A Strong Foundation for Bitcoin as Legal Tender

With President Nayib Bukele's re-election date just around the corner, El Salvador is witnessing a surge in institutional support for Bitcoin, indicating a solid foundation for the country's experiment with cryptocurrency as legal tender.

Election Season in El Salvador

As the Republic of El Salvador gears up for the upcoming presidential vote on February 4, 2024, President Bukele enjoys a substantial lead over his competitors. Despite initial doubts about his eligibility for re-election, the courts have officially validated his candidacy. Bukele's presidency has been internationally renowned for his decision to make Bitcoin legal tender, although his domestic popularity largely stems from his anti-gang initiatives.

Bitcoin's Adoption in El Salvador

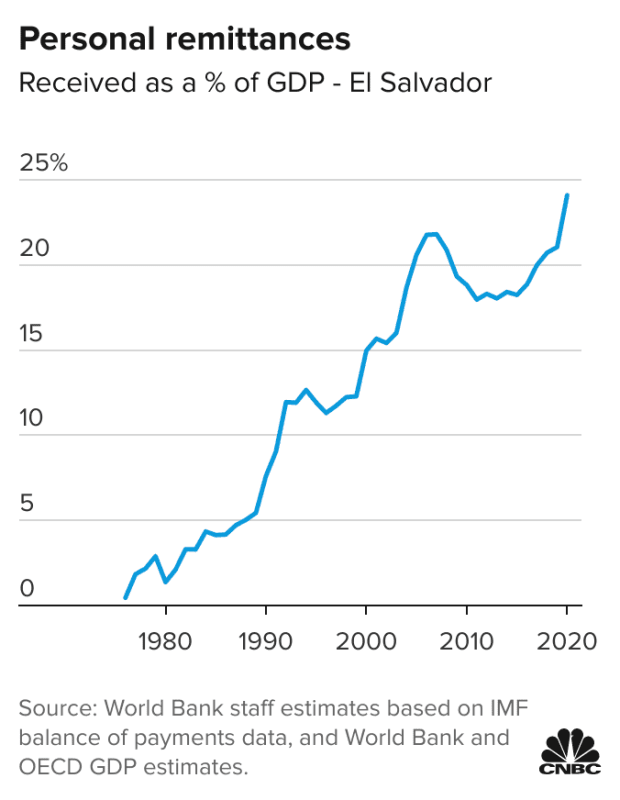

In September 2021, El Salvador became the first country to adopt Bitcoin as a valid currency. This move aimed to address the country's reliance on the US dollar and eliminate the leverage held by another nation over El Salvador's economy. Additionally, Bitcoin offers numerous benefits for an economy like El Salvador's, including the ability to streamline international remittances and bypass traditional financial intermediaries like Western Union.

Growing Acceptance and Stability

Despite initial challenges, El Salvador's new economic model, driven by Bitcoin, is gaining acceptance in the global economy. The nation's credit rating was upgraded by S&P in November, citing efforts to manage debt obligations and maintain economic stability. Bitcoin has played a significant role in this growing stability, contributing to a surge in tourism and attracting foreign residents due to the ease of using cryptocurrency in daily transactions.

The Challenge of Mass Adoption

While Bitcoin has garnered a significant following in El Salvador, mass adoption remains a challenge. The population has shown some reluctance to fully embrace the cryptocurrency. Given President Bukele's reputation as a crimefighter, there is a possibility that Bitcoin may gradually lose prominence even if he is successfully re-elected.

Institutional Support for Bitcoin

To prevent a decline in Bitcoin adoption, increasing institutional support is crucial. The government of El Salvador has taken proactive measures to foster a robust domestic Bitcoin community. For instance, they have supported projects like the Lava Pool initiative, encouraging local companies to engage in Bitcoin mining using renewable energy. Furthermore, private firms are independently investing in Bitcoin adoption. Distribuidora Morazán, the country's second-largest distributor of goods, has partnered with the wallet and API platform Blink to accept and promote Bitcoin.

Expanding Bitcoinization through B2B Transactions

Distribuidora Morazán aims to boost Bitcoinization through business-to-business (B2B) transactions. By encouraging businesses to accept and promote Bitcoin, the company seeks to overcome logistical and operational challenges associated with cash transactions. This move is particularly significant as many customers lack access to banking services, and Bitcoin serves as their first financial tool. The plan has already been rolled out to dozens of merchants, with a goal of reaching 1,000 within the next year.

Lightning Network Functionality

Bitcoin ATM providers Athena and Genesis Coin have initiated a plan to introduce Lightning Network functionality to Bitcoin ATMs across El Salvador. This upgrade allows for smaller and faster transactions with lower fees, making Bitcoin more accessible for everyday purchases. The introduction of Lightning Network demonstrates confidence in the profitability of this investment.

El Salvador's Bitcoin Experiment: A Promising Economic Institution

All signs indicate that El Salvador's Bitcoin experiment is on its way to becoming a significant economic institution. President Bukele has successfully transformed the country during his first term, and with additional years in office, the project's growth potential is immense. While the population may remain skeptical of Bitcoin, they continue to support Bukele's administration, and the most challenging aspects of the transition are behind them.

As bridges are rebuilt with global financial institutions and Bitcoin drives tourism revenue, confidence in the cryptocurrency is growing. While Bukele's focus may be divided between re-election and normal administration, private firms like Distribuidora Morazán are actively driving the vision of Bitcoin adoption. With sustained growth, El Salvador's experience with Bitcoin could serve as a global model for economic innovation.

Frequently Asked Questions

Can the government steal your gold?

The government cannot take your gold because you own it. You worked hard to earn it. It is yours. But, this rule is not universal. You could lose your gold if convicted of fraud against a federal government agency. Additionally, your precious metals may be forfeited if you owe the IRS taxes. You can keep your gold even if your taxes are not paid.

What does gold do as an investment?

Supply and demand determine the gold price. Interest rates can also affect the gold price.

Gold prices are volatile due to their limited supply. Physical gold is not always in stock.

What precious metals could you invest in to retire?

Gold and silver are the best precious metal investments. Both are easy to sell and can be bought easily. They are a great way to diversify your portfolio.

Gold: This is the oldest form of currency that man has ever known. It is very stable and secure. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: The popularity of silver has always been a concern for investors. It is an excellent choice for investors who wish to avoid volatility. Silver tends instead to go up than down, which is unlike gold.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. It is very durable and resistant against corrosion, much like silver and gold. It's also more expensive than the other two.

Rhodium: Rhodium is used in catalytic converters. It is also used in jewelry-making. It is relatively affordable when compared to other types.

Palladium (or Palladium): Palladium can be compared to platinum, but is much more common. It's also more accessible. For these reasons, it's become a favorite among investors looking to add precious metals to their portfolios.

Who is entitled to the gold in a IRA that holds gold?

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

To find out what options you have, consult an accountant or financial planner.

What are the benefits to having a gold IRA

You can save money on retirement by putting your money into an Individual Retirement Account. It is tax-deferred until it's withdrawn. You can decide how much money you withdraw each year. There are many types of IRAs. Some are better suited for people who want to save for college expenses. Some are for investors who seek higher returns. Roth IRAs, for example, allow people to contribute after they turn 59 1/2. They also pay taxes on any earnings when they retire. But once they start withdrawing funds, those earnings aren't taxed again. So if you're planning to retire early, this type of account may make sense.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. People who want to invest their money rather than spend it make gold IRA accounts a great option.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. This eliminates the need to constantly make deposits. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, gold remains one of the best investment options today. Because it's not tied to any particular country, its value tends to remain steady. Even during economic turmoil, gold prices tend to stay relatively stable. Therefore, gold is often considered a good investment to protect your savings against inflation.

How much should your IRA include precious metals

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. You don't need to be rich to make an investment in precious metals. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You could also consider buying physical coins like bullion bars, rounds or bullion bars. Also, you could buy shares in companies producing precious metals. Your retirement plan provider may offer an IRA rollingover program.

No matter what your preference, precious metals will still be of benefit to you. They are not stocks but offer long-term growth.

And, unlike traditional investments, their prices tend to rise over time. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

bbb.org

How To

The growing trend of gold IRAs

As investors seek to diversify their portfolios while protecting themselves from inflation, the trend towards gold IRAs is on the rise.

Owners of the gold IRA can use it to invest in physical bars and bullion gold. It can be used for tax-free growth and provides an alternative investment option for those concerned about stocks and bonds.

An investor can use a gold IRA to manage their assets and not worry about market volatility. The gold IRA can be used to protect against inflation or other potential problems.

Investors also benefit from physical gold's unique properties, such as durability and portability.

Additional benefits of the gold IRA include the ability to quickly pass ownership to heirs. Additionally, the IRS does not consider gold a money or a commodity.

Investors who seek financial stability and a safe haven are finding the gold IRA increasingly attractive.

—————————————————————————————————————————————————————————————–

By: Landon Manning

Title: El Salvador's Bitcoin Experiment Gains Momentum as President Bukele Approaches Re-Election

Sourced From: bitcoinmagazine.com/el-salvador-bitcoin-news/el-salvador-bukele-election-bitcoin-deepens

Published Date: Mon, 13 Nov 2023 16:37:47 GMT