Hey there, fellow crypto enthusiasts! Today, I'm diving into a hot topic that's buzzing in the world of Bitcoin mining: the growing centralization of mining operations in the United States. So, grab your virtual pickaxe, and let's explore what this trend means for the industry's future.

The U.S. Dominance in Bitcoin Mining

The Current Landscape

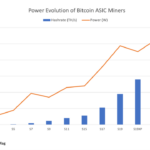

According to a recent study by the Cambridge Centre for Alternative Finance (CCAF), the U.S. now commands a staggering 75.4% of global Bitcoin hashing power. Picture this: out of the total 796 exahashes per second (EH/s) worldwide, the U.S. controls around 600 EH/s. That's a significant chunk, right?

Implications of Centralization

Risk Assessment

With such a heavy concentration of mining power in one country, it's natural to wonder about the potential risks. Are we heading towards a scenario where Bitcoin mining becomes overly centralized in the U.S.? And more importantly, what dangers does this pose for the future of this burgeoning asset?

The American Mining Boom

A Closer Look

Howard Lutnick, the U.S. Secretary of Commerce, and former Cantor Fitzgerald CEO, recently shed light on the Trump administration's ambition to position the U.S. as a dominant force in Bitcoin mining. Lutnick likened Bitcoin to gold, emphasizing its finite supply of 21 million coins. He outlined plans to supercharge U.S. mining efforts through the Commerce Department's Investment Accelerator, making it easier for miners to set up off-grid power plants. Talk about turbocharging, right?

Challenges and Opportunities

Navigating the Path Ahead

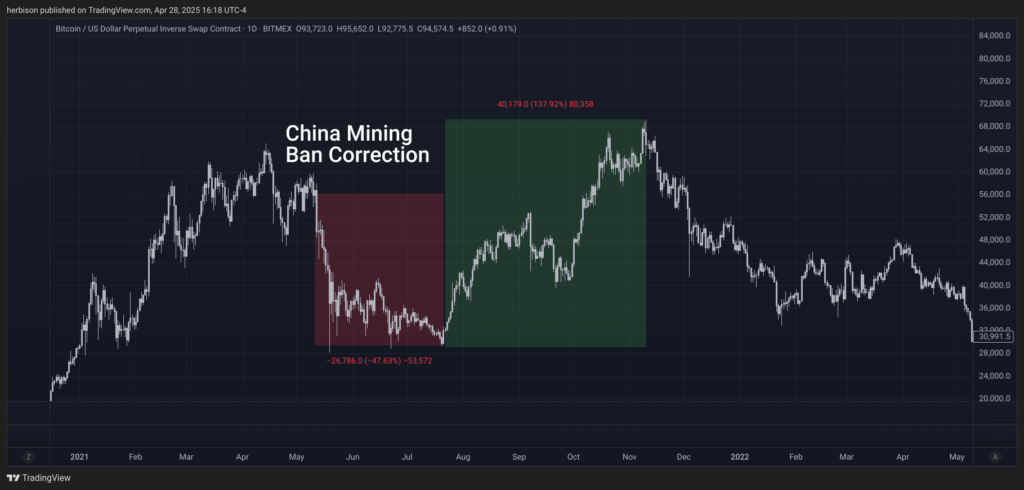

While the U.S. mining surge is a boon for business, the CCAF's research points to a potential downside: centralization. This shift from China to the U.S. has raised concerns about the risks associated with concentrating mining power in one location. The fear is that a future administration could exploit this centralized control to manipulate or regulate the network, posing a threat to Bitcoin's decentralized nature.

As we stand at this critical juncture in the Bitcoin industry, the question arises: Should we diversify mining operations globally to mitigate risks, or should we embrace America's mining dominance? The future of Bitcoin hinges on how we navigate these challenges and ensure the resilience of this revolutionary digital currency.

Staying Ahead of the Curve

Proactive Measures

For American Bitcoin enthusiasts, staying proactive is key. By promoting wider adoption of Bitcoin and integrating it into the global economy, we can deter potential censorship attempts that threaten the network's integrity. Remember, history has shown us that miners adapt to challenges, but it's crucial for us to stay vigilant and prepared for any regulatory shifts that may lie ahead.

Final Thoughts

As we witness the U.S. solidifying its role in Bitcoin mining, it's essential for the community to work together to safeguard the decentralized ethos of this groundbreaking digital currency. Let's keep the Bitcoin flag flying high, ensuring that this sovereign money remains robust and resilient, regardless of the geopolitical landscape.

What are your thoughts on the U.S. dominance in Bitcoin mining? Share your insights and join the conversation on shaping the future of crypto!

Frequently Asked Questions

What are the benefits of having a gold IRA?

The best way to invest money for retirement is by putting it into an Individual Retirement Account (IRA). You can withdraw it at any time, but it is tax-deferred. You control how much you take each year. There are many types of IRAs. Some are better for those who want to save money for college. Others are designed for investors looking for higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. However, once they begin withdrawing funds, these earnings are not taxed again. So if you're planning to retire early, this type of account may make sense.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA where you pay taxes on gains, a gold IRA doesn't require you to worry about taxation while you wait to get them. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. It means that you don’t have to remember to make deposits every month. You could also set up direct debits to never miss a payment.

Finally, the gold investment is among the most reliable. Because it's not tied to any particular country, its value tends to remain steady. Even during economic turmoil the gold price tends to remain fairly stable. As a result, it's often considered a good choice when protecting your savings from inflation.

How is gold taxed in an IRA?

The fair market price of gold when it is sold determines the tax due on its sale. Gold is not subject to tax when it's purchased. It isn't considered income. If you decide to sell it later, there will be a taxable gain if its price rises.

Gold can be used as collateral for loans. Lenders try to maximize the return on loans that you take against your assets. This usually involves selling your gold. The lender might not do this. They may keep it. They may decide to resell it. Either way, you lose potential profit.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. You should leave it alone if you don't intend to lend against it.

How is gold taxed within a Roth IRA

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

These rules vary from one state to another. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you up to April 1st. New York has a maximum age limit of 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

What are the fees for an IRA that holds gold?

An Individual Retirement Account (IRA) fee is $6 per month. This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

Diversifying your portfolio may require you to pay additional fees. These fees will vary depending upon the type of IRA chosen. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

A majority of providers also charge annual administration fees. These fees vary from 0% to 11%. The average rate per year is.25%. These rates can be waived if the broker is TD Ameritrade.

Is the government allowed to take your gold

You own your gold and therefore the government cannot seize it. You worked hard to earn it. It belongs entirely to you. This rule may not apply to all cases. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. Also, if you owe taxes to the IRS, you can lose your precious metals. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

Can I have physical gold in my IRA

Gold is money and not just paper currency. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Many Americans today prefer to invest in precious metals, such as silver and gold, over stocks and bonds. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

One reason is that gold historically performs better than other assets during financial panics. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

Another benefit to investing in gold? It has virtually zero counterparty exposure. You still have your shares even if your stock portfolio falls. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, gold offers liquidity. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. Because gold is so liquid compared to other investments, buying it in small amounts makes sense. This allows you take advantage of the short-term fluctuations that occur in the gold markets.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

irs.gov

cftc.gov

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

How To

Three Ways to Invest In Gold For Retirement

It is crucial to understand how you can incorporate gold into your retirement plans. There are many ways to invest in gold if you have a 401k account at work. You might also be interested to invest in gold outside the workplace. For example, if you own an IRA (Individual Retirement Account), you could open a custodial account at a brokerage firm such as Fidelity Investments. Or, if you don't already own any precious metals, you may want to consider buying them directly from a reputable dealer.

These are three easy rules to remember if you invest in gold.

- Buy Gold with Cash – Avoid using credit cards or borrowing money to fund investments. Instead, deposit cash into your accounts. This will help you to protect yourself against inflation while also preserving your purchasing power.

- Own Physical Gold Coins – You should buy physical gold coins rather than just owning a paper certificate. Physical gold coins are easier to sell than certificates. You don't have to store physical gold coins.

- Diversify your Portfolio. This is how you spread your wealth. You can invest in different assets. This can reduce market volatility and help you be more flexible.

—————————————————————————————————————————————————————————————–

By: Juan Galt

Title: Bitcoin Mining Centralization in the U.S.: Navigating Industry Risks

Sourced From: bitcoinmagazine.com/takes/bitcoin-mining-centralization-in-the-u-s-a-new-risk-for-the-industry

Published Date: Mon, 28 Apr 2025 20:48:01 +0000