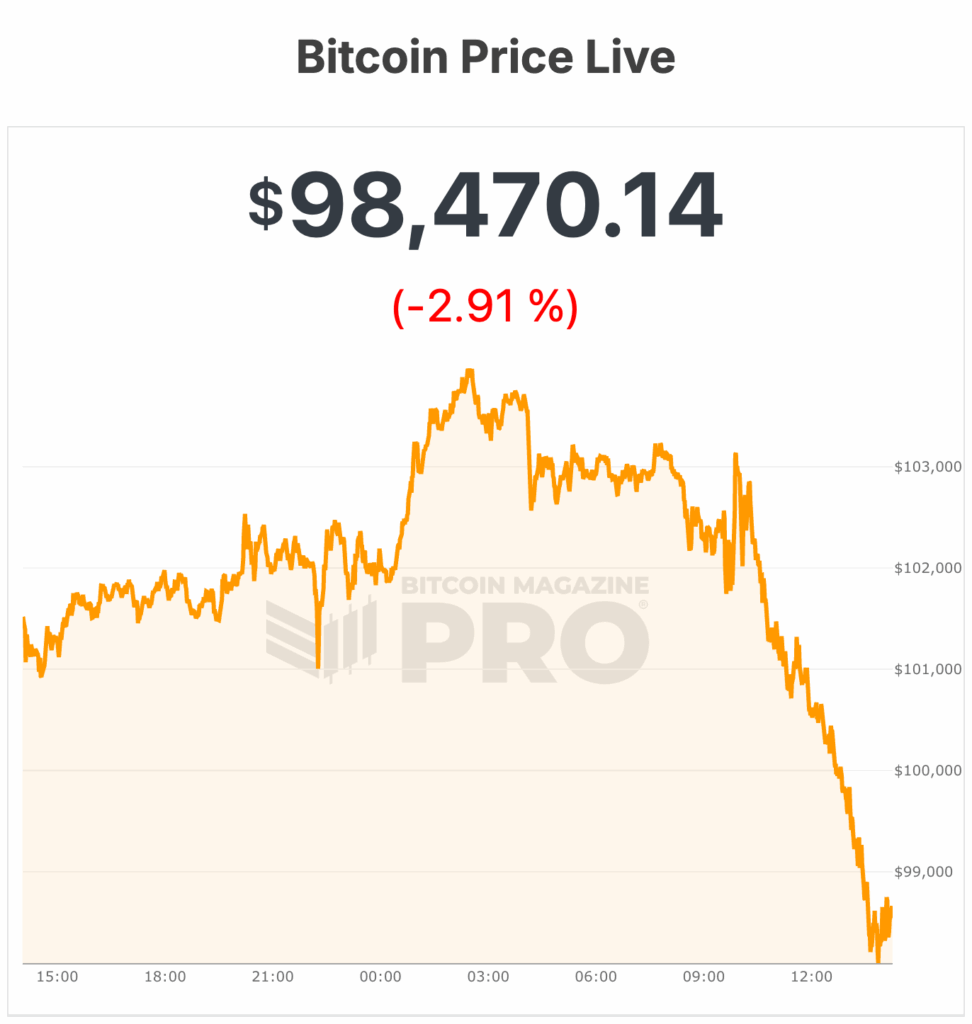

Hey there, crypto enthusiasts! Today, we're diving into the recent rollercoaster ride that is Bitcoin's price movement. Buckle up as we explore how this digital darling plummeted below $98,000, nearing a six-month low.

Bitcoin's Price Rollercoaster: A Closer Look

Market Woes and Investor Behavior

Picture this: Bitcoin's price took a nosedive from $104,000 to $98,113 in a flash, erasing gains and setting a gloomy tone. The downward spiral kicked off in the morning, dragging the price to unsettling lows of $97,870. Ouch!

Holders Unload as Prices Dip

Ever wondered why prices sink? Well, long-term holders are offloading their assets at record rates, causing a stir. Data reveals a whopping 815,000 BTC sold in 30 days, signaling profit-taking frenzy with billions in realized gains. Talk about a wild ride!

The Future Forecast: Brace for Impact

Expert Insights and Projections

Analysts foresee stormy weather ahead, with institutional buying dropping below mining supply, adding pressure. Keeping an eye on the $102,000 mark is crucial, as breaching it might trigger further losses, as per Bitcoin Magazine Pro's in-depth analysis.

Market Resilience and Potential Rebound

Despite the storm clouds, there's a glimmer of hope. Industry experts predict a short relief rally but stress that sustained recovery hinges on fresh demand. Hold tight, folks; we might just weather this storm together!

Bitcoin's Dance with Nasdaq: A Bumpy Ride

The Unusual Correlation

Bitcoin's tango with Nasdaq is turning heads, with a twist. It seems to sway more dramatically with stock market plunges than surges, hinting at investor fatigue rather than excitement. The plot thickens as the crypto saga unfolds!

Ready to ride the crypto wave? Stay tuned for more updates on Bitcoin's bumpy journey. Remember, in the volatile realm of cryptocurrencies, expect the unexpected!

Frequently Asked Questions

What is a Precious Metal IRA, and how can you get one?

A precious metal IRA allows you to diversify your retirement savings into gold, silver, platinum, palladium, rhodium, iridium, osmium, and other rare metals. These rare metals are often called “precious” as they are very difficult to find and highly valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Precious metals are often referred to as “bullion.” Bullion refers actually to the metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. This allows you to receive dividends every year.

Precious metal IRAs are not like regular IRAs. They don't need paperwork and don't have to be renewed annually. Instead, your gains are subject to a small tax. Plus, you can access your funds whenever you like.

How does a gold IRA work?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase gold bullion coins in physical form at any moment. To invest in gold, you don't need to wait for retirement.

Owning gold as an IRA has the advantage of allowing you to keep it forever. When you die, your gold assets won't be subjected to taxes.

Your heirs will inherit your gold, and not pay capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

First, an individual retirement account will be set up to allow you to open a golden IRA. Once you've done so, you'll be given an IRA custodian. This company acts as a mediator between you, the IRS.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. The minimum deposit is $1,000. You'll get a higher rate of interest if you deposit more.

Taxes will apply to gold that you take out of an IRA. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

Even if your contribution is small, you might not have to pay any taxes. There are exceptions. However, there are exceptions. If you take 30% or more of your total IRA asset, you'll owe federal Income Taxes plus a 20% penalty.

It is best to not take out more than 50% annually of your total IRA assets. You could end up with severe financial consequences.

What are the benefits of a Gold IRA?

The best way to save money for retirement is to place it in an Individual Retirement Account. It's tax-deferred until you withdraw it. You are in complete control of how much you take out each fiscal year. There are many types to choose from when it comes to IRAs. Some are better suited for college students. Some are for investors who seek higher returns. Roth IRAs permit individuals to contribute after the age 59 1/2. Any earnings earned at retirement are subject to tax. Once they start withdrawing money, however, the earnings aren’t subject to tax again. This account is a good option if you plan to retire early.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

Another benefit to owning IRA gold is the ability to withdraw automatically. That means you won't have to think about making deposits every month. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, gold is one the most secure investment options available. It is not tied to any country so its value tends stay steady. Even during economic turmoil the gold price tends to remain fairly stable. This makes it a great investment option to protect your savings from inflation.

Is gold a good investment IRA option?

If you are looking for a way to save money, gold is a great investment. It is also an excellent way to diversify you portfolio. There is much more to gold than meets your eye.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is often called “the most ancient currency in the universe.”

But gold, unlike paper currency, which is created by governments, is mined out from the ground. It is very valuable, as it is rare and hard to create.

The supply and demand for gold determine the price of gold. If the economy is strong, people will spend more money which means less people can mine gold. The result is that gold's value increases.

On the flip side, people save cash for emergencies and don't spend it. This causes more gold to be produced, which lowers its value.

This is why it makes sense to invest in gold for individuals and companies. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

Additionally, you'll earn interest on your investments which will help you grow your wealth. In addition, you won’t lose any money if gold falls in value.

What is the value of a gold IRA

A gold IRA has many benefits. It is an investment vehicle that can diversify your portfolio. You decide how much money you want to put into each account, and when you want it to be withdrawn.

You can also rollover funds from other retirement accounts to a gold IRA. This will allow you to transition easily if it is your decision to retire early.

The best thing is that investing in gold IRAs doesn't require any special skills. These IRAs are available at all banks and brokerage houses. Withdrawals are made automatically without having to worry about fees or penalties.

There are, however, some drawbacks. The volatility of gold has been a hallmark of its history. It's important to understand the reasons you're considering investing in gold. Is it for growth or safety? Are you looking for growth or insurance? Only then will you be able make informed decisions.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. A single ounce will not be sufficient to meet all your requirements. Depending on your plans for using your gold, you may need multiple ounces.

You don't need to have a lot of gold if you are selling it. You can even get by with less than one ounce. These funds won't allow you to purchase anything else.

Are You Ready to Invest in Gold?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. You can invest in both options if you aren't sure which option is best for you.

Gold is a safe investment and can also offer potential returns. This makes it a worthwhile choice for retirees.

Although most investments promise a fixed rate of return, gold is more volatile than others. As a result, its value changes over time.

However, this does not mean that gold should be avoided. You should just factor the fluctuations into any overall portfolio.

Another benefit to gold? It's a tangible asset. Gold is less difficult to store than stocks or bonds. It is also easily portable.

You can always access your gold as long as it is kept safe. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

A portion of your savings can be invested in something that doesn't go down in value. Gold usually rises when the stock market falls.

Another advantage to investing in gold is the ability to sell it whenever you wish. Like stocks, you can sell your position anytime you need cash. You don't even have to wait until you retire.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

Also, don't buy too much at once. Start by purchasing a few ounces. You can add more as you need.

Remember, the goal here isn't to get rich quickly. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- How do you keep your IRA Gold at Home? It's not legal – WSJ

finance.yahoo.com

bbb.org

investopedia.com

How To

A rising trend in gold IRAs

As investors look for ways to diversify their portfolios and protect themselves against inflation, the gold IRA trend is on the rise.

The gold IRA allows investors to purchase physical gold bars and bullion. It can be used for tax-free growth and provides an alternative investment option for those concerned about stocks and bonds.

Investors can have confidence in their investments and avoid market volatility with a gold IRA. Investors can use the gold IRA for protection against inflation and potential problems.

Investors also benefit from physical gold's unique properties, such as durability and portability.

The gold IRA also offers many other benefits, such as the ability to quickly transfer the ownership of the gold to heirs, and the fact the IRS doesn't consider gold a currency.

All this means that the gold IRA is becoming increasingly popular among investors seeking a haven during financial uncertainty.

—————————————————————————————————————————————————————————————–

By: Micah Zimmerman

Title: Expert Analysis: Bitcoin's Dive Below $98,000 Signals Market Turbulence

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-crashes-to-98000

Published Date: Thu, 13 Nov 2025 20:32:13 +0000