Bitcoin skeptics often argue that bitcoin lacks intrinsic value, suggesting that investments like real estate, with their tangible cash flows, hold more superiority.

The Myth of Intrinsic Value

The concept of intrinsic value, influenced by the labor theory of value (LTV), is a misconception. This flawed idea misinterprets how value is perceived in the economy, extending to real estate's ability to generate cash flow or utility as living and production spaces.

Subjectivity of Value

In a free market, value is subjective, determined by individual perception rather than inherent qualities. Assets like bitcoin and real estate derive worth from personal perceptions and collective desire rather than predetermined values.

Bitcoin's Value Proposition

Bitcoin's value stems from the protection offered by the network and its scarcity, driving demand as an absolute scarce commodity in the universe.

Real Estate's Value Proposition

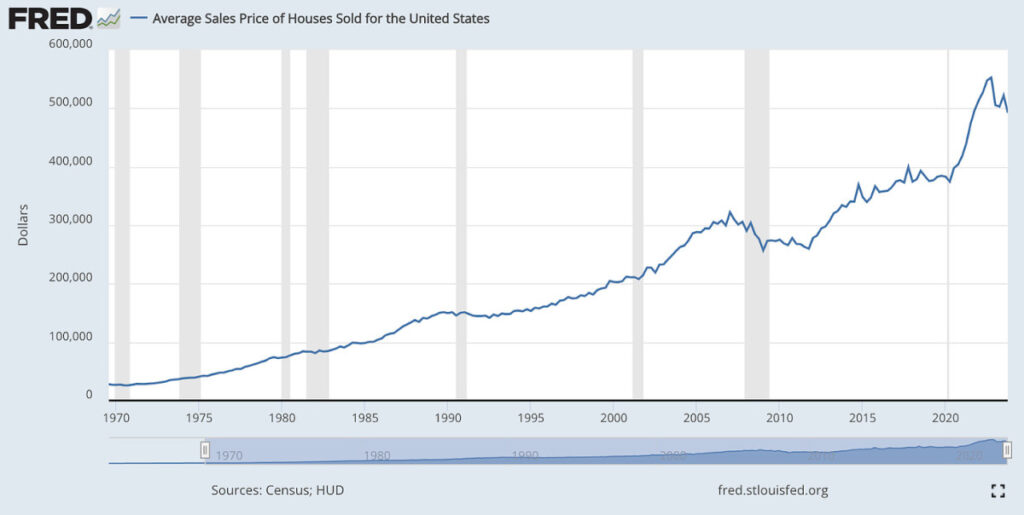

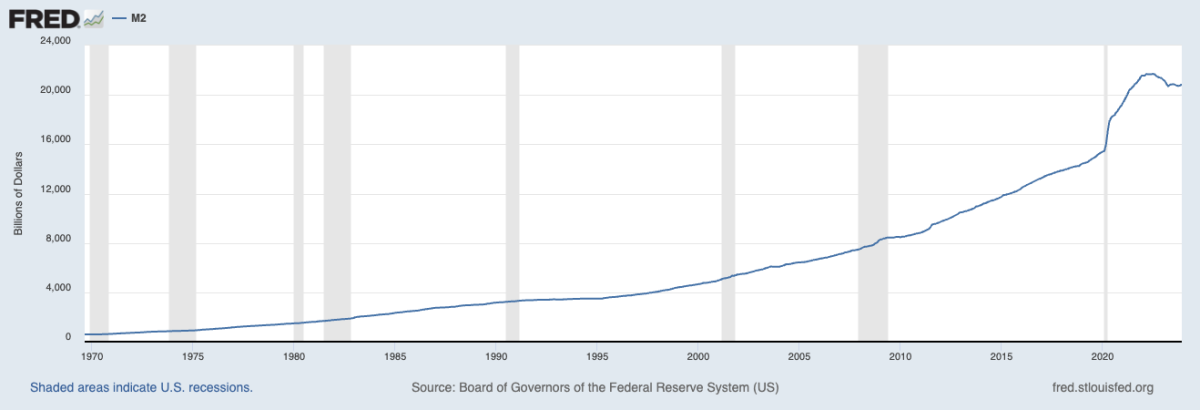

Real estate's high valuation is primarily about scarcity and hedging against inflation, with profits often assumed to come from price appreciation rather than cash flow.

Real Estate vs. Bitcoin

Real estate's popularity as an investment choice is largely due to financing options and ability to generate cash flows for debt repayment, while bitcoin offers unique advantages as a store of value.

Conclusion

The narrative of cash flow and intrinsic value in investments is evolving with the emergence of bitcoin, offering a glimpse into the future of finance where value is preserved digitally.

Frequently Asked Questions

Can I buy or sell gold from my self-directed IRA

Your self-directed IRA can be used to purchase gold, but first you need to open an account with a brokerage firm such as TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals are allowed to contribute $1,000 each ($2,000 if married or filing jointly) to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts are financial instruments based on the price of gold. They let you speculate on future price without having to own the metal. But physical bullion refers to real gold and silver bars you can carry in your hand.

What are the pros and cons of a gold IRA?

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. However, there are disadvantages to this type investment.

To give an example, if your IRA is withdrawn too often, you can lose all your accumulated funds. You may also be prohibited by the IRS from making withdrawals from an IRA after you turn 59 1/2. If you do withdraw funds, you'll need to pay a penalty.

You will also need to pay fees for managing your IRA. Most banks charge 0.5% to 2.0% per annum. Other providers may charge monthly management fees, ranging between $10 and $50.

If you prefer your money to be kept out of a bank, then you will need insurance. Most insurers require you to own a minimum amount of gold before making a claim. You might be required to buy insurance that covers losses up to $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. Some providers restrict the amount you can own in gold. Others let you pick your weight.

Also, you will need to decide if you want to buy physical gold futures contracts or physical gold. Physical gold is more expensive than gold futures contracts. Futures contracts offer flexibility for buying gold. They let you set up a contract that has a specific expiration.

You will also have to decide which type of insurance coverage is best for you. The standard policy does NOT include theft protection and loss due to fire or flood. It does include coverage for damage due to natural disasters. Additional coverage may be necessary if you reside in high-risk areas.

Insurance is not enough. You also need to think about the cost of gold storage. Storage costs are not covered by insurance. Banks charge between $25 and $40 per month for safekeeping.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians aren't allowed to sell your assets. Instead, they must hold them as long as you request.

After you've determined which type of IRA is best for you, fill out the paperwork indicating your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). You should also specify how much you want to invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. The company will review your application and send you a confirmation letter.

When opening a gold IRA, you should consider using a financial planner. A financial planner can help you decide the type of IRA that is right for your needs. They can help you find cheaper insurance options to lower your costs.

How much do gold IRA fees cost?

The Individual Retirement Account (IRA), fee is $6 per monthly. This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

You may have to pay additional fees if you want to diversify your portfolio. These fees vary depending on what type of IRA you choose. Some companies offer free checking, but charge monthly fees for IRAs.

A majority of providers also charge annual administration fees. These fees range between 0% and 1 percent. The average rate is.25% annually. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

Should you Invest In Gold For Retirement?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. If you are unsure of which option to invest in, consider both.

You can earn potential returns on your investment of gold. It's a great investment for retirees.

While many investments promise fixed returns, gold is subject to fluctuations. Its value fluctuates over time.

However, it doesn't necessarily mean that you shouldn't invest your money in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another advantage of gold is its tangible nature. Unlike stocks and bonds, gold is easier to store. It can also be transported.

As long as you keep your gold in a secure location, you can always access it. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. It's a great way to hedge against rising prices, as gold prices tend to increase along with other commodities.

It's also a good idea to have a portion your savings invested in something which isn't losing value. When the stock market drops, gold usually rises instead.

Another advantage to investing in gold is the ability to sell it whenever you wish. Just like stocks, you can liquidate your position whenever you need cash. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

Also, don't buy too much at once. Begin by buying a few grams. Add more as you're able.

Don't expect to be rich overnight. Instead, the goal is to accumulate enough wealth that you don't have to rely on Social Security.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

How much of your portfolio should you hold in precious metals

To answer this question we need to first define precious metals. Precious Metals are elements that have a very high relative value to other commodities. This makes them highly valuable for both investment and trading. Gold is currently the most widely traded precious metal.

But, there are other types of precious metals available, including platinum and silver. The price volatility of gold can be unpredictable, but it is generally stable during periods of economic turmoil. It also remains relatively unaffected by inflation and deflation.

In general, all precious metals have a tendency to go up with the market. However, the prices of precious metals do not always move in sync with one another. For example, when the economy is doing poorly, the price of gold typically rises while the prices of other precious metals tend to fall. This is because investors expect lower interest rates, making bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. They are more rare, so they become more expensive and less valuable.

Diversifying across precious metals is a great way to maximize your investment returns. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

External Links

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

How To

Guidelines for Gold Roth IRA

You should start investing early to ensure you have enough money for retirement. It is best to start saving for retirement as soon you can (typically at age 50). It is essential to save enough money each year in order to maintain a steady growth rate.

You may also wish to take advantage of tax-free investments such as a SIMPLE IRA, SEP IRA, and traditional 401(k). These savings vehicles permit you to make contributions, but not pay any tax until your earnings are withdrawn. They are a great option for those who do not have access to employer matching money.

Save regularly and continue to save over time. If you aren't contributing the maximum amount permitted, you could miss out on tax benefits.

—————————————————————————————————————————————————————————————–

By: Leon Wankum

Title: Dismantling The Cash-flow Narrative: Real Estate vs. Bitcoin

Sourced From: bitcoinmagazine.com/markets/dismantling-the-cash-flow-narrative-real-estate-vs-bitcoin

Published Date: Tue, 21 May 2024 17:00:00 GMT