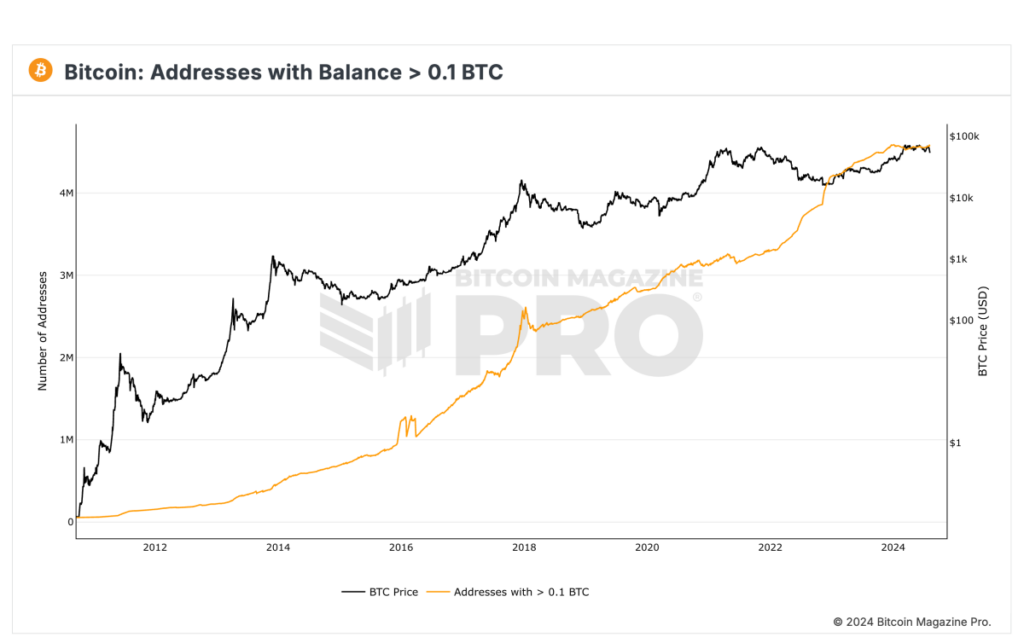

Recent data from Bitcoin Magazine Pro reveals that the number of Bitcoin addresses with a balance exceeding 0.1 BTC is rapidly approaching a historical peak. Currently, there are 4,580,424 such addresses, just slightly below the record of 4,586,540. This marks a significant month-over-month increase of 27,939 addresses.

Unique Buying Opportunity Amid Price Drop

The recent price dip of Bitcoin from $67,500 to $49,000 presented investors with a unique opportunity to acquire Bitcoin at prices below $50,000. Despite Bitcoin's current trading range of $50,000-$60,000, which is 24% lower than its peak, investors are still accumulating, potentially driving the number of addresses holding over 0.1 BTC to a new high soon.

Significance of Addresses Holding 0.1 BTC

An essential metric to track is the number of unique addresses holding at least 0.1 BTC, as it provides insights into Bitcoin adoption and usage trends. The increase in addresses with small Bitcoin holdings signifies a growing adoption rate among new users.

Understanding Bitcoin Addresses

A Bitcoin address, comprising 26-35 alphanumeric characters, enables individuals to send and receive Bitcoin. Each wallet can accommodate multiple addresses, serving as the public-facing component necessary for conducting transactions.

Future Outlook and Adoption Trends

With Bitcoin's total supply capped at 21 million and approximately 19 million already mined, estimates suggest that around 3 million Bitcoins may be lost. As Bitcoin gains momentum, the number of addresses holding at least 0.1 BTC is anticipated to increase, reflecting broader adoption and heightened usage across diverse user groups.

For a more comprehensive understanding, detailed insights, and to explore Bitcoin Magazine Pro's data and analytics, interested individuals can visit the official website for a free trial.

Frequently Asked Questions

Can I keep physical gold in an IRA?

Not just paper money or coins, gold is money. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Today, investors invest in gold as part a diversified portfolio. This is because gold tends do better in financial turmoil.

Many Americans today prefer to invest in precious metals, such as silver and gold, over stocks and bonds. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

Gold has historically performed better during financial panics than other assets. Between August 2011 to early 2013, gold prices rose close to 100 percent while the S&P 500 fell 21 per cent. During these turbulent market times, gold was among few assets that outperformed the stocks.

Gold is one of the few assets that has virtually no counterparty risks. Your stock portfolio can fall, but you will still own your shares. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Finally, gold offers liquidity. This means that you can sell gold anytime, regardless of whether or not another buyer is available. The liquidity of gold makes it a good investment. This allows for you to benefit from the short-term fluctuations of the gold market.

What are the benefits of a gold IRA

Many benefits come with a gold IRA. It's an investment vehicle that lets you diversify your portfolio. You decide how much money you want to put into each account, and when you want it to be withdrawn.

You also have the option to roll over funds from other retirement accounts into a gold IRA. This allows you to easily transition if your retirement is early.

The best part about gold IRAs? You don't have to be an expert. They're available at most banks and brokerage firms. Withdrawals are made automatically without having to worry about fees or penalties.

There are also drawbacks. Gold has historically been volatile. Understanding why you want to invest in gold is essential. Are you looking for growth or safety? Do you want to use it as an insurance strategy or for long-term growth? Only then will you be able make informed decisions.

If you plan to keep your gold IRA indefinitely, you'll probably want to consider buying more than one ounce of gold. You won't need to buy more than one ounce of gold to cover all your needs. Depending on the purpose of your gold, you might need more than one ounce.

You don’t necessarily need a lot if you’re looking to sell your gold. You can even live with just one ounce. However, you will not be able buy any other items with those funds.

How much are gold IRA fees?

$6 per month is the Individual Retirement Account Fee (IRA). This includes account maintenance and any investment costs.

To diversify your portfolio you might need to pay additional charges. These fees can vary depending on which type of IRA account you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Most providers also charge an annual management fee. These fees range from 0% to 1%. The average rate per year is.25%. These rates are often waived if a broker like TD Ameritrade is used.

Can the government seize your gold?

The government cannot take your gold because you own it. You have earned it by working hard for it. It belongs to you. But, this rule is not universal. You can lose your gold if you have been convicted for fraud against the federal governments. Additionally, your precious metals may be forfeited if you owe the IRS taxes. You can keep your gold even if your taxes are not paid.

How do I Withdraw from an IRA with Precious Metals?

First decide if your IRA account allows you to withdraw funds. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, you need to determine how much money is going to be taken out from your IRA. This calculation will depend on many factors including your age at the time of withdrawal, how long the account has been in your possession, and whether you plan to continue contributing towards your retirement plan.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. A majority of brokers offer free signup bonuses, as well as other promotions, to get people to open accounts. However, a debit card is better than a card. This will save you unnecessary fees.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. Some storage areas will accept bullion, while others require you to purchase individual coins. Before you choose one, weigh the pros and cons.

For example, storing bullion bars requires less space because you aren't dealing with individual coins. However, you'll need to count every coin individually. However, keeping individual coins in a separate place allows you to easily track their values.

Some prefer to keep their money in a vault. Some people prefer to store their coins safely in a vault. Regardless of the method you prefer, ensure that your bullion is safe so that you can continue to enjoy its benefits for many years.

Who has the gold in a IRA gold?

The IRS considers gold owned by an individual to be “a type of money” and is subject taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Owning gold can also help protect against inflation and price volatility, but it doesn't make sense to hold gold if you're not going to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

A financial planner or accountant should be consulted to discuss your options.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

finance.yahoo.com

investopedia.com

- Are You a Good Candidate for a Gold IRA

- What are the Options? Types, Spreads. Example. And Risk Metrics

irs.gov

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Investing in gold or stocks

Investing in gold as an investment vehicle might seem like a very risky proposition these days. This is because most people believe that it is no longer economically profitable to invest gold. This belief comes from the fact most people see gold prices falling due to the global economy. People believe that investing in gold would result in them losing money. In reality, though, gold investment can offer significant benefits. Below are some of them.

Gold is one of the oldest forms of currency known to man. There are thousands of records that show gold was used over the years. It was used by many people around the globe as a currency store. As a means of payment, South Africa and many other countries still rely on it.

When deciding whether to invest in gold, the first thing you need to do is to decide what price per gram you are willing to pay. When looking into buying gold bullion, you must decide how much you are willing to spend per gram. If you don’t know what the current market price is, you can always call a local jewelry store and ask them their opinion.

It is important to remember that even though gold prices have dropped in recent times, the cost of making gold has risen. Although gold's price has fallen, its production costs have not.

It is important to keep in mind the amount you plan to purchase of gold when you're weighing whether or not it is worth your time. If you intend to only purchase enough gold to cover your wedding rings it may be a smart decision to not buy any gold. This is not a wise decision if you're looking to invest in long-term assets. Selling your gold at a higher value than what you bought can help you make money.

We hope our article has given you a better understanding of gold as an investment tool. We recommend you do your research before making any final decisions. Only after doing so can you make an informed decision.

—————————————————————————————————————————————————————————————–

By: Nik Hoffman

Title: Bitcoin Addresses Holding over 0.1 BTC Approach All-Time High

Sourced From: bitcoinmagazine.com/markets/bitcoin-addresses-holding-over-0-1-btc-near-all-time-high-amid-price-dip

Published Date: Wed, 07 Aug 2024 17:10:00 GMT