Are you intrigued by how companies like MSTR could have boosted their Bitcoin holdings significantly? Let's dive into the strategy that could have made them richer in crypto! Bitcoin Magazine explores the potential gains from implementing the MVRV BTC strategy.

The Dominance of MSTR in Bitcoin Treasury Holdings

MSTR Sets the Standard for Bitcoin Treasury Holdings

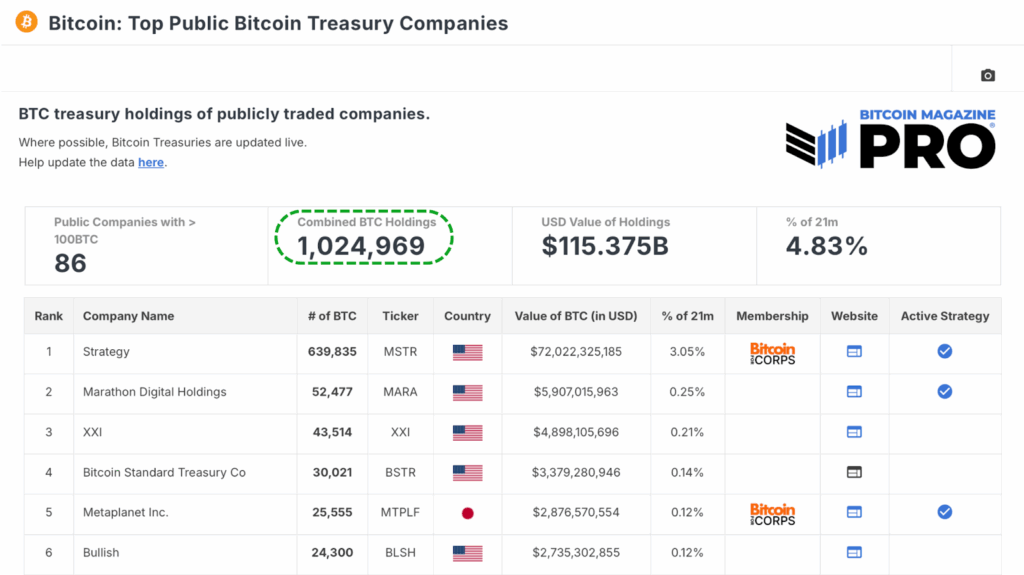

When it comes to corporate Bitcoin holdings, MSTR stands out as the leading player with nearly 640,000 BTC. The overall trend of public Bitcoin treasury companies locking away over 1 million BTC has reshaped Bitcoin's supply-demand dynamics. However, a closer look reveals that these companies might have overpaid for their Bitcoin during market peaks.

MSTR's Case: Timing Bitcoin Cycles

Strategic Bitcoin Purchases by MSTR

Examining MSTR's approach sheds light on how companies bought Bitcoin during market frenzies, resulting in potential overpayments. Waiting for market corrections could have saved them substantial amounts, showcasing the impact of timing in Bitcoin accumulation strategies.

A Data-Driven Solution for MSTR and Treasury Companies

Utilizing MVRV Ratio for Strategic Bitcoin Accumulation

A simple fix involving using the MVRV Ratio as a filter could have yielded remarkable outcomes for companies like MSTR. By avoiding overvalued market phases, these companies could have accumulated almost 50,000 additional BTC, translating to billions in added value.

Similar data-driven strategies have proven successful across various markets, offering superior results compared to emotional decision-making during market fluctuations.

Impact on Companies and Investors

Implications for Companies and Individual Investors

Implementing such strategies could unlock substantial value for corporate treasuries and individual investors alike. By avoiding impulsive decisions during market peaks, investors can enhance their returns and let the market dynamics work in their favor.

Wrapping Up: Smart Bitcoin Accumulation for MSTR

Enhancing Bitcoin Accumulation Strategies for MSTR

MSTR and other treasury companies have reshaped the Bitcoin landscape, but there's room for improvement. By adopting disciplined, data-driven approaches, companies can maximize their Bitcoin holdings and navigate market volatility more effectively without taking on additional risks.

For a deeper dive into this topic, check out our latest YouTube video: This Simple Bitcoin Strategy Would Have Made Them Billions

Frequently Asked Questions

How to open a Precious Metal IRA

First, you must decide if your Individual Retirement Account (IRA) is what you want. If you do, you must open the account by completing Form 8606. You will then need to complete Form 5204 in order to determine which type IRA you are eligible. You must complete this form within 60 days of opening your account. After this, you are ready to start investing. You can also choose to pay your salary directly by making a payroll deduction.

You must complete Form 8903 if you choose a Roth IRA. Otherwise, the process will look identical to an existing IRA.

To be eligible for a precious metals IRA, you will need to meet certain requirements. The IRS stipulates that you must have earned income and be at least 18-years old. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). Additionally, you must make regular contributions. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

A precious metals IRA can be used to invest in palladium or platinum, gold, silver, palladium or rhodium. However, you won't be able purchase physical bullion. This means that you will not be allowed to trade shares or bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option is available from some IRA providers.

However, investing in precious metals via an IRA has two serious drawbacks. First, they aren't as liquid than stocks and bonds. This makes them harder to sell when needed. They don't yield dividends like bonds and stocks. Therefore, you will lose more money than you gain over time.

How is gold taxed by Roth IRA?

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

However, if the money is deposited into a traditional IRA/401(k), the tax on the withdrawal of the money is not applicable. Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

These rules vary from one state to another. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. Massachusetts allows you to delay withdrawals until April 1. And in New York, you have until age 70 1/2 . To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

How much money should I put into my Roth IRA?

Roth IRAs are retirement accounts where you deposit your own money tax-free. These accounts cannot be withdrawn until you turn 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, you cannot touch your principal (the original amount deposited). No matter how much money you contribute, you cannot take out more than was originally deposited to the account. If you take out more than the initial contribution, you must pay tax.

The second rule is that your earnings cannot be withheld without income tax. So, when you withdraw, you'll pay taxes on those earnings. For example, let's say that you contribute $5,000 to your Roth IRA every year. Let's also assume that you make $10,000 per year from your Roth IRA contributions. Federal income taxes would apply to the earnings. You would be responsible for $3500 You would have $6,500 less. The amount you can withdraw is limited to the original contribution.

So, if you were to take out $4,000 of your earnings, you'd still owe taxes on the remaining $1,500. In addition, 50% of your earnings will be subject to tax again (half of 40%). So, even though you ended up with $7,000 in your Roth IRA, you only got back $4,000.

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow you to deduct pretax contributions from your taxable income. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. You can withdraw as much as you want from a traditional IRA.

Roth IRAs don't allow you deduct contributions. Once you are retired, however, you may withdraw all of your contributions plus accrued interest. There is no minimum withdrawal limit, unlike traditional IRAs. You don't need to wait until your 70 1/2 year old age before you can withdraw your contribution.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- You want to keep gold in your IRA at home? It's not legal – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement plans

cftc.gov

irs.gov

How To

Gold IRAs: A Growing Trend

As investors look for ways to diversify their portfolios and protect themselves against inflation, the gold IRA trend is on the rise.

The gold IRA allows owners to invest in physical gold bullion and bars. It can be used as a tax-free way to grow and it is an alternative investment option for people who are not comfortable with stocks or bonds.

A gold IRA allows investors to manage their assets without worrying about market volatility. Investors can use the gold IRA for protection against inflation and potential problems.

Physical gold is also a great investment option, as it has unique properties like durability, portability, divisibility, and portability.

A gold IRA provides many additional benefits. One is the ability for heirs to quickly transfer ownership of gold. Another is the fact that gold is not considered a currency or a commodities by the IRS.

All this means that the gold IRA is becoming increasingly popular among investors seeking a haven during financial uncertainty.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: How MSTR Could Have Earned an Extra 50K Bitcoin with MVRV BTC Strategy

Sourced From: bitcoinmagazine.com/markets/mstr-50k-bitcoin-mvrv-btc-strategy

Published Date: Fri, 26 Sep 2025 13:49:51 +0000