As Bitcoin finds itself once again in price discovery mode, many are wondering if retail FOMO has kicked in, or if the retail surge typical of past bull cycles is still on the horizon. By analyzing data from active addresses, historical cycles, and various market indicators, we can gain insights into the current state of the Bitcoin market and what it may indicate about the near future.

Rising Interest in Retail Investors

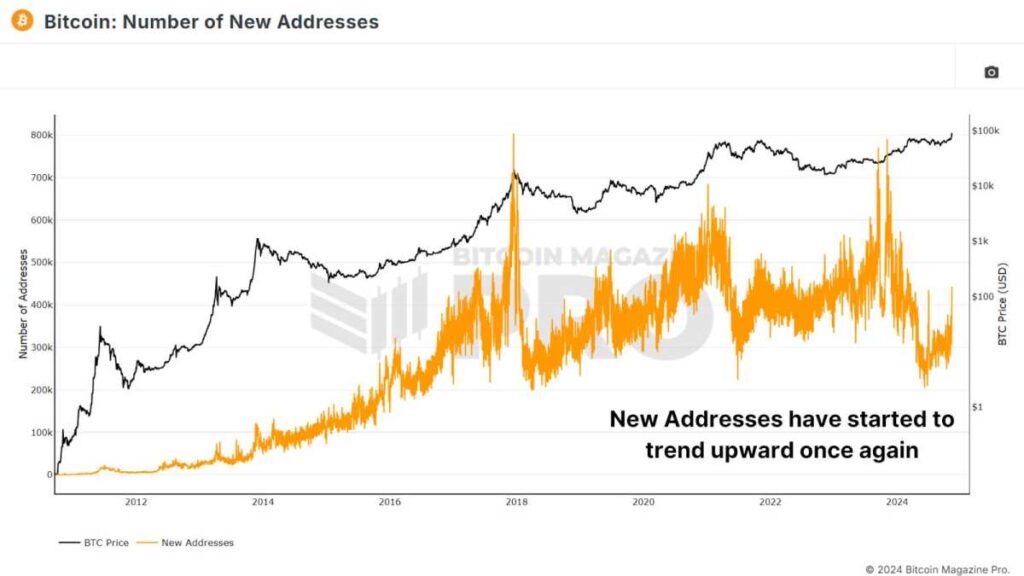

One of the clearest signs of retail interest is the number of new Bitcoin addresses being created. In the past, sharp increases in new addresses have often signaled the beginning of a bull run as retail investors enter the market. While the growth in new addresses has not been as steep in recent months, there has been a modest uptick. Last year, there were approximately 791,000 new addresses created in a single day, highlighting significant retail interest. Although the current numbers are lower, the recent increase in new addresses is worth noting.

Google Trends Reflect Tempered Interest

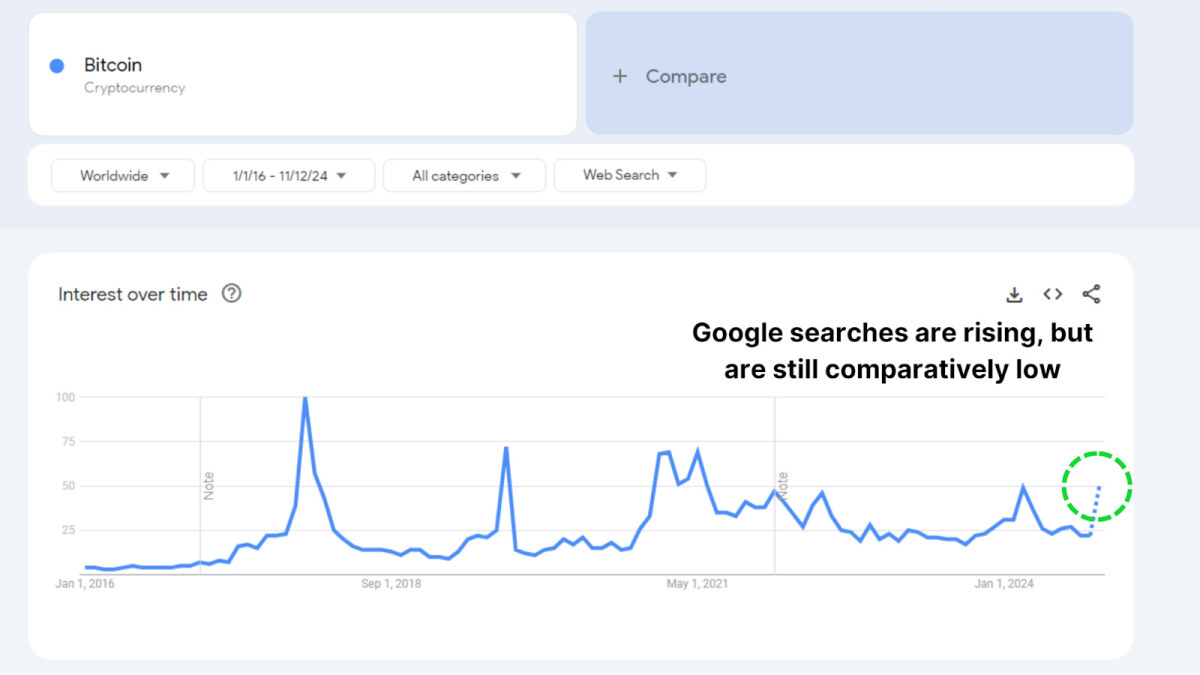

Google Trends data also mirrors this subdued interest. Searches for "Bitcoin" have been on the rise in the past month but remain below previous peaks seen in 2021 and 2017. This suggests that while retail investors are showing renewed interest, they have not yet reached the level of excitement typically associated with FOMO-driven markets.

Shift in Supply Dynamics

We are observing a slight shift in Bitcoin ownership from long-term holders to newer, short-term holders. This transition in supply dynamics could indicate the beginning of a new market phase, where experienced holders start taking profits and selling to newer participants. However, the overall volume of coins being transferred remains relatively low, indicating that long-term holders are holding onto their Bitcoin despite the market's recent gains.

Spot-Driven Rally and Accumulation by Big Holders

The current rally in Bitcoin is primarily spot-driven, unlike previous bull runs that heavily relied on leveraged positions. Open interest in Bitcoin derivatives has seen minor increases, signaling a more stable market environment. While retail addresses have not surged significantly, addresses holding at least 100 BTC (whale addresses) have been accumulating large amounts of Bitcoin, indicating confidence in future price growth.

Conclusion: Potential for Retail-Driven Surge

Despite Bitcoin reaching all-time highs, widespread retail FOMO has not yet materialized. The subdued retail interest suggests that we may be in the early stages of this rally. With long-term holders holding their positions, whales accumulating, and leverage remaining modest, the market shows signs of a sustainable rally. As the bull cycle progresses, the potential for a larger retail-driven surge looms on the horizon, which could propel Bitcoin to new highs.

Frequently Asked Questions

Can I buy gold with my self-directed IRA?

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

Individuals can contribute as much as $5,500 per year ($6,500 if married filing jointly) to a traditional IRA. Individuals may contribute up to $1,000 ($2,000 if married, filing jointly) directly into a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contracts can be described as financial instruments that are determined by the gold price. These financial instruments allow you to speculate about future prices without actually owning the metal. But physical bullion refers to real gold and silver bars you can carry in your hand.

Should You Invest Gold in Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. If you're unsure about which option to choose then consider investing in both.

You can earn potential returns on your investment of gold. Retirement investors will find gold a worthy investment.

Although most investments promise a fixed rate of return, gold is more volatile than others. Its value fluctuates over time.

However, this does not mean that gold should be avoided. It is important to consider the fluctuations when planning your portfolio.

Another benefit of gold is that it's a tangible asset. Gold is much easier to store than bonds and stocks. It is also easily portable.

Your gold will always be accessible as long you keep it in a safe place. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

It's also a good idea to have a portion your savings invested in something which isn't losing value. Gold rises in the face of a falling stock market.

Another benefit to investing in gold? You can always sell it. You can easily liquidate your investment, just as with stocks. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all your eggs on one basket.

Do not buy too much at one time. Start small, buying only a few ounces. Add more as you're able.

Keep in mind that the goal is not to quickly become wealthy. It is to create enough wealth that you no longer have to depend on Social Security.

Although gold might not be the right investment for everyone it could make a great addition in any retirement plan.

How much gold can you keep in your portfolio

The amount that you want to invest will dictate how much money it takes. Start small with $5k-10k. As your business grows, you might consider renting out office space or desks. This will allow you to pay rent monthly, and not worry about it all at once. It's only one monthly payment.

It's also important to determine what type business you'll run. In my case, we charge clients between $1000-2000/month, depending on what they order. If you are doing this type of thing, it is important to think about how much you can expect from each client.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. This means that you may only be paid once every six months.

You need to determine what kind or income you want before you decide how much of it you will need.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

How Much of Your IRA Should Include Precious Metals?

You should remember that precious metals are not only for the wealthy. You don't need to be rich to make an investment in precious metals. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You may consider buying physical coins such as bullion bars or rounds. You could also buy shares in companies that produce precious metals. Your retirement plan provider may offer an IRA rollingover program.

You can still get benefits from precious metals regardless of what choice you make. These metals are not stocks, but they can still provide long-term growth.

And unlike traditional investments, they tend to increase in value over time. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

finance.yahoo.com

irs.gov

How To

The best place online to buy silver and gold

Understanding how gold works is essential before you buy it. Precious metals like gold are similar to platinum. It's rare and often used to make money due its resistance and durability to corrosion. It is hard to use, so most people prefer jewelry made of it to real bars of gold.

Two types of gold coins are available today: the legal tender type and the bullion type. The legal tender coins are issued for circulation in a country. They usually have denominations such as $1, $5, $10, and so on.

Bullion coins can only be used as investment currency. They increase in value due to inflation.

They aren’t exchangeable in any currency exchange. One example is that if someone buys $100 worth gold, they get 100 grams with a $100 value. For every dollar spent, the buyer gets 1 gram of Gold.

Next, you need to find out where to buy gold. There are several options available if your goal is to purchase gold from a dealer. You can start by visiting your local coin shop. You can also go to a reputable website such as eBay. You may also be interested in buying gold through private sellers online.

Individuals who sell gold at wholesale and retail prices are called private sellers. Private sellers will charge you a 10% to 15% commission for every transaction. A private seller will usually return less money than a coin shop and eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

The other option is to purchase physical gold. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank will be able to provide you with a loan for the amount of money you want to invest in gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks charge higher interest rates than those offered by pawn shops.

Another way to purchase gold is to ask another person to do it. Selling gold is easy too. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Are Retail Investors Driving The Bitcoin Price Surge in This Bull Run?

Sourced From: bitcoinmagazine.com/markets/are-retail-investors-behind-the-bitcoin-price-surge-this-bull-run

Published Date: Sat, 16 Nov 2024 15:02:26 GMT