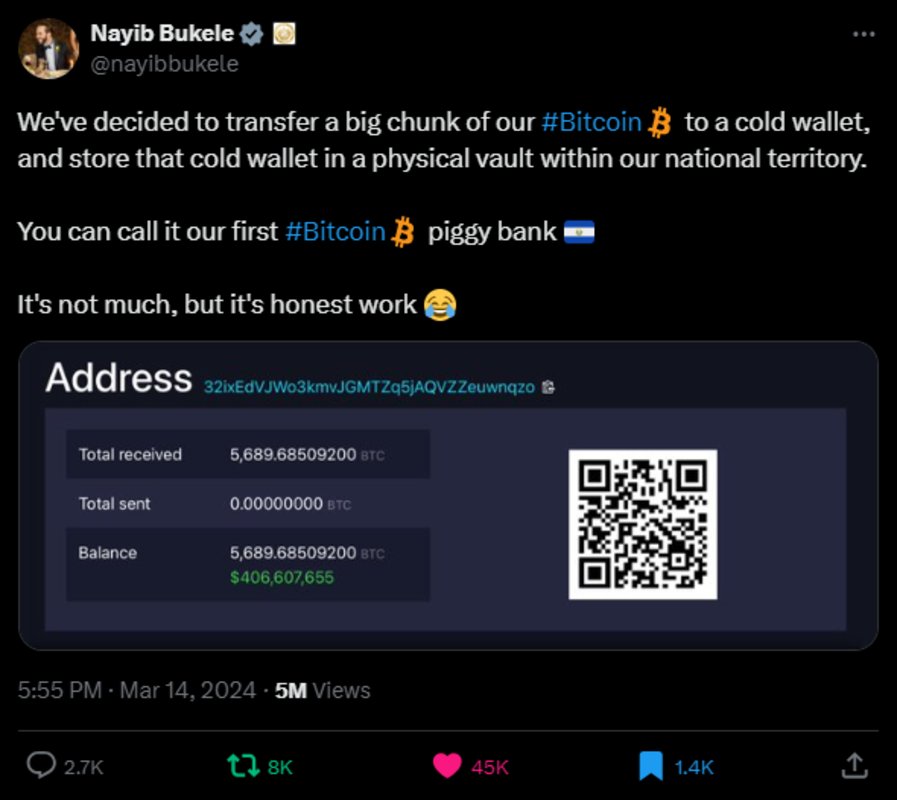

On March 14, 2024, El Salvador's president-elect, Nayib Bukele, made a significant announcement that reverberated throughout the Bitcoin community. El Salvador officially moved a substantial portion of its Bitcoin holdings into cold storage, securely housed within a vault located within its national borders. This strategic decision marks a pivotal moment in El Salvador's Bitcoin journey following the implementation of the Bitcoin Law, which has garnered both praise and skepticism on a global scale.

Commitment Amidst Critiques

Despite facing a barrage of criticisms, including allegations of human rights violations and concerns over outdated infrastructure, El Salvador has remained steadfast in its commitment. The country has weathered disapproval from traditional financial institutions and even staunch Bitcoin supporters on platforms like Twitter Spaces. The veil of uncertainty surrounding the size of El Salvador's Bitcoin reserves, a subject of much debate and scrutiny, has now been lifted, ushering in a new era of transparency and confidence in the nation's dedication to nurturing a thriving Bitcoin-friendly environment.

Embracing Transparency

With this groundbreaking move, Salvadorans and Bitcoin enthusiasts worldwide now have the ability to monitor El Salvador's Bitcoin reserves and track all incoming and outgoing transactions. This bold step, taken voluntarily and not by mandate, showcases El Salvador's commitment to earning the trust of its citizens and aligning with the ethos of transparency embraced by the global Bitcoin community. Following the announcement of El Salvador's Bitcoin address, donations began pouring in, with nearly 6 Million Sats in transactions recorded to date. Additionally, individuals can now monitor El Salvador's daily 1 bitcoin DCA purchases, underscoring the country's proactive approach to financial governance.

Strategic Shift for Financial Autonomy

By securing 5,689 Bitcoins valued at $385,111,456 USD within its borders, El Salvador has not only safeguarded its digital wealth but also navigated the complexities of international politics with finesse. The decision to move its Bitcoin holdings from an American custodian to a sovereign vault was not merely a PR move but a strategic necessity. Given the strained relations between the US government and El Salvador over the Bitcoin Law, the risk of entanglement in sanctions prompted this decisive action, preserving the country's financial independence and demonstrating a keen understanding of regulatory challenges.

Balancing Opacity and Transparency

While the disclosure of reserves has garnered widespread approval, El Salvador's initial reluctance to reveal its complete holdings may have been rooted in strategic considerations. President Bukele's assertion that only a "big chunk" of the total reserves has been transferred to cold storage reflects a nuanced approach to financial management in a rapidly evolving landscape. In the realm of nation-states embracing the Bitcoin Standard, maintaining a degree of opacity can be a prudent strategy, allowing El Salvador to strategically unveil its wealth at opportune moments.

Fostering Innovation and Investment

El Salvador's disclosure of its Bitcoin reserves not only promotes transparency but also highlights the nation's innovative strategies for wealth accumulation. Beyond traditional acquisitions, initiatives like the innovative visa program, profits from Bitcoin-to-dollar exchanges, government service revenues, and mining activities have all contributed to a robust Bitcoin treasury. This multifaceted approach dispels misconceptions and underscores El Salvador's commitment to leveraging diverse avenues for financial growth.

Building a Prosperous Future

While critics may persist, El Salvador's focus remains on creating a conducive environment for Bitcoin entrepreneurs and fostering economic prosperity for its citizens. By establishing a transparent digital Fort Knox, the country aims to instill trust and incentivize local investment, steering away from reliance on external promises. Through strategic moves and a vision for economic empowerment, El Salvador is laying the groundwork for a prosperous future where opportunities abound for its people.

Frequently Asked Questions

Is gold buying a good retirement option?

While buying gold as an investment may seem unattractive at first glance it becomes worth the effort when you consider how much gold is consumed worldwide each year.

The best form of investing is physical bullion, which is the most widely used. There are many ways to invest your gold. The best thing to do is research all options thoroughly and then make an informed decision based on what you want from your investments.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. If you are looking for cash flow from your investment, buying gold stocks will work well.

ETFs allow you to invest in exchange-traded funds. These funds give you exposure, but not actual gold, by investing in gold-related securities. These ETFs can include stocks of precious metals refiners and gold miners.

What are the pros & con's of a golden IRA?

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. But, this type of investment comes with its own set of disadvantages.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. You might also not be able to withdraw from your IRA until the IRS deems you to be 59 1/2. A penalty fee will be charged if you decide to withdraw funds.

Another disadvantage is that you must pay fees to manage your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

If you prefer to keep your money outside a bank, you'll need to purchase insurance. Many insurers require that you own at least one ounce of gold before you can make a claim. You might be required to buy insurance that covers losses up to $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. You may be limited in the amount of gold you can have by some providers. Some providers allow you to choose your weight.

You will also have to decide whether to purchase futures or physical gold. Futures contracts for gold are less expensive than physical gold. Futures contracts provide flexibility for purchasing gold. They enable you to establish a contract with an expiration date.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does include coverage for damage due to natural disasters. You may consider adding additional coverage if you live in an area at high risk.

Apart from insurance, you should consider the costs of storing your precious metals. Insurance doesn't cover storage costs. In addition, most banks charge around $25-$40 per month for safekeeping.

A qualified custodian is required to help you open a Gold IRA. A custodian is responsible for keeping track of your investments. They also ensure that you adhere to federal regulations. Custodians don't have the right to sell assets. Instead, they must keep your assets for as long you request.

After you have decided on the type of IRA that best suits you, you will need to complete paperwork detailing your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. You should also specify how much you want to invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. The company will then review your application and mail you a letter of confirmation.

When opening a gold IRA, you should consider using a financial planner. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can help you find cheaper insurance options to lower your costs.

How much money should I put into my Roth IRA?

Roth IRAs can be used to save taxes on your retirement funds. You cannot withdraw funds from these accounts until you reach 59 1/2. However, if your goal is to withdraw funds before that time, there are certain rules you must observe. First, you can't touch your principal (the initial amount that was deposited). This means that no matter how much you contribute, you can never take out more than what was initially contributed to this account. If you are able to take out more that what you have initially contributed, you must pay taxes.

The second rule states that income taxes must be paid before you can withdraw earnings. So, when you withdraw, you'll pay taxes on those earnings. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's say you earn $10,000 each year after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. The remaining $6,500 is yours. This is the maximum amount you can withdraw because you are limited to what you initially contributed.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). So even though your Roth IRA ended up having $7,000, you only got $4,000.

Two types of Roth IRAs are available: Roth and traditional. Traditional IRAs allow you to deduct pretax contributions from your taxable income. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. There are no restrictions on the amount you can withdraw from a Traditional IRA.

Roth IRAs do not allow you to deduct your contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. There is no minimum withdrawal requirement, unlike traditional IRAs. It doesn't matter if you are 70 1/2 or older before you withdraw your contribution.

How to Open a Precious Metal IRA

First, you must decide if your Individual Retirement Account (IRA) is what you want. If you do, you must open the account by completing Form 8606. For you to determine the type and eligibility for which IRA, you need Form 5204. This form should be filled within 60 calendar days of opening the account. Once you have completed this form, it is possible to begin investing. You can also contribute directly to your paycheck via payroll deduction.

For a Roth IRA you will need to complete Form 8903. Otherwise, it will be the same process as an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. The IRS requires that you are at least 18 years old and have earned an income. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). Contributions must be made on a regular basis. These rules apply whether you're contributing through an employer or directly from your paychecks.

A precious metals IRA can be used to invest in palladium or platinum, gold, silver, palladium or rhodium. However, you can't purchase physical bullion. This means that you will not be allowed to trade shares or bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. Some IRA providers offer this option.

There are two major drawbacks to investing via an IRA in precious metals. First, they aren't as liquid than stocks and bonds. This makes it harder to sell them when needed. Second, they don’t produce dividends like stocks or bonds. So, you'll lose money over time rather than gain it.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

cftc.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement plans

forbes.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- You want to keep gold in your IRA at home? It's not legal – WSJ

How To

Tips for Investing Gold

One of the most sought-after investment strategies is investing in gold. There are many advantages to investing in Gold. There are several options to invest in the gold. Some people buy physical gold coins, while others prefer investing in gold ETFs (Exchange Traded Funds).

Before you buy any type of gold, there are some things that you should think about.

- First, find out if your country allows gold ownership. If it is, you can move on. You can also look at buying gold abroad.

- The second is to decide which kind of gold coin it is you want. You can go for yellow gold, white gold, rose gold, etc.

- Thirdly, it is important to take into account the gold price. It is better to start small, and then work your way up. Diversifying your portfolio is a key thing to remember when purchasing gold. You should invest in different assets such as stocks, bonds, real estate, mutual funds, and commodities.

- You should also remember that gold prices can change often. Therefore, you have to be aware of current trends.

—————————————————————————————————————————————————————————————–

By: Jaime García

Title: El Salvador's Bold Move: Transferring Bitcoin Reserves to Cold Storage Vault

Sourced From: bitcoinmagazine.com/el-salvador-bitcoin-news/el-salvador-moves-bitcoin-reserves-to-cold-storage-vault

Published Date: Mon, 18 Mar 2024 15:32:02 GMT

Related posts:

Is The President Of El Salvador Acting Like An Authoritarian?

Is The President Of El Salvador Acting Like An Authoritarian?

Bitcoin-Embracing El Salvador President’s Re-Election Declaration Slammed

Bitcoin-Embracing El Salvador President’s Re-Election Declaration Slammed

El Salvador’s Bitcoin Experiment Gains Momentum as President Bukele Approaches Re-Election

El Salvador’s Bitcoin Experiment Gains Momentum as President Bukele Approaches Re-Election

El Salvador’s Freedom Visa: A Path to Citizenship for Crypto Millionaires

El Salvador’s Freedom Visa: A Path to Citizenship for Crypto Millionaires