Bitcoin's recent price volatility has raised speculation about whether large-scale bitcoin hodlers are utilizing price dips to accumulate more bitcoin. While some metrics may suggest an uptick in long-term holdings at first glance, a closer examination reveals a more complex narrative, especially amidst the current extended period of choppy consolidation.

Are Long-Term Holders Accumulating?

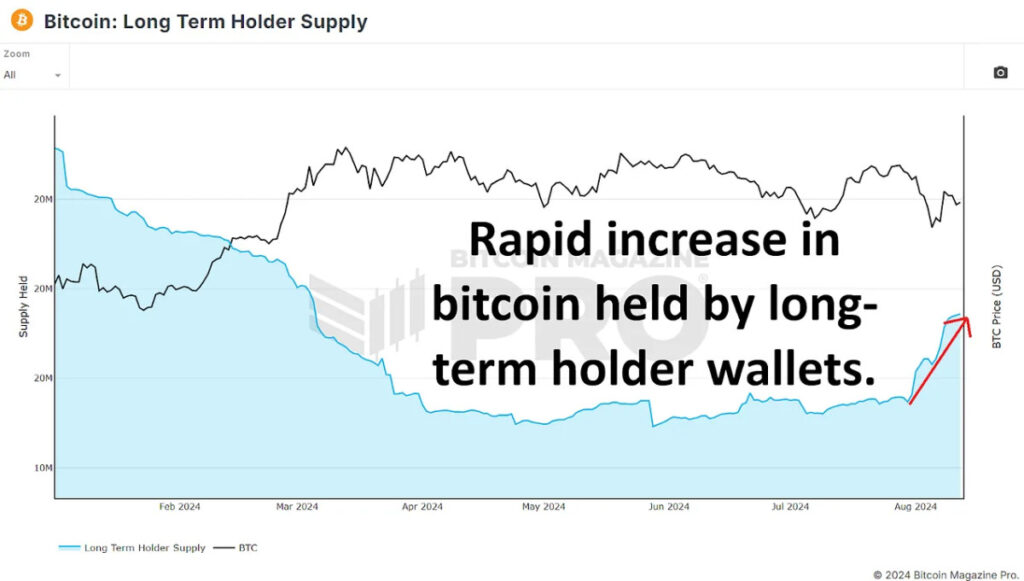

Upon initial observation, it seems that long-term Bitcoin holders are increasing their holdings. The Long Term Holder Supply data indicates that since July 30th, the amount of BTC held by long-term holders has risen from 14.86 million to 15.36 million BTC. This surge of approximately 500,000 BTC has led to speculation that long-term holders are actively buying the dip, potentially laying the groundwork for a significant price rally.

However, this interpretation could be misleading. Long-term holders are defined as wallets that have held BTC for 155 days or more. Since we have recently surpassed 155 days since the last all-time high, it is probable that many short-term holders from that period have transitioned into the long-term category without engaging in new accumulation. These investors are now holding onto their BTC in anticipation of higher prices. Therefore, this chart alone does not necessarily indicate fresh buying activity from established market participants.

Coin Days Destroyed: A Contradictory Indicator

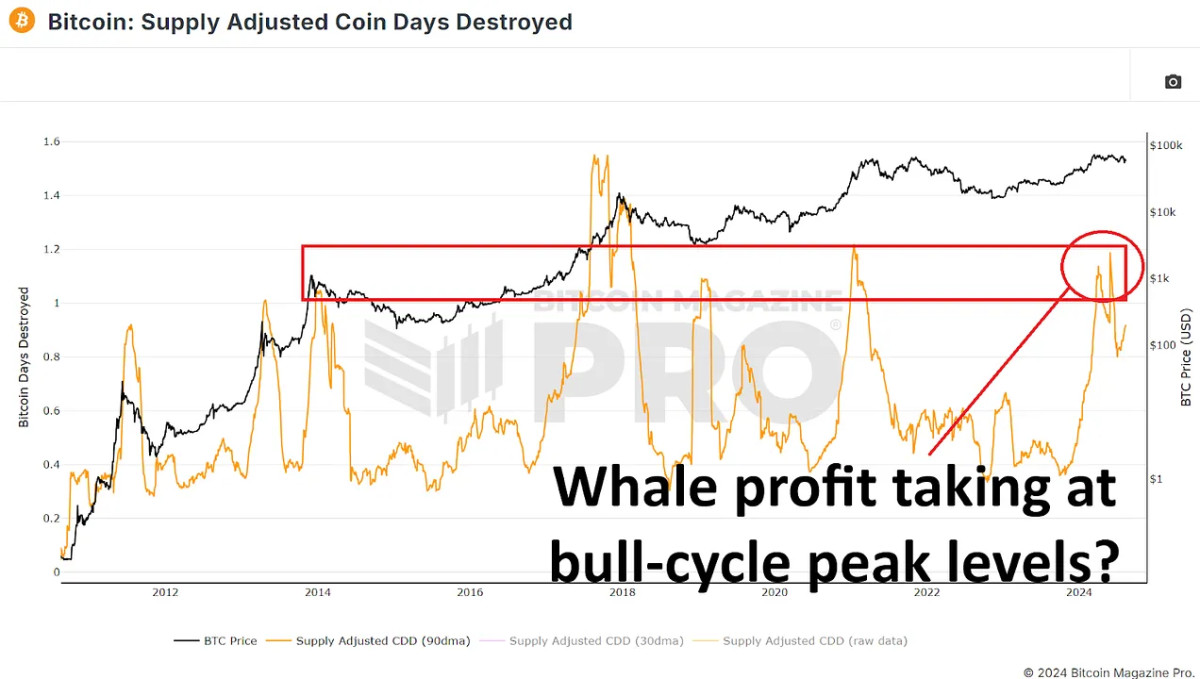

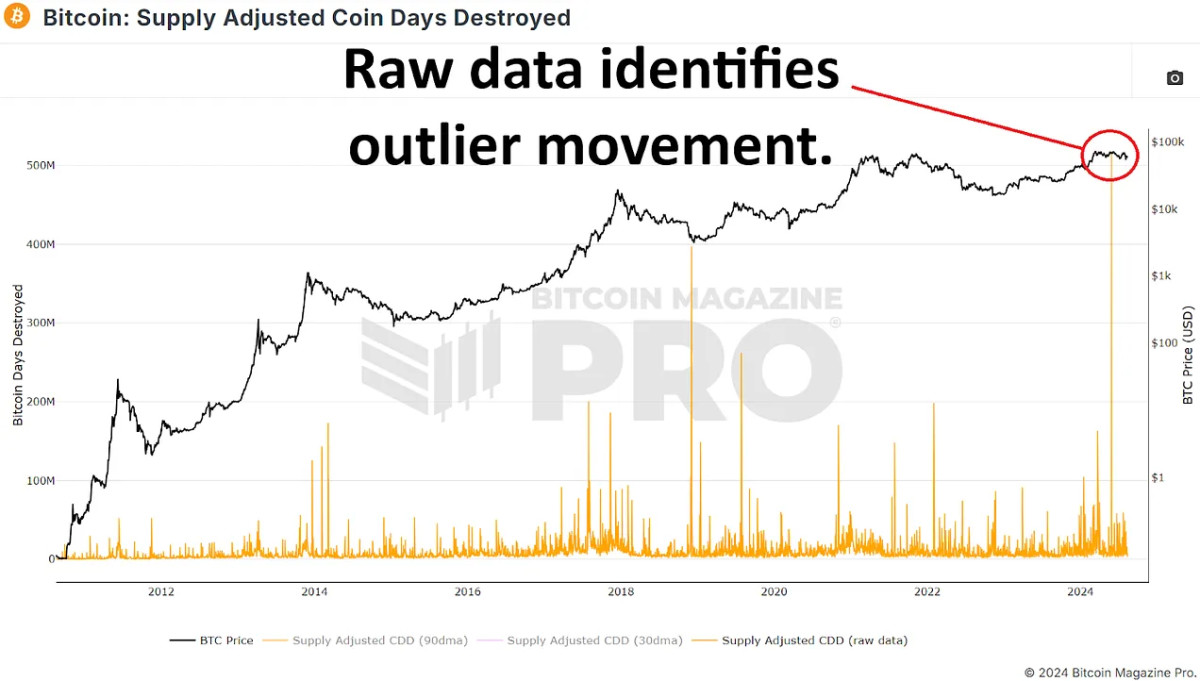

To delve deeper into the behavior of long-term holders, we can analyze the Supply Adjusted Coin Days Destroyed metric over the past 155-day period. This metric assesses the velocity of coin movement, giving more weight to coins held for extended durations. A spike in this metric could suggest that long-term holders with a substantial amount of bitcoin are moving their coins, indicating more selling rather than accumulating.

Recently, there has been a notable increase in this metric, implying that long-term holders might be distributing rather than accumulating BTC. However, this spike is largely influenced by a single massive transaction of around 140,000 BTC from a known Mt. Gox wallet on May 28, 2024. When excluding this outlier, the data appears more consistent with previous market cycles, such as late 2016 and early 2017 or mid-2019 to early 2020.

The Behavior of Whale Wallets

Examining wallets holding significant amounts of coins is essential in determining whether whales are buying or selling bitcoin. By studying wallets with a minimum of 10 BTC (approximately ~$600,000 at current prices), we can gauge the actions of major market participants.

Following Bitcoin's peak earlier this year, there has been a slight increase in the number of wallets holding at least 10 BTC. Similarly, wallets holding 100 BTC or more have also experienced a modest uptick. However, when looking at larger wallets holding 1,000 BTC or more, the trend reverses with a slight decrease in their numbers. This indicates that some major holders may be distributing their BTC, especially evident in wallets holding 10,000 BTC or more.

The Role of ETFs and Institutional Inflows

Since peaking at $60.8 billion in assets under management (AUM) on March 14th, BTC ETFs have witnessed a decrease in AUM of around $6 billion. However, factoring in the price decline of bitcoin since the all-time high, this decrease roughly equates to an increase of approximately 85,000 BTC. While ETFs have helped alleviate selling pressure from miners and significant holders, their accumulation has not been substantial enough to notably impact the price positively.

Retail Interest on the Rise

Despite signs of selling from big holders, there has been a notable rise in smaller wallets holding between 0.01 and 10 BTC. These smaller wallets have acquired tens of thousands of BTC, indicating growing interest from retail investors. While there has been a shift of around 60,000 bitcoin from larger wallets to smaller ones, this is a common occurrence throughout a bull cycle and does not currently raise concerns.

The narrative that whales are accumulating bitcoin during price dips and consolidation phases does not align with the data. While long-term holder metrics may initially seem positive, they primarily reflect the transition of short-term holders into long-term categories rather than new accumulation.

The increase in retail holdings and the stabilizing influence of ETFs could lay a solid foundation for future price appreciation, especially with potential institutional interest and continued retail inflows post halving. However, these factors are currently contributing minimally to Bitcoin's price appreciation.

The pivotal question remains whether the ongoing distribution phase will transition into a new accumulation phase, potentially driving Bitcoin to new highs in the upcoming months, or if the flow of older coins to newer participants persists, likely limiting the upside potential for the remainder of the bull cycle.

For a more detailed analysis, watch our recent YouTube video on whether Bitcoin whales are still buying. Don't miss our latest video discussing potential improvements in one of the top bitcoin metrics.

Frequently Asked Questions

What does a gold IRA look like?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase physical bullion gold coins at any point in time. To invest in gold, you don't need to wait for retirement.

An IRA lets you keep your gold for life. Your gold holdings won't be subject to taxes when you pass away.

Your gold is passed to your heirs without capital gains tax. Because your gold doesn't belong to the estate, it's not necessary to include it on your final estate plan.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. After you have done this, an IRA custodian will be assigned to you. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA custodian can handle all paperwork and submit necessary forms to IRS. This includes filing annual reporting.

After you have established your gold IRA you will be able purchase gold bullion coin. The minimum deposit required to purchase gold bullion coins is $1,000 However, you'll receive a higher interest rate if you put in more.

You'll have to pay taxes if you take your gold out of your IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

If you only take out a very small percentage of your income, you may not need to pay tax. There are some exceptions, though. However, there are exceptions. If you take 30% or more of your total IRA asset, you'll owe federal Income Taxes plus a 20% penalty.

You shouldn't take out more then 50% of your total IRA assets annually. You could end up with severe financial consequences.

How much money should my Roth IRA be funded?

Roth IRAs allow you to deposit your money tax-free. The account cannot be withdrawn from until you are 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. First, you cannot touch your principal (the original amount deposited). This means that you can't take out more money than you originally contributed. If you decide to withdraw more money than what you contributed initially, you will need to pay taxes.

You cannot withhold your earnings from income taxes. So, when you withdraw, you'll pay taxes on those earnings. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's further assume you earn $10,000 annually after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. So you would only have $6,500 left. You can only take out what you originally contributed.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. Additionally, half of your earnings would be lost because they will be taxed at 50% (half the 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow pre-tax contributions to be deducted from your taxable tax income. Your traditional IRA allows you to withdraw your entire contribution plus any interest. There is no limit on how much you can withdraw from a traditional IRA.

Roth IRAs do not allow you to deduct your contributions. However, once you retire, you can withdraw your entire contribution plus accrued interest. There is no minimum withdrawal limit, unlike traditional IRAs. Your contribution can be withdrawn at any age, not just when you reach 70 1/2.

Can I have a gold ETF in a Roth IRA

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

Traditional IRAs allow contributions from both the employer and employee. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money you invest in the ESOP will be taxed at a lower rate than if it were directly held by the employee.

Also available is an Individual Retirement Annuity. With an IRA, you make regular payments to yourself throughout your lifetime and receive income during retirement. Contributions to IRAs do not have to be taxable

Who owns the gold in a Gold IRA?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

You must have gold at least $10,000 and it must be stored for at the least five years in order to take advantage of this tax-free status.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

You should consult a financial planner or accountant to see what options are available to you.

Are You Ready to Invest in Gold?

The answer will depend on how many dollars you have saved so far and whether you had gold as an investment option at the time. Consider investing in both.

In addition to being a safe investment, gold also offers potential returns. This makes it a worthwhile choice for retirees.

While many investments promise fixed returns, gold is subject to fluctuations. This causes its value to fluctuate over time.

However, it doesn't necessarily mean that you shouldn't invest your money in gold. You should just factor the fluctuations into any overall portfolio.

Another benefit to gold? It's a tangible asset. Gold is much easier to store than bonds and stocks. It's also portable.

You can always access gold as long your place it safe. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. As gold prices rise in tandem with other commodities it can be a good hedge against rising cost.

A portion of your savings can be invested in something that doesn't go down in value. Gold usually rises when stocks fall.

Another advantage to investing in gold is the ability to sell it whenever you wish. Just like stocks, you can liquidate your position whenever you need cash. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. Don't put all of your eggs in one basket.

Do not buy too much at one time. Start with just a few drops. Next, add more as required.

Don't expect to be rich overnight. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

While gold may not be the best investment, it can be a great addition to any retirement plan.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not legal – WSJ

bbb.org

investopedia.com

irs.gov

How To

How to Hold Physical Gold in an IRA

The easiest way to invest is to buy shares in companies that make gold. However, this method comes with many risks because there's no guarantee that these companies will continue to survive. Even if they survive, there's always the risk that they will lose money due fluctuations in gold prices.

You can also buy gold directly. You'll need to open a bank account, buy gold online from a trusted seller, or open an online bullion trading account. This option offers the advantages of being able to purchase gold at low prices and easy access (you don’t need to deal directly with stock exchanges). It's also easy to see how many gold you have. You will receive a receipt detailing exactly what you paid. There's also less chance of theft than investing in stocks.

There are also some drawbacks. There are some disadvantages, such as the inability to take advantage of investment funds and interest rates from banks. You won't have the ability to diversify your holdings; you will be stuck with what you purchased. Finally, the taxman might want to know where your gold has been placed!

BullionVault.com offers more information on buying gold for an IRA.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Are Bitcoin Whales Buying The Dip?

Sourced From: bitcoinmagazine.com/markets/are-bitcoin-whales-buying-the-dip-

Published Date: Fri, 16 Aug 2024 19:14:05 GMT