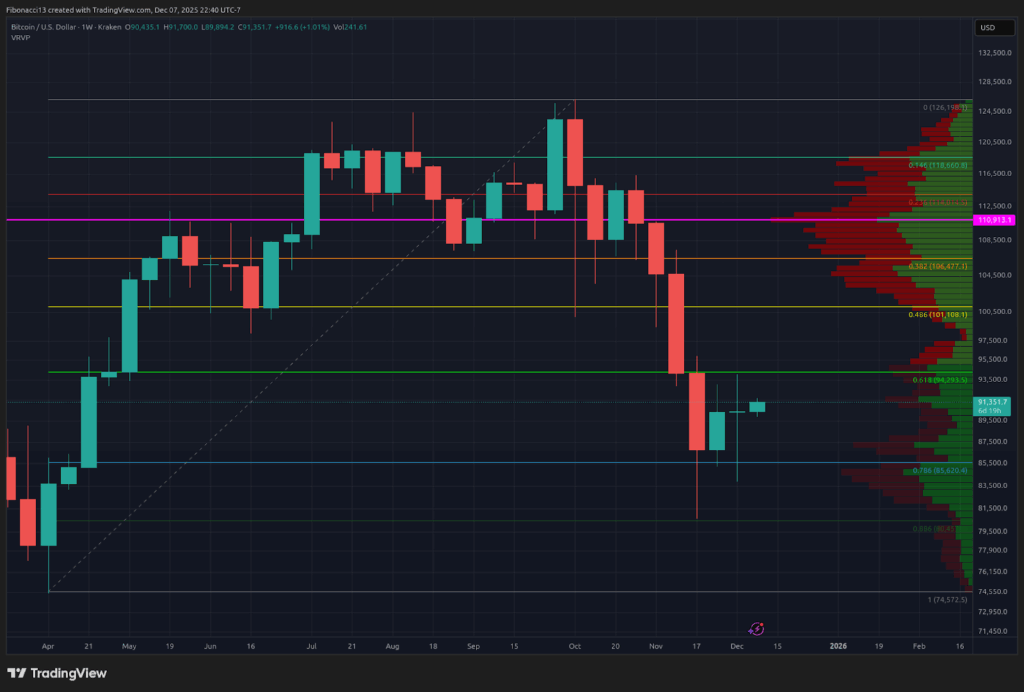

Hey there, crypto enthusiasts! If you've been keeping an eye on the Bitcoin roller coaster, you're in for a treat. Last week was quite the ride, with bears initially pushing the price down to $84,000 only to be met by bullish momentum bringing it up to $94,000. But hold on tight – the price dipped below $88,000 before closing the week at $90,429. Now, all eyes are on the FOMC meeting this week, eagerly awaiting a potential rate cut that could impact Bitcoin's investment landscape. Will the bulls break through the $94,000 resistance level and steer the market in their favor? Let's find out!

The Battle for Levels: Bulls vs. Bears

Bulls Eyeing New Heights

As we analyze the charts, Bitcoin closed the week with a doji candle on Sunday, reflecting the ongoing tug of war between buyers and sellers. Short-term prospects seem to lean slightly towards the bulls, aiming to conquer the $94,000 hurdle. If successful, their next targets are $101,000, $104,000, and a tough resistance zone between $107,000 and $110,000. Breaking past $100,000 won't be a walk in the park, as the resistance gets notably stronger beyond this milestone.

Support Levels: A Safety Net for Bulls

On the flip side, bulls are keeping a watchful eye on the $87,200 mark to prevent a slide back to the $84,000 support level. Continuous testing of $84,000 weakens its viability as a floor, with a support zone of $72,000 to $68,000 ready to provide a cushion. Dropping below $68,000 could lead to choppy waters, but the 0.618 Fibonacci retracement level at $57,700 might offer some stability, at least in the short term.

The Week Ahead: What to Expect

Short-Term Momentum and Market Mood

Looking ahead, short-term momentum seems to favor the bulls, with the Relative Strength Index (RSI) showing positive signs on the daily chart. Bulls are counting on the 13 SMA for support, aiming to push the RSI above 60 into bullish territory. As we gear up for the FOMC meeting, a rate cut announcement could propel Bitcoin to higher grounds. However, a surprise of no rate cut might tip the scales towards the bears, risking a fall below the $84,000 mark.

Market mood: Feeling quite bearish at the moment, despite a recent mini-rally. Bears are still holding some influence over the price action, keeping the bulls on their toes.

Insights and Beyond: Navigating the Crypto Terrain

Charting the Future

Peering into the coming weeks, the bearish trend indicated by the monthly MACD oscillator could continue to cast a shadow over Bitcoin. Sustaining momentum above the 100-week SMA at $84,700 is crucial, but the journey ahead is far from smooth sailing. With resistance looming around $110,000, a pullback seems likely, marking a significant test for Bitcoin's upward trajectory.

Decoding the Terminology

Before we dive deeper, let's clarify some key terms:

- Bulls/Bullish: Buyers anticipating price hikes.

- Bears/Bearish: Sellers expecting price drops.

- Support Level: A price level where assets are expected to hold, weakening with repeated tests.

- Resistance Level: A price level likely to reject an increase, also weakening with multiple challenges.

- SMA: Simple Moving Average, indicating average prices over a specific period.

Now that we've decoded the jargon, keep an eye on Bitcoin's journey ahead. Will the bulls conquer the $94,000 barrier and pave the way for new highs? The crypto arena awaits the next move with bated breath. Stay tuned!

Frequently Asked Questions

What is the cost of gold IRA fees

The Individual Retirement Account (IRA), fee is $6 per monthly. This includes account maintenance and any investment costs.

You may have to pay additional fees if you want to diversify your portfolio. The type of IRA you choose will determine the fees. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

Most providers also charge an annual management fee. These fees range from 0% to 1%. The average rate per year is.25%. These rates can be waived if the broker is TD Ameritrade.

Is gold buying a good retirement option?

Although gold investment may not seem appealing at first glance due to the high average global gold consumption, it's worth considering.

Physical bullion bars are the most popular way to invest in gold. However, there are many other ways to invest in gold. You should research all options thoroughly before making a decision on which option you prefer.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. If you require cash flow, gold stocks can work well.

You can also invest your money in exchange-traded fund (ETFs), which give you exposure to the gold price by holding securities related to gold. These ETFs usually include stocks of precious metals refiners or gold miners.

What should I pay into my Roth IRA

Roth IRAs can be used to save taxes on your retirement funds. You cannot withdraw funds from these accounts until you reach 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. First, your principal (the original deposit amount) cannot be touched. This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. You must pay taxes on the difference if you want to take out more than what you initially contributed.

The second rule states that income taxes must be paid before you can withdraw earnings. Also, taxes will be due on any earnings you take. Let's assume that you contribute $5,000 each year to your Roth IRA. Let's also say that you earn $10,000 per annum after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. You would have $6,500 less. This is the maximum amount you can withdraw because you are limited to what you initially contributed.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. In addition, 50% of your earnings will be subject to tax again (half of 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

Two types of Roth IRAs are available: Roth and traditional. Traditional IRAs allow you to deduct pretax contributions from your taxable income. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. You have the option to withdraw any amount from a traditional IRA.

A Roth IRA doesn't allow you to deduct your contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. Unlike a traditional IRA, there is no minimum withdrawal requirement. It doesn't matter if you are 70 1/2 or older before you withdraw your contribution.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- How do you keep your IRA Gold at Home? It's Not Exactly Legal – WSJ

How To

How to keep physical gold in an IRA

The easiest way to invest is to buy shares in companies that make gold. This method is not without risks. There's no guarantee these companies will survive. Even if the company survives, they still face the risk of losing their investment due to fluctuations in gold's price.

You can also buy gold directly. This means that you will need to open an account at a bank, bullion seller online, or purchase gold from a trusted seller. These options offer the convenience of easy access, as you don't need stock exchanges to do so. You can also make purchases at lower prices. It's also easier to see how much gold you've got stored. You will receive a receipt detailing exactly what you paid. You're also less susceptible to theft than investing with stocks.

There are however some disadvantages. You won't be able to benefit from investment funds or interest rates offered by banks. Also, you won't be able to diversify your holdings – you're stuck with whatever you bought. Finally, tax man may want to ask where you put your gold.

If you'd like to learn more about buying gold in an IRA, visit the website of BullionVault.com today!

—————————————————————————————————————————————————————————————–

By: Ethan Greene – Feral Analysis and Juan Galt

Title: Bitcoin Bulls: Are We Headed Towards a $94K Breakout Before the Crucial FOMC Rate Cut Decision?

Sourced From: bitcoinmagazine.com/markets/bitcoin-bulls-eye-94k-breakout-ahead-of-crucial-fomc-rate-cut-decision

Published Date: Mon, 08 Dec 2025 17:38:07 +0000