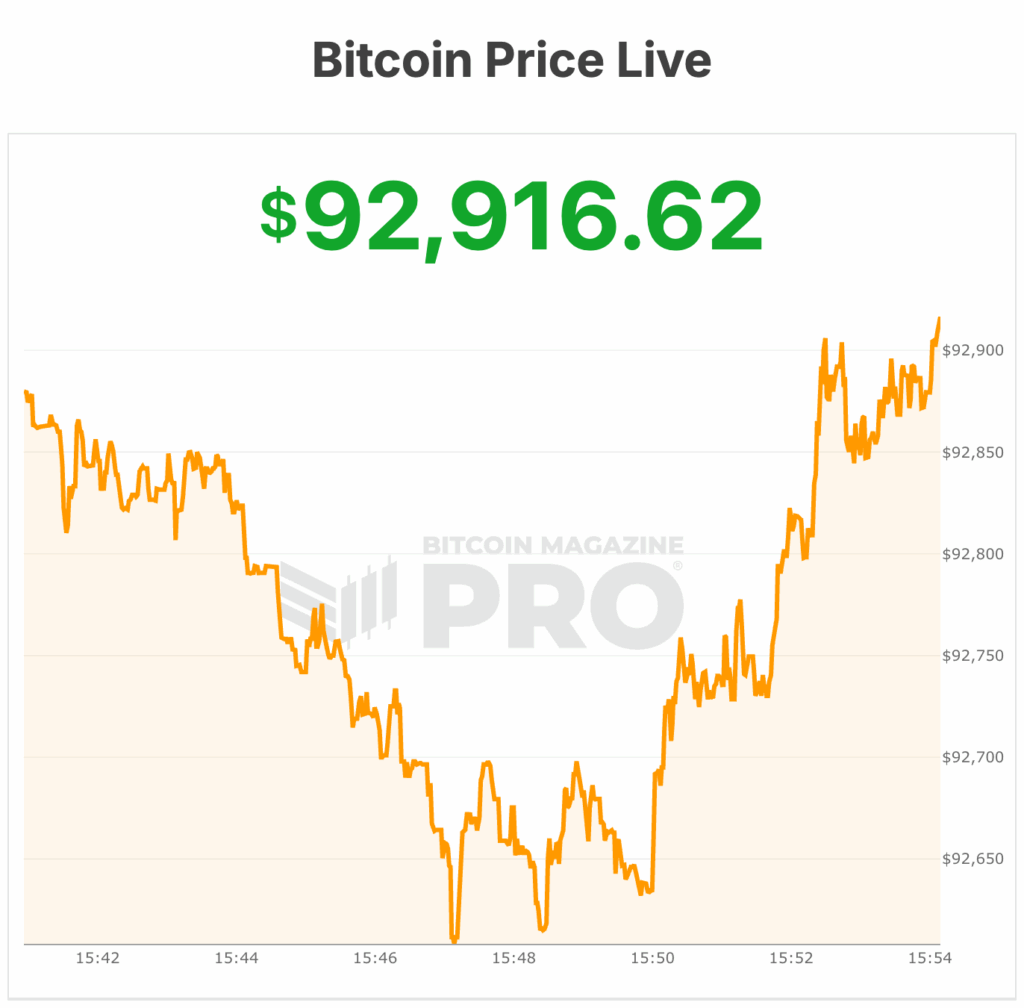

As we dive into the latest on Bitcoin's price movements, it's evident that the market is experiencing some turbulence. The price of Bitcoin has been dancing around the $93,000 mark, showcasing a battle between bulls and bears. Let's explore what's driving this uncertainty and how it impacts investors.

The Impact of Market Sentiment

Volatility and Liquidity Concerns

One of the key factors influencing Bitcoin's price is the growing bearish sentiment prevailing across the market. Volatility is on the rise, and liquidity is thinning, making it easier for even small trades to sway prices significantly. This scenario is akin to a small pebble creating ripples in a pond, amplifying market movements.

The Aftermath of Liquidation Events

Recent liquidation events triggered by trade uncertainties have added fuel to the fire. The rush to unwind long positions resulted in a massive sell-off, causing billions of dollars to exit leveraged positions in a short span. This led to a historic drop in Bitcoin's price, marking a significant event in the cryptocurrency world.

Evaluating Bitcoin's Bearish Trend

Key Price Levels and Support Zones

Analysts have identified critical price levels that are now acting as strong resistance for Bitcoin. The breach below $96,000 set a bearish tone, with resistance mounting above $94,000. Sellers are looming at various price points, creating hurdles for any upward movement.

In terms of support, key zones at $83,000–$84,000 and $69,000–$72,000 are crucial for stabilizing Bitcoin's price. As volatility persists, a potential slide into the mid-$80K range is becoming increasingly plausible, making it essential for investors to monitor these levels closely.

Outlook for Bitcoin's Price Trajectory

With Bitcoin retracing more than 25% from its recent peak, discussions are emerging about the possibility of the 2025 cycle reaching its peak. While historical trends suggest major highs between September and December, this year's cycle appears to deviate slightly. The prospect of a late-cycle peak in Q1 2026 is on the horizon, especially with other markets showing signs of fatigue.

Conclusion: Navigating the Bitcoin Price Rollercoaster

As Bitcoin continues its price fluctuations, staying informed and agile is key for investors. Understanding the market sentiment, monitoring crucial price levels, and anticipating potential scenarios are vital for navigating the cryptocurrency landscape. Whether you're a seasoned investor or a newcomer, adapting to the dynamic nature of Bitcoin's price movements is crucial for long-term success.

Frequently Asked Questions

What tax is gold subject in an IRA

The tax on the sale of gold is based on its fair market value when sold. You don't pay taxes when you buy gold. It is not considered income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

As collateral for loans, gold is possible. Lenders try to maximize the return on loans that you take against your assets. For gold, this means selling it. However, there is no guarantee that the lender would do this. They might just hold onto it. They might decide that they want to resell it. The bottom line is that you could lose potential profit in any case.

If you plan on using your gold as collateral, then you shouldn't lend against it. If you don't plan to use it as collateral, it is better to let it be.

Should You Invest in Gold for Retirement?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. You can invest in both options if you aren't sure which option is best for you.

Not only is it a safe investment but gold can also provide potential returns. It's a great investment for retirees.

Although most investments promise a fixed rate of return, gold is more volatile than others. Because of this, gold's value can fluctuate over time.

This doesn't mean that you should not invest in gold. This just means you need to account for fluctuations in your overall portfolio.

Another benefit of gold is that it's a tangible asset. Gold is much easier to store than bonds and stocks. It is also easily portable.

As long as you keep your gold in a secure location, you can always access it. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold usually rises when stocks fall.

Another benefit to investing in gold? You can always sell it. You can easily liquidate your investment, just as with stocks. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

You shouldn't buy too little at once. Start with a few ounces. Then add more as needed.

Don't expect to be rich overnight. It's not to get rich quickly, but to accumulate enough wealth to no longer need Social Security benefits.

And while gold might not be the best investment for everyone, it could be a great supplement to any retirement plan.

How to Open a Precious Metal IRA?

The first step is to decide if you want an Individual Retirement Account (IRA). You must complete Form 8606 to open an account. To determine which type of IRA you qualify for, you will need to fill out Form 5204. This form should not be completed more than 60 days after the account is opened. Once this has been completed, you can begin investing. You can also choose to pay your salary directly by making a payroll deduction.

If you opt for a Roth IRA, you must complete Form 8903. Otherwise, the process is identical to an ordinary IRA.

To qualify for a precious Metals IRA, there are specific requirements. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. Contributions must be made on a regular basis. These rules apply whether you're contributing through an employer or directly from your paychecks.

An IRA for precious metals allows you to invest in gold and silver as well as platinum, rhodium, and even platinum. However, you can't purchase physical bullion. This means you won’t be able to trade stocks and bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option is offered by some IRA providers.

However, investing in precious metals via an IRA has two serious drawbacks. They aren't as liquid as bonds or stocks. It is therefore harder to sell them when required. They also don't pay dividends, like stocks and bonds. You'll lose your money over time, rather than making it.

How much are gold IRA fees?

Six dollars per month is the fee for an Individual Retirement Account (IRA). This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

If you wish to diversify your portfolio, you may need to pay additional fees. The type of IRA you choose will determine the fees. Some companies offer free checking, but charge monthly fees for IRAs.

In addition, most providers charge annual management fees. These fees vary from 0% to 11%. The average rate is.25% each year. However, these rates are typically waived if you use a broker like TD Ameritrade.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

irs.gov

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options? Types, Spreads, Example and Risk Metrics

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

The growing trend of gold IRAs

As investors seek to diversify their portfolios while protecting themselves from inflation, the trend towards gold IRAs is on the rise.

The gold IRA allows owners to invest in physical gold bullion and bars. It can be used as a tax-free way to grow and it is an alternative investment option for people who are not comfortable with stocks or bonds.

Investors can have confidence in their investments and avoid market volatility with a gold IRA. They can use the gold IRA to protect themselves against inflation and other potential problems.

Physical gold is also a great investment option, as it has unique properties like durability, portability, divisibility, and portability.

Additional benefits of the gold IRA include the ability to quickly pass ownership to heirs. Additionally, the IRS does not consider gold a money or a commodity.

This is why the gold IRA has become increasingly popular with investors looking to provide financial security during times of financial uncertainty.

—————————————————————————————————————————————————————————————–

By: Micah Zimmerman

Title: Bitcoin Price Update: Bears Hold Sway as Bitcoin Hovers at $93,000

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-teeters-at-93000

Published Date: Tue, 18 Nov 2025 21:01:41 +0000