The Bitcoin MVRV Z-Score has a strong track record of accurately identifying market cycle tops and bottoms in the world of Bitcoin. Today, we are thrilled to introduce an enhanced version of this metric that brings even more value and insights to the ever-changing market landscape.

Understanding the Bitcoin MVRV Z-Score

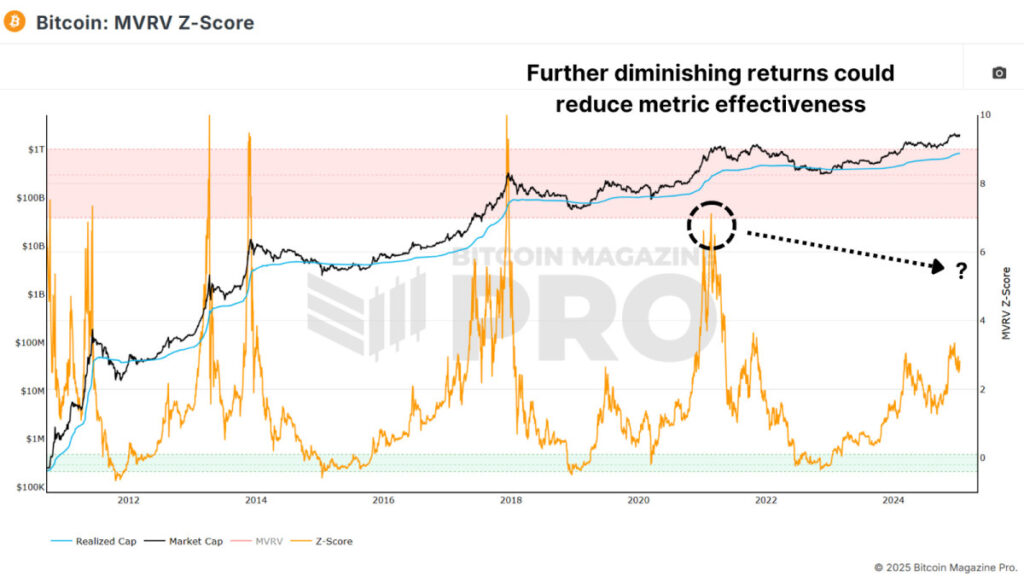

The MVRV Z-Score is a metric that delves into the relationship between Bitcoin's realized cap (which reflects the average acquisition cost of all circulating Bitcoin) and its market cap (the current valuation of the network). By normalizing this ratio with Bitcoin's price volatility (measured as the standard deviation), the Z-Score sheds light on periods of overvaluation or undervaluation compared to historical patterns.

Instances where the Z-Score peaks in the red zone indicate overvaluation, signaling potential profit-taking opportunities. On the other hand, bottoms in the green zone suggest undervaluation, often pointing towards strong accumulation chances. Over time, this metric has proven to be highly reliable in pinpointing major market cycle extremities.

The Evolution of the MVRV Z-Score

While the traditional MVRV Z-Score has been a robust tool, it does have its limitations. In previous cycles, the Z-Score surged to levels of 9–10 during market peaks. However, in the last cycle, it only reached around 7. This deviation could be attributed to the more rounded nature of the recent double-peak cycle, rather than the sharp blow-off top typically observed. Consequently, there is a need to incorporate the changing dynamics of the market, including the increasing participation of institutions and evolving investor behaviors.

To address these challenges, a new and enhanced version of the MVRV Z-Score has been introduced – the MVRV Z-Score 2YR Rolling. Unlike its predecessor that considered Bitcoin's entire price history, this updated version calculates volatility based on the preceding two years of data.

Enhanced Accuracy and Adaptability

This refined approach better aligns with Bitcoin's current market cap and dynamics, ensuring that the metric remains relevant and accurate amidst modern market conditions. While still adept at identifying market cycle extremes, this version adapts more effectively to the contemporary environment. In the previous cycle, the enhanced Z-Score achieved a higher peak value, closely mirroring the price action of 2017. Moreover, it continues to pinpoint strong accumulation zones with precision.

Another valuable method involves examining the raw MVRV ratio without adjusting for volatility. Comparing previous cycles, the MVRV ratio peaked at 3.96 in one cycle and 4.72 in another, indicating potentially less deviation and a more stable basis for projecting future price targets.

Projection and Adaptation

With a realized price projection of $60,000 and an MVRV ratio of 3.96, a potential peak price estimation could reach around $240,000. Even if diminishing returns lower the ratio to 3.0, the peak price projection might still reach $180,000.

Final Thoughts

While the MVRV Z-Score remains a powerful tool for timing market cycles, it is crucial to acknowledge that it may not hit the same highs observed in previous cycles. By refining this metric to accommodate the evolving dynamics of the Bitcoin market, we can better navigate reduced volatility as Bitcoin continues to evolve.

For a deeper dive into this subject, consider watching a recent YouTube video titled "Improving The Bitcoin MVRV Z-Score." For more comprehensive Bitcoin analysis and access to advanced features like live charts, customized indicator alerts, and detailed industry reports, explore Bitcoin Magazine Pro.

Disclaimer: This article serves informational purposes only and should not be construed as financial advice. Conduct your own research before making any investment decisions.

Frequently Asked Questions

How much should I contribute to my Roth IRA account?

Roth IRAs can be used to save taxes on your retirement funds. You can't withdraw money from these accounts before you reach the age of 59 1/2. There are some rules that you need to keep in mind if you want to withdraw funds from these accounts before you reach 59 1/2. First, your principal (the original deposit amount) cannot be touched. This means that you can't take out more money than you originally contributed. If you take out more than the initial contribution, you must pay tax.

The second rule is that you cannot withdraw your earnings without paying income taxes. When you withdraw, you will have to pay income tax. For example, let's say that you contribute $5,000 to your Roth IRA every year. Let's further assume you earn $10,000 annually after contributing. You would owe $3,500 in federal income taxes on the earnings. You would have $6,500 less. The amount you can withdraw is limited to the original contribution.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). You only got back $4,000. Even though you were able to withdraw $7,000 from your Roth IRA,

There are two types: Roth IRAs that are traditional and Roth. A traditional IRA allows you to deduct pre-tax contributions from your taxable income. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. There is no limit on how much you can withdraw from a traditional IRA.

A Roth IRA doesn't allow you to deduct your contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. There is no minimum withdrawal amount, unlike traditional IRAs. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

Is the government allowed to take your gold

You own your gold and therefore the government cannot seize it. You worked hard to earn it. It belongs exclusively to you. But, this rule is not universal. You could lose your gold if convicted of fraud against a federal government agency. Also, if you owe taxes to the IRS, you can lose your precious metals. You can keep your gold even if your taxes are not paid.

Can I keep a Gold ETF in a Roth IRA

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

Traditional IRAs allow for contributions from both employees and employers. A Employee Stock Ownership Plan, or ESOP, is another way to invest publicly traded companies.

An ESOP gives employees tax advantages as they share the stock of the company and the profits it makes. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

A Individual Retirement Annuity (IRA), is also available. An IRA lets you make regular, income-generating payments to yourself over your life. Contributions to IRAs will not be taxed

How Does Gold Perform as an Investment?

The supply and the demand for gold determine how much gold is worth. It is also affected by interest rates.

Gold prices are volatile due to their limited supply. You must also store physical gold somewhere to avoid the risk of it becoming stale.

How to Open a Precious Metal IRA?

The first step is to decide if you want an Individual Retirement Account (IRA). Open the account by filling out Form 8606. To determine which type of IRA you qualify for, you will need to fill out Form 5204. This form should be completed within 60 days after opening the account. Once this has been completed, you can begin investing. You can also choose to pay your salary directly by making a payroll deduction.

Complete Form 8903 if your Roth IRA option is chosen. Otherwise, it will be the same process as an ordinary IRA.

You'll need to meet specific requirements to qualify for a precious metals IRA. The IRS stipulates that you must have earned income and be at least 18-years old. You can't earn more than $110,000 per annum ($220,000 in married filing jointly) for any given tax year. Contributions must be made regularly. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. But, you'll only be able to purchase physical bullion. This means you can't trade shares of stock and bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. This option may be offered by some IRA providers.

An IRA is a great way to invest in precious metals. However, there are two important drawbacks. First, they aren't as liquid than stocks and bonds. This makes them harder to sell when needed. They don't yield dividends like bonds and stocks. You'll lose your money over time, rather than making it.

What Is a Precious Metal IRA?

A precious metal IRA allows for you to diversify your retirement savings in gold, silver, palladium and iridium. These are “precious metals” because they are hard to find, and therefore very valuable. These are excellent investments that will protect your wealth from inflation and economic instability.

Precious metals often refer to themselves as “bullion.” Bullion refers to the actual physical metal itself.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

A precious metal IRA allows you to invest directly in bullion, rather than buying stock shares. This will ensure that you receive annual dividends.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. Instead, you only pay a small percentage on your gains. Additionally, you have access to your funds at no cost whenever you need them.

What are the benefits of having a gold IRA?

It is best to put your retirement money in an Individual Retirement Account (IRA). It will be tax-deferred up until the time you withdraw it. You can decide how much money you withdraw each year. There are many types of IRAs. Some are better suited for college students. Others are made for investors seeking higher returns. Roth IRAs, for example, allow people to contribute after they turn 59 1/2. They also pay taxes on any earnings when they retire. These earnings don't get taxed if they withdraw funds. This type of account might be a good choice if your goal is to retire early.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA you don't need to worry about taxes while you wait for your gains to be available. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. This means that you don't need to worry about making monthly deposits. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, gold remains one of the best investment options today. Because it's not tied to any particular country, its value tends to remain steady. Even in times of economic turmoil, gold prices tend not to fluctuate. Gold is a good option for protecting your savings from inflation.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

finance.yahoo.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

cftc.gov

How To

Tips for Investing In Gold

Investing in Gold is one of the most popular investment strategies worldwide. There are many benefits to investing in gold. There are many options for investing in gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before you purchase any type or gold, here are some things to think about.

- First, verify that your country permits gold ownership. If your country allows you to own gold, then you are allowed to proceed. You can also look at buying gold abroad.

- You should also know the type of gold coin that you desire. There are many options for gold coins: yellow, white, and rose.

- Thirdly, it is important to take into account the gold price. It is best to start small and work your way up. It is important to diversify your portfolio whenever you purchase gold. Diversifying your portfolio should be a priority, including stocks, bonds and real estate.

- You should also remember that gold prices can change often. It is important to stay up-to-date with the latest trends.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Enhancing Bitcoin Price Predictions with the Updated MVRV Z-Score

Sourced From: bitcoinmagazine.com/markets/how-the-updated-mvrv-z-score-improves-bitcoin-price-predictions

Published Date: Fri, 17 Jan 2025 14:34:04 GMT