Hey there, crypto enthusiasts! Exciting news – Bitcoin has surged past the $90,000 mark amidst buzzing anticipation surrounding the Federal Reserve meeting and a crucial Senate vote on cryptocurrencies.

Bitcoin's Meteoric Rise

Market Momentum and Regulatory Developments

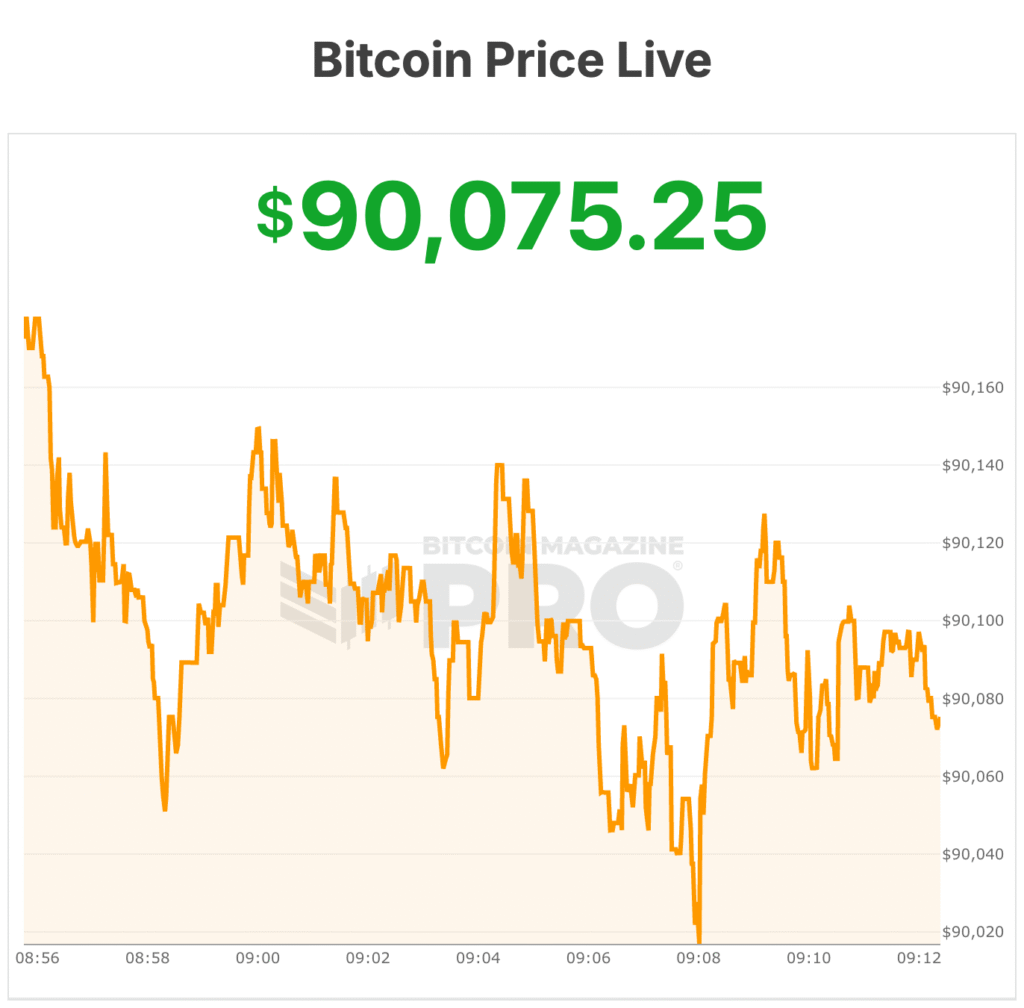

Picture this: Bitcoin's price recently skyrocketed to $90,361 after bouncing back from weekend lows around $86,000. This surge comes as the crypto market eagerly awaits the Federal Reserve's rate decision, with expectations leaning towards a rate hold today.

Macro Factors at Play

Amidst a robust job market and gold hitting record highs, Bitcoin seems to be riding the wave of renewed interest in hard assets. As investors seek stability in uncertain times, Bitcoin's appeal shines brighter, aligning with the macroeconomic landscape.

The Senate Crypto Bill Vote

Regulatory Clarity on the Horizon

Here's the deal: The Senate Agriculture Committee is gearing up to vote on a bill that could bring much-needed clarity to crypto market regulations. This pivotal decision could set the tone for the future of digital asset markets in the US.

Market Response to Legislative Developments

Market dynamics are shifting in response to the evolving regulatory landscape. With potential progress on the bill, Bitcoin's price action reflects the market's optimism, standing at $90,075 with a notable 2% surge in the last 24 hours.

As the crypto world braces for impactful decisions, the future looks promising for Bitcoin enthusiasts. Stay tuned for more updates on this exhilarating journey into the realm of cryptocurrencies!

Frequently Asked Questions

How much is gold taxed under a Roth IRA

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. If you invest $1,000 into a mutual fund, stock, or other investment account, then any gains are subjected tax.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Only earnings from capital gains and dividends are subject to tax. These taxes do not apply to investments that have been held for more than one year.

Each state has its own rules regarding these accounts. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. In Massachusetts, you can wait until April 1st. New York is open until 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

What is the best precious metal to invest in?

This question depends on how risky you are willing to take, and what return you want. While gold is considered a safe investment option, it can also be a risky choice. If you are looking for quick profits, gold might not be the right investment. You should invest in silver if you have the patience and time.

If you don't care about getting rich quickly, gold is probably the way to go. If you are looking for a long-term investment that will provide steady returns, silver may be a better choice.

Is physical gold allowed in an IRA.

Gold is money and not just paper currency. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Investors use gold today as part of their diversified portfolio, because it tends to perform better in times of financial turmoil.

Many Americans are now more inclined to invest in precious metals like gold and silver than stocks or bonds. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

One reason is that gold historically performs better than other assets during financial panics. The S&P 500 declined 21 percent during the same period. Gold prices increased nearly 100 per cent between August 2011 – early 2013. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Your shares will still be yours even if your stock portfolio drops. You can still own your gold even if the company where you invested fails to pay its debt.

Gold provides liquidity. This means that you can sell gold anytime, regardless of whether or not another buyer is available. You can buy gold in small amounts because it is so liquid. This allows for you to benefit from the short-term fluctuations of the gold market.

Can I keep a Gold ETF in a Roth IRA

This option may not be available in a 401(k), but you should look into other options such as an Individual Retirement account (IRA).

Traditional IRAs allow contributions from both the employer and employee. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money you invest in the ESOP will be taxed at a lower rate than if it were directly held by the employee.

A Individual Retirement Annuity (IRA), is also available. You can make regular payments to your IRA throughout your life, and you will also receive income when you retire. Contributions to IRAs don't have to be taxable

How do I open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. You must complete Form 8606 to open an account. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form should not be completed more than 60 days after the account is opened. Once you have completed this form, it is possible to begin investing. You may also choose to contribute directly from your paycheck using payroll deduction.

For a Roth IRA you will need to complete Form 8903. The process for an ordinary IRA will not be affected.

To be eligible to have a precious metals IRA you must meet certain criteria. The IRS states that you must be at least 18 and have earned income. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. Additionally, you must make regular contributions. These rules apply regardless of whether you are contributing directly to your paychecks or through your employer.

You can invest in precious metals IRAs to buy gold, palladium and platinum. But, you'll only be able to purchase physical bullion. You won't have the ability to trade stocks or bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option is offered by some IRA providers.

However, investing in precious metals via an IRA has two serious drawbacks. They aren't as liquid as bonds or stocks. They are therefore more difficult to sell when necessary. Second, they are not able to generate dividends as stocks and bonds. You'll lose your money over time, rather than making it.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

investopedia.com

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Want to Keep Gold in Your IRA at Home? It's Not Exactly Legal – WSJ

irs.gov

How To

Guidelines for Gold Roth IRA

The best way to invest for retirement is by starting early. Start saving as soon and as often as you're eligible (usually around 50 years old) and keep going until retirement. It is essential to save enough money each year in order to maintain a steady growth rate.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles enable you to make contributions while not paying any taxes on the earnings, until they are withdrawn. These savings vehicles are great for those who don't have access or can't get employer matching funds.

It is important to save consistently over time. If you don't contribute the maximum amount, you will miss any tax benefits.

—————————————————————————————————————————————————————————————–

By: Micah Zimmerman

Title: Bitcoin Price Skyrockets Over $90,000 in Anticipation of Fed Meeting and Senate Crypto Vote

Sourced From: bitcoinmagazine.com/markets/bitcoin-price-jumps-above-90000

Published Date: Wed, 28 Jan 2026 14:20:06 +0000