Data as a Liquid Commodity

Data stands as the most fluid commodity in global markets. In the era of smartphones, without extreme measures, your every move, conversation, and consumption become quantifiable in the vast spectrum of information goods markets. These goods, existing purely as nonphysical data bits, can be conceptualized, crafted, and distributed solely as digital entities. The internet, alongside digital technologies for computation and communication, acts as a complete e-commerce infrastructure, facilitating the lifecycle of designing, producing, distributing, and consuming various information goods. The seamless shift from traditional to digital formats for information goods is easily achievable, with media formats now feasible in the digital realm that were previously impractical in the analog world.

The Evolution of Information Goods Markets

An initial analysis of products within the information goods industry reveals that, despite all being pure information products impacted by technological advancements, each market undergoes distinct economic transformations. These evolutions are closely linked to differences in product characteristics, production methods, distribution channels, and consumption patterns. Notably, the separation of value creation and revenue processes can lead to opportunistic scenarios, potentially leaving established market players with unprofitable customer bases and costly value-creation processes.

The Rise of Novel Information Markets

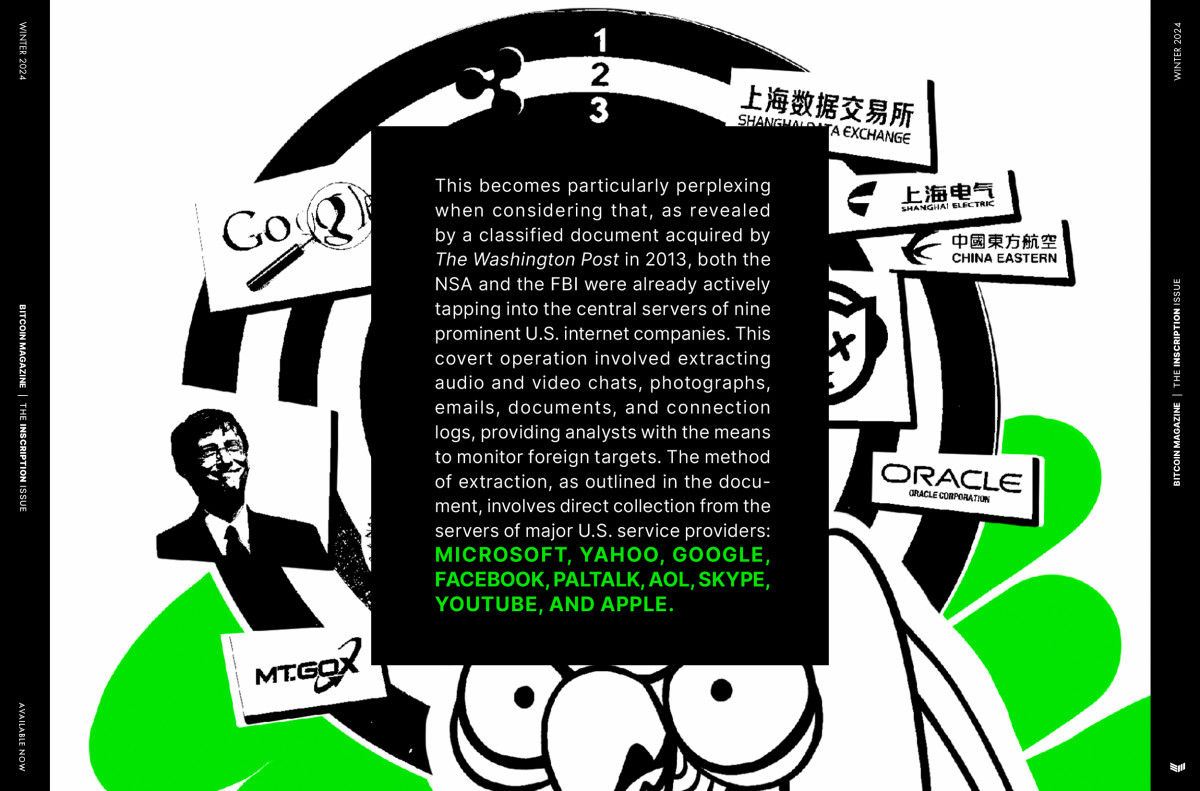

New organizational structures may emerge in response to evolving technological conditions, leading to the creation and destruction of traditional information good markets. The advent of digital production, distribution, and consumption has radically redesigned the value chains, paving the way for entirely new industries. For example, the market conditions for mass surveillance have evolved dramatically with the proliferation of cameras, microphones, and data transmission capabilities. This shift has given rise to services like mass surveillance as a service, reflecting the transformative impact of digital technologies on traditional market propositions.

Emergence of Location Firms

The growth of a new industry focused on location data is evident, with companies like Near curating vast amounts of intelligence on individuals and places. The global market for location intelligence data is expanding rapidly, driven by the increasing penetration of smart devices and investments in IoT and network services. This growth is further accelerated by the adoption of location intelligence solutions in response to changing business scenarios, particularly highlighted during the COVID-19 pandemic.

The Shanghai Data Exchange

In 2021, China launched the Shanghai Data Exchange, aiming to establish a state-owned monopoly on a new speculative commodities market for data sourced from a highly surveilled population. The exchange offered various data products, including customer flight information and telecommunications data. This move reflects a broader trend towards state-controlled data exchanges and the monetization of vast amounts of personal information.

The Modern Data Market

The modern data market traces its roots back to the late 1970s and early 1980s, with companies like Oracle Corporation playing pivotal roles in shaping the industry. The convergence of government, private sector, and intelligence agencies in data markets underscores the complex interplay between data collection, surveillance, and commercial interests.

Bitcoin-native Data Markets

The advent of Bitcoin-native data markets represents a novel approach to information goods, leveraging the blockchain's properties for secure and censorship-resistant data publishing. Technologies like Ord and precursive inscriptions offer innovative solutions for data storage, verification, and dissemination within the Bitcoin ecosystem.

ReQuest: A Novel Data Market

ReQuest introduces a new data market model that allows users to issue bounties for specific data, encouraging secure storage and incentivizing data fulfillment. The protocol leverages social validation and contractual parameters to ensure accurate and reliable data inscriptions.

Durabit: Incentivizing Data Distribution

Durabit proposes a mechanism for durable and large-scale data distribution through time-locked Bitcoin transactions and magnet links. The protocol aims to create a self-sustaining incentive structure for data seeding and sharing, facilitating the dissemination of information across the Bitcoin blockchain.

Securing Data Ownership

The fight for data ownership and privacy is crucial in the digital age, with individuals encouraged to take control of their metadata. By leveraging encryption, decentralized technologies, and alternative data markets, users can increase the costs associated with data harvesting and surveillance, fostering a more privacy-centric approach to data management.

Frequently Asked Questions

How much tax is gold subject to in an IRA

The fair value of gold sold to determines the price at which tax is due. When you purchase gold, you don't have to pay any taxes. It's not considered income. If you sell it later you will have a taxable profit if the price goes down.

Loans can be secured with gold. Lenders look for the highest return when you borrow against assets. This usually involves selling your gold. There's no guarantee that the lender will do this. They may hold on to it. They may decide to resell it. You lose potential profits in either case.

So to avoid losing money, you should only lend against your gold if you plan to use it as collateral. If you don't plan to use it as collateral, it is better to let it be.

How does a Gold IRA account work?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can purchase physical bullion gold coins at any point in time. You don’t have to wait to begin investing in gold.

An IRA lets you keep your gold for life. You won't have to pay taxes on your gold investments when you die.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. Your gold is not part of your estate and you don't have to include it in the final estate report.

First, an individual retirement account will be set up to allow you to open a golden IRA. Once you've done that, you'll receive an IRA custody. This company acts like a middleman between the IRS and you.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual reports.

After you have created your gold IRA, the only thing you need to do is purchase gold bullion. The minimum deposit required for gold bullion coins purchase is $1,000 If you make more, however, you will get a higher interest rate.

You will pay taxes when you withdraw your gold from your IRA. If you are withdrawing your entire balance, you will owe income tax plus a 10% penalty.

Even if your contribution is small, you might not have to pay any taxes. There are exceptions. There are some exceptions. For instance, if you take out 30% or more from your total IRA assets, federal income taxes will apply plus a 20 percent penalty.

You should avoid taking out more than 50% of your total IRA assets yearly. Otherwise, you'll face steep financial consequences.

How to Open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. Open the account by filling out Form 8606. You will then need to complete Form 5204 in order to determine which type IRA you are eligible. You must complete this form within 60 days of opening your account. After this, you are ready to start investing. You might also be able to contribute directly from the paycheck through payroll deduction.

For a Roth IRA you will need to complete Form 8903. Otherwise, it will be the same process as an ordinary IRA.

To qualify for a precious Metals IRA, there are specific requirements. The IRS stipulates that you must have earned income and be at least 18-years old. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. You must also contribute regularly. These rules are applicable whether you contribute through your employer or directly from the paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. You can only purchase bullion in physical form. You won't have the ability to trade stocks or bonds.

Your precious metals IRA can be used to directly invest in precious metals-related companies. This option is offered by some IRA providers.

There are two major drawbacks to investing via an IRA in precious metals. They aren't as liquid as bonds or stocks. It's also more difficult to sell them when they are needed. They don't yield dividends like bonds and stocks. Also, they don't generate dividends like stocks and bonds. You will eventually lose money rather than make it.

How Do You Make a Withdrawal from a Precious Metal IRA?

First decide if your IRA account allows you to withdraw funds. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. You will also have to account for taxes due on any amount you withdraw if you choose this option.

Next, figure out how much money will be taken out of your IRA. This calculation will depend on many factors including your age at the time of withdrawal, how long the account has been in your possession, and whether you plan to continue contributing towards your retirement plan.

Once you know how much of your total savings to convert to cash, it's time to choose the type of IRA that you want. Traditional IRAs allow for you to withdraw funds without tax when you turn 59 1/2. Roth IRAs, on the other hand, charge income taxes upfront but you can access your earnings later and pay no additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. To avoid unnecessary fees, however, try opening an account using a debit card rather than a credit card.

When you finally get around to making withdrawals from your precious metal IRA, you'll need a safe place where you can store your coins. Some storage facilities will take bullion bars while others require you only to purchase individual coins. Either way, you'll need to weigh the pros and cons of each before choosing one.

For example, storing bullion bars requires less space because you aren't dealing with individual coins. However, each coin will need to be counted individually. You can track their value by keeping individual coins.

Some prefer to store their coins in a vault. Others prefer to store them in a safe deposit box. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

Who has the gold in a IRA gold?

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

The purchase of gold can protect you from inflation and price volatility. But it's not smart to hold it if your only intention is to use it.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

Consult a financial advisor or accountant to determine your options.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options? Types, Spreads, Example and Risk Metrics

bbb.org

cftc.gov

irs.gov

How To

How to Keep Physical Gold in an IRA

The best way to invest in Gold is by purchasing shares of companies that produce it. But this investment method has many risks as there is no guarantee of survival. Even if the company survives, they still face the risk of losing their investment due to fluctuations in gold's price.

The alternative is to buy physical gold. You will need to either open an online or bank account or simply buy gold from a reliable seller. This option has many advantages, including the ease of access (you don’t have to deal with stock markets) and the ability of making purchases at low prices. It's also easy to see how many gold you have. You will receive a receipt detailing exactly what you paid. You're also less susceptible to theft than investing with stocks.

However, there are disadvantages. You won't get the bank's interest rates or investment money. Also, you won't be able to diversify your holdings – you're stuck with whatever you bought. Finally, the taxman might want to know where your gold has been placed!

BullionVault.com has more information about how to buy gold in an IRA.

—————————————————————————————————————————————————————————————–

By: Mark Goodwin

Title: Decentralizing Information Ownership: The Revolution of Random Access Markets

Sourced From: bitcoinmagazine.com/technical/random-access-markets-the-free-market-of-information

Published Date: Wed, 20 Mar 2024 13:30:00 GMT

Did you miss our previous article…

https://altcoinirareview.com/decentralized-finance-witnesses-remarkable-recovery-in-2023/