As we witness fluctuations in the Bitcoin price, uncertainty looms over whether we're witnessing a temporary dip or the emergence of a new bear market. Understanding these market dynamics is crucial to making informed decisions that can impact your investment strategy.

Decoding Market Behavior

Interpreting Short-Term Holder Realized Price

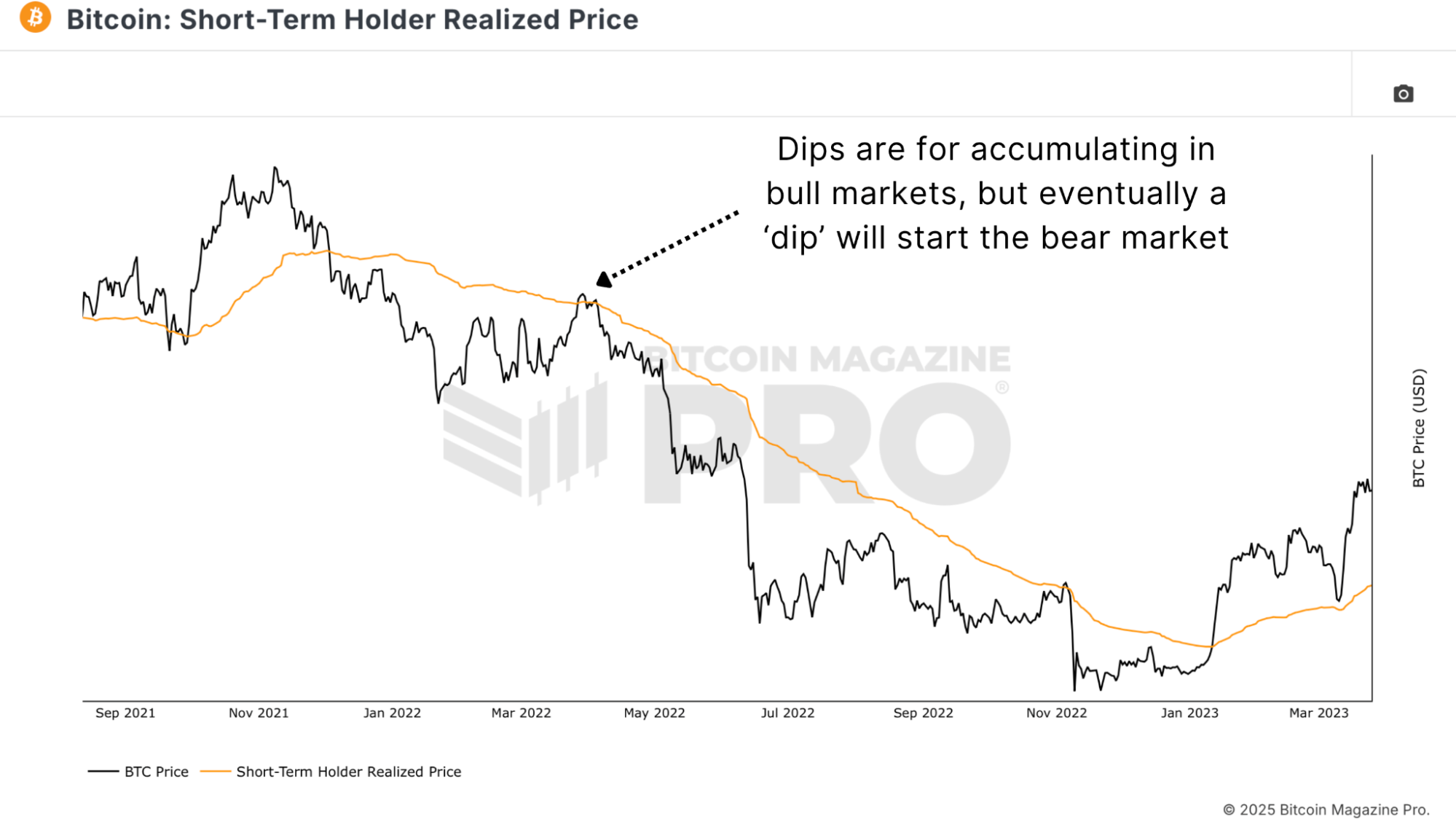

Looking back at historical patterns, we can draw parallels between current market movements and past trends. The Short-Term Holder Realized Price chart unveils how certain price levels act as critical resistance points, guiding us on potential recovery opportunities.

Insights from MVRV Z-Score and Bitcoin Realized Price

Analyzing metrics like MVRV Z-Score and Bitcoin Realized Price offers a deeper understanding of the market's cost basis. These indicators shed light on where the market stands and provide valuable insights into potential buying opportunities.

Identifying Market Inflection Points

Value Days Destroyed (VDD) Multiple: A Key Indicator

Monitoring the Value Days Destroyed (VDD) Multiple helps identify stress points among long-term holders. A spike in this metric could signal a market turning point, guiding investors on potential entry or exit strategies.

Long-Term Holder Supply: A Crucial Trend

Observing the trend in Long-Term Holder Supply is essential. A stabilization followed by an increase in this supply could indicate a potential market bottom, highlighting the importance of patient investor participation.

Strategies for Turbulent Times

Navigating Uncertainty with Caution

While market conditions remain uncertain, adopting a defensive approach by refraining from impulsive buying, waiting for confirmation signals, and aligning with macro trends can mitigate risks and enhance decision-making.

Embracing Opportunity with Confidence

Positioning oneself strategically in areas of high probability, backed by thorough analysis and confirmation, can pave the way for a more confident and calculated investment approach in the volatile cryptocurrency market.

Conclusion: A Roadmap to Informed Decisions

By staying informed, assessing critical market indicators, and embracing a cautious yet confident strategy, investors can navigate the turbulent waters of the Bitcoin market with resilience and clarity. Remember, the key lies in prudent decision-making based on a comprehensive understanding of market dynamics.

For further insights on navigating Bitcoin price fluctuations, check out our informative YouTube video: My Bitcoin Strategy Going Forward

Frequently Asked Questions

What precious metal should I invest in?

Answering this question will depend on your willingness to take some risk and the return you seek. Although gold has traditionally been considered a safe investment choice, it may not be the most profitable. You might not want to invest in gold if you're looking for quick returns. Silver is a better investment if you have patience and the time to do it.

If you don’t want to be rich fast, gold might be the right choice. Silver may be a better option for investors who want long-term steady returns.

What proportion of your portfolio should you have in precious metals

To answer this question we need to first define precious metals. Precious metals refer to elements with a very high value relative other commodities. This makes them valuable in investment and trading. Gold is by far the most common precious metal traded today.

However, many other types of precious metals exist, including silver and platinum. The price of gold tends to fluctuate but generally stays at a reasonably stable level during periods of economic turmoil. It is also relatively unaffected both by inflation and deflation.

In general, prices for precious metals tend increase with the overall marketplace. That said, they do not always move in lockstep with each other. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. This is because investors expect lower rates of interest, which makes bonds less attractive investments.

The opposite effect happens when the economy is strong. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. They become less expensive and have a lower value because they are limited.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. Additionally, since the prices of precious metals tend to rise and fall together, it's best to invest in several different types of precious metals rather than just focusing on one type.

How to Open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. If you do, you must open the account by completing Form 8606. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form should be filled within 60 calendar days of opening the account. After this, you are ready to start investing. You can also choose to pay your salary directly by making a payroll deduction.

For a Roth IRA you will need to complete Form 8903. The process for an ordinary IRA will not be affected.

To qualify for a precious Metals IRA, there are specific requirements. The IRS stipulates that you must have earned income and be at least 18-years old. You can't earn more than $110,000 per annum ($220,000 in married filing jointly) for any given tax year. Additionally, you must make regular contributions. These rules apply to contributions made directly or through employer sponsorship.

You can use a precious-metals IRA to purchase gold, silver and palladium. But, you'll only be able to purchase physical bullion. This means you can't trade shares of stock and bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. Some IRA providers offer this option.

There are two major drawbacks to investing via an IRA in precious metals. First, they are not as liquid or as easy to sell as stocks and bonds. This makes it harder to sell them when needed. They also don't pay dividends, like stocks and bonds. Therefore, you will lose money over time and not gain it.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

cftc.gov

bbb.org

forbes.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's not legal – WSJ

How To

Gold IRAs are a growing trend

As investors look for ways to diversify their portfolios and protect themselves against inflation, the gold IRA trend is on the rise.

Gold IRA owners can now invest in physical gold bullion or bars. This IRA can be used to grow your wealth tax-free and is an alternative option to stocks and bonds.

Investors can have confidence in their investments and avoid market volatility with a gold IRA. They can also use the gold IRA as a protection against potential problems like inflation.

Investors also get the unique benefits of owning physical Gold, including its durability, portability, flexibility, and divisibility.

The gold IRA also offers many other benefits, such as the ability to quickly transfer the ownership of the gold to heirs, and the fact the IRS doesn't consider gold a currency.

This is why the gold IRA has become increasingly popular with investors looking to provide financial security during times of financial uncertainty.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Bitcoin Price Analysis: Navigating Volatility with Confidence

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-dip-or-new-bear-market

Published Date: Fri, 21 Nov 2025 14:38:50 +0000