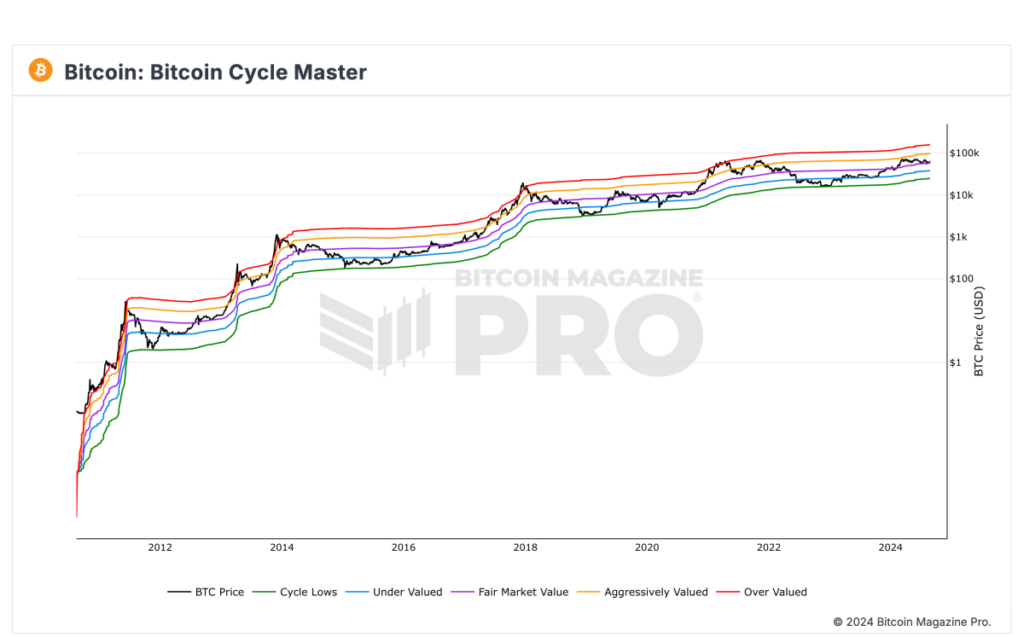

As of the latest data available, Bitcoin is currently priced at $63,500, which is considered a fair market value based on insights from the Bitcoin Cycle Master chart and data sourced from Bitcoin Magazine Pro. The Bitcoin Cycle Master chart utilizes on-chain metrics such as Coin Value Days Destroyed and Terminal Price to evaluate Bitcoin's position within its economic cycles. These cycles typically occur around every four years, aligning with significant Bitcoin halving events.

Understanding Bitcoin Cycle Master Analysis

The Bitcoin Cycle Master tool delves into real economic activity on the Bitcoin blockchain to determine whether Bitcoin is undervalued, fairly valued, aggressively valued, or overvalued. The current data suggests that Bitcoin is trading at a fair market value, indicating a harmonious balance between demand and supply during the ongoing cycle.

Identifying Risks and Opportunities

Aside from pinpointing periods of heightened risk, indicating potential cycle peaks, the Bitcoin Cycle Master also identifies value opportunities during cycle lows. By monitoring on-chain transaction trends, this tool offers valuable insights into possible future price movements, aiding investors in making well-informed decisions.

Positive Outlook and Price Predictions

Industry institutions, analysts, and Bitcoin advocates are optimistic about a price surge later this year, drawing from historical patterns where Bitcoin's value typically sees significant growth several months post-halving. This optimism has been reinforced by recent forecasts made by notable figures in the financial industry. For instance, Jan van Eck, CEO of ETF & Mutual Fund Manager VanEck, predicted a soaring Bitcoin price target of $350,000, showcasing strong confidence in Bitcoin's prolonged growth trajectory.

For a more comprehensive understanding of Bitcoin's market dynamics, detailed insights, and access to Bitcoin Magazine Pro's data and analytics, you can visit the official website here.

Frequently Asked Questions

Is it possible to hold a gold ETF within a Roth IRA

This option may not be available in a 401(k), but you should look into other options such as an Individual Retirement account (IRA).

Traditional IRAs allow for contributions from both employees and employers. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money invested in the ESOP is then taxed at lower rates than if it were held directly in the hands of the employee.

You can also get an Individual Retirement Annuity, or IRA. You can make regular payments to your IRA throughout your life, and you will also receive income when you retire. Contributions to IRAs will not be taxed

How Much of Your IRA Should Include Precious Metals?

It's important to understand that precious metals aren't only for wealthy people. You don’t need to have a lot of money to invest. There are many ways to make money on silver and gold investments without spending too much.

You might think about buying physical coins such a bullion bar or round. Also, you could buy shares in companies producing precious metals. Your retirement plan provider may offer an IRA rollingover program.

You can still get benefits from precious metals regardless of what choice you make. These metals are not stocks, but they can still provide long-term growth.

Their prices rise with time, which is a different to traditional investments. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

How is gold taxed within an IRA?

The fair value of gold sold to determines the price at which tax is due. You don't pay taxes when you buy gold. It isn't considered income. If you decide to sell it later, there will be a taxable gain if its price rises.

Loans can be secured with gold. Lenders look for the highest return when you borrow against assets. In the case of gold, this usually means selling it. It's not guaranteed that the lender will do it. They may keep it. They might decide that they want to resell it. You lose potential profits in either case.

To avoid losing money, only lend against gold if you intend to use it for collateral. You should leave it alone if you don't intend to lend against it.

Who has the gold in a IRA gold?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

This tax-free status is only available to those who have owned at least $10,000 of gold and have kept it for at minimum five years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

Consult a financial advisor or accountant to determine your options.

How much should you have of gold in your portfolio

The amount that you want to invest will dictate how much money it takes. A small investment of $5k-10k would be a great option if you are looking to start small. As you grow, you can move into an office and rent out desks. So you don't have all the hassle of paying rent. Rent is only paid per month.

Also, you need to think about the type of business that you are going to run. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. So if you do this kind of thing, you need to consider how much income you expect from each client.

If you are doing freelance work, you probably won't have a monthly salary like I do because the project pays freelancers. You may get paid just once every 6 months.

You need to determine what kind or income you want before you decide how much of it you will need.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

What is the best way to hold physical gold?

Gold is money and not just paper currency. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. The S&P 500 dropped 21 percent in the same time period, while gold prices rose by nearly 100 percent between August 2011-early 2013. During these turbulent market times, gold was among few assets that outperformed the stocks.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. If your stock portfolio goes down, you still own your shares. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, gold offers liquidity. This means that you can sell gold anytime, regardless of whether or not another buyer is available. Because gold is so liquid compared to other investments, buying it in small amounts makes sense. This allows you to profit from short-term fluctuations on the gold market.

Which precious metal is best to invest in?

This question is dependent on the amount of risk you are willing and able to accept as well as the type of return you desire. Gold is a traditional haven investment. However, it is not always the most profitable. For example, if you need a quick profit, gold may not be for you. If you have time and patience, you should consider investing in silver instead.

If you don't care about getting rich quickly, gold is probably the way to go. If you want to invest in long-term, steady returns, silver is a better choice.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement plans

irs.gov

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

How To

How to Keep Physical Gold in an IRA

The best way of investing in gold is to purchase shares from companies that produce gold. However, this method comes with many risks because there's no guarantee that these companies will continue to survive. If they survive, there's still the risk of losing money due to fluctuations in the price of gold.

You can also buy gold directly. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. This option has many advantages, including the ease of access (you don’t have to deal with stock markets) and the ability of making purchases at low prices. It is also easier to check how much gold you have stored. The receipt will show exactly what you paid. You'll also know if taxes were not paid. There's also less chance of theft than investing in stocks.

However, there are some disadvantages too. You won't get the bank's interest rates or investment money. You won't have the ability to diversify your holdings; you will be stuck with what you purchased. Finally, tax man may want to ask where you put your gold.

BullionVault.com is the best website to learn about gold purchases in an IRA.

—————————————————————————————————————————————————————————————–

By: Nik Hoffman

Title: Bitcoin's Current Valuation at a Fair Market Price Revealed by Bitcoin Magazine Pro Data

Sourced From: bitcoinmagazine.com/markets/btc-currently-valued-at-fair-market-price-bitcoin-magazine-pro-data-shows

Published Date: Mon, 26 Aug 2024 21:09:01 GMT