Greetings, crypto enthusiasts! Today, we delve into the recent developments in the world of Bitcoin and how the looming FOMC rate cuts might impact its trajectory. Let's explore the insights together to grasp the potential opportunities ahead.

Bitcoin Price Volatility Unveiled

Price Movements Last Week

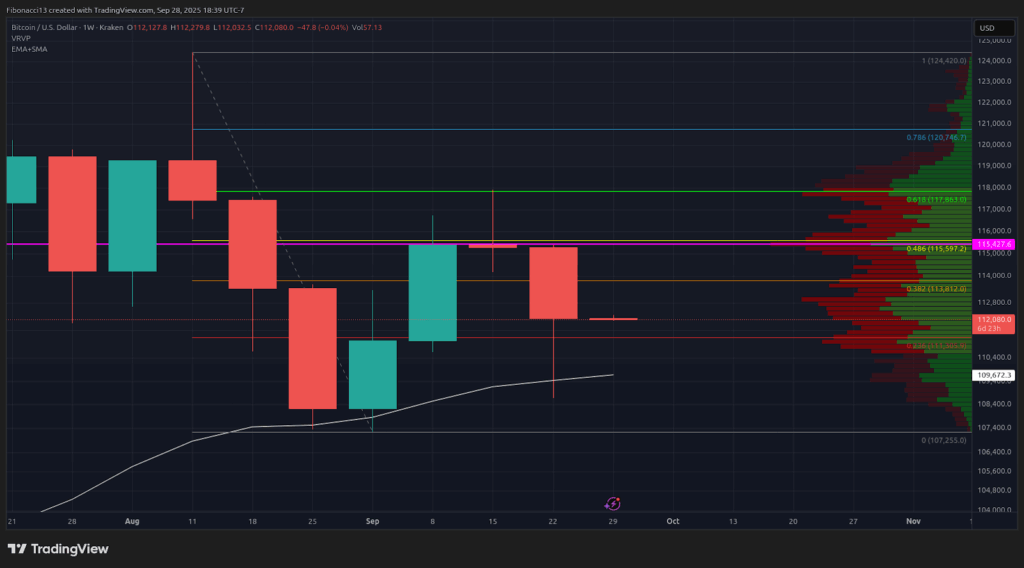

Last week, Bitcoin encountered a significant drop, testing the $111,800 mark. Despite a brief resurgence towards the $113,800 resistance and the 21-day EMA at $114,000, it faced rejection, spiraling back to the $111,300 support level. The subsequent rebound led to another test at the 21-day EMA. However, the resistance persisted, causing a dip just below the $109,500 support on Thursday, with the week concluding at $112,225.

Current Support and Resistance Levels

With the week's closure above the 21-week EMA at $109,500, maintaining this support becomes crucial for bullish momentum. The $109,500 mark should serve as the baseline, while a breach could signal a downward trend towards $105,000 and possibly $102,000. Further decline could pave the way to long-term support at $96,000.

Conversely, bullish scenarios involve surpassing the $115,500 resistance to reaffirm an upward trend. A breakthrough here would embolden the bulls to challenge the $118,000 resistance and potentially surge towards $121,000 for new highs.

Anticipated Trends for the Week

Short-Term Predictions

This week might witness a retest of the $109,500 support early on, with a chance to solidify it for an upward move towards $113,800. Surmounting the $115,500 barrier could be demanding, necessitating robust buying pressure. The bearish bias persists on the weekly chart, hinting at a likely retention of the $113,800 resistance. A breach below $109,500 could trigger a substantial price decline, targeting the $105,000 to $102,000 support range.

Considering the market mood, currently leaning bearish, a resilient effort from the bulls is imperative to defend the 21-week EMA support.

Insights into Future Prospects

Market Analysis and Expectations

Looking ahead, the weekly chart remains bearish, demanding a shift in momentum for positive price actions. A strong finish to the week could tilt the scales in favor of the bulls. Moreover, post-September's rate cut, attention shifts to potential cuts in the upcoming FOMC meetings, driving market sentiments. Investors await US financial indicators for insights supporting additional rate adjustments. Any hurdles in the data might trigger bearish trends and increased selling pressure.

Terminology Simplified

- Bulls/Bullish: Optimistic buyers anticipating price hikes.

- Bears/Bearish: Pessimistic sellers foreseeing price drops.

- Support: A level where the price ideally holds, weakening with repeated tests.

- Resistance: A level likely to obstruct price movements, losing strength with multiple rejections.

- EMA: Exponential Moving Average, emphasizing recent prices for faster trend identification.

By embracing these insights, you can navigate the volatile crypto landscape with more confidence. Stay informed, stay proactive, and let's seize the opportunities together!

Frequently Asked Questions

How do you withdraw from an IRA that holds precious metals?

First, determine if you would like to withdraw money directly from an IRA. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, calculate how much money your IRA will allow you to withdraw. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. Traditional IRAs let you withdraw money tax-free after you turn 59 1/2, while Roth IRAs require you to pay income taxes upfront but allow you access the earnings later without paying any additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. Brokers often offer promotional offers and signup bonuses to encourage people into opening accounts. However, a debit card is better than a card. This will save you unnecessary fees.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage areas will accept bullion, while others require you to purchase individual coins. You will need to weigh each one before making a decision.

For example, storing bullion bars requires less space because you aren't dealing with individual coins. But you will have to count each coin separately. However, individual coins can be stored to make it easy to track their value.

Some prefer to store their coins in a vault. Others prefer to store them in a safe deposit box. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

Should You Purchase Gold?

Gold was considered a safety net for investors during times of economic turmoil in the past. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

This could be changing, according to some experts. Experts predict that gold prices will rise sharply in the wake of another global financial collapse.

They also point out that gold is becoming popular because of its perceived value and potential return.

Consider these things if you are thinking of investing in gold.

- Consider whether you will actually need the money that you are saving for retirement. It is possible to save for retirement while still investing your gold savings. However, when you retire at age 65, gold can provide additional protection.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each account offers different levels of security and flexibility.

- Last but not least, gold doesn't provide the same level security as a savings account. If you lose your gold coins, you may never recover them.

If you are thinking of buying gold, do your research. If you already have gold, make sure you protect it.

Should you Invest In Gold For Retirement?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. Consider investing in both.

Gold is a safe investment and can also offer potential returns. It is a good choice for retirees.

Gold is more volatile than most other investments. Its value fluctuates over time.

This doesn't mean that you should not invest in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another advantage to gold is that it can be used as a tangible asset. Gold is more convenient than bonds or stocks because it can be stored easily. It's also portable.

You can always access gold as long your place it safe. Additionally, physical gold does not require storage fees.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

Also, you'll reap the benefits of having some savings invested in something with a stable value. Gold usually rises when stocks fall.

You can also sell gold anytime you like by investing in it. Just like stocks, you can liquidate your position whenever you need cash. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

You shouldn't buy too little at once. Start small, buying only a few ounces. Then add more as needed.

Keep in mind that the goal is not to quickly become wealthy. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

Although gold might not be the right investment for everyone it could make a great addition in any retirement plan.

What Should Your IRA Include in Precious Metals?

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don’t need to have a lot of money to invest. There are many ways to make money on silver and gold investments without spending too much.

You might also be interested in buying physical coins, such bullion rounds or bars. It is possible to also purchase shares in companies that make precious metals. You might also want to use an IRA rollover program offered through your retirement plan provider.

No matter what your preference, precious metals will still be of benefit to you. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

Their prices rise with time, which is a different to traditional investments. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

How much gold should your portfolio contain?

The amount you make will depend on the amount of capital you have. For a small start, $5k to $10k is a good range. As your business grows, you might consider renting out office space or desks. You don't need to worry about paying rent every month. You only pay one month.

Also, you need to think about the type of business that you are going to run. In my case, we charge clients between $1000-2000/month, depending on what they order. This is why you should consider what you expect from each client if you're doing this kind of thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. You may get paid just once every 6 months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I suggest starting with $1k-2k gold and building from there.

How does a gold IRA account work?

Gold Ira accounts are tax-free investment vehicles for people who want to invest in precious metals.

You can purchase gold bullion coins in physical form at any moment. You don't have to wait until retirement to start investing in gold.

Owning gold as an IRA has the advantage of allowing you to keep it forever. Your gold assets will not be subjected tax upon your death.

Your heirs will inherit your gold, and not pay capital gains taxes. Because your gold doesn't belong to the estate, it's not necessary to include it on your final estate plan.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. Once you've done that, you'll receive an IRA custody. This company acts as a middleman between you and the IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

After you have established your gold IRA you will be able purchase gold bullion coin. The minimum deposit is $1,000. You'll get a higher rate of interest if you deposit more.

You will pay taxes when you withdraw your gold from your IRA. If you are withdrawing your entire balance, you will owe income tax plus a 10% penalty.

Even if your contribution is small, you might not have to pay any taxes. There are exceptions. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

Avoid taking out more that 50% of your total IRA assets each year. A violation of this rule can lead to severe financial consequences.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

investopedia.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

3 Ways To Invest in Gold For Retirement

It is important to understand the role of gold in your retirement plan. If you have a 401(k) account at work, there are several ways you can invest in gold. You may also be interested in investing in gold beyond your workplace. If you have an IRA (Individual Retirement Account), a custodial account could be opened at Fidelity Investments. If you don't have any precious metals yet, you might want to buy them from a reputable dealer.

These are the three rules to follow if you decide to invest in gold.

- Buy Gold with Your Cash – Don't use credit cards or borrow money to fund your investments. Instead, cash in your accounts. This will help protect you against inflation and keep your purchasing power high.

- Physical Gold Coins: You should own physical gold coins, not just a certificate. It's easier to sell physical gold coins rather than certificates. Also, there are no storage fees associated with physical gold coins.

- Diversify Your Portfolio. – Do not put all your eggs into one basket. Also, diversify your wealth and invest in different assets. This reduces risk and allows you to be more flexible during market volatility.

—————————————————————————————————————————————————————————————–

By: Ethan Greene – Feral Analysis

Title: Bitcoin Price Analysis: FOMC Rate Cuts Imminent While Bitcoin Maintains Position Above $109,500 EMA

Sourced From: bitcoinmagazine.com/markets/fomc-rate-cuts-loom-as-bitcoin-holds-above-109500-ema

Published Date: Tue, 30 Sep 2025 23:36:05 +0000