Bitcoin is showing signs of a promising upward trajectory as we kick off 2025. Yet, uncertainties loom over the market's overall well-being and the sustainability of the current bullish trend in the weeks and months ahead. Let's delve into a comprehensive and data-backed examination of the key metrics driving our current market sentiment.

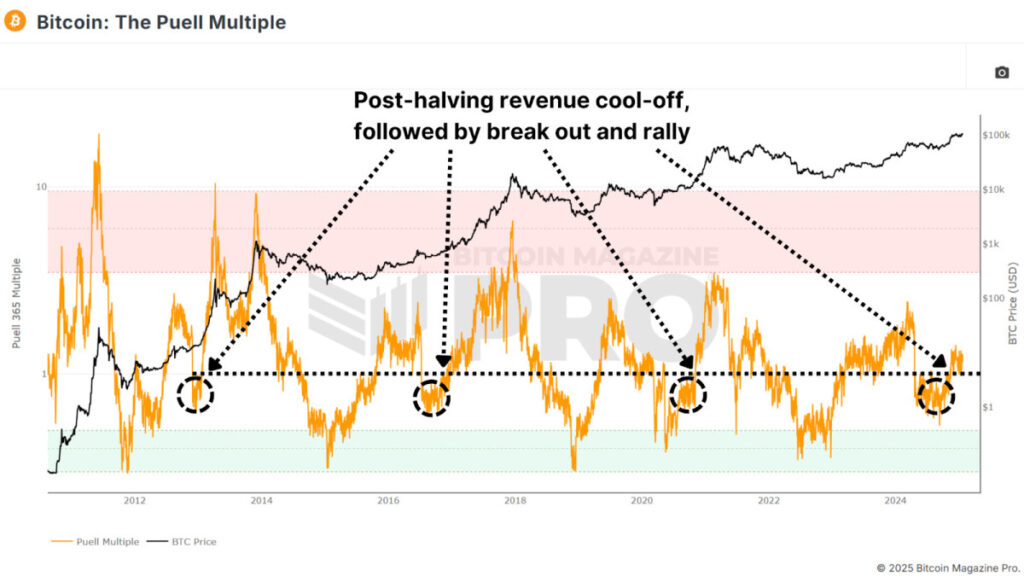

Miner Recovery

The Puell Multiple, a metric that compares miners' daily USD revenue to their yearly average, indicates that Bitcoin's fundamental network strength remains robust. Post-halving events, miner revenue typically sees a significant decline following a 50% block reward reduction. However, the Puell Multiple has recently surpassed the crucial value of 1, signaling a recovery and a potential bullish phase.

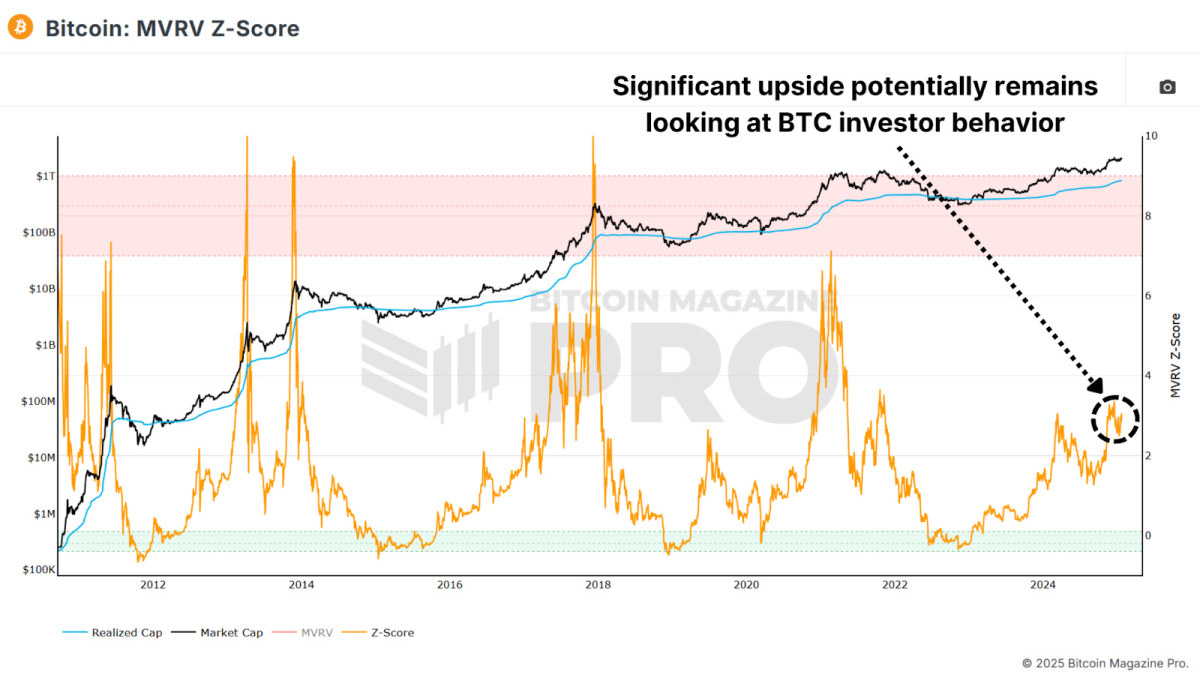

Substantial Upside Potential

The MVRV Z-Score, which evaluates Bitcoin's market value in relation to its realized value or average accumulation price, suggests that current levels are well below historical peaks, indicating ample room for growth. Even after adjusting for market dynamics, Bitcoin is still far from its previous cycle peaks, hinting at further price appreciation.

Sustainable Sentiment

The Bitcoin Fear and Greed Index reflects a healthy level of Greedy sentiment, signaling sustainable market sentiment. Past data from the 2020-2021 bull cycle indicates that greed levels in the range of 80-90 can endure for extended periods, supporting a sustained bullish momentum. Extreme greed levels (95+) typically precede significant market corrections.

Network Activity

The Active Address Sentiment Indicator suggests a minor decline in network activity, indicating that retail investors may not have fully re-entered the market yet. This dip could signify untapped retail demand that could propel the next phase of the rally.

Risk Appetite Shifts

Traditional market sentiment is displaying positive signals, with a rise in High Yield Credit appetite as the macro-economic landscape shifts towards a more risk-on stance. Historically, Bitcoin's performance has exhibited a strong correlation with periods of heightened global risk appetite, often aligning with bullish trends in Bitcoin's price.

Conclusion

Bitcoin's on-chain metrics, market sentiment, and macroeconomic outlook collectively indicate a continuation of the current bull market. While short-term volatility remains a possibility, the alignment of these indicators suggests that Bitcoin is poised to reach and potentially surpass its current all-time high in the near future.

For a more detailed analysis of Bitcoin and access to advanced features such as live charts, personalized indicator alerts, and comprehensive industry reports, explore Bitcoin Magazine Pro.

Disclaimer: This article serves as informational content and should not be construed as financial advice. Conduct thorough research before making any investment decisions.

Frequently Asked Questions

How much do gold IRA fees cost?

The Individual Retirement Account (IRA), fee is $6 per monthly. This includes account maintenance and any investment costs.

You may have to pay additional fees if you want to diversify your portfolio. The type of IRA you choose will determine the fees. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

In addition, most providers charge annual management fees. These fees vary from 0% to 11%. The average rate per year is.25%. These rates are often waived if a broker like TD Ameritrade is used.

Can the government take your gold?

Your gold is yours and the government cannot take it. It is yours because you worked hard for it. It belongs to you. However, there may be some exceptions to this rule. You can lose your gold if you have been convicted for fraud against the federal governments. You can also lose precious metals if you owe taxes. However, if you do not pay your taxes, you can still keep your gold even though it is considered property of the United States Government.

Can I buy gold with my self-directed IRA?

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

The IRS allows individuals to contribute up to $5,500 annually ($6,500 if married and filing jointly) to a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contracts can be described as financial instruments that are determined by the gold price. They let you speculate on future price without having to own the metal. You can only hold physical bullion, which is real silver and gold bars.

What precious metal should I invest in?

This depends on what risk you are willing take and what kind of return you desire. Although gold has been considered a safe investment, it is not always the most lucrative. If you are looking for quick profits, gold might not be the right investment. You should invest in silver if you have the patience and time.

Gold is the best investment if you aren't looking to get rich quick. Silver might be a better investment option if steady returns are desired over a long period of time.

Should You Invest in gold for Retirement?

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. If you are unsure of which option to invest in, consider both.

Gold is a safe investment and can also offer potential returns. Retirees will find it an attractive investment.

While most investments offer fixed rates of return, gold tends to fluctuate. Because of this, gold's value can fluctuate over time.

This does not mean you shouldn’t invest in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another benefit to gold? It's a tangible asset. Gold is more convenient than bonds or stocks because it can be stored easily. It can also be carried.

You can always access gold as long your place it safe. Plus, there are no storage fees associated with holding physical gold.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold usually rises when the stock market falls.

Another benefit to investing in gold? You can always sell it. Like stocks, you can sell your position anytime you need cash. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all your eggs on one basket.

You shouldn't buy too little at once. Start small, buying only a few ounces. Continue adding more as necessary.

It's not about getting rich fast. It is to create enough wealth that you no longer have to depend on Social Security.

Although gold might not be the right investment for everyone it could make a great addition in any retirement plan.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement funds

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Lawful – WSJ

How To

How to Hold Physical Gold in an IRA

The most obvious way to invest in gold is by buying shares from companies producing gold. However, there are risks associated with this strategy. It isn't always possible for these companies to survive. Even if the company survives, they still face the risk of losing their investment due to fluctuations in gold's price.

The alternative is to buy physical gold. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. This option has many advantages, including the ease of access (you don’t have to deal with stock markets) and the ability of making purchases at low prices. It is also easier to check how much gold you have stored. The receipt will show exactly what you paid. You'll also know if taxes were not paid. There's also less chance of theft than investing in stocks.

However, there can be some downsides. You won't be able to benefit from investment funds or interest rates offered by banks. It won't allow you to diversify any of your holdings. Instead, you'll be stuck with what's been bought. The taxman might also ask you questions about where your gold is located.

BullionVault.com offers more information on buying gold for an IRA.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Exploring Bitcoin's Potential: In-Depth Data Analysis & On-Chain Insights

Sourced From: bitcoinmagazine.com/markets/bitcoin-deep-dive-data-analysis-on-chain-roundup

Published Date: Thu, 23 Jan 2025 15:33:00 GMT