Financial Benchmarks Display Bullish Trend Following FOMC Announcement

The Federal Reserve's most recent session of the Federal Open Market Committee (FOMC) concluded with the decision to leave interest rates unchanged. This outcome was in line with market expectations of rate reductions in 2024 and was influenced by Fed Chair Jerome Powell's dovish stance. As a result, the market responded positively, leading to an uplift in U.S. stocks, the crypto economy, and precious metals such as gold and silver.

Following the FOMC's announcement, major U.S. stock indices experienced substantial growth, reflecting the market's optimistic mood after the meeting. The crypto sector also rallied, with a significant 3.66% increase, and bitcoin (BTC) rose by 4%. Additionally, traditional safe-haven assets like gold and silver saw gains of 2.41% and 4.48%, respectively. These increases indicate a widespread positive response to the Fed's decision.

Powell Highlights Importance of Careful Monetary Policy

In his remarks after the meeting, Powell discussed the current economic situation and emphasized that the economy is not currently in a recession. However, he did acknowledge the possibility of a recession in the coming year. Powell stressed the need for careful monetary policy, stating, "We are very focused on not making the mistake of keeping rates too high for too long." He also acknowledged the progress made in core inflation and non-housing services inflation. These comments suggest a cautious yet adaptable approach to future monetary policy adjustments.

Shift in Policy Indicates Unlikeliness of Further Rate Hikes

Contrary to speculations in the market, further rate hikes are unlikely. Powell hinted at a shift in the central bank's policy, suggesting that the current policy rate is likely at or near its peak for this tightening cycle. This aligns with the belief among speculators that the Fed may have finished hiking rates and that rate cuts could be on the horizon in 2024. The FOMC's statement and Powell's remarks underscore the Fed's commitment to returning inflation to its 2% target, although the method to achieve this appears to be evolving.

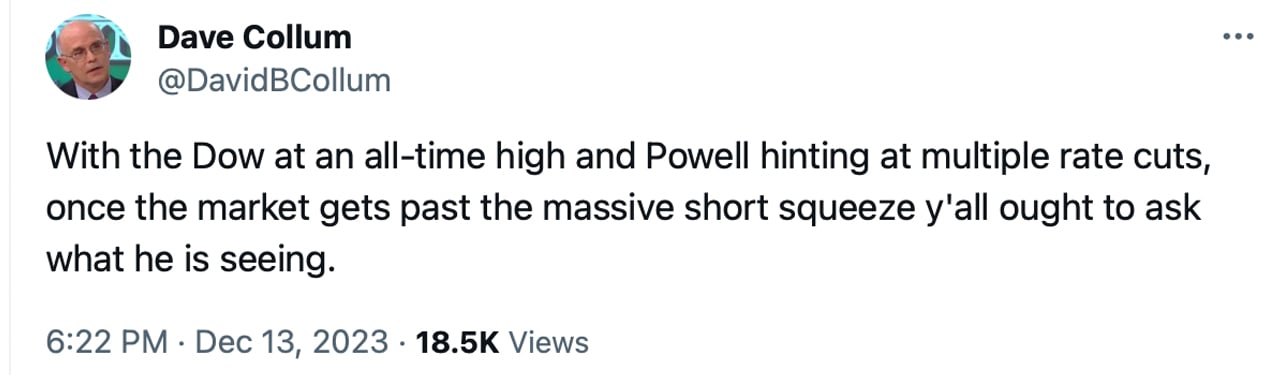

Insights from Market Experts

Several market experts have shared their thoughts following Powell's speech. Economist Peter Schiff commented on social media platform X, stating, "The only reason Powell can claim he won the inflation war without harming the economy or employment is because he didn't actually win, he surrendered. The phony economy and bull market are still alive because inflation is not dead."

Sven Henrich of Northman Trader provided his insights, saying, "By further easing financial conditions, Powell has abandoned his previous tough talk, which the market had already ignored. The credibility destruction is now complete." Henrich added that Powell claims the Fed is implementing restrictive policies while financial conditions have actually eased to the same loose levels that were present when rates started rising.

Another account known as "QE Infinity" on social media platform X stated, "Powell just poured a giant can of lighter fluid on a fire that was about to burn out. Consequences be damned." The FOMC's decision to maintain the federal funds rate was influenced by various factors, including concerns about persistent inflation and the broader economic climate.

Market Anticipates Rate Hike in January, Despite Powell's Remarks

Despite Powell's indication that rate hikes are nearing their limit and reductions may occur in 2024, the CME Fedwatch tool predicts a rate increase at the next FOMC meeting in January. The market anticipates a hike with a probability of 89.7%, while 10.3% foresee no change.

What are your thoughts on the Fed's current stance? Do you expect more rate hikes or rate cuts in the future? Share your opinions in the comments section below.

Frequently Asked Questions

Is gold a good choice for an investment IRA?

For anyone who wants to save some money, gold can be a good investment. It is also an excellent way to diversify you portfolio. There is much more to gold than meets your eye.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is often called “the most ancient currency in the universe.”

Gold, unlike other paper currencies created by governments is mined directly from the earth. This makes it highly valuable as it is hard and rare to produce.

The supply and demand factors determine how much gold is worth. If the economy is strong, people will spend more money which means less people can mine gold. The value of gold rises as a consequence.

On the flipside, people may save cash rather than spend it when the economy slows. This leads to more gold being produced which decreases its value.

This is why both individuals as well as businesses can benefit from investing in gold. You will benefit from economic growth if you invest in gold.

You'll also earn interest on your investments, which helps you grow your wealth. You won't lose your money if gold prices drop.

What is the best way to hold physical gold?

Gold is money, not just paper currency or coinage. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. During these turbulent market times, gold was among few assets that outperformed the stocks.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Your stock portfolio can fall, but you will still own your shares. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Gold provides liquidity. This means that you can sell gold anytime, regardless of whether or not another buyer is available. The liquidity of gold makes it a good investment. This allows you take advantage of the short-term fluctuations that occur in the gold markets.

Is it possible to hold a gold ETF within a Roth IRA

You may not have this option with a 401(k), however, you might want to consider other options, like an Individual retirement account (IRA).

A traditional IRA allows contributions from both employee and employer. An Employee Stock Ownership Plan (ESOP) is another way to invest in publicly traded companies.

An ESOP can provide tax advantages, as employees are allowed to share in company stock and the profits generated by the business. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

An Individual Retirement Annuity (IRA) is also available. An IRA allows you to make regular payments throughout your life and earn income in retirement. Contributions made to IRAs are not taxable.

What is the value of a gold IRA

Many benefits come with a gold IRA. It can be used to diversify portfolios and is an investment vehicle. You control how much money goes into each account and when it's withdrawn.

You also have the option to roll over funds from other retirement accounts into a gold IRA. This allows you to easily transition if your retirement is early.

The best part about gold IRAs? You don't have to be an expert. They're available at most banks and brokerage firms. Withdrawals can be made instantly without the need to pay fees or penalties.

But there are downsides. Gold is known for being volatile in the past. It is important to understand why you are investing in gold. Are you seeking safety or growth? Are you looking for growth or insurance? Only after you have this information will you make an informed decision.

If you want to keep your gold IRA open for life, you might consider purchasing more than one ounce. One ounce doesn't suffice to cover all your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don't have to buy a lot of gold if your goal is to sell it. You can even manage with one ounce. But you won't be able to buy anything else with those funds.

Are You Ready to Invest in Gold?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. If you are unsure which option to choose, consider investing in both options.

In addition to being a safe investment, gold also offers potential returns. This makes it a worthwhile choice for retirees.

While many investments promise fixed returns, gold is subject to fluctuations. Therefore, its value is subject to change over time.

However, it doesn't necessarily mean that you shouldn't invest your money in gold. This just means you need to account for fluctuations in your overall portfolio.

Another advantage of gold is its tangible nature. Gold is less difficult to store than stocks or bonds. It can be easily transported.

As long as you keep your gold in a secure location, you can always access it. Plus, there are no storage fees associated with holding physical gold.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

It's also a good idea to have a portion your savings invested in something which isn't losing value. Gold usually rises when the stock market falls.

You can also sell gold anytime you like by investing in it. As with stocks, your position can be liquidated whenever you require cash. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

Don't purchase too much at once. Start with just a few drops. Then add more as needed.

Remember, the goal here isn't to get rich quickly. Instead, the goal here is to build enough wealth to not need to rely upon Social Security benefits.

While gold may not be the best investment, it can be a great addition to any retirement plan.

What precious metal is best for investing?

Answering this question will depend on your willingness to take some risk and the return you seek. Gold is a traditional haven investment. However, it is not always the most profitable. If you are looking for quick profits, gold might not be the right investment. You should invest in silver if you have the patience and time.

Gold is the best investment if you aren't looking to get rich quick. Silver may be a better option for investors who want long-term steady returns.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

finance.yahoo.com

investopedia.com

irs.gov

cftc.gov

How To

3 Ways to Invest Gold for Retirement

It is crucial to understand how you can incorporate gold into your retirement plans. There are many ways to invest in gold if you have a 401k account at work. It is also possible to invest in gold from outside of your work environment. If you have an IRA (Individual Retirement Account), a custodial account could be opened at Fidelity Investments. You may also want to purchase precious metals from a reputable dealer if you don’t already have them.

These are the rules for gold investing:

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, cash in your accounts. This will help you to protect yourself against inflation while also preserving your purchasing power.

- Own Physical Gold Coins – You should buy physical gold coins rather than just owning a paper certificate. The reason for this is that physical gold coins are much more easily sold than certificates. You don't have to store physical gold coins.

- Diversify Your Portfolio – Never put all of your eggs in one basket. This means that you should diversify your wealth by investing in different assets. This helps to reduce risk and provides more flexibility when markets are volatile.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: Federal Reserve Maintains Current Rates, Eyes Potential Reductions in 2024

Sourced From: news.bitcoin.com/powells-fed-policy-criticized-experts-claim-phony-economy-and-credibility-destruction-post-rate-decision/

Published Date: Thu, 14 Dec 2023 06:30:56 +0000

Did you miss our previous article…

https://altcoinirareview.com/nft-sales-soar-in-early-december-bitcoin-outshines-competition/

Related posts:

Jerome Powell’s Firm Commitment to Curb Inflation: A Closer Look at Monetary Policy

Jerome Powell’s Firm Commitment to Curb Inflation: A Closer Look at Monetary Policy

The Impact of Jerome Powell’s Remarks on the Economy and Financial Markets

The Impact of Jerome Powell’s Remarks on the Economy and Financial Markets

Predictions For Bitcoin And World Markets With The Upcoming FOMC Meeting

Predictions For Bitcoin And World Markets With The Upcoming FOMC Meeting

When markets forget that Central Banks cannot fix the world with interest rates

When markets forget that Central Banks cannot fix the world with interest rates