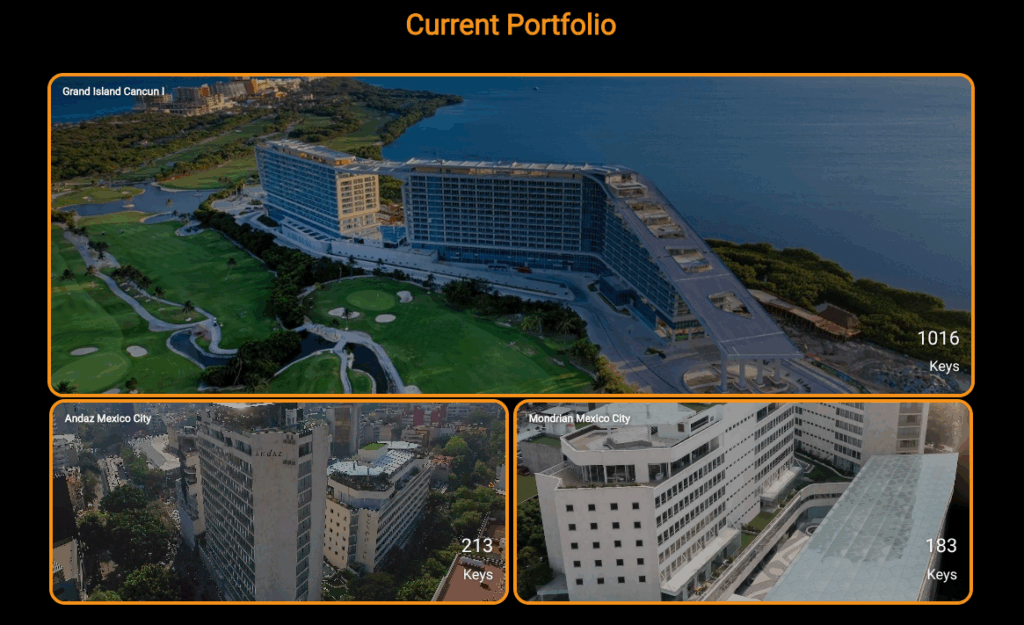

Are you ready to witness a groundbreaking shift in the real estate landscape? Grupo Murano, a leading $1 billion real estate giant based in Mexico, is making waves by diving headfirst into the world of Bitcoin. This strategic leap isn't just about embracing a new trend; it's a visionary move that could reshape the future of real estate as we know it.

The Visionary Strategy Unveiled

Bitcoin: The Game Changer in Real Estate

Picture this: Grupo Murano, known for managing top-tier hotels like Hyatt and Mondrian, is now venturing into uncharted waters. By converting assets into Bitcoin through innovative financial maneuvers, they are setting the stage for a financial revolution that could potentially skyrocket their growth.

Redefining Financial Stability in Real Estate

Traditional real estate financing is like a shaky house of cards, especially with fluctuating interest rates. But with Bitcoin as their cornerstone, Grupo Murano is fortifying their financial structure. This move isn't just about stability; it's about future-proofing their operations against economic uncertainties.

The Bitcoin Revolution Unfolds

Empowering Stakeholders with Bitcoin

Grupo Murano isn't just a lone crusader in this Bitcoin revolution. They are on a mission to educate and empower their stakeholders about the benefits of Bitcoin. By integrating Bitcoin ATMs and forging key partnerships, they are paving the way for seamless transactions and a brighter future for all involved.

Latin America: The Epicenter of Change

Latin America, spearheaded by trailblazers like El Salvador, is emerging as a fertile ground for Bitcoin adoption. Grupo Murano sees this region as a beacon of hope, where Bitcoin could unify economies and usher in a new era of financial independence.

A Blueprint for the Future

Laying the Foundation for Tomorrow

Grupo Murano's strategic shift isn't just about embracing Bitcoin; it's a bold statement about the future of real estate. By balancing high-margin development projects with savvy Bitcoin investments, they are setting a new standard for resilience and innovation in the industry.

As you delve into Grupo Murano's journey, remember that this isn't just a story of financial transformation; it's a testament to the power of embracing change and leading the way towards a brighter, decentralized future. So, are you ready to be a part of this revolutionary wave?

Frequently Asked Questions

What are the benefits of a Gold IRA?

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It will be tax-deferred up until the time you withdraw it. You have complete control over how much you take out each year. And there are many different types of IRAs. Some are better suited for college students. Others are intended for investors seeking higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. However, once they begin withdrawing funds, these earnings are not taxed again. This account may be worth considering if you are looking to retire earlier.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. For people who would rather invest than spend their money, gold IRA accounts are a good option.

Another benefit of owning gold through an IRA is that you get to enjoy the convenience of automatic withdrawals. That means you won't have to think about making deposits every month. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, the gold investment is among the most reliable. Its value is stable because it's not tied with any one country. Even in times of economic turmoil, gold prices tend not to fluctuate. Gold is a good option for protecting your savings from inflation.

Can I have a gold ETF in a Roth IRA

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

A traditional IRA allows contributions from both employee and employer. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money you invest in the ESOP will be taxed at a lower rate than if it were directly held by the employee.

Also available is an Individual Retirement Annuity. An IRA allows for you to make regular income payments during your life. Contributions to IRAs can be made without tax.

Should you Invest In Gold For Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. If you are unsure of which option to invest in, consider both.

Gold is a safe investment and can also offer potential returns. It is a good choice for retirees.

Most investments have fixed returns, but gold's volatility is what makes it unique. As a result, its value changes over time.

This does not mean you shouldn’t invest in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another advantage of gold is its tangible nature. Gold is much easier to store than bonds and stocks. It can also be transported.

You can always access gold as long your place it safe. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. It's a great way to hedge against rising prices, as gold prices tend to increase along with other commodities.

Also, you'll reap the benefits of having some savings invested in something with a stable value. When the stock market drops, gold usually rises instead.

Investing in gold has another advantage: you can sell it anytime you want. You can easily liquidate your investment, just as with stocks. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

You shouldn't buy too little at once. Begin by buying a few grams. Continue adding more as necessary.

The goal is not to become rich quick. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

How Do You Make a Withdrawal from a Precious Metal IRA?

First, decide if it is possible to withdraw funds from an IRA. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

A taxable brokerage account is a better option than an IRA if you are prepared to pay a penalty for early withdrawals. You will also have to account for taxes due on any amount you withdraw if you choose this option.

Next, figure out how much money will be taken out of your IRA. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. Traditional IRAs let you withdraw money tax-free after you turn 59 1/2, while Roth IRAs require you to pay income taxes upfront but allow you access the earnings later without paying any additional taxes.

Once you have completed these calculations, you need to open your brokerage account. A majority of brokers offer free signup bonuses, as well as other promotions, to get people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage facilities will accept bullion bars, others require you to buy individual coins. You will need to weigh each one before making a decision.

Bullion bars require less space, as they don't contain individual coins. You will need to count each coin individually. On the flip side, storing individual coins allows you to easily track their value.

Some prefer to keep their money in a vault. Some people prefer to store their coins safely in a vault. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

How do I open a Precious Metal IRA

The first step is to decide if you want an Individual Retirement Account (IRA). You must complete Form 8606 to open an account. To determine which type of IRA you qualify for, you will need to fill out Form 5204. This form must be submitted within 60 days of the account opening. Once you have completed this form, it is possible to begin investing. You could also opt to make a contribution directly from your paycheck by using payroll deduction.

Complete Form 8903 if your Roth IRA option is chosen. The process for an ordinary IRA will not be affected.

To be eligible for a precious metals IRA, you will need to meet certain requirements. The IRS stipulates that you must have earned income and be at least 18-years old. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. Additionally, you must make regular contributions. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. However, physical bullion will not be available for purchase. This means you can't trade shares of stock and bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. Some IRA providers offer this option.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they are not as liquid or as easy to sell as stocks and bonds. It is therefore harder to sell them when required. Second, they don't generate dividends like stocks and bonds. So, you'll lose money over time rather than gain it.

How does gold perform as an investment?

Supply and demand determine the gold price. Interest rates can also affect the gold price.

Because of their limited supply, gold prices can fluctuate. There is also a risk in owning gold, as you must store it somewhere.

Is it a good idea to open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. You cannot recover any money you have invested. This includes all investments that are lost to theft, fire, flood, or other causes.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These items can be lost because they have real value and have been around for thousands years. These items are worth more today than they were when first produced.

When opening an IRA account, make sure you choose a reputable company offering competitive rates and high-quality products. It's also wise to consider using a third-party custodian who will keep your assets safe while giving you access to them anytime.

When you open an account, keep in mind that you won't receive any returns until your retirement. Don't forget the future!

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

cftc.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Lawful – WSJ

investopedia.com

How To

Gold Roth IRA guidelines

You should start investing early to ensure you have enough money for retirement. It is best to start saving for retirement as soon you can (typically at age 50). It's vital to contribute enough money each year to ensure adequate growth on an ongoing basis.

You can also take advantage of tax-free savings opportunities like a traditional 401k (k), SEP IRA (or SIMPLE IRA). These savings vehicles allow you the freedom to contribute without having to pay tax on your earnings until they are withdrawn. They are a great option for those who do not have access to employer matching money.

Savings should be done consistently and regularly over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————–

By: Juan Galt

Title: Grupo Murano's Bold Move: Embracing Bitcoin to Revolutionize Real Estate

Sourced From: bitcoinmagazine.com/news/grupo-muranos-1b-bitcoin-bet-real-estate

Published Date: Tue, 22 Jul 2025 00:11:35 +0000