Bitcoin, the world's leading cryptocurrency, recently experienced a significant selloff, causing its value to plummet from over $100,000 to below $80,000. This sharp decline left many traders wondering if the Bitcoin bull market is back on track or if it's just a temporary rally in a larger bear market cycle.

Bitcoin's Local Bottom and Potential Bull Market Resurgence

The recent correction in Bitcoin's price shook investor confidence, but it also managed to maintain the overall macro trend structure. It appears that Bitcoin may have established a local bottom in the $76K–$77K range. Several key metrics are indicating that this could lead to further price appreciation.

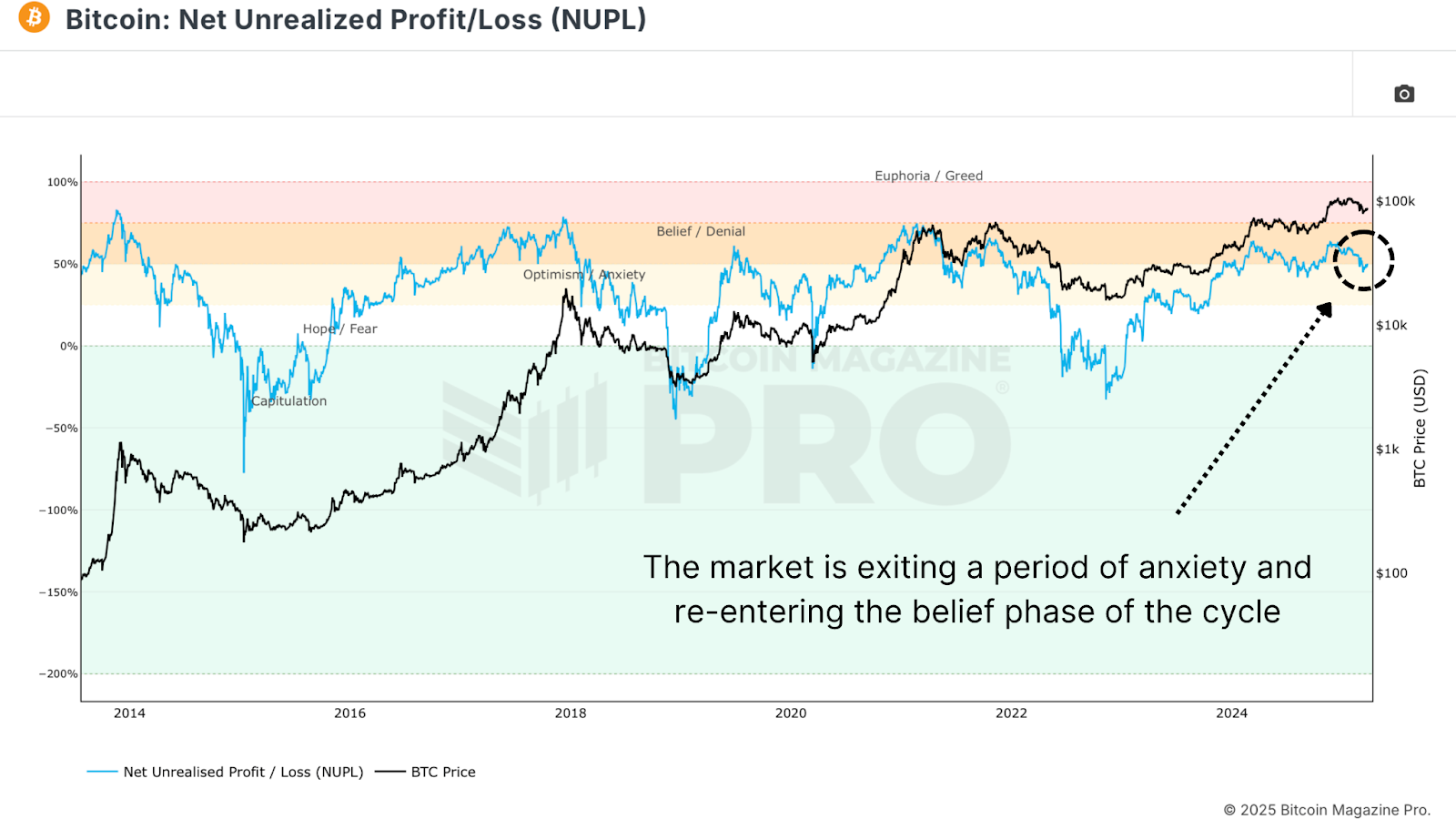

The Role of Net Unrealized Profit and Loss (NUPL)

The Net Unrealized Profit and Loss (NUPL) metric is a reliable indicator of market sentiment throughout Bitcoin's various cycles. Following the price drop, NUPL entered the "Anxiety" zone, but with the recent rebound, it has now moved back into the "Belief" zone. Historically, this sentiment shift has been associated with higher lows in the market.

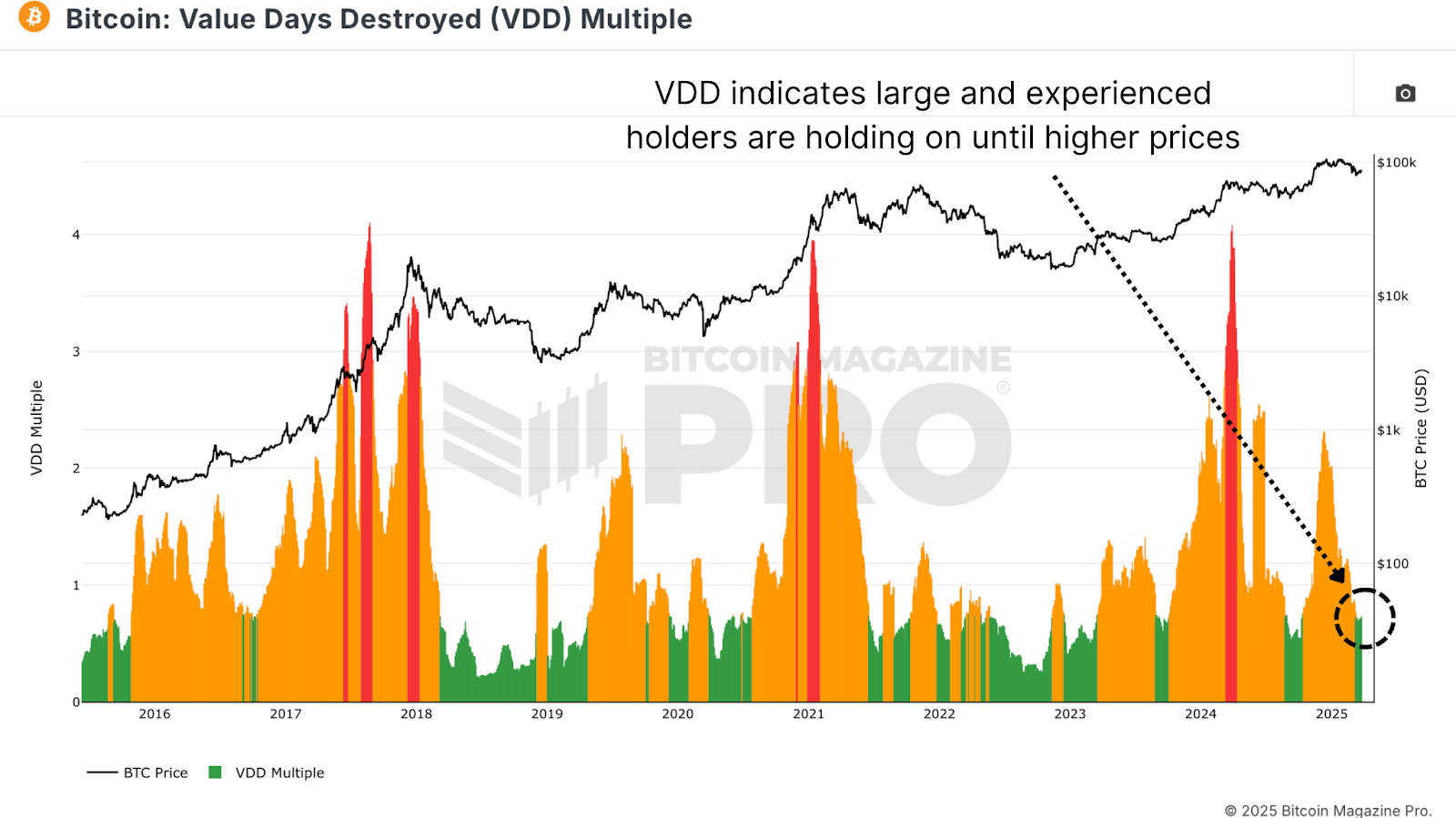

Value Days Destroyed (VDD) Multiple and Long-Term Holder Behavior

The Value Days Destroyed (VDD) Multiple analyzes Bitcoin spending based on coin age and transaction size compared to historical averages. Currently, the readings suggest that large, aged Bitcoin holdings are not being moved—a sign of strong conviction among long-term investors. Similar trends preceded significant price rallies in previous bull cycles.

Long-term holders are also accumulating Bitcoin at lower price levels after taking profits above $100,000. This accumulation phase often leads to supply squeezes and subsequent rapid price increases.

Bitcoin Hash Ribbons and Miner Confidence

The Hash Ribbons Indicator recently signaled a bullish crossover, indicating that the short-term hash rate trend is surpassing the longer-term average. This crossover has historically marked market bottoms and trend reversals. Miner behavior reflects their profit expectations, suggesting confidence in higher Bitcoin prices ahead.

Bitcoin's Relationship with Stock Markets

Despite positive on-chain data, Bitcoin's price movements are still closely tied to global liquidity trends and equity markets, especially the S&P 500. This correlation means that Bitcoin's performance is influenced by broader economic factors such as monetary policy and market sentiment.

Bitcoin Bull Market Outlook and Considerations

Overall, Bitcoin appears well-positioned for continued growth based on on-chain metrics and historical patterns. Long-term holders' behavior, miner confidence, and market sentiment all point towards a potential bull market resurgence. However, external factors, such as global economic conditions and regulatory changes, could introduce volatility to the market.

While the recent price stabilization around $76K–$77K is a positive sign, sustained momentum in the bull market will require patience and favorable market conditions. Traders should remain cautious and monitor both on-chain data and external factors to navigate the next phase of Bitcoin's price movement.

For more detailed analysis and real-time data, consider exploring Bitcoin Magazine Pro for valuable insights into the cryptocurrency market.

Disclaimer: This article is intended for informational purposes only and should not be construed as financial advice. It is crucial to conduct thorough research before making any investment decisions.

Author: Matt Crosby

Frequently Asked Questions

What tax is gold subject in an IRA

The fair value of gold sold to determines the price at which tax is due. You don't have tax to pay when you buy or sell gold. It isn't considered income. If you sell it later, you'll have a taxable gain if the price goes up.

Loans can be secured with gold. Lenders try to maximize the return on loans that you take against your assets. In the case of gold, this usually means selling it. There's no guarantee that the lender will do this. They might just hold onto it. Or they might decide to resell it themselves. In either case, you risk losing potential profits.

So to avoid losing money, you should only lend against your gold if you plan to use it as collateral. It's better to keep it alone.

How much of your portfolio should be in precious metals?

This question can only be answered if we first know what precious metals are. Precious metals refer to elements with a very high value relative other commodities. They are therefore very attractive for investment and trading. The most traded precious metal is gold.

There are many other precious metals, such as silver and platinum. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It also remains relatively unaffected by inflation and deflation.

As a general rule, the prices for all precious metals tend to increase with the overall market. However, they may not always move in synchrony with each other. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. This is because investors expect lower interest rates, making bonds less attractive investments.

In contrast, when the economy is strong, the opposite effect occurs. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. They become less expensive and have a lower value because they are limited.

You must therefore diversify your investments in precious metals to reap the maximum profits. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

How does a gold IRA account work?

Gold Ira accounts are tax-free investment vehicles for people who want to invest in precious metals.

You can purchase physical gold bullion coins anytime. To start investing in gold, it doesn't matter if you are retired.

You can keep gold in an IRA forever. Your gold holdings won't be subject to taxes when you pass away.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. Once you've done that, you'll receive an IRA custody. This company acts as a middleman between you and the IRS.

Your gold IRA custodian is responsible for handling all paperwork and submitting the required forms to the IRS. This includes filing annual reporting.

After you have established your gold IRA you will be able purchase gold bullion coin. The minimum deposit is $1,000. A higher interest rate will be offered if you invest more.

You will pay taxes when you withdraw your gold from your IRA. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

If you only take out a very small percentage of your income, you may not need to pay tax. There are exceptions. You'll owe federal income tax and a 20% penalty if you take out more than 30% of your total IRA assets.

You should avoid taking out more than 50% of your total IRA assets yearly. If you do, you could face severe financial consequences.

How much gold do you need in your portfolio?

The amount of capital required will affect the amount you make. A small investment of $5k-10k would be a great option if you are looking to start small. Then as you grow, you could move into an office space and rent out desks, etc. This will allow you to pay rent monthly, and not worry about it all at once. You only pay one month.

It's also important to determine what type business you'll run. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. If you are doing this type of thing, it is important to think about how much you can expect from each client.

As freelance work requires you to be paid freelancers, your monthly salary won't be as high as mine. You might get paid only once every six months.

So you need to decide what kind of income you want to generate before you know how much gold you will need.

I suggest starting with $1k-2k gold and building from there.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Lawful – WSJ

cftc.gov

How To

The growing trend of gold IRAs

The gold IRA trend is growing as investors seek ways to diversify their portfolios while protecting against inflation and other risks.

Owners can invest in gold bars and bullion with the gold IRA. It can be used for tax-free growth and provides an alternative investment option for those concerned about stocks and bonds.

A gold IRA allows investors the freedom to manage their wealth without worrying about volatility in the markets. Investors can protect themselves from inflation and other possible problems by using the gold IRA.

Investors also have the benefit of physical gold, which has unique properties such durability, portability and divisibility.

A gold IRA provides many additional benefits. One is the ability for heirs to quickly transfer ownership of gold. Another is the fact that gold is not considered a currency or a commodities by the IRS.

Investors looking for financial security are increasingly turning to the gold IRA.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Bitcoin's Bull Market: A Comprehensive Analysis

Sourced From: bitcoinmagazine.com/markets/is-bitcoins-bull-market-truly-back

Published Date: Fri, 28 Mar 2025 13:38:05 +0000