The Moscow Exchange, Russia's premier exchange platform, has revealed its intent to mint real estate digital assets by 2024. Sergei Kharinov, the platform's digital assets director, suggests that this move will facilitate both qualified and unqualified investors in diversifying their portfolios with real estate assets.

Integration of Blockchain Technology in Real Estate

As per recent news, the Moscow Exchange has set its sights on issuing blockchain-anchored digital assets for housing and real estate in 2024. This move comes following a similar proposal from the exchange in August 2022. The exchange is currently engaged in discussions with housing and development corporations to inaugurate this operation in the coming year, as per Kharinov's statements.

Benefits of Real Estate Digital Assets

The introduction of these instruments is expected to reduce investment barriers, allowing both qualified and unqualified investors to invest in construction and real estate ventures. Real estate developers and builders will also reap benefits from these digital assets, with a unique opportunity to raise capital directly from investors. This represents an innovative alternative to the conventional financing methods offered by banks.

Kharinov further hinted that these instruments might take the form of monetary claims against the issuer, who possesses square meters.

Partnerships and Future Prospects

Izvestia has reached out to Samolet Plus, a real estate development firm that intends to introduce digital investments in collaboration with the Moscow Exchange. Denis Kondrakhin, the General Director, emphasized the potential of this product to attract a wide spectrum of investors to real estate investments.

Notably, the Moscow Exchange is not the only institution in Russia to experiment with issuing blockchain-based housing and real estate digital assets. Three such issuances have previously occurred, with Samolet Plus being a participant in two of them.

Regulation and Profitability of Digital Assets

The third issuance was carried out by the G Group, which enabled unqualified investors to earn a profit of 10% above their investment cost. This profit also included a bonus from the square meter area expansion of the construction, as per Pavel Sidorkin, the Director of Products at Atomize Russia, the platform that facilitated these digital asset issuances.

These digital assets are already regulated and can only be issued by ten financial institutions that have received prior approval from the Bank of Russia. These include the Sberbank of Russia, Alfa Bank, Atomize, Lighthouse, St. Petersburg Exchange, and Blockchain Hub.

What is your opinion on the Moscow Exchange's proposal to issue housing or real estate digital assets in Russia? Share your thoughts in the comments section below.

Frequently Asked Questions

Is gold buying a good retirement option?

While buying gold as an investment may seem unattractive at first glance it becomes worth the effort when you consider how much gold is consumed worldwide each year.

The best form of investing is physical bullion, which is the most widely used. But there are many other options for investing in gold. It is best to research all options and make informed decisions based on your goals.

For example, purchasing shares of companies that extract gold or mining equipment might be a better option if you aren't looking for a safe place to store your wealth. If you need cash flow from an investment, purchasing gold stocks is a good choice.

ETFs allow you to invest in exchange-traded funds. These funds give you exposure, but not actual gold, by investing in gold-related securities. These ETFs can include stocks of precious metals refiners and gold miners.

How is gold taxed within a Roth IRA

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

You don't pay tax if you have the money in a traditional IRA/401k. You pay taxes only on earnings from dividends and capital gains — which apply only to investments held longer than one year.

The rules governing these accounts vary by state. In Maryland, for example, withdrawals must be made within 60 days of reaching the age of 59 1/2 in order to qualify. Massachusetts allows you to wait until April 1. New York is open until 70 1/2. To avoid penalties, plan ahead so you can take distributions at the right time.

What is the tax on gold in an IRA

The tax on the sale of gold is based on its fair market value when sold. Gold is not subject to tax when it's purchased. It isn't considered income. If you sell it after the purchase, you will get a tax-deductible gain if you increase the price.

Loans can be secured with gold. Lenders seek to get the best return when you borrow against your assets. In the case of gold, this usually means selling it. There's no guarantee that the lender will do this. They might keep it. Or, they may decide to resell the item themselves. In either case, you risk losing potential profits.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. It's better to keep it alone.

Should You Invest in gold for Retirement?

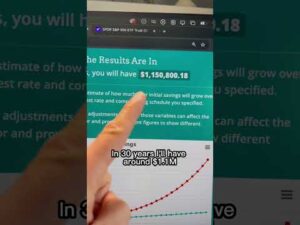

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. You can invest in both options if you aren't sure which option is best for you.

Gold offers potential returns and is therefore a safe investment. Retirement investors will find gold a worthy investment.

While many investments promise fixed returns, gold is subject to fluctuations. Because of this, gold's value can fluctuate over time.

This doesn't mean that you should not invest in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another benefit of gold is that it's a tangible asset. Gold is much easier to store than bonds and stocks. It is also easily portable.

You can always access gold as long your place it safe. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold usually rises when the stock market falls.

You can also sell gold anytime you like by investing in it. You can also liquidate your gold position at any time you need cash, just like stocks. You don’t even need to wait until retirement to liquidate your position.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

You shouldn't buy too little at once. Start by purchasing a few ounces. Next, add more as required.

Don't expect to be rich overnight. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

Although gold might not be the right investment for everyone it could make a great addition in any retirement plan.

What precious metal is best for investing?

This question depends on how risky you are willing to take, and what return you want. While gold is considered a safe investment option, it can also be a risky choice. Gold may not be right for you if you want quick profits. You should invest in silver if you have the patience and time.

If you don’t desire to become rich quickly, gold may be your best option. Silver may be a better option for investors who want long-term steady returns.

What are the benefits of a Gold IRA?

The best way to invest money for retirement is by putting it into an Individual Retirement Account (IRA). It will be tax-deferred up until the time you withdraw it. You are in complete control of how much you take out each fiscal year. There are many types available. Some are better suited for college students. Some are for investors who seek higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. The earnings earned after they withdraw the funds aren't subject to any tax. This account is a good option if you plan to retire early.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA you don't need to worry about taxes while you wait for your gains to be available. This makes gold IRA accounts excellent options for people who prefer to keep their money invested instead of spending it.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. You won't have the hassle of making deposits each month. To avoid missing a payment, direct debits can be set up.

Gold is one of today's most safest investments. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even in times of economic turmoil, gold prices tend not to fluctuate. It is therefore a great choice for protecting your savings against inflation.

Do you need to open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. There are no ways to recover the money you lost in an investment. This includes any loss of investments from theft, fire, flood or other circumstances.

Investing in physical gold and silver coins is the best way to protect yourself from this type of loss. These items have been around thousands of years and are irreplaceable. If you were to sell them today, you would likely receive more than what you paid for them when they were first minted.

When opening an IRA account, make sure you choose a reputable company offering competitive rates and high-quality products. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

Do not open an account unless you're ready to retire. Don't forget the future!

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

cftc.gov

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

irs.gov

How To

The best place to buy silver or gold online

First, understand the basics of gold. Gold is a precious metal similar to platinum. Because of its resistance to corrosion and durability, it is very rare. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

There are two types today of gold coins. One is legal tender while the other is bullion. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coins should only be used for investment purposes. Inflation can cause their value to increase.

They aren't circulated in any currency exchange systems. If a person purchases $100 worth of gold, 100 grams of the gold will be given to him/her. The $100 value is $100. Each dollar spent earns the buyer 1 gram gold.

When looking to buy precious metals, the next thing you should be aware of is where it can be purchased. You have a few options to choose from if you are looking to buy gold directly through a dealer. First, your local currency shop is a good place to start. You can also go to a reputable website such as eBay. You can also purchase gold through private online sellers.

Private sellers are individuals who offer gold for sale, either at wholesale prices or retail prices. You pay a commission fee between 10% and 15% for each transaction when you sell gold through private sellers. This means that you will get less back from a private seller than if you sell it through a coin shop or on eBay. This is a great option for gold investing because you have more control over the item’s price.

Another option for buying gold is to invest in physical gold. Physical gold is much easier to store than paper certificates, but you still have to worry about storing it safely. Physical gold must be kept safe in an impassible container, such as a vault.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank can give you a loan up to the amount you intend to invest in Gold. These are small businesses that let customers borrow money against the items they bring to them. Banks usually charge higher interest rates that pawn shops.

Finally, another way to buy gold is to simply ask someone else to do it! Selling gold can also be done easily. It is easy to sell gold by contacting a company like GoldMoney.com. You can create a simple account immediately and begin receiving payments.

—————————————————————————————————————————————————————————————–

By: Sergio Goschenko

Title: Emerging Real Estate Digital Assets from Moscow Exchange: A 2024 Perspective

Sourced From: news.bitcoin.com/moscow-exchange-plans-to-issue-real-estate-digital-assets-by-2024/

Published Date: Sat, 14 Oct 2023 06:30:39 +0000

Did you miss our previous article…

https://altcoinirareview.com/shiba-inu-and-solana-witness-bullish-movement-over-the-weekend/