After a major difficulty adjustment rise, hash price heads for new lows as miners’ profitability gets squeezed.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

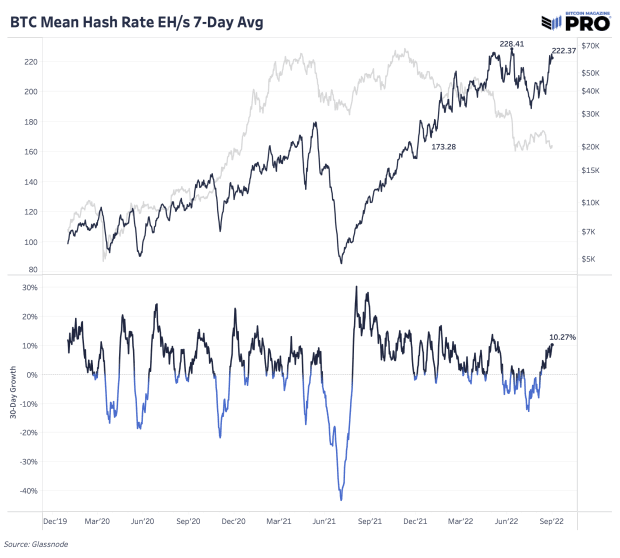

Bitcoin’s latest difficulty adjustment came in at 9.26% earlier today, its second largest increase this year behind 9.32% back in January. As per usual, the increase is a result of a surge in hash rate over the last two weeks driving faster block production times. Now both hash rate and difficulty sit just below all-time high values. Hash rate is up 10.27% over the last 30 days.

What looks to be the driving forces behind the hash rate increases over the last of couple weeks are a few factors: larger public miners are getting more rigs plugged in which are in alignment with their 2022 expansion plans; we’re getting past the hotter summer months, especially in Texas where miners were temporarily shutting down rigs per incentives from their purchase power agreements; price rallying to $25,000 will drive more hash online and less efficient rigs shift hands to more efficient, competitive operations. It’s difficult to quantify which is the most impactful force, but all seem to be playing a role in hash rate growth.

The Bitcoin mining difficulty increase is a result of a surge in hash rate over the last two weeks

Multiple factors have likely been driving the Bitcoin hash rate in the last few weeks.

To see this level of rise in difficulty this quickly is a rare occasion and looks less sustainable than gradual rises in hash rate and difficulty we’ve seen in the past. If anything, the latest difficulty rise brings more pressures to miners’ profit margins at a time where we think bitcoin price has further to fall.

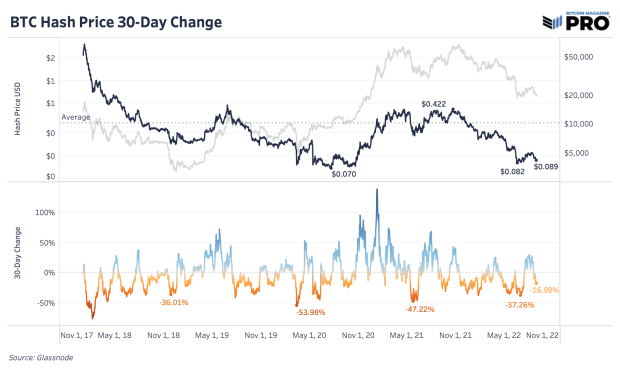

Hash price continues its fall from its golden period, down nearly 17% over the last 30 days. If the increase in hash rate is mostly driven by prefinanced expansion plans by major public miners, the hash rate increase isn't reflective of a sustained increase in hash rate coming online on the margin.

As you can see by the charts above, even a reversal in the short term doesn’t change the long-term trend of an ever-increasing hash rate and rising network difficulty.

Hash price continues its fall from its golden period, down nearly 17% over the last 30 days.

We’ve previously highlighted some analysis from Arcane Research that showed major public miners' baseline bitcoin production cost (based solely on electricity prices) were around $6,000 to $10,000. You can read more on that research by clicking the above link or reading “Bitcoin Hash Rate Plummets 17% From All-Time High.” Although we haven’t performed this analysis ourselves or triangulated the data, there’s one estimate that points to an “all-in” bitcoin production cost across public miners to be closer to $27,600 in Q2 of this year. This cost would include general expenses, maintenance, payroll, interest expenses on outstanding loans and other costs outside of electricity.

Even assuming that estimate could be heavily overstated because we don’t have insight into the quality or methodology of the analysis, a bitcoin price hovering around $20,000 still puts major public miners on the ropes to achieve profitability on each bitcoin mined.

—————————————————————————————————————————————————————————————–

By: Dylan LeClair,Sam Rule

Title: Bitcoin’s Rising Difficulty Squeezes Miner Profitability

Sourced From: bitcoinmagazine.com/markets/difficulty-hits-bitcoin-miner-profits

Published Date: Fri, 02 Sep 2022 00:30:00 GMT

Did you miss our previous article…

https://altcoinirareview.com/how-to-convert-your-ira-to-physical-gold-silver/