Jurrien Timmer, the Director of Global Macro at Fidelity, recently made a significant statement about Bitcoin, referring to it as "exponential gold" and a rising star in the realm of "store of value" assets. Timmer's insights were shared through a series of posts where he delved into Bitcoin's evolving role in the financial landscape.

Bitcoin's Unique Position in the Market

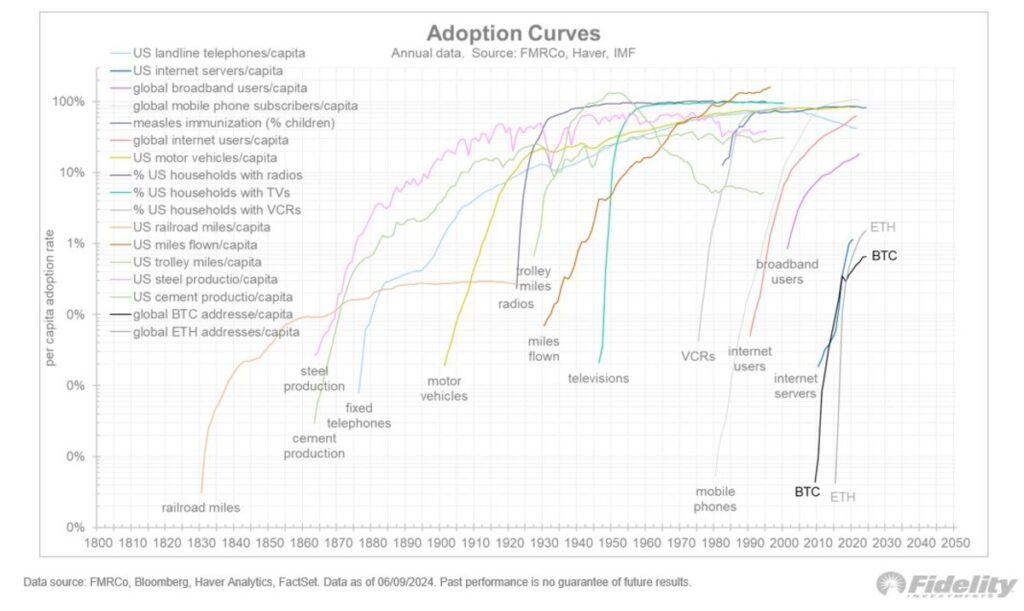

Timmer highlighted Bitcoin's exceptional position in the market and drew parallels between its growth trajectory and the exponential adoption curves witnessed in technologies such as the internet and mobile phones. He underscored that Bitcoin's scarcity and increasing acceptance as a digital asset are key factors that contribute to its potential as a long-term store of value, comparable to gold.

The Role of Adoption and Network Growth

In his posts, Timmer emphasized the importance of Bitcoin's adoption rate and network growth in determining its value. While acknowledging that Bitcoin is still in its nascent stages compared to traditional assets, he pointed out that its adoption is rapidly accelerating, hinting at the possibility of Bitcoin emerging as a significant store of value in the future.

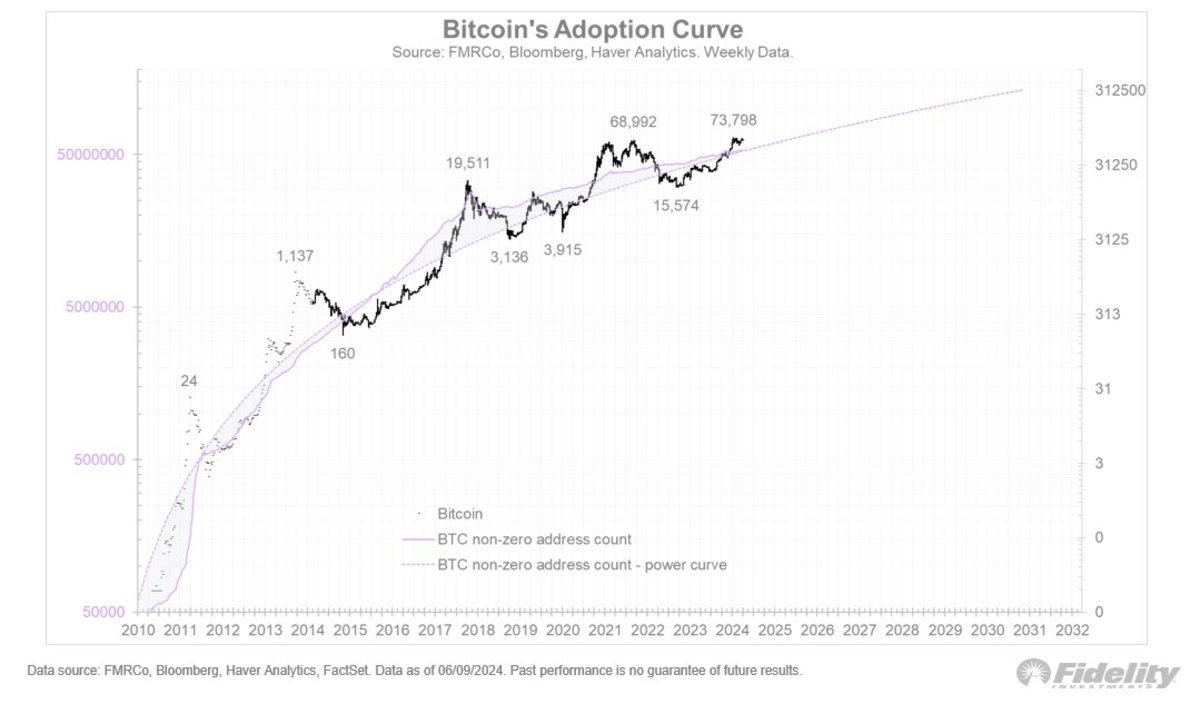

"The chart below illustrates Bitcoin's expanding network following a simple power curve. The number of non-zero addresses has been aligning with this power curve, with Bitcoin's price fluctuating around it akin to a pendulum," he remarked. "Such is the unique series of boom-bust cycles that Bitcoin experiences."

Institutional Recognition and Future Prospects

Timmer's endorsement echoes a broader trend among institutional investors who are increasingly acknowledging Bitcoin's potential. His perspective adds to the growing acceptance of Bitcoin within the financial sector, indicating that it could play a crucial role in future investment strategies.

"The growth of Bitcoin's network has shown signs of deceleration in recent months, yet its price continues to climb," he noted. "This disparity between price and adoption could elucidate why Bitcoin's momentum has slightly slowed on its path to potential new all-time highs. The pendulum has its limits. To sustain new highs, the network might need to ramp up once again."

Frequently Asked Questions

How Does Gold Perform as an Investment?

Gold's price fluctuates depending on the supply and demand. It is also affected by interest rates.

Gold prices are volatile due to their limited supply. You must also store physical gold somewhere to avoid the risk of it becoming stale.

What Should Your IRA Include in Precious Metals?

It's important to understand that precious metals aren't only for wealthy people. You don't need to be rich to make an investment in precious metals. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You could also consider buying physical coins like bullion bars, rounds or bullion bars. Shares in precious metals-producing companies could be an option. Your retirement plan provider may offer an IRA rollingover program.

No matter what your preference, precious metals will still be of benefit to you. These metals are not stocks, but they can still provide long-term growth.

And unlike traditional investments, they tend to increase in value over time. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

What are some of the advantages and disadvantages to a gold IRA

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. An IRA is a great option for those who want to save money, but don't want tax on any interest earned. This type of investment has its downsides.

You could lose all of your accumulated money if you take out too much from your IRA. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. If you do decide to withdraw funds from your IRA, you'll likely need to pay a penalty fee.

Another disadvantage is that you must pay fees to manage your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management costs ranging from $10-50.

Insurance will be required if you would like to keep your cash out of banks. In order to make a claim, most insurers will require that you have a minimum amount in gold. You might be required to buy insurance that covers losses up to $500,000.

If you are considering a Gold IRA, you need to first decide how much of it you would like to use. Some providers limit how many ounces you can keep. Others let you choose your weight.

It is also up to you to decide whether you want to purchase physical gold or futures. Gold futures contracts are more expensive than physical gold. Futures contracts provide flexibility for purchasing gold. They enable you to establish a contract with an expiration date.

You'll also need to decide what kind of insurance coverage you want. The standard policy does not include theft protection or loss caused by fire, flood, earthquake. It does provide coverage for damage from natural disasters, however. Additional coverage may be necessary if you reside in high-risk areas.

Insurance is not enough. You also need to think about the cost of gold storage. Storage costs are not covered by insurance. Safekeeping costs can be as high as $25-40 per month at most banks.

You must first contact a qualified custodian before you open a gold IRA. A custodian is responsible for keeping track of your investments. They also ensure that you adhere to federal regulations. Custodians don't have the right to sell assets. Instead, they must keep your assets for as long you request.

Once you've decided which type of IRA best suits your needs, you'll need to fill out paperwork specifying your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. It is also important to specify how much money you will invest each month.

You will need to fill out the forms and send them to your chosen provider together with a check for small deposits. The company will then review your application and mail you a letter of confirmation.

When opening a gold IRA, you should consider using a financial planner. Financial planners are experts in investing and will help you decide which type of IRA works best for your situation. They can help you find cheaper insurance options to lower your costs.

Is gold a good investment IRA option?

Anyone who is looking to save money can make gold an excellent investment. You can diversify your portfolio with gold. There is much more to gold than meets your eye.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is sometimes called the “oldest currency in the world”.

But gold, unlike paper currency, which is created by governments, is mined out from the ground. This makes it highly valuable as it is hard and rare to produce.

The supply and demand for gold determine the price of gold. The economy that is strong tends to be more affluent, which means there are less gold miners. This results in gold prices rising.

The flip side is that people tend to save money when the economy slows. This increases the production of gold, which in turn drives down its value.

This is why both individuals as well as businesses can benefit from investing in gold. If you have gold to invest, you will reap the rewards when the economy expands.

In addition to earning interest on your investments, this will allow you to grow your wealth. You won't lose your money if gold prices drop.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement funds

cftc.gov

finance.yahoo.com

How To

Gold Roth IRA guidelines

You should start investing early to ensure you have enough money for retirement. It is best to start saving for retirement as soon you can (typically at age 50). It is important to invest enough money each and every year to ensure you get adequate growth.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles enable you to make contributions while not paying any taxes on the earnings, until they are withdrawn. These savings vehicles can be a great option for individuals who don't qualify for employer matching funds.

Save regularly and continue to save over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————–

By: Nik Hoffman

Title: Bitcoin: The Exponential Gold of the Digital Age

Sourced From: bitcoinmagazine.com/markets/bitcoin-is-exponential-gold-says-fidelitys-director-of-global-macro

Published Date: Thu, 13 Jun 2024 19:09:57 GMT