Bitcoin is currently in a phase of evolution, with diverse viewpoints on its role and potential. Some see it as a currency for daily transactions, others as a modern equivalent of gold for wealth storage, and still, others as a decentralized global platform for securing and validating off-chain transactions. However, a prevailing perspective is emerging that Bitcoin is transforming into a digital base money.

The Rise of Bitcoin as Base Money

Functioning similarly to physical gold with attributes such as being a bearer asset, a hedge against inflation, and offering currency denominations like the dollar, Bitcoin is revolutionizing the concept of monetary base assets. Its transparent algorithm and fixed supply of 21 million units ensure a monetary policy that is non-discretionary. In contrast, traditional fiat currencies like the US dollar depend on centralized authorities to regulate their supply, leading to concerns about predictability and effectiveness in today's volatile landscape.

The Hayekian Perspective on Bitcoin

Nobel laureate Friedrich August von Hayek criticized centralized monetary decision-making in his work, "The Pretense of Knowledge." Bitcoin's transparent and predictable monetary policy starkly contrasts with the traditional fiat currency management, which can be opaque and uncertain.

Debunking the Notion of Leveraging Bitcoin

Within the Bitcoin community, there is a widespread skepticism towards leveraging Bitcoin. Many enthusiasts believe that any form of leverage could undermine Bitcoin's core principles and liken it to fiat currency practices. This skepticism is rooted in the distinction between commodity credit, based on real savings, and circulation credit, which lacks such backing, resembling unbacked IOUs.

The Caution Against Bitcoin Leverage

Even nuanced perspectives within the community caution against leveraging Bitcoin, with figures like Caitlin Long warning about the risks involved. The collapse of Bitcoin lending companies based on leverage in 2022, such as Celsius and BlockFi, further reinforced these concerns.

Lessons from the Celsius and BlockFi Collapse

The collapse of major Bitcoin lending companies in 2022 led to a significant upheaval in the crypto market, reminiscent of the Lehman Brothers collapse. This event highlighted the risks associated with centralized lending platforms and emphasized the importance of transparency, trust, and risk management in the crypto lending sector.

The Imperative of Bitcoin-Based Yield Products

Despite the challenges faced by Bitcoin lending platforms, the need for Bitcoin-based yield products remains crucial. These products play a vital role in fostering the growth of a robust Bitcoin-centric economy and leveraging Bitcoin as a digital base money.

Building Trust in Bitcoin-Powered Finance

Bitcoin-powered finance will evolve in layers, similar to the existing financial system. Understanding the trust spectrum and assessing Bitcoin yield products based on consensus, asset, and yield alignment with Bitcoin's ethos is essential for the development of a sustainable financial ecosystem.

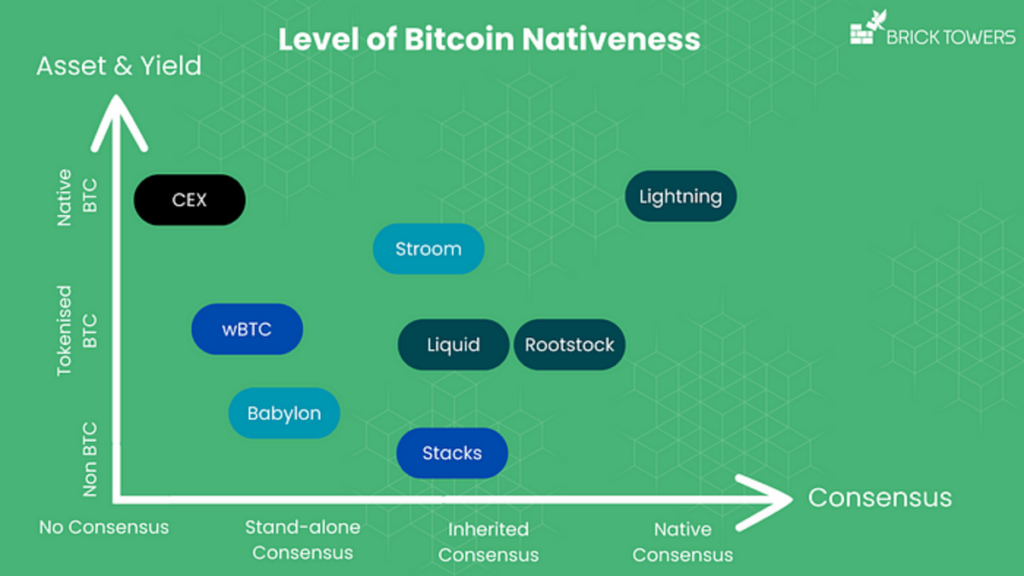

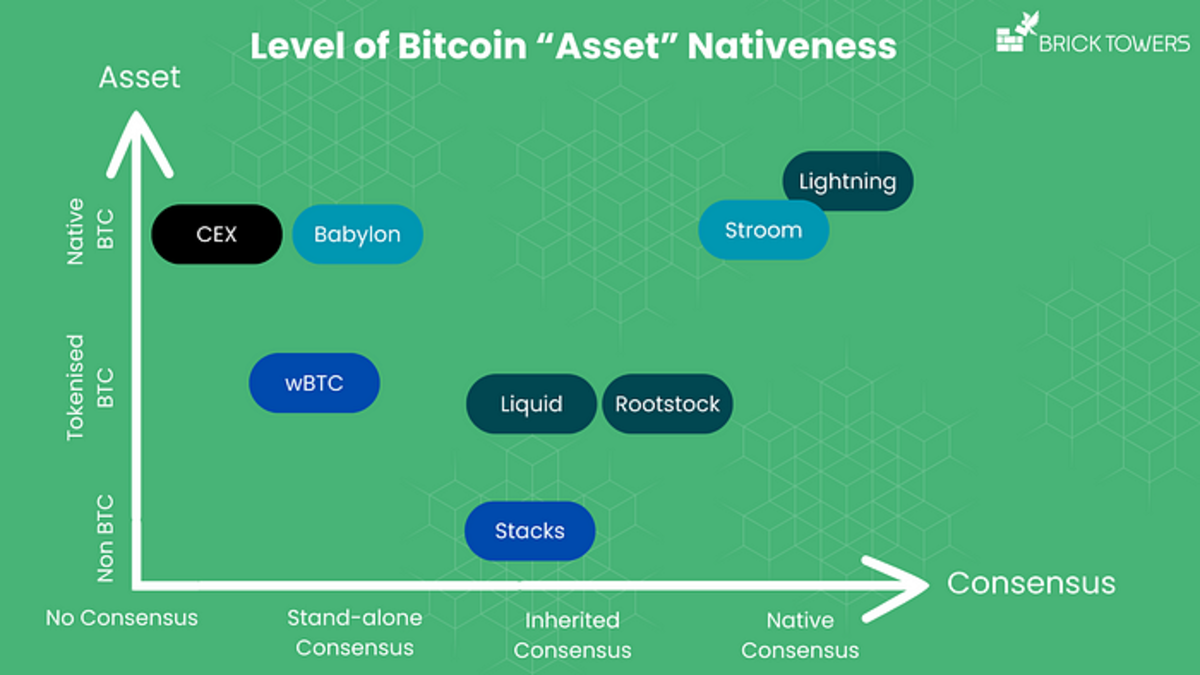

The Consensus Angle in Bitcoin Yield Products

Bitcoin yield products can be categorized based on their alignment with Bitcoin's consensus mechanism, ranging from no consensus to native consensus. The closer a product is to Bitcoin's native consensus, the more aligned it is with Bitcoin's principles.

The Asset and Yield Angles in Bitcoin Yield Products

Bitcoin yield products can also be classified based on the assets used and the type of yields generated, including non-BTC, tokenized BTC, and native BTC options. Native BTC assets and yields offer the highest level of alignment with Bitcoin's ethos.

Striving for the Gold Standard in Bitcoin-Based Yield Products

The ideal Bitcoin-based yield product would combine native Bitcoin consensus, asset, and yield, offering near-perfect alignment with Bitcoin's principles. Projects like Brick Towers are working towards this goal by leveraging Bitcoin's ecosystem to provide customers with a secure and seamless way to earn yield on their Bitcoin holdings.

Frequently Asked Questions

What is the best precious metal to invest in?

This depends on what risk you are willing take and what kind of return you desire. Gold is a traditional haven investment. However, it is not always the most profitable. You might not want to invest in gold if you're looking for quick returns. Silver is a better investment if you have patience and the time to do it.

If you don't care about getting rich quickly, gold is probably the way to go. However, silver might be a better option if you're looking for an investment that provides steady returns over long periods.

How much money should my Roth IRA be funded?

Roth IRAs can be used to save taxes on your retirement funds. You can't withdraw money from these accounts before you reach the age of 59 1/2. However, if your goal is to withdraw funds before that time, there are certain rules you must observe. First, your principal (the original deposit amount) cannot be touched. This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. If you take out more than the initial contribution, you must pay tax.

The second rule states that income taxes must be paid before you can withdraw earnings. So, when you withdraw, you'll pay taxes on those earnings. Let's assume that you contribute $5,000 each year to your Roth IRA. Let's also assume that you make $10,000 per year from your Roth IRA contributions. This would mean that you would have to pay $3,500 in federal income tax. So you would only have $6,500 left. This is the maximum amount you can withdraw because you are limited to what you initially contributed.

The $4,000 you take out of your earnings would be subject to taxes. You'd still owe $1,500 in taxes. Additionally, half of your earnings would be lost because they will be taxed at 50% (half the 40%). So, even though you ended up with $7,000 in your Roth IRA, you only got back $4,000.

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow for pre-tax deductions from your taxable earnings. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. There is no limit on how much you can withdraw from a traditional IRA.

Roth IRAs won't let you deduct your contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. There is no minimum withdrawal limit, unlike traditional IRAs. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

What is a gold IRA account?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can purchase physical gold bullion coins anytime. You don’t have to wait to begin investing in gold.

You can keep gold in an IRA forever. You won't have to pay taxes on your gold investments when you die.

Your heirs will inherit your gold, and not pay capital gains taxes. It is not required that you include your gold in the final estate report because it remains outside your estate.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. Once you've completed this step, an IRA administrator will be appointed to your account. This company acts as a mediator between you, the IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual returns.

Once your gold IRA is established, you can purchase gold bullion coins. The minimum deposit is $1,000. The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

You will pay taxes when you withdraw your gold from your IRA. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

Even if your contribution is small, you might not have to pay any taxes. There are exceptions. If you take out 30% of your total IRA assets or more, you will owe federal income taxes and a 20 percent penalty.

You should avoid taking out more than 50% of your total IRA assets yearly. You'll be facing severe financial consequences if you do.

Can I have physical gold in my IRA

Not just paper money or coins, gold is money. It is an asset that people have used over thousands of years as money, and a way to protect wealth from inflation and economic uncertainties. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. It's not guaranteed that you'll make any money investing gold, but there are several reasons it might be worthwhile to add gold to retirement funds.

Another reason is that gold has historically outperformed other assets in financial panic periods. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. During these turbulent market times, gold was among few assets that outperformed the stocks.

Gold is one of the few assets that has virtually no counterparty risks. You still have your shares even if your stock portfolio falls. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Gold provides liquidity. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. You can buy gold in small amounts because it is so liquid. This allows for you to benefit from the short-term fluctuations of the gold market.

How do I open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. Open the account by filling out Form 8606. For you to determine the type and eligibility for which IRA, you need Form 5204. This form should not be completed more than 60 days after the account is opened. After this, you are ready to start investing. You can also choose to pay your salary directly by making a payroll deduction.

To get a Roth IRA, complete Form 8903. Otherwise, it will be the same process as an ordinary IRA.

To qualify for a precious-metals IRA, you'll need to meet some requirements. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. Contributions must be made on a regular basis. These rules apply whether you're contributing through an employer or directly from your paychecks.

You can use a precious metals IRA to invest in gold, silver, palladium, platinum, rhodium, or even platinum. However, you won't be able purchase physical bullion. This means you won't be allowed to trade shares of stock or bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. Some IRA providers offer this option.

There are two main drawbacks to investing through an IRA in precious metallics. First, they don't have the same liquidity as stocks or bonds. It is therefore harder to sell them when required. They also don't pay dividends, like stocks and bonds. Therefore, you will lose money over time and not gain it.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

cftc.gov

finance.yahoo.com

How To

How to Hold Physical Gold in an IRA

The best way to invest in Gold is by purchasing shares of companies that produce it. But, this approach comes with risks. These companies may not survive the next few years. Even if they survive, there's always the risk that they will lose money due fluctuations in gold prices.

An alternative option would be to buy physical gold itself. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. These options offer the convenience of easy access, as you don't need stock exchanges to do so. You can also make purchases at lower prices. It is easier to view how much gold has been stored. The receipt will show exactly what you paid. You'll also know if taxes were not paid. You also have a lower chance of theft than stocks.

However, there are disadvantages. You won't get the bank's interest rates or investment money. You won't have the ability to diversify your holdings; you will be stuck with what you purchased. Finally, tax man may want to ask where you put your gold.

Visit BullionVault.com to find out more about gold buying in an IRA.

—————————————————————————————————————————————————————————————–

By: Pascal Hügli

Title: Exploring Bitcoin as a Productive Asset: A Deep Dive

Sourced From: bitcoinmagazine.com/markets/can-bitcoin-be-a-productive-asset-

Published Date: Thu, 13 Jun 2024 15:30:21 GMT