Bitcoin's Supply Tightens Despite Price Rally, According to Glassnode Study

A recent study conducted by Glassnode on onchain activities has revealed that the scarcity of the bitcoin supply is increasing. Despite a significant increase in bitcoin's value this year, the study shows that coins are becoming less liquid and are being held by steadfast holders.

Bitcoin's Value Surges, but Supply Remains Limited

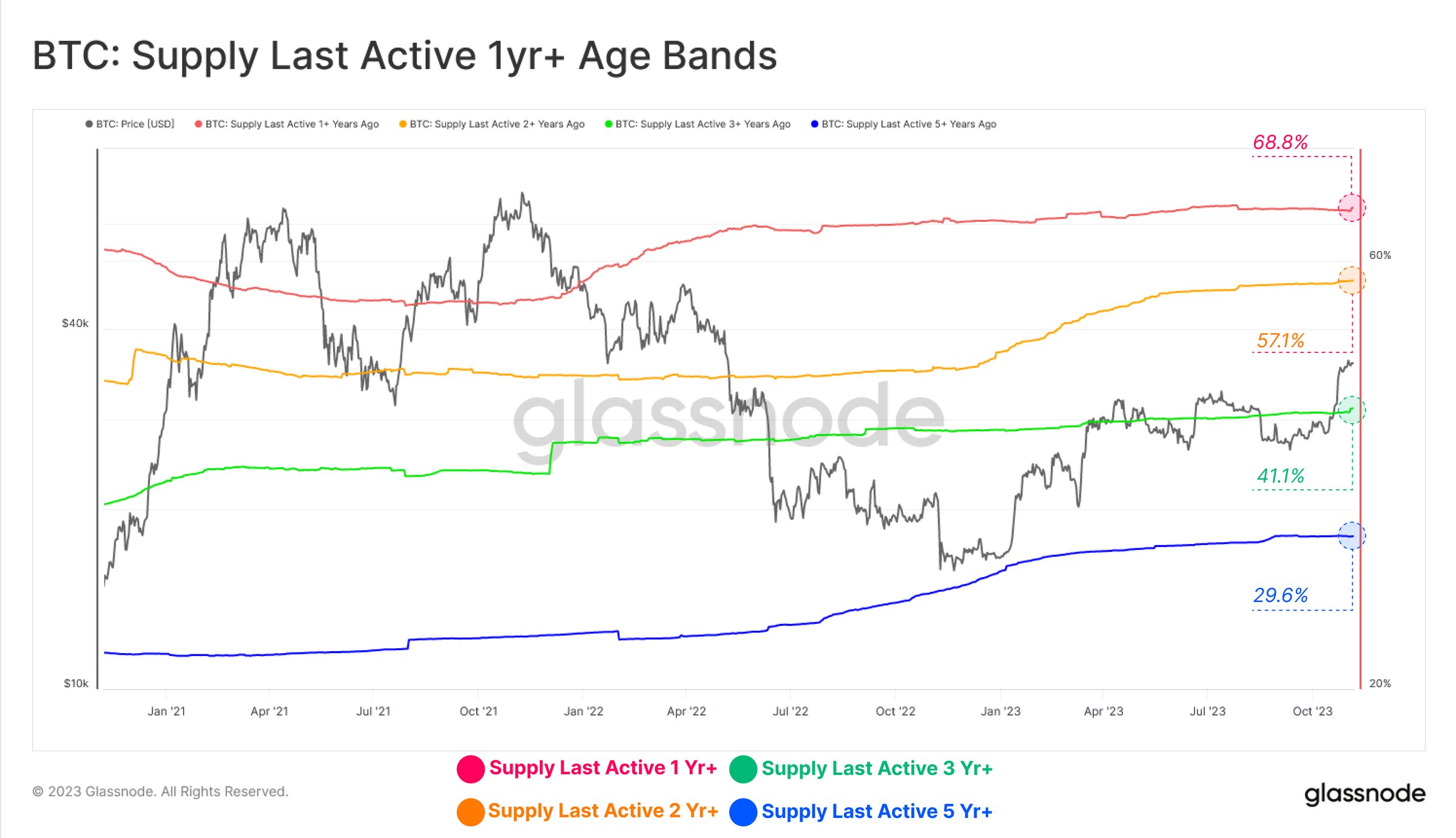

Over the past year, BTC has experienced a 71% surge in value, with a 114% increase since the beginning of the year. However, Glassnode's latest report indicates that the availability of bitcoin remains limited, as a large share of BTC has not moved in over a year.

The report highlights that 68.8% of bitcoin has been inactive for more than a year, and the non-liquid supply index has reached a record-breaking 15.4 million BTC. This suggests that long-term investors are holding onto their bitcoin, while short-term investors are reducing their supply.

Supply Gap Widens, Reflecting Reluctance to Sell

Glassnode's analysis shows that the gap between long-standing and recent investors has been widening since July 2022. This indicates that current investors are becoming more reluctant to sell their holdings, leading to a solidifying of the bitcoin supply. The contrast between dormant and circulating supplies is becoming more pronounced.

Activity-to-Vaulting Ratio Declines, Signaling Market Transition

The newly introduced Glassnode metric, the Activity-to-Vaulting Ratio, has been declining since June 2021, with a notable dip after June 2022. Glassnode suggests that this decline signifies the diminishing market exuberance of the 2021-22 cycle.

Investors Accumulate and Retain Bitcoin

Glassnode's analysis of spending patterns reveals a trend of investor accumulation and retention, rather than active trading. The Sell-Side Risk Ratio for short-term holders has increased, indicating some profit-taking in the short run. On the other hand, the Sell-Side Risk Ratio for long-term holders remains historically low.

Increasing Confidence Among Investors

Glassnode's evaluation of wallet activity shows that wallet sizes are growing across the board, indicating increased investor confidence. Small investors, known as "Shrimps" and "Crabs," have absorbed 92% of the bitcoin mined since May 2022. "Shrimps" hold less than one bitcoin, "Crabs" hold 1-10 BTC, and "Fish" hold anywhere between 10-100 BTC.

Bitcoin Supply Historically Tight, Despite Strong Price Performance

In conclusion, Glassnode analysts assert that the bitcoin supply is historically tight, with many supply metrics indicating long periods of coin inactivity. This suggests that the supply is tightly held, which is particularly impressive considering the strong price performance of bitcoin this year.

What are your thoughts on Glassnode's report regarding the tightening bitcoin supply? Share your opinions in the comments section below.

Frequently Asked Questions

Do You Need to Open a Precious Metal IRA

Before opening an IRA, it is important to understand that precious metals aren't covered by insurance. There is no way to recover money that you have invested in precious metals. This includes investments that have been damaged by fire, flooding, theft, and so on.

Protect yourself against this type of loss by investing in physical gold or silver coins. These coins have been around for thousands and represent a real asset that can never be lost. You would probably get more if you sold them today than you paid when they were first created.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

Remember that you will not see any returns unless you are retired if you open an Account. Do not forget about the future!

How much gold should you have in your portfolio?

The amount of capital required will affect the amount you make. A small investment of $5k-10k would be a great option if you are looking to start small. As you grow, it is possible to rent desks or office space. This way, you don't have to worry about paying rent all at once. Only one month's rent is required.

Also, you need to think about the type of business that you are going to run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. You should also consider the expected income from each client when you do this type of thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. You might get paid only once every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k to $2k of gold, and then growing from there.

Can the government take your gold?

You own your gold and therefore the government cannot seize it. It is yours because you worked hard for it. It belongs to you. But, this rule is not universal. You could lose your gold if convicted of fraud against a federal government agency. Your precious metals can also be lost if you owe tax to the IRS. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

What is a Precious Metal IRA (IRA)?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These metals are known as “precious” because they are rare and extremely valuable. They make excellent investments for your money and help you protect your future from inflation and economic instability.

Precious metals are often referred to as “bullion.” Bullion refers only to the actual metal.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

With a precious metal IRA, you invest in bullion directly rather than purchasing shares of stock. You'll get dividends each year.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. Instead, you pay only a small percentage tax on your gains. Plus, you get free access to your funds whenever you want.

Who owns the gold in a Gold IRA?

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

This tax-free status is only available to those who have owned at least $10,000 of gold and have kept it for at minimum five years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

It is a good idea to consult an accountant or financial planner to learn more about your options.

What are some of the benefits of a gold IRA

The best way to invest money for retirement is by putting it into an Individual Retirement Account (IRA). It will be tax-deferred up until the time you withdraw it. You have complete control over how much you take out each year. And there are many different types of IRAs. Some are better suited for college students. Others are designed for investors looking for higher returns. Roth IRAs, for example, allow people to contribute after they turn 59 1/2. They also pay taxes on any earnings when they retire. Once they start withdrawing money, however, the earnings aren’t subject to tax again. This account may be worth considering if you are looking to retire earlier.

Because it allows you money to be invested in multiple asset classes, a ‘gold IRA' is similar to any other IRAs. Unlike a regular IRA, you don't have to worry about paying taxes on your gains while you wait to access them. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. This eliminates the need to constantly make deposits. To avoid missing a payment, direct debits can be set up.

Finally, gold is one of the safest investment choices available today. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even in economic turmoil, gold prices tends to remain relatively stable. Gold is a good option for protecting your savings from inflation.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

irs.gov

investopedia.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- You want to keep gold in your IRA at home? It's not legal – WSJ

How To

Guidelines for Gold Roth IRA

You should start investing early to ensure you have enough money for retirement. Start saving as soon as possible, usually at age 50. You can continue to save throughout your career. It is important to invest enough money each and every year to ensure you get adequate growth.

You may also wish to take advantage of tax-free investments such as a SIMPLE IRA, SEP IRA, and traditional 401(k). These savings vehicles enable you to make contributions while not paying any taxes on the earnings, until they are withdrawn. These savings vehicles can be a great option for individuals who don't qualify for employer matching funds.

Savings should be done consistently and regularly over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: Glassnode Data Shows Bitcoin Supply Less Liquid Than Ever Despite Market Gains

Sourced From: news.bitcoin.com/glassnode-data-shows-bitcoin-supply-less-liquid-than-ever-despite-market-gains/

Published Date: Wed, 08 Nov 2023 18:30:10 +0000

Did you miss our previous article…

https://altcoinirareview.com/central-bank-digital-currencies-cbdcs-will-shape-the-future-financial-system-says-bis-chief/