Larry Fink, the CEO of BlackRock, has put forward a bold prediction suggesting that Bitcoin could soar to a value of $700,000 per BTC. This forecast comes at a time when worries about currency devaluation and global economic uncertainty are on the rise, positioning Bitcoin as a safeguard against vulnerabilities in conventional financial systems. Fink's statement, while not a direct endorsement, reflects discussions he had with a sovereign wealth fund. The fund was seeking advice on whether to allocate 2% or 5% of its investment portfolio to Bitcoin. According to Fink, if more institutions adopt Bitcoin and follow similar allocation strategies, market forces could propel Bitcoin to unprecedented levels.

The Market Implication of Fink's Statement

With BlackRock overseeing assets worth $11.5 trillion, Fink's remarks carry substantial influence, conveying a clear message to both individual and institutional investors. His support goes beyond personal views, acting as a market indicator for Bitcoin's potential trajectory. Often referred to as "digital gold," Bitcoin is viewed as a wealth-preserving asset that shields against inflation and governmental financial mismanagement. Fink's acknowledgment of this narrative could accelerate Bitcoin's adoption among traditional investors.

A Timely Prediction in the Face of Economic Challenges

Fink's forecast comes amidst global concerns over rising inflation, mounting national debts, and geopolitical uncertainties that pose threats to currency stability. With its capped supply of 21 million coins and decentralized nature, Bitcoin emerges as an alternative asset class resistant to the inflationary pressures linked with fiat currencies. In such a scenario, its value proposition becomes increasingly appealing.

BlackRock's Bitcoin ETF: Reflecting Institutional Interest

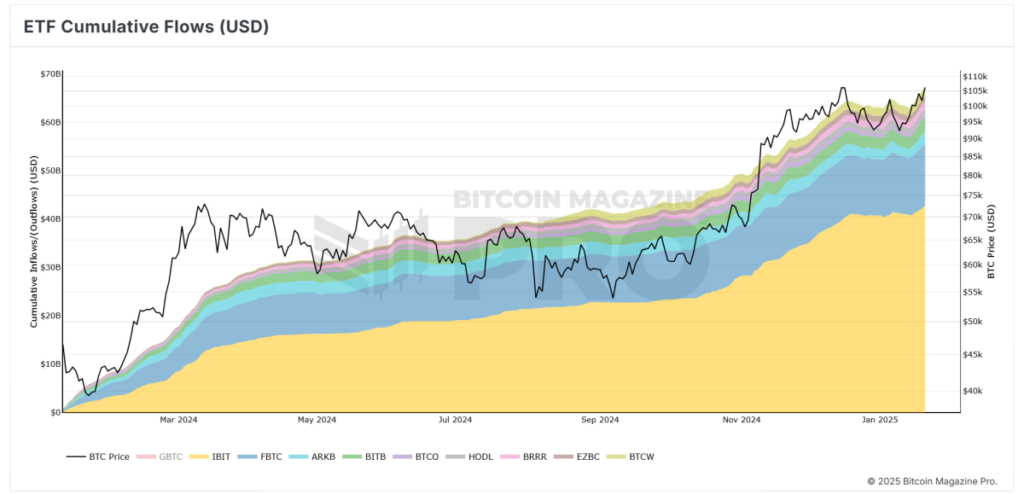

BlackRock's deepening engagement with Bitcoin hit a milestone on January 21, 2025, as the firm acquired $662 million worth of Bitcoin for its exchange-traded fund (ETF), marking its largest daily purchase this year so far.

The BlackRock iShares Bitcoin Trust (IBIT) surpassed the iShares Gold Trust (IAU) in net assets in October 2024, just months after the launch of IBIT in January 2024. This achievement underscores the rapid growth and rising investor enthusiasm for Bitcoin-focused exchange-traded funds.

A Balanced View on Bitcoin's Future

Despite the bullish nature of Fink's projection, its realization hinges on the continuation of existing economic trends. If global economic stability improves or innovative financial systems emerge to allay concerns of currency devaluation, Bitcoin's price trajectory could stabilize at a lower level. Nonetheless, Fink's high-profile commentary underscores the expanding role of Bitcoin as a legitimate asset category.

The Evolution of Bitcoin's Role in Finance

Bitcoin's shift from a niche digital experiment to a mainstream financial tool is gaining momentum. Fink's comments may mark a critical juncture, not just for Bitcoin but for its broader acceptance in traditional finance. For investors and supporters, this signifies more than just confidence—it signals that Bitcoin's integration into the global financial framework is not only approaching but already in progress.

As the world observes, Bitcoin's impact on reshaping finance continues to expand. Fink's forecast serves as a reminder that Bitcoin is no longer a marginal concept but a pivotal player in the future of monetary systems.

Frequently Asked Questions

What are the advantages of a IRA with a gold component?

The benefits of a gold IRA are many. It can be used to diversify portfolios and is an investment vehicle. You have control over how much money goes into each account.

Another option is to rollover funds from another retirement account into a IRA with gold. This will allow you to transition easily if it is your decision to retire early.

The best thing about investing in gold IRAs is that you don’t need any special skills. These IRAs are available at all banks and brokerage houses. Withdrawals are made automatically without having to worry about fees or penalties.

There are also drawbacks. Gold has historically been volatile. It is important to understand why you are investing in gold. Are you seeking safety or growth? Is it for security or long-term planning? Only then will you be able make informed decisions.

If you are planning to keep your Gold IRA indefinitely you will want to purchase more than one ounce. One ounce doesn't suffice to cover all your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don't need to have a lot of gold if you are selling it. You can even live with just one ounce. But, those funds will not allow you to buy anything.

Is it a good retirement strategy to buy gold?

Although buying gold as an investment might not sound appealing at first, when you look at the average annual gold consumption worldwide, it is worth looking into.

Physical bullion bar is the best way to invest in precious metals. However, there are many other ways to invest in gold. You should research all options thoroughly before making a decision on which option you prefer.

If you're not looking to secure your wealth, it may be worth considering purchasing shares in mining equipment or companies that extract gold. If you require cash flow, gold stocks can work well.

You can also put your money in exchange traded funds (ETFs). These funds allow you to be exposed to the price and value of gold by holding gold related securities. These ETFs can include stocks of precious metals refiners and gold miners.

Who has the gold in a IRA gold?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

The purchase of gold can protect you from inflation and price volatility. But it's not smart to hold it if your only intention is to use it.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

Consult a financial advisor or accountant to determine your options.

What precious metals can you invest in for retirement?

Gold and silver are the best precious metal investments. They're both easy to buy and sell and have been around forever. You should add them to your portfolio if you are looking to diversify.

Gold: The oldest form of currency known to man is gold. It is very stable and secure. This makes it a good option to preserve wealth in uncertain times.

Silver: Silver has always been popular among investors. It's a good choice for those who want to avoid volatility. Silver, unlike gold, tends not to go down but up.

Platinum: A new form of precious metal, platinum is growing in popularity. It's like silver or gold in that it is durable and resistant to corrosion. It's however much more costly than any of its counterparts.

Rhodium: Rhodium can be used in catalytic convertors. It's also used in jewelry making. It is relatively affordable when compared to other types.

Palladium: Palladium has a similarity to platinum but is more rare. It's also more accessible. For these reasons, it's become a favorite among investors looking to add precious metals to their portfolios.

What precious metal should I invest in?

This question depends on how risky you are willing to take, and what return you want. Although gold has been considered a safe investment, it is not always the most lucrative. Gold may not be right for you if you want quick profits. If you have the patience to wait, then you might consider investing in silver.

Gold is the best investment if you aren't looking to get rich quick. Silver may be a better option for investors who want long-term steady returns.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

investopedia.com

bbb.org

finance.yahoo.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

How To

The best place online to buy silver and gold

You must first understand the workings of gold before you can purchase it. Precious metals like gold are similar to platinum. Because of its resistance to corrosion and durability, it is very rare. It's hard to use, so most people prefer buying jewelry made out of it to actual bars of gold.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. Legal tender coins are designed for circulation in a country. They often have denominations like $1 or $5 or $10.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They can't be exchanged in currency exchange systems. If a person purchases $100 worth of gold, 100 grams of the gold will be given to him/her. The $100 value is $100. Every dollar spent on gold purchases, the buyer receives one gram of gold.

When looking to buy precious metals, the next thing you should be aware of is where it can be purchased. There are many options for buying gold directly from dealers. First, your local currency shop is a good place to start. You might also consider going through a reputable online seller like eBay. Finally, you can look into purchasing gold through private sellers online.

Private sellers are individuals who offer gold for sale, either at wholesale prices or retail prices. Private sellers will charge you a 10% to 15% commission for every transaction. That means you would get back less money from a private seller than from a coin shop or eBay. This option is often a great choice for investing gold as it allows you more control over its price.

You can also invest in gold physical. While physical gold is easier than paper certificates to store, you still need to make sure it is safe. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

A bank or pawnshop can help you buy gold. A bank will be able to provide you with a loan for the amount of money you want to invest in gold. Pawnshops are small establishments allowing customers to borrow money against items they bring. Banks usually charge higher interest rates that pawn shops.

A third way to buy gold? Simply ask someone else! Selling gold can be as easy as selling. Set up a simple account with GoldMoney.com and you will start receiving payments instantly.

—————————————————————————————————————————————————————————————–

By: Mark Mason

Title: BlackRock CEO Larry Fink Predicts Bitcoin Price Surge to $700K Amid Inflation Concerns

Sourced From: bitcoinmagazine.com/markets/blackrock-ceo-larry-fink-forecasts-700k-bitcoin-price-amid-inflation-worries

Published Date: Wed, 22 Jan 2025 19:33:10 GMT