In the realm of retirement accounts, the term "Roth IRA" may not frequently grace headlines, but in 2021, tech investor Peter Thiel sparked interest with his $5 billion tax-free Roth IRA strategy. How did he achieve this feat? The secret lies in alternative investments. By utilizing a self-directed IRA, Thiel invested in early-stage tech ventures multiple times, possibly exploiting a loophole. While this move garnered attention, it also raised concerns about the scrutiny surrounding such IRA structures.

Distinguishing IRA Structures

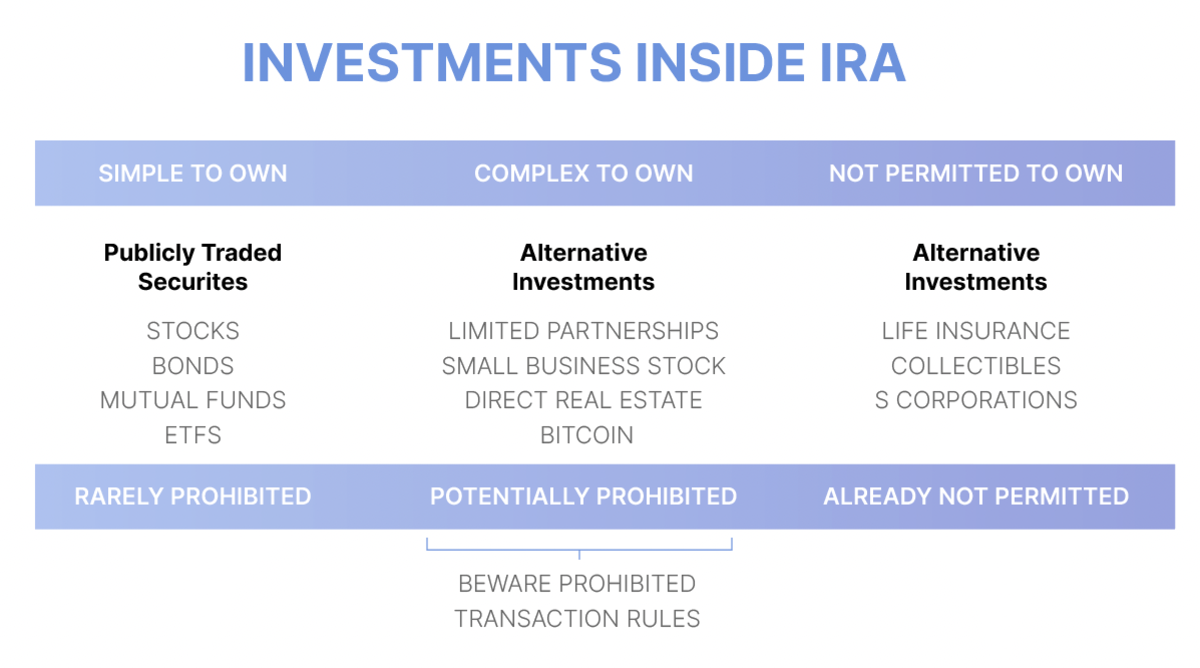

Before delving into the risks associated with self-directed and checkbook IRAs, it's essential to grasp the variations in IRA structures. IRAs can be categorized as Traditional (pre-tax) or Roth (post-tax) irrespective of their custodial setup. All IRAs are custodial, with a licensed financial institution acting as the custodian overseeing the IRA's administration.

Brokerage and Bank IRAs

Brokerage and bank IRAs are the conventional types, allowing investors to engage in stocks, bonds, ETFs, mutual funds, and banking instruments like CDs and deposit accounts. Examples include popular institutions such as Fidelity, TD Ameritrade, and Charles Schwab. The Unchained IRA closely aligns with this structure within the hierarchy.

Self-Directed IRA (SDIRA)

A self-directed IRA expands investment horizons beyond traditional assets like stocks and bonds to include real estate, businesses, precious metals, and digital assets. While the IRS doesn't offer an exhaustive list of permissible investments, it prohibits collectibles, certain derivatives, and life insurance among others.

Checkbook IRA

Checkbook IRAs, a subset of self-directed IRAs, grant account owners control over investments through a checking account, typically via an LLC conduit. This autonomy in investment choices necessitates diligent administration to maintain the IRA's tax-exempt status.

Non-Checkbook Self-Directed IRA

Distinct from checkbook IRAs, this subset requires custodian approval before transactions are executed. Investors must await custodian validation for each investment, a practice that regained popularity amid legal uncertainties surrounding checkbook IRAs in late 2021.

Risks in Self-Directed and Checkbook IRAs

1. Liquidity Concerns

Assets in self-directed IRAs often lack liquidity, posing challenges in quick asset liquidation when needed. Investors should conduct thorough due diligence on asset liquidity before committing to any investment strategy.

2. Formation and Legal Structure

Establishing a checkbook IRA necessitates precise legal structuring to prevent potential issues that could jeopardize the IRA's tax-advantaged status.

3. Transaction Reporting

Owners of checkbook IRAs must diligently adhere to transaction reporting requirements to avoid misreporting income, ensuring compliance with regulations.

4. "Deemed Distribution" Risks

The case of McNulty v. Commissioner underscores the risks associated with maintaining a checkbook IRA, emphasizing the importance of prudent investment practices to prevent unfavorable tax implications.

5. Prohibited Transactions

Self-directed IRA owners must avoid commingling personal and IRA assets to prevent penalties, emphasizing the stringent rules governing disqualified individuals.

6. Financing Complexities

Financing within self-directed IRAs presents challenges, such as non-recourse loans for property purchases and the need to segregate income and expenses within the IRA structure.

Impact on Bitcoin IRAs

Given the regulatory scrutiny surrounding self-directed IRAs and the rising interest in digital assets, it's crucial for bitcoin IRAs to navigate these risks effectively.

For individuals seeking to incorporate bitcoin in their IRAs, exploring alternatives like the Unchained IRA, which offers collaborative custody without the complexities of checkbook IRAs, can provide a compliant and secure investment avenue.

Disclaimer: This article serves for educational purposes only and does not constitute tax advice. For specific queries regarding tax implications, it's advisable to consult with a qualified attorney or CPA.

Frequently Asked Questions

Who is the owner of the gold in a gold IRA

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

You must have at least $10,000 in gold and keep it for at most five years to qualify for this tax-free status.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

It is a good idea to consult an accountant or financial planner to learn more about your options.

What does gold do as an investment?

Supply and demand determine the gold price. Interest rates also have an impact on the price of gold.

Due to limited supplies, gold prices are subject to volatility. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

Should You Buy or Sell Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. Many people are shifting away from traditional investments like bonds or stocks to instead look toward precious metals such gold.

Although gold prices have shown an upward trend in recent years, they are still relatively low when compared to other commodities like oil and silver.

Experts believe this could change soon. They believe gold prices could increase dramatically if there is another global financial crises.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

These are some important things to remember if your goal is to invest in gold.

- The first thing to do is assess whether you actually need the money you're putting aside for retirement. It is possible to save for retirement while still investing your gold savings. However, when you retire at age 65, gold can provide additional protection.

- Second, be sure to understand your obligations before you purchase gold. Each account offers different levels of security and flexibility.

- Remember that gold is not as safe as a bank account. Your gold coins may be lost and you might never get them back.

You should do your research before buying gold. You should also ensure that you do everything you can to protect your gold.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

finance.yahoo.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- You want to keep gold in your IRA at home? It's not legal – WSJ

How To

The History of Gold as an Asset

From ancient times to the beginning of the 20th century, gold was used as a currency. It was universally accepted and loved for its beauty, durability, purity and divisibility. Due to its value, it was also internationally traded. Different weights and measurements existed around the world, however, because there were not international standards to measure gold. For example, one pound sterling in England equals 24 carats; one livre tournois equals 25 carats; one mark equals 28 carats; and so on.

The United States began issuing American coin made up 90% copper, 10% zinc and 0.942 fine-gold in the 1860s. This resulted in a decline of foreign currency demand and an increase in the price. At this point, the United States minted large amounts of gold coins, causing the price of gold to drop. The U.S. government needed to find a solution to their debt because there was too much money in circulation. To do this, they decided that some of their excess gold would be sold back to Europe.

Most European countries distrusted the U.S. Dollar and began to accept gold as payment. Many European countries began to use paper money and stopped accepting gold as payment after World War I. The value of gold has significantly increased since then. Today, although the price fluctuates, gold remains one of the safest investments you can make.

—————————————————————————————————————————————————————————————–

By: Jessy Gilger

Title: Exploring Risks of Self-Directed and Checkbook Bitcoin IRAs

Sourced From: bitcoinmagazine.com/business/6-common-pitfalls-of-self-directed-and-checkbook-bitcoin-iras

Published Date: Fri, 12 Apr 2024 16:48:41 GMT