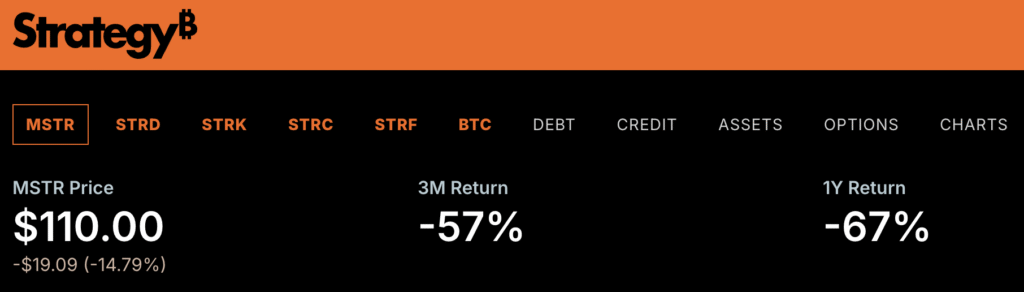

Hey there, fellow investors! If you've been keeping an eye on Strategy ($MSTR) stock, you probably noticed the significant 15% drop it experienced recently. This tumble coincided with a tumultuous period in the market, especially with the declining strength of Bitcoin, and all eyes are now on the upcoming quarterly earnings report set to be unveiled after the market's closing bell.

Anticipating Volatility: What Analysts Are Saying

Options Markets Predict Significant Swings

Analysts are predicting a potentially sizeable post-earnings movement for Strategy, hinting at a swing of around ±8.3% to 8.7% after the report is out. The anticipation is high, and investors are bracing themselves for what's to come.

Strategy's Rollercoaster Ride

The Impact of Bitcoin's Price Fluctuations

Strategy's recent downtrend is closely linked to Bitcoin's price instability. As Bitcoin faced a sharp decline, Strategy felt the impact on its balance sheet, heavily reliant on crypto assets. This connection between Strategy's performance and Bitcoin's value is a critical factor causing concern among investors.

Michael Saylor's Bold Stance Amidst Market Turbulence

Despite the storm, Strategy's Chairman, Michael Saylor, remains steadfast in his approach. He has reiterated the company's commitment to holding onto its Bitcoin reserves and even increasing its holdings. Saylor's confidence in the long-term potential of Bitcoin is evident as he continues to accumulate more, showing resilience in the face of market fluctuations.

The Road Ahead: Uncertainty Looms

Market Speculation and Strategy's Earnings Call

With Strategy's earnings call looming, investors and traders are abuzz with speculation. The financial results to be disclosed will directly mirror Bitcoin's price volatility, posing potential challenges under fair value accounting regulations. The market is bracing for possible significant swings in reported earnings based on Bitcoin's performance by the end of December 2025.

Staying the Course: Strategy's Future Amidst Challenges

Despite the hurdles, Strategy stands firm in its decision not to offload its Bitcoin holdings. The company's unwavering commitment to its investment strategy, even during market downturns, showcases a long-term vision that investors find reassuring.

As we navigate through these turbulent times, it's essential to stay informed and make well-thought-out decisions. Remember, the market is ever-changing, but with the right knowledge and strategy, you can weather any storm. Happy investing!

Frequently Asked Questions

How to Open a Precious Metal IRA

It is important to decide if you would like an Individual Retirement Account (IRA). To open the account, complete Form 8606. To determine which type of IRA you qualify for, you will need to fill out Form 5204. This form should be filled within 60 calendar days of opening the account. Once you have completed this form, it is possible to begin investing. You can also choose to pay your salary directly by making a payroll deduction.

To get a Roth IRA, complete Form 8903. Otherwise, the process will look identical to an existing IRA.

To qualify for a precious-metals IRA, you'll need to meet some requirements. The IRS states that you must be at least 18 and have earned income. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. Additionally, you must make regular contributions. These rules apply to contributions made directly or through employer sponsorship.

You can use a precious metals IRA to invest in gold, silver, palladium, platinum, rhodium, or even platinum. But, you'll only be able to purchase physical bullion. This means you can't trade shares of stock and bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option is available from some IRA providers.

There are two main drawbacks to investing through an IRA in precious metallics. They aren't as liquid as bonds or stocks. It is therefore harder to sell them when required. Second, they are not able to generate dividends as stocks and bonds. Also, they don't generate dividends like stocks and bonds. You will eventually lose money rather than make it.

What is a Precious Metal IRA (IRA)?

An IRA with precious metals allows you to diversify retirement savings into gold and silver, palladium, rhodiums, iridiums, osmium, or other rare metals. These are called “precious” metals because they're very hard to find and very valuable. These are excellent investments that will protect your wealth from inflation and economic instability.

Bullion is often used for precious metals. Bullion refers actually to the metal.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. You'll get dividends each year.

Precious metal IRAs do not require paperwork nor annual fees, unlike regular IRAs. You pay only a small percentage of your gains tax. You also have unlimited access to your funds whenever and wherever you wish.

What are the advantages of a gold IRA

An Individual Retirement Account (IRA) is the best way to put money towards retirement. You can withdraw it at any time, but it is tax-deferred. You can decide how much money you withdraw each year. There are many types available. Some are more suitable for students who wish to save money for college. Others are made for investors seeking higher returns. For example, Roth IRAs allow individuals to contribute after age 59 1/2 and pay taxes on any earnings at retirement. The earnings earned after they withdraw the funds aren't subject to any tax. So if you're planning to retire early, this type of account may make sense.

A gold IRA is similar to other IRAs because it allows you to invest money in various asset classes. Unlike a regular IRA which requires taxes to be paid on gains as you wait to withdraw them, a IRA with gold allows you to invest in multiple asset classes. People who prefer to save their money and invest it instead of spending it are well-suited for gold IRAs.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. You won't have the hassle of making deposits each month. You could also set up direct debits to never miss a payment.

Finally, gold is one the most secure investment options available. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even in economic turmoil, gold prices tends to remain relatively stable. As a result, it's often considered a good choice when protecting your savings from inflation.

How does a Gold IRA account work?

Individuals who want to invest with precious metals may use the Gold Ira accounts, which are tax-free.

You can purchase physical gold bullion coins anytime. You don't have to wait until retirement to start investing in gold.

An IRA allows you to keep your gold forever. When you die, your gold assets won't be subjected to taxes.

Your heirs can inherit your gold and avoid capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. Once you've done so, you'll be given an IRA custodian. This company acts as a middleman between you and the IRS.

Your gold IRA custodian will handle the paperwork and submit the necessary forms to the IRS. This includes filing annual returns.

Once you've set up your gold IRA, it's possible to buy gold bullion. The minimum deposit required for gold bullion coins purchase is $1,000 A higher interest rate will be offered if you invest more.

You'll have to pay taxes if you take your gold out of your IRA. If you are withdrawing your entire balance, you will owe income tax plus a 10% penalty.

However, if you only take out a small percentage, you may not have to pay taxes. There are some exceptions, though. You'll owe federal income tax and a 20% penalty if you take out more than 30% of your total IRA assets.

Avoid taking out more that 50% of your total IRA assets each year. A violation of this rule can lead to severe financial consequences.

How much of your portfolio should you hold in precious metals

This question can only be answered if we first know what precious metals are. Precious metals refer to elements with a very high value relative other commodities. This makes them valuable in investment and trading. Gold is by far the most common precious metal traded today.

There are many other precious metals, such as silver and platinum. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It is also relatively unaffected both by inflation and deflation.

The general trend is for precious metals to increase in price with the overall market. That said, they do not always move in lockstep with each other. For example, when the economy is doing poorly, the price of gold typically rises while the prices of other precious metals tend to fall. Investors are more likely to expect lower interest rates making bonds less attractive investments.

The opposite effect happens when the economy is strong. Investors are more inclined to invest in safe assets, such as Treasury Bonds, and they will not demand precious metals. These precious metals are rare and become more costly.

It is important to diversify your portfolio across precious metals in order to maximize your profit from precious metals investments. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

How do you withdraw from an IRA that holds precious metals?

First decide if your IRA account allows you to withdraw funds. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, you need to determine how much money is going to be taken out from your IRA. This calculation will depend on many factors including your age at the time of withdrawal, how long the account has been in your possession, and whether you plan to continue contributing towards your retirement plan.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. Traditional IRAs permit you to withdraw your funds tax-free once you turn 59 1/2. Roth IRAs have income taxes upfront, but you can access the earnings later on without paying additional taxes.

Once the calculations have been completed, it's time to open a brokerage accounts. A majority of brokers offer free signup bonuses, as well as other promotions, to get people to open accounts. However, a debit card is better than a card. This will save you unnecessary fees.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. Before choosing one, consider the pros and disadvantages of each.

Because you don't have to store individual coins, bullion bars take up less space than other items. But, each coin must be counted separately. However, individual coins can be stored to make it easy to track their value.

Some people like to keep their coins in vaults. Others prefer to store them in a safe deposit box. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

finance.yahoo.com

cftc.gov

investopedia.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The History of Gold as an Asset

From ancient times to the beginning of the 20th century, gold was used as a currency. It was accepted worldwide and became popular due to its durability, purity, divisibility, uniformity, scarcity, and beauty. It was also traded internationally due to its high value. However, since there were no international standards for measuring gold at this point, different weights and measures existed worldwide. For example, in England, one pound sterling was equal to 24 carats of silver; in France, one livre tournois was equal to 25 carats of gold; in Germany, one mark was equal to 28 carats of gold; etc.

The United States began issuing American coin made up 90% copper, 10% zinc and 0.942 fine-gold in the 1860s. This resulted in a decline of foreign currency demand and an increase in the price. The United States began minting large quantities gold coins at this time, which led to a drop in the price. The U.S. government needed to find a solution to their debt because there was too much money in circulation. They sold some of their excess gold to Europe to pay off the debt.

Many European countries began accepting gold in exchange for the dollar because they did not trust it. Many European countries started to accept paper money as a substitute for gold after World War I. The gold price has gone up significantly in the years since. Even though the price fluctuates, gold is still one of best investments.

—————————————————————————————————————————————————————————————–

By: Micah Zimmerman

Title: Strategy Stock Plummets 15% Ahead of Earnings Call: What Investors Need to Know

Sourced From: bitcoinmagazine.com/news/strategy-falls-brace-for-earnings

Published Date: Thu, 05 Feb 2026 19:34:04 +0000

Did you miss our previous article…

https://altcoinirareview.com/unlocking-the-clarity-act-senate-republicans-shed-light-with-fact-sheets/