The price of Bitcoin took a nosedive below $50,000 on Monday, hitting lows that haven't been witnessed in over six months amidst a broad global market sell-off.

Global Market Turmoil Impacts Bitcoin

Bitcoin experienced a sharp drop of up to 20%, hovering around $49,000 before showing a slight recovery to trade above the $50,000 mark once more. This significant decline coincided with plummeting stock markets worldwide, driven by concerns of an impending recession.

Market Performance Across the Globe

Japan's Nikkei index plummeted by more than 8%, marking its most substantial two-day decline since 1987. Asian and European markets are currently facing some of their most severe losses in history. In the United States, the Nasdaq, dominated by tech stocks, slipped over 20% from its peak, entering correction territory. The S&P 500 also saw a nearly 4% drop over the past week.

Factors Contributing to the Market Downturn

Increasing interest rates, underwhelming tech company earnings, and indicators of economic fragility, such as Friday's underwhelming U.S. job report, have all shaken investor confidence. Consequently, the Bitcoin market mirrored the downward trend of stocks, with Bitcoin slipping below $50,000 for the first time since February. The total market capitalization of Bitcoin plummeted by almost $200 billion over the weekend.

Bitcoin Reacts to Market Uncertainty

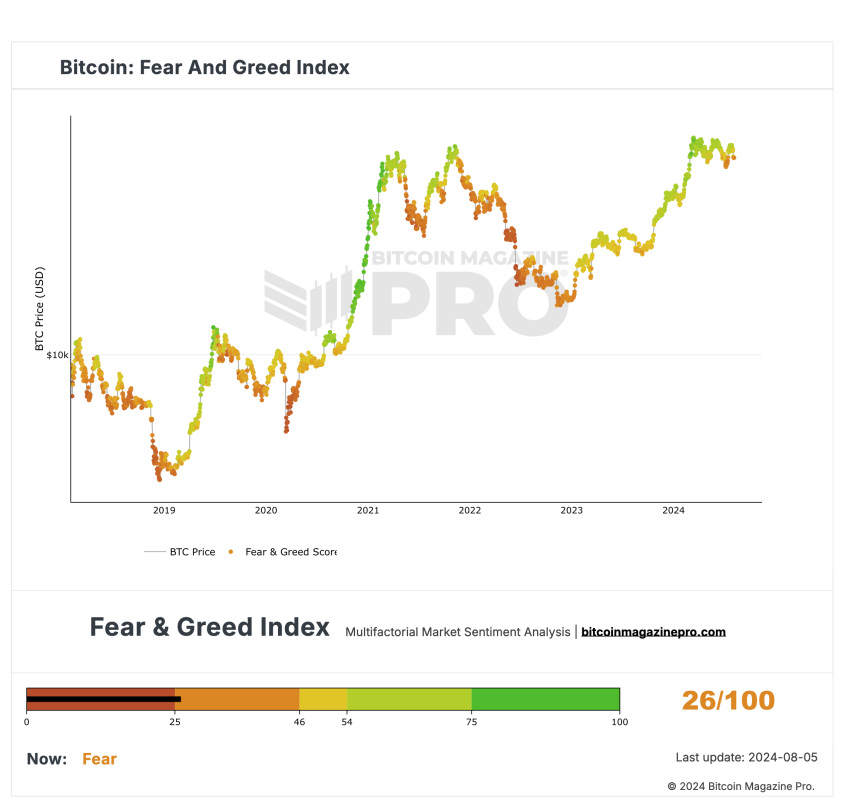

The Bitcoin fear and greed index shifted into "fear" territory as prices approached levels not seen in half a year. Despite this, Bitcoin has bounced back from similar market crashes on numerous occasions, including a 20% drop in a single day last November.

Outlook and Analyst Perspectives

While some analysts caution that ongoing declines could signify the conclusion of the bull market, potentially leading to a prolonged bear phase, others argue that this is merely a minor correction preceding a new record high. They point to the infusion of additional liquidity into the global market as a catalyst for potential future growth.

The $50,000 threshold represents a crucial support level for Bitcoin. This recent downturn underscores the cryptocurrency's volatility and its correlation with speculative equities. Despite setbacks, Bitcoin has historically bounced back from sell-offs, resuming its upward trajectory over the long term.

Frequently Asked Questions

How much gold should your portfolio contain?

The amount that you want to invest will dictate how much money it takes. For a small start, $5k to $10k is a good range. As you grow, you can move into an office and rent out desks. This will allow you to pay rent monthly, and not worry about it all at once. Only one month's rent is required.

It's also important to determine what type business you'll run. My website design company charges clients $1000-2000 per month depending on the order. You should also consider the expected income from each client when you do this type of thing.

You won't get a monthly paycheck if you work freelance. This is because freelancers are paid. You may get paid just once every 6 months.

Decide what kind of income do you want before you calculate how much gold is needed.

I recommend starting with $1k-$2k of gold and growing from there.

What are the advantages of a IRA with a gold component?

A gold IRA has many benefits. It's an investment vehicle that lets you diversify your portfolio. You control how much money goes into each account and when it's withdrawn.

You can also rollover funds from other retirement accounts to a gold IRA. If you are planning to retire early, this makes it easy to transition.

The best part about gold IRAs? You don't have to be an expert. These IRAs are available at all banks and brokerage houses. Withdrawals can happen automatically, without any fees or penalties.

There are, however, some drawbacks. Gold is known for being volatile in the past. It's important to understand the reasons you're considering investing in gold. Are you looking for growth or safety? Do you want to use it as an insurance strategy or for long-term growth? Only once you know, that will you be able to make an informed decision.

If you plan to keep your gold IRA indefinitely, you'll probably want to consider buying more than one ounce of gold. A single ounce will not be sufficient to meet all your requirements. You may need several ounces, depending on what you intend to do with your precious gold.

You don't need to have a lot of gold if you are selling it. You can even live with just one ounce. But, those funds will not allow you to buy anything.

What are the fees associated with an IRA for gold?

The Individual Retirement Account (IRA), fee is $6 per monthly. This includes account maintenance fees and investment costs for your chosen investments.

To diversify your portfolio you might need to pay additional charges. These fees vary depending on what type of IRA you choose. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

Most providers also charge an annual management fee. These fees vary from 0% to 11%. The average rate for a year is.25%. These rates are often waived if a broker like TD Ameritrade is used.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

bbb.org

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

cftc.gov

finance.yahoo.com

How To

Gold IRAs: A Growing Trend

Investors are increasingly turning to gold IRAs as a way to diversify and protect their portfolios from inflation.

Gold IRA owners can now invest in physical gold bullion or bars. It is tax-free and can be used by investors who aren't concerned about stocks and bond.

A gold IRA allows investors the freedom to manage their wealth without worrying about volatility in the markets. They can also use the gold IRA as a protection against potential problems like inflation.

Investors also benefit from physical gold's unique properties, such as durability and portability.

Additional benefits of the gold IRA include the ability to quickly pass ownership to heirs. Additionally, the IRS does not consider gold a money or a commodity.

This is why the gold IRA has become increasingly popular with investors looking to provide financial security during times of financial uncertainty.

—————————————————————————————————————————————————————————————–

By: Vivek Sen

Title: Bitcoin Price Plunges Below $50K Amid Global Market Turmoil

Sourced From: bitcoinmagazine.com/business/bitcoin-dips-below-50k-as-global-market-crashes

Published Date: Mon, 05 Aug 2024 10:27:15 GMT