you be more flexible.

—————————————————————————————————————————————————————————————–

By: Guillaume

Title: Insights from Nashville Bitcoin Event: A VC's Perspective on the Future

Sourced From: bitcoinmagazine.com/industry-events/post-nashville-event-recap-a-bitcoin-vc-perspective-the-good-the-bad-and-the-bullish-

Published Date: Wed, 31 Jul 2024 16:46:39 GMT