Bitcoin's recent price action has been a rollercoaster of highs and lows. However, even though bitcoin has set a new all-time high and had two years of a near-constant positive trajectory, we're yet to see a consistent influx of retail investors. The potential for a surge in retail participation and the possibility of elevating the bitcoin price to unprecedented levels are prospects that many investors are anxiously anticipating. In this article, we're going to explore when we might see these retail investors dive back into the bitcoin pool and whether their return could indeed propel BTC to even greater heights.

Active Address Growth and its Impact

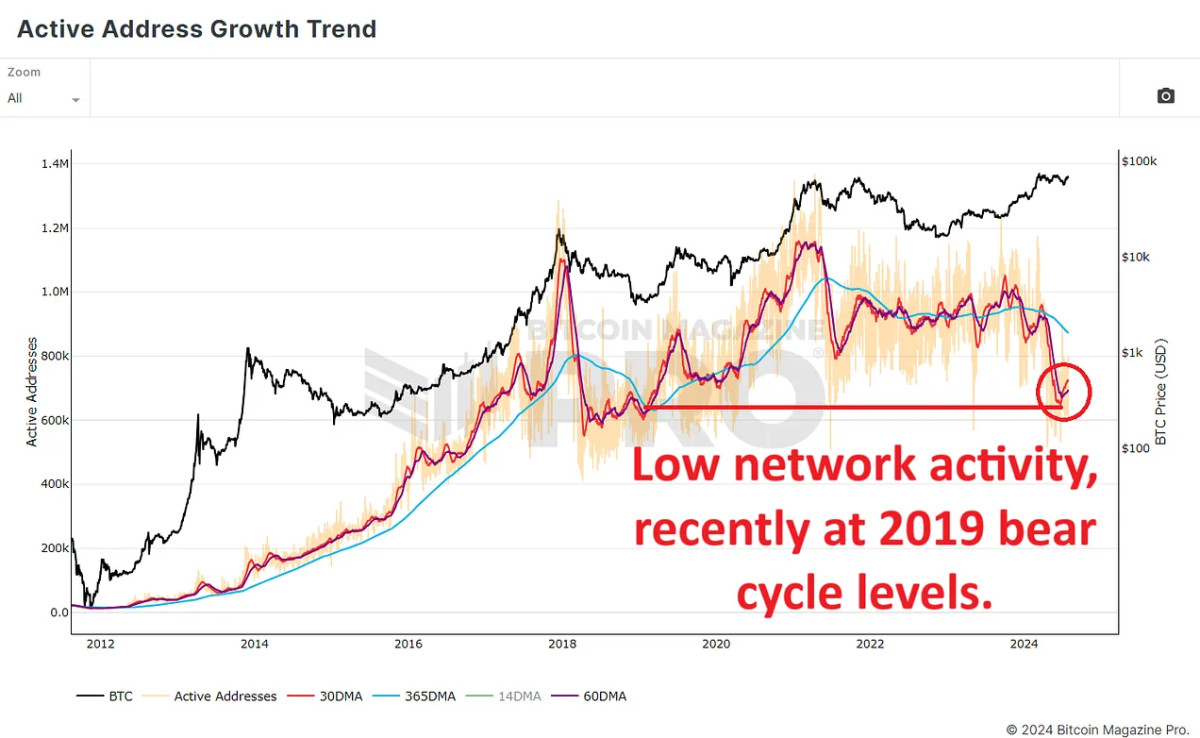

To anticipate this potential retail wave, it's important to scrutinize the trend of active address growth. Data sourced from Bitcoin Magazine Pro suggests a downward swing in the number of active network participants in recent months. The 365-day moving average (blue line), along with the 60-day (purple line) and 30-day averages (red line), tell a tale of decreased network activity. This drop takes the count of active users back to levels reminiscent of early 2019, following bitcoin's bear cycle, when prices hovered between $3,500 to $4,000.

This decline in active network users raises eyebrows about bitcoin's upside potential in the current cycle. Interestingly, despite bitcoin hitting a new record of roughly $74,000, there was no corresponding sustained uptick in network users, a stark departure from previous cycles.

The Necessary Inflow of New Capital

This trend could be a reflection of Bitcoin's evolving identity. Originally a digital peer-to-peer currency, Bitcoin is increasingly seen as a store of value. As a result, fewer people are using it for everyday transactions and are instead pouring capital into bitcoin as a long-term asset.

The Bitcoin HODL Waves & Realized Cap HODL Waves shed light on this shift. These metrics group Bitcoin network users based on the duration they've held their coins, as well as showing their influence on the accumulation price of BTC. Recent data reveals that about 20% of bitcoin has been held for three months or less, indicating that new users are entering the market, but as we can see from the average active addresses in the above data, not using Bitcoin as frequently as before.

Understanding Market Forces and Retail Involvement

A look at Bitcoin’s past cycles shows that a surge in retail activity often precedes market peaks. For example, in the 2017 and 2021 bull runs, retail interest spiked around 6 months before the price peaks. The current absence of a significant increase in retail interest, as evidenced by Google Trends, suggests we’re experiencing a more measured, and more sustainable market growth.

Another key consideration is the Bitcoin Open Interest chart, which measures the total value of open bitcoin futures contracts. Since late 2022, this metric hasn't shown a significant increase; in fact, we’ve seen a steady decline since the bear cycle lows (indicated by the declining red line in the chart below). Revealing that investors are now preferring to trade actual bitcoin rather than merely participating in derivatives trading. This indicates a shift in narrative where investors are more interested in holding bitcoin for the long haul rather than chasing short-term speculative gains.

Given current trends, the lack of a retail frenzy could be seen as a positive sign for the market's long-term prospects. As bitcoin approaches new record highs, keeping a close eye on the arrival of retail investors will be essential. If retail investors start entering the market in large numbers, will they fall back into old habits of pure FOMO buying, or will they continue to favor long-term holding?

In short, despite a fall in Bitcoin's active user metrics, the market shows signs of stability and long-term investment. The absence of immediate retail interest might seem bearish, but it's more likely to be bullish as it indicates a more measured and sustainable growth trajectory.

For a more in-depth look into this topic, check out a recent YouTube video here:

Frequently Asked Questions

Is it a good retirement strategy to buy gold?

Although gold investment may not seem appealing at first glance due to the high average global gold consumption, it's worth considering.

The best form of investing is physical bullion, which is the most widely used. There are many ways to invest your gold. You should research all options thoroughly before making a decision on which option you prefer.

If you're not looking to secure your wealth, it may be worth considering purchasing shares in mining equipment or companies that extract gold. If you require cash flow, gold stocks can work well.

You also can put your money into exchange-traded funds (ETFs), which essentially give you exposure to the price of gold by holding gold-related securities instead of actual gold. These ETFs usually include stocks of precious metals refiners or gold miners.

How much gold can you keep in your portfolio

The amount that you want to invest will dictate how much money it takes. If you want to start small, then $5k-$10k would be great. As your business grows, you might consider renting out office space or desks. You don't need to worry about paying rent every month. You only pay one month.

It's also important to determine what type business you'll run. In my case, I am running a website creation company, so we charge clients around $1000-2000/month depending on what they order. This is why you should consider what you expect from each client if you're doing this kind of thing.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. So you might only get paid once every 6 months or so.

You need to determine what kind or income you want before you decide how much of it you will need.

I recommend starting with $1k to $2k of gold, and then growing from there.

How Much of Your IRA Should Be Made Up Of Precious Metals

You should remember that precious metals are not only for the wealthy. You don't have to be rich to invest in them. You can actually make money without spending a lot on gold or silver investments.

You might consider purchasing physical coins, such as bullion bars and rounds. Also, you could buy shares in companies producing precious metals. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

You'll still get the benefit of precious metals no matter which country you live in. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

Their prices rise with time, which is a different to traditional investments. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

How much money should I put into my Roth IRA?

Roth IRAs are retirement accounts where you deposit your own money tax-free. These accounts are not allowed to be withdrawn before the age of 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. First, you cannot touch your principal (the original amount deposited). You cannot withdraw more than the original amount you contributed. If you are able to take out more that what you have initially contributed, you must pay taxes.

You cannot withhold your earnings from income taxes. So, when you withdraw, you'll pay taxes on those earnings. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. Let's also say that you earn $10,000 per annum after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. This leaves you with $6,500 remaining. The amount you can withdraw is limited to the original contribution.

If you took $4,000 from your earnings, you would still owe taxes for the $1,500 remaining. Additionally, half of your earnings would be lost because they will be taxed at 50% (half the 40%). So even though your Roth IRA ended up having $7,000, you only got $4,000.

There are two types if Roth IRAs, Roth and Traditional. A traditional IRA allows for you to deduct pretax contributions of your taxable income. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. There are no restrictions on the amount you can withdraw from a Traditional IRA.

Roth IRAs don't allow you deduct contributions. Once you are retired, however, you may withdraw all of your contributions plus accrued interest. There is no minimum withdrawal requirement, unlike traditional IRAs. You don't need to wait until your 70 1/2 year old age before you can withdraw your contribution.

What precious metal should I invest in?

This question is dependent on the amount of risk you are willing and able to accept as well as the type of return you desire. While gold is considered a safe investment option, it can also be a risky choice. Gold may not be right for you if you want quick profits. If patience and time are your priorities, silver is the best investment.

If you're not looking to make quick money, gold is probably your best choice. If you want to invest in long-term, steady returns, silver is a better choice.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

irs.gov

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options? Types, Spreads, Example, and Risk Metrics

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Legal – WSJ

How To

How to keep physical gold in an IRA

An easy way to invest gold is to buy shares from gold-producing companies. However, there are risks associated with this strategy. It isn't always possible for these companies to survive. If they survive, there's still the risk of losing money due to fluctuations in the price of gold.

The alternative is to buy physical gold. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. This option offers the advantages of being able to purchase gold at low prices and easy access (you don’t need to deal directly with stock exchanges). It's easier to track how much gold is in your possession. You'll get a receipt showing exactly what you paid, so you'll know if any taxes were missed. You also have a lower chance of theft than stocks.

However, there are disadvantages. You won't get the bank's interest rates or investment money. Additionally, you won’t be able diversify your holdings. You will remain with the same items you bought. The taxman might also ask you questions about where your gold is located.

BullionVault.com offers more information on buying gold for an IRA.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Bitcoin’s Anticipated Retail Resurgence

Sourced From: bitcoinmagazine.com/markets/bitcoins-anticipated-retail-resurgence-

Published Date: Fri, 02 Aug 2024 16:34:26 GMT