Hey there, crypto enthusiasts! If you've been keeping an eye on Bitcoin, you probably noticed the recent drop below the crucial $96,000 support level. The bearish sentiment is strong, and it's essential to understand what's happening in the market. Let's dive into the details to grasp the implications of this significant price movement.

Unpacking Support and Resistance Levels

The Current Scenario

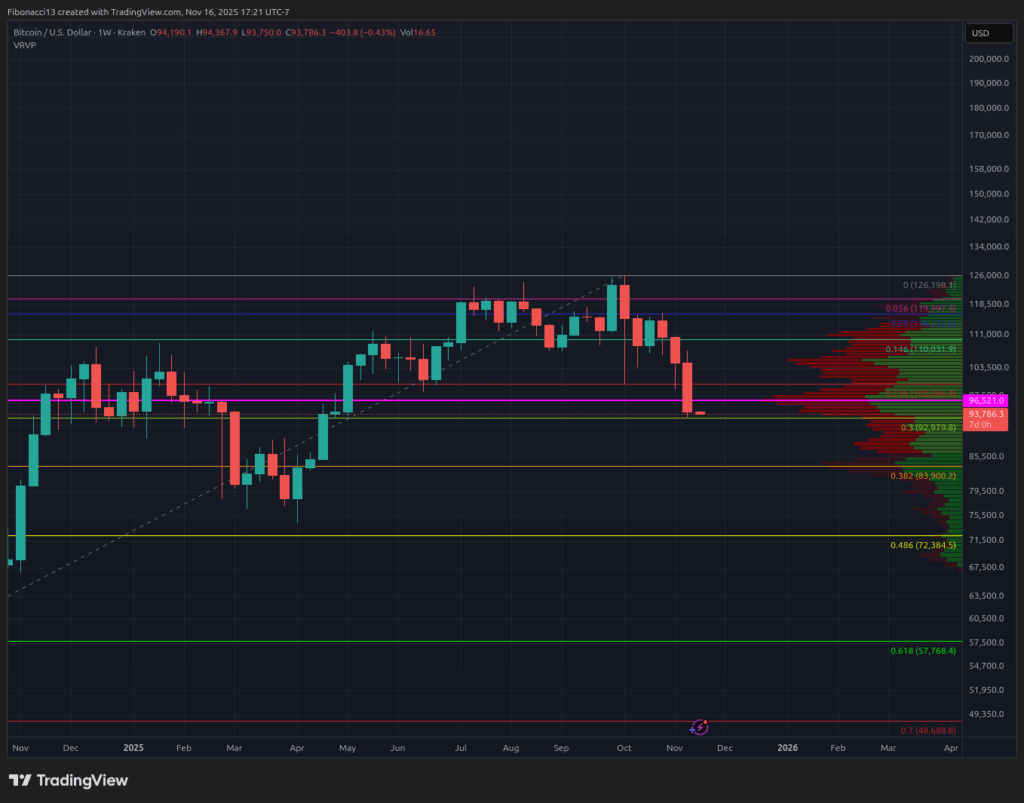

Bitcoin's price slipping under $96,000 has raised concerns among investors. The next support zones lie at the 0.382 Fibonacci Retracement level and the $83,000 to $84,000 range. If these fail, we might revisit the 2024 consolidation highs around $69,000 to $72,000. On the flip side, resistance is robust above $94,000, with key levels at $98,000, $101,000, and a tough barrier from $106,000 to $116,000.

What to Expect This Week

The Outlook

Are you hoping for a miracle rally? While the broadening wedge pattern hasn't definitively broken bearish yet, the path ahead is challenging for the bulls. A bounce to $106,000 seems plausible, but further gains face significant resistance. Bears are currently dictating the market sentiment, making bullish scenarios quite tough to envision.

Market Sentiment: Bearish Territory

The market mood is undeniably bearish, with Bitcoin's price drop of over 25% from the recent highs painting a bleak picture. The chances of a substantial rally in the near term look slim, given the loss of critical support levels.

Insights on the 4-Year Bitcoin Cycle

Looking Ahead

Considering the 4-year cycle theory, the recent price actions suggest that the peak might have already occurred. While a late-cycle high in Q1 2026 remains a possibility, the current market conditions and external factors imply a challenging road ahead for Bitcoin bulls.

Understanding Key Terms

Before we wrap up, let's clarify some essential terms:

- Bulls/Bullish: Those anticipating price increases.

- Bears/Bearish: Those expecting price declines.

- Support Level: Where prices tend to hold initially.

- Resistance Level: Where prices face rejection initially.

- Fibonacci Retracements and Extensions: Ratios based on the golden ratio for price analysis.

- Volume Profile: Indicator showing transaction volumes at different price levels.

- Broadening Wedge: A pattern indicating increased price volatility.

As we navigate through these turbulent times in the crypto market, staying informed and strategic is key. Keep a close watch on key levels and market dynamics to make well-informed decisions. Remember, the crypto market is ever-evolving, so adaptability and knowledge are your best tools for success. Here's to weathering the storm together!

Frequently Asked Questions

Can the government take your gold

Your gold is yours and the government cannot take it. It's yours, and you earned it by working hard. It belongs to you. This rule could be broken by exceptions. If you are convicted of fraud against the federal government, your gold can be forfeit. Also, if you owe taxes to the IRS, you can lose your precious metals. However, if you do not pay your taxes, you can still keep your gold even though it is considered property of the United States Government.

What Does Gold Do as an Investment Option?

The supply and demand for gold affect the price of gold. Interest rates can also affect the gold price.

Due to the limited supply of gold, prices for gold are highly volatile. Additionally, physical gold can be volatile because it must be stored somewhere.

How much of your portfolio should you hold in precious metals

Before we can answer this question, it is important to understand what precious metals actually are. Precious metals are those elements that have an extremely high value relative to other commodities. They are therefore very attractive for investment and trading. Gold is by far the most common precious metal traded today.

But, there are other types of precious metals available, including platinum and silver. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It is also unaffected significantly by inflation and Deflation.

As a general rule, the prices for all precious metals tend to increase with the overall market. But they don't always move in tandem with one another. If the economy is struggling, the gold price tends to rise, while the prices for other precious metals tends to fall. This is because investors expect lower interest rates, making bonds less attractive investments.

However, when an economy is strong, the reverse effect occurs. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. They are more rare, so they become more expensive and less valuable.

You must therefore diversify your investments in precious metals to reap the maximum profits. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

What are the pros and disadvantages of a gold IRA

The main advantage of an Individual Retirement Account (IRA) over a regular savings account is that you don't have to pay taxes on any interest earned. This makes an IRA great for people who want to save money but don't want to pay tax on the interest they earn. However, there are disadvantages to this type investment.

If you withdraw too many funds from your IRA at once, you may lose all your accumulated assets. Also, the IRS may not allow you to make withdrawals from your IRA until you're 59 1/2 years old. If you do withdraw funds from your IRA you will most likely be required to pay a penalty.

Another problem is the cost of managing your IRA. Most banks charge 0.5% to 2.0% per annum. Other providers charge monthly management charges ranging anywhere from $10 to $50.

Insurance is necessary if you wish to keep your money safe from the banks. A majority of insurance companies require that you possess a minimum amount gold to be eligible for a claim. It is possible that you will be required to purchase insurance that covers losses of up to $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. Some providers limit the number of ounces of gold that you can own. Others let you choose your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Physical gold is more costly than gold futures. Futures contracts allow you to buy gold with more flexibility. You can set up futures contracts with a fixed expiration date.

You also need to decide the type and level of insurance coverage you want. Standard policies don't cover theft protection, loss due to fire, flood or earthquake. It does offer coverage for natural disasters. If you live near a high-risk region, you might want to consider additional coverage.

Apart from insurance, you should consider the costs of storing your precious metals. Storage costs will not be covered by insurance. For safekeeping, banks typically charge $25-40 per month.

To open a IRA in gold, you will need to first speak with a qualified custodian. A custodian maintains track of all your investments and ensures you are in compliance with federal regulations. Custodians can't sell assets. Instead, they must retain them for as long and as you require.

Once you've chosen the best type of IRA for you, you need to fill in paperwork describing your goals. Information about your investments such as stocks and bonds, mutual fund, or real property should be included in your plan. The plan should also include information about how much you are willing to invest each month.

After filling out the forms, you'll need to send them to your chosen provider along with a check for a small deposit. Once the company has received your application, they will review it and send you a confirmation email.

When opening a gold IRA, you should consider using a financial planner. Financial planners are experts at investing and can help you determine which type of IRA is best for you. They can also help you lower your expenses by finding cheaper alternatives to purchasing insurance.

How to Open a Precious Metal IRA

First, decide if an Individual Retirement Account is right for you. You must complete Form 8606 to open an account. You will then need to complete Form 5204 in order to determine which type IRA you are eligible. This form must be submitted within 60 days of the account opening. After this, you are ready to start investing. You can also choose to pay your salary directly by making a payroll deduction.

For a Roth IRA you will need to complete Form 8903. Otherwise, the process is identical to an ordinary IRA.

To qualify for a precious-metals IRA, you'll need to meet some requirements. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. Additionally, you must make regular contributions. These rules are applicable whether you contribute through your employer or directly from the paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. You can only purchase bullion in physical form. This means you won't be allowed to trade shares of stock or bonds.

Your precious metals IRA can be used to directly invest in precious metals-related companies. This option may be offered by some IRA providers.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they don't have the same liquidity as stocks or bonds. They are therefore more difficult to sell when necessary. Second, they don’t produce dividends like stocks or bonds. Therefore, you will lose money over time and not gain it.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

irs.gov

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads, Example, and Risk Metrics

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- How do you keep your IRA Gold at Home? It's not legal – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

How To

Investing with gold or stocks

This might make it seem very risky to invest gold as an investment tool. This is because most people believe that it is no longer economically profitable to invest gold. This belief arises because most people believe that the global economy is driving down gold prices. They believe they would lose their money if they invested gold. In reality, however, there are still significant benefits that you can get when investing in gold. Let's take a look at some of the benefits.

One of the oldest currencies known to man is gold. There are records of its use going back thousands of years. People around the world have used it as a store of value. As a means of payment, South Africa and many other countries still rely on it.

It is important to determine the price per Gram that you will pay for gold when making a decision about whether or not to invest. It is important to determine the price per gram you are willing and able to pay for gold bullion. If you don't know your current market rate, you could always contact a local jeweler and ask them what they think the price is.

Noting that gold prices have fallen in recent years, it is worth noting that the cost to produce gold has gone up. Although gold's price has fallen, its production costs have not.

It is important to keep in mind the amount you plan to purchase of gold when you're weighing whether or not it is worth your time. For example, if you only intend to purchase enough to cover your wedding rings, it probably makes sense to hold off on buying any gold. However, if you are planning on doing so for long-term investments, then it is worth considering. Selling your gold at a higher value than what you bought can help you make money.

We hope you have gained a better understanding about gold as an investment tool. It is important to research all options before you make any decision. Only then can you make informed decisions.

—————————————————————————————————————————————————————————————–

By: Ethan Greene – Feral Analysis and Juan Galt

Title: Bitcoin Price Analysis: Breaking Down the Plunge Below $96K and What It Means for Investors

Sourced From: bitcoinmagazine.com/markets/bitcoin-plunges-below-96k-support-erasing-2025-gains-amid-extreme-bearish-sentiment

Published Date: Tue, 18 Nov 2025 00:52:39 +0000