Hey there, cryptocurrency enthusiasts! Today, we're diving into the turbulent world of Bitcoin mining stocks as they experienced a significant downturn alongside the broader market due to Bitcoin's third consecutive day of decline.

The Bitcoin Mining Rollercoaster: What Happened?

The Rollercoaster Begins

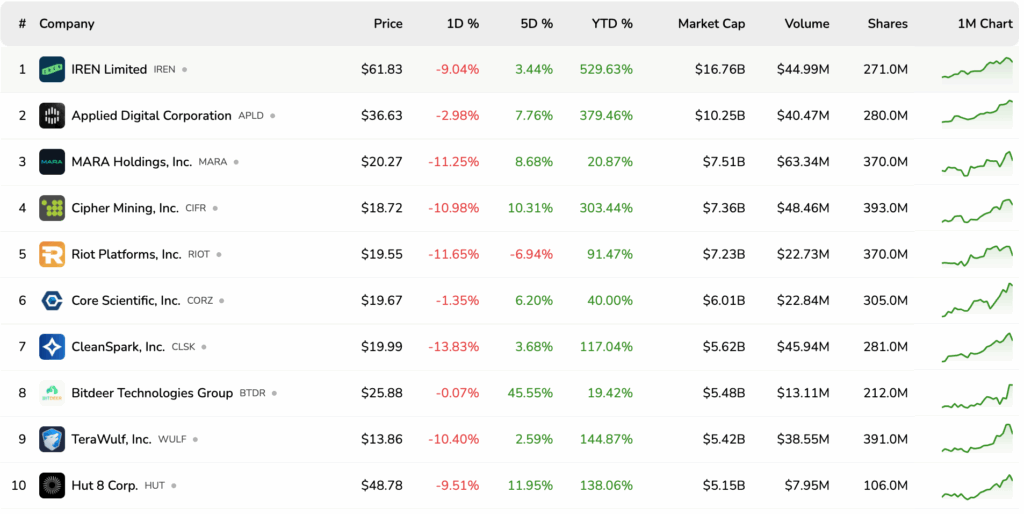

As the crypto market rollercoaster took a sharp turn downwards, major mining players like Bitfarms ($BITF), Riot Platforms ($RIOT), and Marathon Digital Holdings ($MARA) saw substantial losses. Bitfarms led the plunge with over an 18% drop, while Riot Platforms and Marathon Digital Holdings weren't far behind, with declines of 10% to 11%. The sector felt the tremors as Hut 8 and Strategy also experienced smaller declines.

Putting a Dent in the Momentum

This sudden pullback has shaken the momentum that Bitcoin miners had been enjoying in recent months. The surge in BTC prices and hash rates had propelled the sector to multi-year highs, but today's events have left many miners reeling.

Recovery or Recession: What's Next for Miners?

The Red Reality Check

Despite today's rough ride, the Bitcoin mining sector remains largely in the green for the week. Companies like Applied Digital and Cipher Mining have shown impressive growth, with gains of 3-4 times over the past year. However, the recent market dip has cast a shadow on the industry.

Seeking Stability Amidst Uncertainty

Bitcoin mining stocks are closely tied to Bitcoin's price movements. With Bitcoin dropping to the $107,000 range today, many mining stocks followed suit, ending the day in the red. This trend reflects the volatile nature of the crypto market and the interconnectedness of its components.

The Ripple Effect

Following a challenging period that saw billions in leveraged positions liquidated and numerous traders facing margin calls, investors are now looking to miners for stability. The question on everyone's mind is whether miners can weather the storm or if further BTC weakness will trigger more turbulence in the space.

The Broader Impact: Crypto Stocks Take a Hit

Marketwide Meltdown

The downturn wasn't limited to Bitcoin mining stocks alone. Crypto-related equities, including Coinbase (COIN), Robinhood (HOOD), and Strategy (MSTR), also felt the heat as selling pressure swept across the sector, causing declines in stock prices.

The Role of Bitcoin Miners: Beyond Mining

Diversification and Innovation

Bitcoin miners aren't just miners anymore. These companies operate massive mining operations, often powered by renewable energy sources, to validate transactions and earn Bitcoin rewards. Their profitability hinges on various factors like Bitcoin's price, mining efficiency, and energy costs. To adapt to market dynamics, many miners are exploring diversification into areas like artificial intelligence and high-performance data center services.

As the crypto rollercoaster continues its twists and turns, keeping an eye on Bitcoin mining stocks can provide valuable insights into the broader market trends. Stay informed, stay curious, and let's navigate this wild ride together!

Frequently Asked Questions

What are the benefits of a Gold IRA?

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It's not subject to tax until you withdraw it. You have complete control over how much you take out each year. There are many types of IRAs. Some are better suited for college students. Others are designed for investors looking for higher returns. For example, Roth IRAs allow individuals to contribute after age 59 1/2 and pay taxes on any earnings at retirement. These earnings don't get taxed if they withdraw funds. So if you're planning to retire early, this type of account may make sense.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. People who want to invest their money rather than spend it make gold IRA accounts a great option.

Another benefit to owning IRA gold is the ability to withdraw automatically. It means that you don’t have to remember to make deposits every month. Direct debits could be set up to ensure you don't miss a single payment.

Finally, gold is one the most secure investment options available. Its value is stable because it's not tied with any one country. Even during economic turmoil, gold prices tend to stay relatively stable. This makes it a great investment option to protect your savings from inflation.

What is a Precious Metal IRA, and how can you get one?

A precious metal IRA allows for you to diversify your retirement savings in gold, silver, palladium and iridium. These are “precious metals” because they are hard to find, and therefore very valuable. They make excellent investments for your money and help you protect your future from inflation and economic instability.

Bullion is often used for precious metals. Bullion is the physical metal.

Bullion can be purchased through many channels including online retailers and large coin dealers as well as some grocery stores.

With a precious metal IRA, you invest in bullion directly rather than purchasing shares of stock. This allows you to receive dividends every year.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. Instead, you pay a small percentage tax on the gains. You also have unlimited access to your funds whenever and wherever you wish.

Is gold a good investment IRA?

Anyone who is looking to save money can make gold an excellent investment. It can be used to diversify your portfolio. But gold has more to it than meets the eyes.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It is often called “the most ancient currency in the universe.”

But gold, unlike paper currency, which is created by governments, is mined out from the ground. That makes it very valuable because it's rare and hard to create.

The price of gold fluctuates based on supply and demand. The strength of the economy means people spend more, and so, there is less demand for gold. This results in gold prices rising.

On the other hand, people will save cash when the economy slows and not spend it. This causes more gold to be produced, which lowers its value.

This is why investing in gold makes sense for individuals and businesses. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

Your investments will also generate interest, which can help you increase your wealth. Additionally, you won't lose cash if the gold price falls.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

finance.yahoo.com

investopedia.com

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement account

bbb.org

How To

The best way to buy gold (or silver) online

First, understand the basics of gold. Gold is a precious metal similar to platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It is hard to use, so most people prefer jewelry made of it to real bars of gold.

There are two types currently available: legal tender and bullion. Legal tender coins are those that are intended for circulation in a country. They typically have denominations of $1, $5 or $10.

Bullion coins can only be used as investment currency. They increase in value due to inflation.

They can't be exchanged in currency exchange systems. A person can buy 100 grams of gold for $100. Every dollar spent on gold purchases, the buyer receives one gram of gold.

The next thing you should know when looking to buy gold is where to do it from. There are a few options if you wish to buy gold directly from a dealer. First, your local currency shop is a good place to start. You might also consider going through a reputable online seller like eBay. You might also consider buying gold from an online private seller.

Individuals selling gold at wholesale prices and retail prices are known as private sellers. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. Private sellers will typically get you less than a coin shop, eBay or other online retailers. This option is often a great choice for investing gold as it allows you more control over its price.

Another option for buying gold is to invest in physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank can provide you with a loan to cover the amount you wish to invest in gold. Pawnshops are small establishments allowing customers to borrow money against items they bring. Banks typically charge higher interest rates than pawn shops.

A third way to buy gold? Simply ask someone else! Selling gold is easy too. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.

—————————————————————————————————————————————————————————————–

By: Micah Zimmerman

Title: Bitcoin Mining Stocks: Understanding the Recent Plunge of $BITF, $MARA, and $RIOT

Sourced From: bitcoinmagazine.com/markets/bitcoin-mining-stocks-tumble

Published Date: Thu, 16 Oct 2025 20:42:19 +0000