AI Crypto Economy Rebounds Strongly

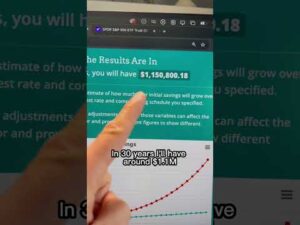

Recent market data reveals a significant surge in the AI-focused cryptocurrency sector, with its value ballooning by nearly $2 billion in just under two weeks. A major contributor to this growth is the token bittensor (TAO), which has soared 86.5% in the last fortnight.

In the AI-oriented crypto landscape, the past month has been marked by impressive growth. The top six AI tokens have all experienced double-digit percentage increases. TAO leads the pack with a striking 207% rise in the last 30 days. Following closely, fetch (FET) has climbed 46.34%, and covalent (CQT) has risen 41.91% against the U.S. dollar during the same period.

Graph (GRT) and Singularitynet (AGIX) Show Encouraging Performance

In the past month, the graph (GRT) experienced a 35% increase, while singularitynet (AGIX) witnessed a 28% uptick in its value. As of 12 days ago, on November 17, 2023, the valuation of the AI-centric crypto economy stood at $3.32 billion. This was a recovery to previous levels, achieved over three months, adding approximately $720 million from its July end low of $2.6 billion.

In just the last 12 days, the sector has expanded by an impressive $1.97 billion. This growth is largely attributed to TAO's rise, escalating from a market value of $329 million on October 29 to today's $1.297 billion. Cortex (CTXC) has also emerged as a significant player in the AI-focused arena, climbing from the 17th to the 11th position in terms of market capitalization.

CTXC's market value has soared from $37 million to a current $90.62 million, following a 194.12% surge this past month. However, not all AI-centric cryptocurrencies fared well over the same period. GOC, XMON, NEURONI, ARCONA, AMC, DX, XRT, and ALI all recorded double-digit declines during the 30-day timeframe.

What are your thoughts on the recent rise of the AI crypto sector? Share your opinions in the comments section below.

Frequently Asked Questions

What are the pros & con's of a golden IRA?

An Individual Retirement Account is a more beneficial option than regular savings accounts. You don't pay taxes on any interest earned. An IRA is a great way to save money and not have to pay taxes on the interest you earn. But, this type of investment comes with its own set of disadvantages.

To give an example, if your IRA is withdrawn too often, you can lose all your accumulated funds. Also, the IRS may not allow you to make withdrawals from your IRA until you're 59 1/2 years old. If you do withdraw funds, you'll need to pay a penalty.

Another problem is the cost of managing your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management charges ranging anywhere from $10 to $50.

Insurance is necessary if you wish to keep your money safe from the banks. Most insurers require you to own a minimum amount of gold before making a claim. You may be required by some insurers to purchase insurance that covers losses as high as $500,000.

If you decide to open a gold IRA, it is important to know how much you can use. You may be limited in the amount of gold you can have by some providers. Some providers allow you to choose your weight.

It's also important to decide whether or not to buy gold futures contracts. Gold futures contracts are more expensive than physical gold. Futures contracts provide flexibility for purchasing gold. They allow you to set up a contract with a specific expiration date.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does include coverage for damage due to natural disasters. Additional coverage may be necessary if you reside in high-risk areas.

Insurance is not enough. You also need to think about the cost of gold storage. Insurance won't cover storage costs. Safekeeping costs can be as high as $25-40 per month at most banks.

If you decide to open a gold IRA, you must first contact a qualified custodian. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians can't sell assets. Instead, they must keep your assets for as long you request.

After you have decided on the type of IRA that best suits you, you will need to complete paperwork detailing your goals. The plan should contain information about the types of investments you wish to make such as stocks, bonds or mutual funds. Also, you should specify how much each month you plan to invest.

Once you have completed the forms, you will need to mail them to your provider with a check and a small deposit. After reviewing your application, the company will send you a confirmation mail.

When opening a gold IRA, you should consider using a financial planner. Financial planners have extensive knowledge in investing and can help determine the best type of IRA to suit your needs. They can also help reduce your costs by suggesting cheaper options for purchasing insurance.

What precious metals can you invest in for retirement?

Silver and gold are two of the most valuable precious metals. They are both easy to trade and have been around for years. These are great options to diversify your portfolio.

Gold: This is the oldest form of currency that man has ever known. It's also very safe and stable. It's a great way to protect wealth in times of uncertainty.

Silver: Investors have always loved silver. It is an excellent choice for investors who wish to avoid volatility. Silver is more volatile than gold. It tends to rise rather than fall.

Platinium is another precious metal that is becoming increasingly popular. Like gold and silver, it's very durable and resistant to corrosion. It is however more expensive than its counterparts.

Rhodium: Rhodium can be used in catalytic convertors. It is also used to make jewelry. It's also relatively inexpensive compared to other precious metals.

Palladium (or Palladium): Palladium can be compared to platinum, but is much more common. It's also more accessible. It is a preferred choice among investors who are looking to add precious materials to their portfolios.

Can I buy gold using my self-directed IRA

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals up to $5.500 annually ($6,500 if you are married and filing jointly). This can be contributed to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

You should consider buying physical gold bullion if you decide to invest in it. Futures contracts are financial instruments that are based on gold's price. They allow you to speculate on future prices without owning the metal itself. You can only hold physical bullion, which is real silver and gold bars.

How does a gold IRA account work?

Gold Ira accounts are tax-free investment vehicles for people who want to invest in precious metals.

You can purchase physical gold bullion coins anytime. To invest in gold, you don't need to wait for retirement.

The beauty of owning gold as an IRA is you can hold on to it forever. Your gold holdings will not be subject to tax when you are gone.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. Because your gold doesn't belong to the estate, it's not necessary to include it on your final estate plan.

First, an individual retirement account will be set up to allow you to open a golden IRA. After you have done this, an IRA custodian will be assigned to you. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

Once your gold IRA is established, you can purchase gold bullion coins. The minimum deposit required for gold bullion coins purchase is $1,000 If you make more, however, you will get a higher interest rate.

Taxes will apply to gold that you take out of an IRA. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

However, if you only take out a small percentage, you may not have to pay taxes. However, there are some exceptions. However, there are exceptions. If you take 30% or more of your total IRA asset, you'll owe federal Income Taxes plus a 20% penalty.

Avoid taking out more that 50% of your total IRA assets each year. If you do, you could face severe financial consequences.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

cftc.gov

finance.yahoo.com

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- How do you keep your IRA Gold at Home? It's not legal – WSJ

How To

Tips to Invest in Gold

Investing in Gold has become a very popular investment strategy. There are many benefits to investing in gold. There are many options for investing in gold. Some people choose to purchase gold coins physically, while some prefer to invest with gold ETFs.

Before you purchase any type or gold, here are some things to think about.

- First, make sure you check if your country allows you own gold. If your country allows you to own gold, then you are allowed to proceed. You can also look at buying gold abroad.

- You should also know the type of gold coin that you desire. You can go for yellow gold, white gold, rose gold, etc.

- Third, consider the cost of gold. It is best to begin small and work your ways up. Diversifying your portfolio is a key thing to remember when purchasing gold. Diversify your investments in stocks, bonds or real estate.

- Last but not least, remember that gold prices fluctuate frequently. Therefore, you have to be aware of current trends.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: AI-Focused Cryptocurrency Sector Sees $2 Billion Growth in Less Than 2 Weeks

Sourced From: news.bitcoin.com/ai-focused-cryptocurrency-sector-expands-by-2-billion-in-less-than-2-weeks/

Published Date: Wed, 29 Nov 2023 15:30:29 +0000

Did you miss our previous article…

https://altcoinirareview.com/bondex-revolutionizing-the-recruitment-landscape-for-user-benefits/